Companies

SOMA GOLD REPORTS 1ST QUARTER FINANCIAL RESULTS

SOMA GOLD REPORTS 1ST QUARTER FINANCIAL RESULTS

Canada NewsWire

VANCOUVER, BC, May 30, 2023

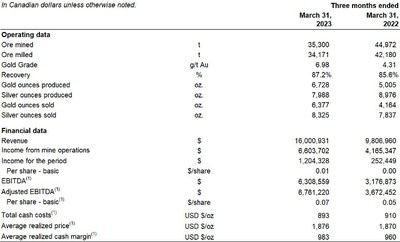

Gold Sales of 6,448 ounces in Q1-2023 – an increase of 52% from Q1-2022Net Income of $1.2 million on Revenue of $16 millionAdjusted EBITDA(1) of $6.8 millio…

SOMA GOLD REPORTS 1ST QUARTER FINANCIAL RESULTS

Canada NewsWire

VANCOUVER, BC, May 30, 2023

- Gold Sales of 6,448 ounces in Q1-2023 – an increase of 52% from Q1-2022

- Net Income of $1.2 million on Revenue of $16 million

- Adjusted EBITDA(1) of $6.8 million

- Total cash cost per ounce of gold sold decreases to US$893(1)

VANCOUVER, BC, May 30, 2023 /CNW/ – Soma Gold Corp. (TSXV: SOMA) (WKN: A2P4DU) (OTC: SMAGF) (the “Company” or “Soma“) is pleased to announce that the Company’s first quarter Financial Statements and MD&A have been filed on SEDAR and are available at the following link: https://bit.ly/Soma2023Q1Financials.

Highlights of the Quarter:

- Cordero Mine declares commercial production as of January 1, 2023 (see news release dated January 11, 2023).

- Sales of 6,448 gold equivalent ounces – the second-highest sales number in Soma’s history.

- Revenue of $16.0 million, income from mine operations of $6.6 million and Net Income of $1.2 million all show significant improvements from the comparative quarter of 2022 (63%, 59% and 377% increases, respectively).

- Adjusted EBITDA(1) of $6.8 million compared to $3.7 million in Q1-2022.

- Total cash costs per ounce of gold sold of US$893(1) compared to US$910 in Q1-2022.

Javier Cordova, Soma’s President and CEO, states, “It is gratifying to deliver the performance we anticipated in our 2023 plan and guidance. We are well on track to completing the year at or above expectations. The team has outperformed on most metrics as we see the effects of self-performing mechanized mining. We are successfully transitioning from the 2022 challenges of managing the construction of the Cordero Mine and gold production to optimizing costs and recovery. During the balance of 2023, we will continue to ramp up gold production and further reduce the costs to produce those ounces.”

ABOUT SOMA GOLD

Soma Gold Corp. (TSXV: SOMA) is a mining company focused on gold production and exploration. The Company owns two adjacent mining properties in Antioquia, Colombia with a combined milling capacity of 675 tpd. (Permitted for 1,400 tpd). The El Bagre Mill is currently operating and producing. Internally generated funds are being used to finance a regional exploration program.

The Company also owns an exploration property near Tucuma, Para State, Brazil that is currently under option to Ero Copper Corp.

On behalf of the Board of Directors

“Javier Cordova Unda”

Chief Executive Officer and President

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

|

(1) |

This news release refers to certain financial measures, such as EBITDA, Adjusted EBITDA, average realized price per ounce of gold sold, and total cash costs per ounce of gold sold which are not measures recognized under IFRS and do not have a standardized meaning prescribed by IFRS. These measures may differ from those made by other companies and accordingly may not be directly comparable to such measures as reported by other companies. These measures have been derived from the Company’s financial statements because the Company believes that they are of benefit in understanding the Company’s results. For a complete explanation of these measures, please refer to Non-IFRS Financial Performance Measures disclosure included in the Company’s MD&A for the Three Months Ended March 31, 2023 and 2022 which can be accessed at www.sedar.com. |

All statements, analysis and other information contained in this press release about anticipated future events or results constitute forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as “seek”, “anticipate”, “believe”, “plan”, “estimate”, “expect” and “intend” and statements that an event or result “may”, “will”, “should”, “could” or “might” occur or be achieved and other similar expressions. Forward-looking statements are subject to business and economic risks and uncertainties and other factors that could cause actual results of operations to differ materially from those contained in the forward-looking statements. Forward-looking statements are based on estimates and opinions of management at the date the statements are made. The Company does not undertake any obligation to update forward-looking statements even if circumstances or management’s estimates or opinions should change except as required by applicable laws. Investors should not place undue reliance on forward-looking statements.

SOURCE Soma Gold Corp.

tsx-ero

ero-copper-corp

ero copper corp

tsxv-soma

soma-gold-corp

soma gold corp

press-release

Dolly Varden consolidates Big Bulk copper-gold porphyry by acquiring southern-portion claims – Richard Mills

2023.12.22

Dolly Varden Silver’s (TSXV:DV, OTCQX:DOLLF) stock price shot up 16 cents for a gain of 20% Thursday, after announcing a consolidation of…

GoldTalks: Going big on ASX-listed gold stocks

Aussie investors are spoiled for choice when it comes to listed goldies, says Kyle Rodda. Here are 3 blue chips … Read More

The post GoldTalks: Going…

Gold Digger: ‘Assured growth’ – central bank buying spree set to drive gold higher in 2024

Central banks will drive the price of gold higher in 2024, believe various analysts Spot gold prices seem stable to … Read More

The post Gold Digger:…