Companies

Closing Bell: A lean green Friday on the screen as ASX climbs 1.3%, rides upbeat economic vibes

ASX 200 closes 1.3% higher, adds 1.5% for the week All Sectors in the green following strong Chinese data drop … Read More

The post Closing Bell: A lean…

- ASX 200 closes 1.3% higher, adds 1.5% for the week

- All Sectors in the green following strong Chinese data drop

- Small caps led by OZM, uranium stocks

Australian shares have risen strongly on Friday following decent overnight leads from Wall Street and some punchy and positive signals from inside the Chinese economy.

As often happens on these occasions there’s 3 company’s which track the measure of how positive the news really is.

That’ll be messers Rio Tinto (ASX:RIO) up 3.8%, BHP Group (ASX:BHP) ahead 4% and Fortescue Metals (ASX:FMG).

It certainly appears like the extended summer break in August paid off for China as retail numbers almost doubled on the previous month.

A mini domestic travel boom and the accumulating if incremental stimulative policies from Beijing have sparked stronger consumer spending while factory output has improved as well.

The government of President Xi Jinping will take some confidence after a month of stoking China’s economic embers failed to start anything more than lots of smoke. More recently, peeling back some of the tighter policies around the staganting real estate sector – like stripping back curbs on house buying and scrapping price caps in Tier-1 cities appears to be finally producing some results.

Markets in China have gained on Friday, while the Hong Kong Hang Seng was 1.7% higher before the close.

In japan the Topix was back nudging near 33-year highs, up 1.25% after lunch and driven by the giant market presence of holding company Softbank which surged over 3% following the happy debut of Arm Holdings which jumped almost 25% on its Nasdaq debut overnight.

Meanwhile the Americans were also reminded that a resilient jobs market, means more consumer spending – the latest non-farm payrolls showing fewer workers than expected applied for unemployment benefits last week, regardless of the Federal Reserve’s historic rate hiking cycle.

Closer to Sydenham, the Aussie telco upstart Aussie Broadband rose 4% on Friday after the ACCC released new research showing smaller telco’s were snatching broadband market share away from Telstra (ASX:TLS) and TPG.

Following the June quarter, Telstra still dominates but has fallen to 41.5% of broadband users, TPG has 21.7 %f the market and Optus’ remains in 3rd with 13.1%

And uranium remains top of the pops across the ASX on Friday.

Uranium prices continue to surge approaching their highest levels in nearly a decade. This surge follows a steady upward trend that has made it the only commodity on Stockhead’s Up, Up, Down, Down list to be a winner in every month since April.

According to price monitor Numerco, U3O8 – or yellowcake – is trading at ~US$65.5/lb.

That is close to the highest spot price in a decade, and experts believe there is more to come.

Up almost 10%, Basin Energy (ASX:BSN) just identified priority uranium targets at its North Millennium project in Canada’s world-class Athabasca Basin.

“The uranium sector has had multiple positive catalysts in recent weeks, which is being reflected in the U3O8 spot price. As momentum continues to build, our aim is to position Basin as the preferred ASX listed explorer for high-grade uranium discoveries,” BSN MD Pete Moorhouse said.

BSN has interests in three projects in the world renowned uranium district of the Athabasca Basin. This includes the North Millennium project, strategically located just 7km from Cameco’s high-grade 104.8Mlb Millennium deposit.

The $17bn capped Cameco is a major player in the Athabasca Basin, a top-three global uranium producer for over 45 years.

“Recent discoveries in the area from projects such as West McArthur and Moon Lake South demonstrate the discovery potential for high-grade uranium mineralisation in this part of the Athabasca Basin,” Moorhouse said.

“The results from Basin’s study show the exploration prospectivity that North Millennium holds.”

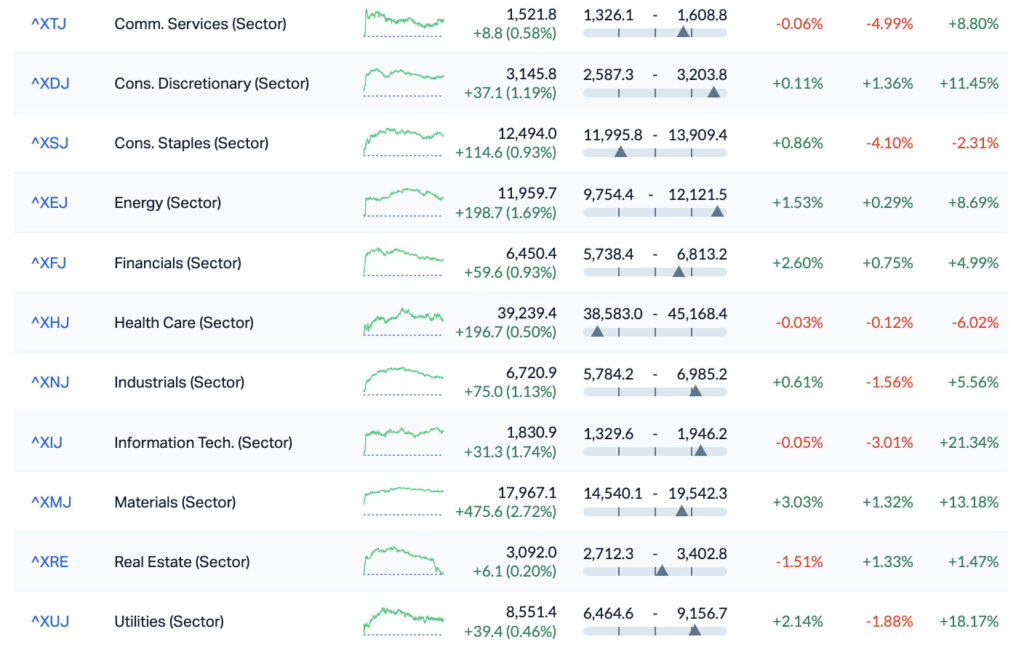

ASX Sectors on Friday September 15 Day – Week – Month – Year

The ASX Small Ords (XSO) Index rose +1.6% and the ASX Emerging Markets (XEC) Index rose +1.1%.

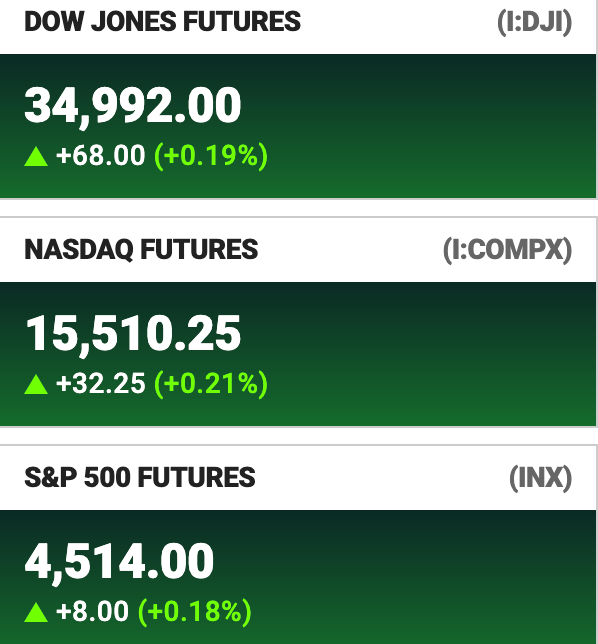

Futures tied to the Dow Jones Industrial Average are climbing ahead of the final session of the week in New York.

US gold futures were up 0.2% to $US1936.70.

RIPPED FROM THE HEADLINES

It’s all in the detail.

As mentioned, China’s retail sales came in earlier today and they were not awful.

Year-on-year retail sales increased by 4.6% last month, accelerating from July’s 2.5% and wowing market expectations of 3.0%.

This was the 8th straight month of retail trade improvements but the strongest pace since May:

Led by sales of clothes, shoes, hats, and textiles (4.5% vs 2.3% in July)

- Tobacco & alcohol (4.3% vs 7.2%)

- Furniture (4.8% vs 0.1%)

- Communications equipment (8.5% vs 3.0%).

- Cosmetics rebounded (9.7% vs -4.1%)

- Jewelry did too (7.2% vs -10.0%)

- As did automobiles (1.1% vs -1.5%).

- Home appliances , office supplies and building materials all fell in August

Details…

Smaller broadband providers continue to grow their market share, with Telstra and TPG’s market share down.

The ACCC says Vocus and Aussie Broadband gained almost 62,000 services in the June 2023 quarter, while the total number of residential broadband services on the NBN remained steady. Voice now has a 7.9 per cent market share, while Aussie Broadband has 7.5 per cent.

“The sustained growth of smaller broadband providers shows that there is continued demand from consumers for innovative and competitive services,” ACCC Commissioner Anna Brakey said in a release.

Reuters says Gold prices gained today as the US dollar eased against the Chinese Renminbi in the wake of that China data, with uncertainty over rates lingering.

Spot gold was up 0.3%at $US1915.09 an ounce. Bullion was still on track for a small weekly decline after dropping to near $US1900, its lowest since August 23.

FRIDAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

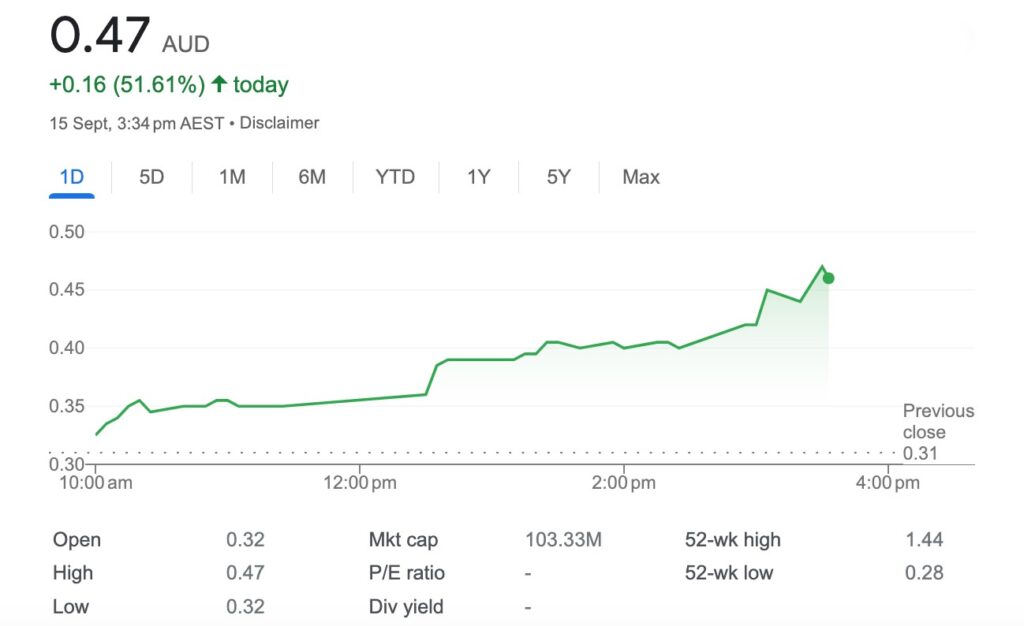

| OZM | Ozaurum Resources | 0.09 | 181% | 26,033,190 | $4,064,000 |

| AVW | Avira Resources Ltd | 0.002 | 100% | 1,000,001 | $2,133,790 |

| PNX | PNX Metals Limited | 0.003 | 50% | 101,309 | $10,761,249 |

| E25 | Element 25 Ltd | 0.455 | 47% | 1,084,384 | $67,434,404 |

| NVX | Novonix Limited | 0.945 | 38% | 16,531,554 | $334,582,784 |

| ADS | Adslot Ltd. | 0.004 | 33% | 2,308,645 | $9,799,853 |

| BNR | Bulletin Res Ltd | 0.077 | 28% | 1,187,440 | $17,615,466 |

| ADD | Adavale Resource Ltd | 0.014 | 27% | 5,482,825 | $8,034,062 |

| GTG | Genetic Technologies | 0.0025 | 25% | 991,065 | $23,083,316 |

| GTR | Gti Energy Ltd | 0.01 | 25% | 24,664,234 | $16,359,577 |

| MRD | Mount Ridley Mines | 0.0025 | 25% | 839,000 | $15,569,766 |

| TKL | Traka Resources | 0.005 | 25% | 3,721,231 | $3,485,317 |

| DEL | Delorean Corporation | 0.028 | 22% | 143,711 | $4,961,581 |

| RNE | Renu Energy Ltd | 0.035 | 21% | 156,396 | $12,774,562 |

| ARD | Argent Minerals | 0.012 | 20% | 3,328,199 | $11,789,812 |

| IEC | Intra Energy Corp | 0.006 | 20% | 8,843,422 | $8,103,908 |

| ME1 | Melodiol Glb Health | 0.006 | 20% | 1,805,697 | $14,736,602 |

| MXC | Mgc Pharmaceuticals | 0.003 | 20% | 17,586 | $11,069,920 |

| RDS | Redstone Resources | 0.006 | 20% | 1,749,999 | $4,356,892 |

| SIS | Simble Solutions | 0.006 | 20% | 1,803,014 | $3,014,754 |

| ARR | American Rare Earths | 0.155 | 19% | 1,353,561 | $58,035,029 |

| TTM | Titan Minerals | 0.046 | 18% | 3,517,254 | $59,048,677 |

| SZL | Sezzle Inc. | 21.3 | 18% | 44,136 | $49,637,929 |

| BSN | Basin Energy | 0.14 | 17% | 986,570 | $7,203,600 |

| KGL | KGL Resources Ltd | 0.14 | 17% | 44,334 | $68,075,024 |

Friday is all about Ozaurum Resources (ASX:OZM).

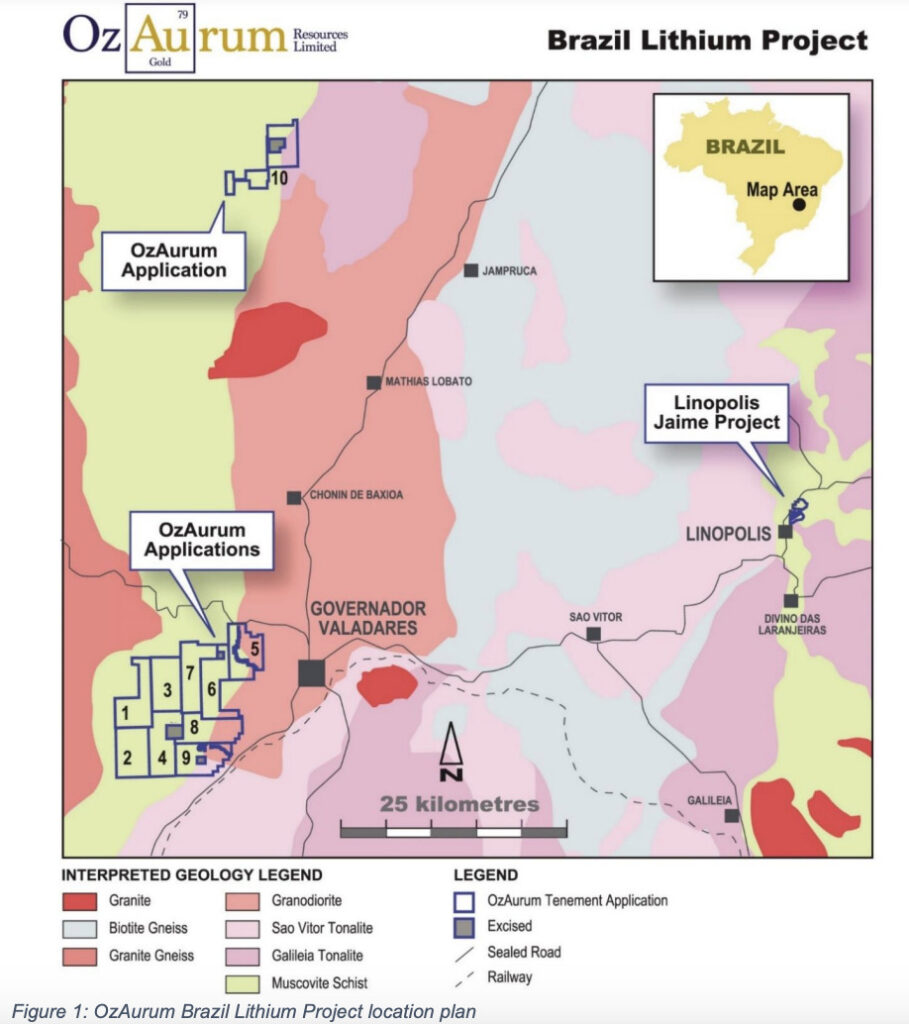

OZM was flying hard right from open this morning, on news that the company has snapped up the Linopolis Jaime Project – a strategically held area of over 20 Lithium-Cesium-Tantalum (LCT) bearing pegmatites that have been mined intermittently for tantalite, beryl, tourmaline, brazilianite and feldspar intermittently by the Pacheco family and other artisanal miners for over 50 years.

CEO and Managing Director, Andrew Pumphrey:

“We believe this is an ideal opportunity for the company to acquire strategic lithium projects in addition to the Mulgabbie and Patricia Gold Projects in Western Australia.

“In particular, the advanced Jaime Linopolis lithium Project with a +7m wide spodumene zone with an average grade of spodumene crystals of 6.94% LiO2 offers an immediate drill target and potential for a new lithium discovery,” Pumphrey said.

I might even repeat that bit: spodumene grades of up to 7.36% LiO2 with an average spodumene grade of 6.94% LiO2 confirmed within a +7m wide spodumene zone.

Them’s big grades and here’s a pic for fans of words with pics:

CEO and Managing Director, Andrew Pumphrey:

OZM adds that there’s also ‘significant upside’ with over 20 LCT pegmatites identified within the Project area to date.

Coarse spodumene crystals up to 1m in length are rare in lithium deposits and are also seen at Greenbushes and Mt Marion in Western Australia.

“Brazil is fast becoming a Tier 1 hard rock lithium producing jurisdiction in the world with Sigma Lithium leading the charge with a targeted production rate of 104,000 tpa lithium carbonate equivalent “LCE” from a hardrock reserve base of 54.8 Mt @ 1.44% LiO2 and also CBL’s underground lithium mine. Both are located only 200km’s north of the Project,” Pumphrey added, happily.

Something fun is happening to the manganese play Element 25 (ASX:E25) ).

I don’t know why, but it’s happening:

Also keeping up the good work is Future Battery Minerals (ASX:FBM) up on news that the company has received firm commitments for a heavily oversubscribed $7.6 million placement, including dollars coming in from some Big Names like Hancock Prospecting.

FBM says it’s going to spend the money on speeding up exploration drilling at the Kangaroo Hills Lithium Project (KHLP) in WA, in which the recent Phase 3 drilling has confirmed a significant spodumene bearing pegmatite swarm at the Big Red and Rocky prospects.

Finally, Adavale Resources (ASX:ADD) had a terrific General Meeting last night. They published the results of the resolutions put to members, advising that ‘all resolutions proposed were passed on a poll and without amendment.’

They placed a bunch of shares. Up circa 23%.

The nickel sulphide exploration company holds 100% of the Kabanga Jirani Nickel Project

FRIDAY’S ASX SMALL CAP LAGGARDS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| BGE | Bridge SaaS | 0.021 | -34% | 278,031 | $929,152.32 |

| ARE | Argonaut Resources | 0.001 | -33% | 575,571 | $10,974,227.95 |

| CT1 | Constellation Tech | 0.002 | -33% | 500,000 | $4,413,601.11 |

| EDE | Eden Inv Ltd | 0.002 | -33% | 4,514,737 | $10,090,910.54 |

| BCK | Brockman Mining Ltd | 0.022 | -27% | 1,418,859 | $278,406,963.93 |

| NZS | New Zealand Coastal | 0.0015 | -25% | 34,147 | $3,308,020.12 |

| BXN | Bioxyne Ltd | 0.013 | -24% | 1,282,200 | $32,327,971.77 |

| EMP | Emperor Energy Ltd | 0.011 | -21% | 1,673,072 | $3,764,074.71 |

| LNU | Linius Tech Limited | 0.002 | -20% | 20,649,848 | $10,574,476.79 |

| 14D | 1414 Degrees Limited | 0.031 | -18% | 663,700 | $9,050,403.80 |

| KCC | Kincora Copper | 0.036 | -18% | 150,050 | $7,056,678.20 |

| MGU | Magnum Mining & Exp | 0.032 | -18% | 5,607,138 | $28,218,776.55 |

| AVM | Advance Metals Ltd | 0.005 | -17% | 2,201,924 | $3,531,352.36 |

| PRX | Prodigy Gold NL | 0.005 | -17% | 54,731 | $10,506,646.91 |

| RLC | Reedy Lagoon Corp. | 0.005 | -17% | 79,949 | $3,700,101.53 |

| AGD | Austral Gold | 0.026 | -16% | 38,541 | $18,981,651.94 |

| NGL | Nightingale Intel | 0.045 | -15% | 158,798 | $5,412,837.95 |

| 1AG | Alterra Limited | 0.006 | -14% | 1,646,769 | $4,875,867.84 |

| AJL | AJ Lucas Group | 0.012 | -14% | 294,361 | $19,260,214.82 |

| GMN | Gold Mountain Ltd | 0.006 | -14% | 1,583,029 | $15,883,550.10 |

| YPB | YPB Group Ltd | 0.003 | -14% | 1,250,016 | $2,602,115.14 |

| EPM | Eclipse Metals | 0.013 | -13% | 402,959 | $30,420,896.90 |

| ETR | Entyr Limited | 0.007 | -13% | 8,840,473 | $15,814,831.14 |

| OAU | Ora Gold Limited | 0.007 | -13% | 2,771,510 | $37,557,795.42 |

LAST ORDERS

Let’s rip through em:

Delta neighbour Reach Resources (ASX:RR1) has identified “multiple, previously unrecognised, wide and strike extensive” pegmatite swarms at its Morrissey Hill lithium project in the Gascoyne.

RR1 has now uncovered more than 50 pegmatites with a combined cumulative strike length of +10km.

Future Battery Minerals (ASX:FBM) will raise $7.6m via placement – supported by big dogs like Hancock Prospecting — to accelerate exploration drilling at the Kangaroo Hills lithium project in WA.Anson Resources (ASX:ASN) has ramped up lithium carbonate production from its demonstration plant in Florida to meet demand from potential US offtakers, a clear sign of the deep need for new sources of the battery material.

Elephant hunter Taiton Resources’ (ASX:T88) has completed a ~3000m maiden drilling campaign at Merino — part of the Highway project in South Australia — where the company believes it is on the trail of a large mineral system.

TRADING HALTS

Leo Lithium (ASX:LLL) – Pending an announcement in relation to correspondence from the government of Mali

The post Closing Bell: A lean green Friday on the screen as ASX climbs 1.3%, rides upbeat economic vibes appeared first on Stockhead.

aim

nasdaq

asx

gold

lithium

uranium

manganese

rare earths

nickel

tantalum

tsxv-sgml

sigma-lithium

sigma lithium

Dolly Varden consolidates Big Bulk copper-gold porphyry by acquiring southern-portion claims – Richard Mills

2023.12.22

Dolly Varden Silver’s (TSXV:DV, OTCQX:DOLLF) stock price shot up 16 cents for a gain of 20% Thursday, after announcing a consolidation of…

GoldTalks: Going big on ASX-listed gold stocks

Aussie investors are spoiled for choice when it comes to listed goldies, says Kyle Rodda. Here are 3 blue chips … Read More

The post GoldTalks: Going…

Gold Digger: ‘Assured growth’ – central bank buying spree set to drive gold higher in 2024

Central banks will drive the price of gold higher in 2024, believe various analysts Spot gold prices seem stable to … Read More

The post Gold Digger:…