Companies

Study Exposes Shipping Firms’ Role in Rising Costs As Port Workers Strike Continues

The strike by port workers in Vancouver has led to significant disruptions in business operations and raised concerns about delayed

The post Study Exposes…

The strike by port workers in Vancouver has led to significant disruptions in business operations and raised concerns about delayed shipments. In light of these developments, a recent study has shed light on the real causes behind rising costs in the industry, contradicting the notion that labor is solely responsible.

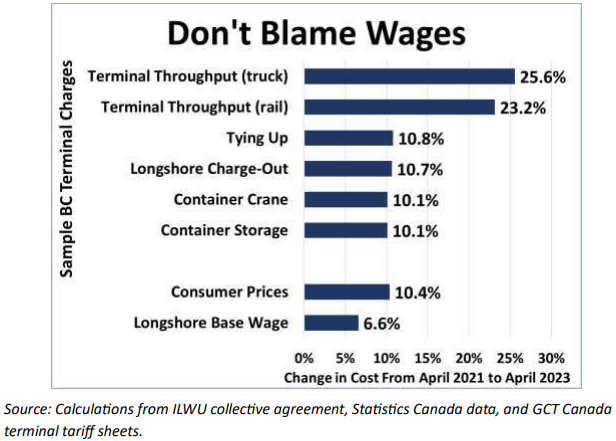

Economist Jim Stanford, director of Vancouver’s Centre for Future Work, conducted the study, which supports the workers’ argument that labor is not to blame for the industry’s escalating expenses. According to Stanford, longshore workers’ hourly wages are comparable to those of other skilled industrial jobs. However, the current dispatch system leaves these workers with insecure schedules and forces them to wait several years to qualify for benefits.

The study also reveals that wages in the sector have not kept pace with British Columbia’s rising cost of living. In fact, the real purchasing power of longshore wages has fallen by 2.5% since 2017.

“Clearly, labour is not the source of rising costs in marine shipping, and the resulting inflation,” said Stanford.

Stanford’s study, commissioned by ILWU Canada, the union representing the striking workers, emphasizes that labor is not the driving force behind the increasing costs and resulting inflation in marine shipping.

The strike, which began on July 1 and tentatively ended on Thursday, involved approximately 7,400 members of the International Longshore and Warehouse Union Canada. Their demands included protection against work outsourcing and automation, as well as higher wages. After entering a second week, the strike is having tangible effects on business operations in Canada.

Nutrien Ltd., a prominent fertilizer producer, was forced to curtail production at its Cory potash mine due to the strike. The company has lost export capacity through Canpotex’s Neptune terminal, and if the strike were to continue, production at Nutrien’s other potash mines in Saskatchewan may also be affected.

Speaking at a meeting of Canada’s premiers in Winnipeg, B.C. Premier David Eby expressed the urgent need for a swift resolution to the strike. He emphasized that the strike’s impact extends beyond the local region, affecting the cost of living across the country due to increased prices and limited availability of imports.

“It has knock-on impacts on cost of living for people across the country as goods get more expensive because imports are not available and it’s really the worst time for that,” he said.

Premier Eby also highlighted the rising costs faced by port workers in British Columbia and stressed the importance of treating workers with respect while aiming for long-term agreements that prevent future disruptions.

Several Canadian premiers, including Alberta Premier Danielle Smith and Ontario Premier Doug Ford, have called on the federal government to enact back-to-work legislation to end the strike. They have cited the severe consequences on supply chains, estimating losses of hundreds of millions of dollars per day and expressing concerns about the overall economic impact.

A survey conducted by the Canadian Federation of Independent Business (CFIB) revealed that 53% of business owners expect the strike to affect their operations. Three-quarters of businesses urged the federal government to intervene with back-to-work legislation to swiftly resolve the strike. Business owners were particularly worried about critical shipments stuck at the port and the resulting delays in completing projects on time.

Dan Kelly, president of the CFIB, emphasized the setback this strike posed, especially as supply chains are just beginning to recover from pandemic-related disruptions. He called on the federal government to take action promptly and get shipments moving again to mitigate the potential damage to businesses across the country.

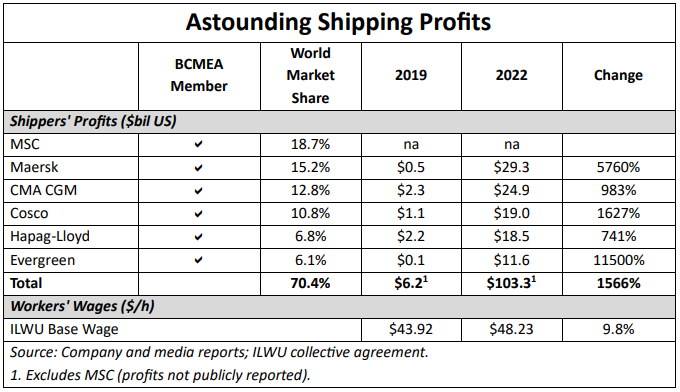

Stanford argues that those who accuse longshore workers of being “greedy and resistant to change” and advocate for back-to-work legislation have completely misunderstood the situation. According to the economist, the reality is quite the opposite. He points out that the largest global shipping lines, which hold a 70 percent share of world shipping, possess significant power to dictate prices and practices within the industry.

Stanford further highlights that public financial data is accessible for five of these companies, revealing that they collectively earned over $100 billion in profits just last year. These facts emphasize that the blame for the current situation lies with the shipping companies, not the workers, and that the workers’ demands for fair treatment and stability are justified.

“The greed of shippers and terminal operators, who took advantage of an economic and health emergency to fatten their bottom lines, is the source of the problem,” he concluded.

Information for this briefing was found via Bloomberg and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

The post Study Exposes Shipping Firms’ Role in Rising Costs As Port Workers Strike Continues appeared first on the deep dive.

Dolly Varden consolidates Big Bulk copper-gold porphyry by acquiring southern-portion claims – Richard Mills

2023.12.22

Dolly Varden Silver’s (TSXV:DV, OTCQX:DOLLF) stock price shot up 16 cents for a gain of 20% Thursday, after announcing a consolidation of…

Gold Digger: ‘Assured growth’ – central bank buying spree set to drive gold higher in 2024

Central banks will drive the price of gold higher in 2024, believe various analysts Spot gold prices seem stable to … Read More

The post Gold Digger:…

GoldTalks: Going big on ASX-listed gold stocks

Aussie investors are spoiled for choice when it comes to listed goldies, says Kyle Rodda. Here are 3 blue chips … Read More

The post GoldTalks: Going…