Companies

ASX Small Caps Lunch Wrap: How has Elon Musk packed an annus horribilus into a single week at work?

Positive vibes around interest rates have seen major markets soar, while local health tech Volpara fields takeover bid by Sth … Read More

The post ASX…

Local markets are surging this morning, after a raft of interest-rate related news both here and overseas lit a fire underneath investors, sending the betting heavily in favour of rate cuts in the US, and here in Australia.

The short version is this: The ASX 200 benchmark is soaring, up more than 1.5% on the way towards lunch, thanks to one-two punch from the Real Estate sector, and a mega-bounce among the local goldies, which have been having a tough time of things the past couple of days.

But first, it’s been a while since I checked in on Elon Musk – partly because there’s been a barrage of far more interesting things to focus on, and partly because it had gotten to the point where writing about him was starting to feel a bit like punching a baby in the face.

Easy to do with a soft, slow-moving target – but with a rapidly diminishing return of joy from each landed blow.

However, it’s been a pretty bumpy week or so for the billionaire, who has – via his many and varied business interests – run into a few bothersome issues that are rapidly piling up around him. And that news is, frankly, too big to ignore any longer.

Let’s start with a setback that arrived courtesy of the US Federal Communications Commission, which announced this week that it will be sticking to its guns on a 2022 decision to deny Musk’s Starlink program a bunch of government subsidy money.

The FCC manages something called the Universal Service Fund, which allocates money to offset the cost of expanding broadband service in rural areas – a market gap that Musk’s space-borne ISP Starlink was absolutely born to play.

Indeed, Starlink was in line for a budget-breaking US$886 million subsidy from the Universal Service Fund for launching kajillions of Starlink satellites into orbit, to bring <10ms ping Call of Duty PVP matchmaking to rural and regional American teenagers.

However, the FCC has made a big call, and denied those subsidies in 2022, reaffirming that decision this week on the basis that Starlink was unable to demonstrate that “it could deliver the promised service” and that forking out close to a billion dollars to the company wouldn’t be “the best use of limited Universal Service Fund dollars.”

That alone would have put most billionaire tech gurus into the kind of “I’m spending a week in bed” funk that routinely cripples the less robust end of the human spectrum – but it’s just one of the obstacles life has thrown at Musk this week.

He’s also staring down the barrel of a massive investigation into his biotech start-up Neuralink, which is – legend has it – trying to put computer chips into the brains of live monkeys and connect them to the internet, or something.

I’m paraphrasing, but that is the gist of it.

I will readily admit that the details surrounding this are still pretty murky, but what we do know is that most, if not all, of those monkeys are dead – which raises concerns around the company’s push for human trials of the tech to start.

And this week, there are fresh calls to the US SEC for Musk and Neuralink to be investigated for “securities fraud”, based on Musk’s public claims that the monkeys were already old and dying (again, I’m paraphrasing) when they were allegedly killed by having things inserted into their brains.

And then, there’s Tesla. The company has announced the largest vehicle recall in its history, because the company’s self-driving Autopilot tech is, allegedly, woefully inadequate and actually quite dangerous.

A two-year investigation more than 1,000 accidents associated with the Autopilot function has resulted in Tesla having to recall 2 million of its cars in the US, which is – by even an extremely generous estimate – pretty much all of them.

Poor Elon… he’s managed to cram an annus horibilus into the space of a single fortnight – and to pop a schadenfreude flavoured cherry on top of all that, even his beloved Grok AI has turned on him, as this request from one Twitter user illustrates.

Grok roasting @elonmusk. No one is safe from Grok’s insults, not even its dad. pic.twitter.com/6IRDDlTNXX

— Aravind Srinivas (@AravSrinivas) December 8, 2023

With an AI roasting its master that well, even I’m starting to worry that I’ll be automated out a gig pretty soon… which would admittedly free up time for me to join Elon Musk on what appears to be his other current obsession: boasting about how great he is at Diablo 5 on Twitter.

How on earth does he find the time?

TO MARKETS

Local markets are climbing rapidly this morning, with the benchmark banking a better than 1.5% lift before lunch.

There are a few reasons stacking up to give local investors reason to be jumping headfirst into the investment pool again this morning, and most of it centres around interest rates in the US and domestically as well.

Domestically speaking, this morning saw the reveal of news that Australia’s unemployment rate has risen to 3.9% in November, despite more than 60,000 jobs being created.

This is, on the face of it, not the most pleasant news in the world – being unemployed is a horror show, and the fact that 3.9% of Australia’s workforce is facing a pretty dire Christmas is undeniably sad.

But… rising unemployment is one of the major triggers that the Reserve Bank is on record as relying on, when it starts considering when to being to bring interest rates down.

A few months back, former RBA boss Philip Lowe went on record to state that he wants to see the unemployment rate rise to a normally-unacceptable level of 4.5%, in a bid to rein in the appallingly high inflation rate, which in turn would allow the RBA to be the Good Guys again by dropping interest rates and easing the squeeze on borrowers.

So the jump to 3.9% is, from an investment perspective, a Good Thing – especially when taken in context with rumblings from the US Fed overnight that offered the strongest indications for quite some time that it believes the US inflation crisis could be coming to an end.

The US Fed decided to leave interest rates unchanged again this month, and overnight Fed Chair Jerome Powell also said at a press conference in Washington that leaving rates high for a prolonged period may not be the best thing to do.

“Inflation keeps coming down, the labour market keeps getting back into balance and, it’s so far, so good,” Powell said.

“We’re aware of the risk that we would hang on too long before reducing borrowing rates. We know that’s a risk, and we’re very focused on not making that mistake.”

And so, local markets are flying this morning.

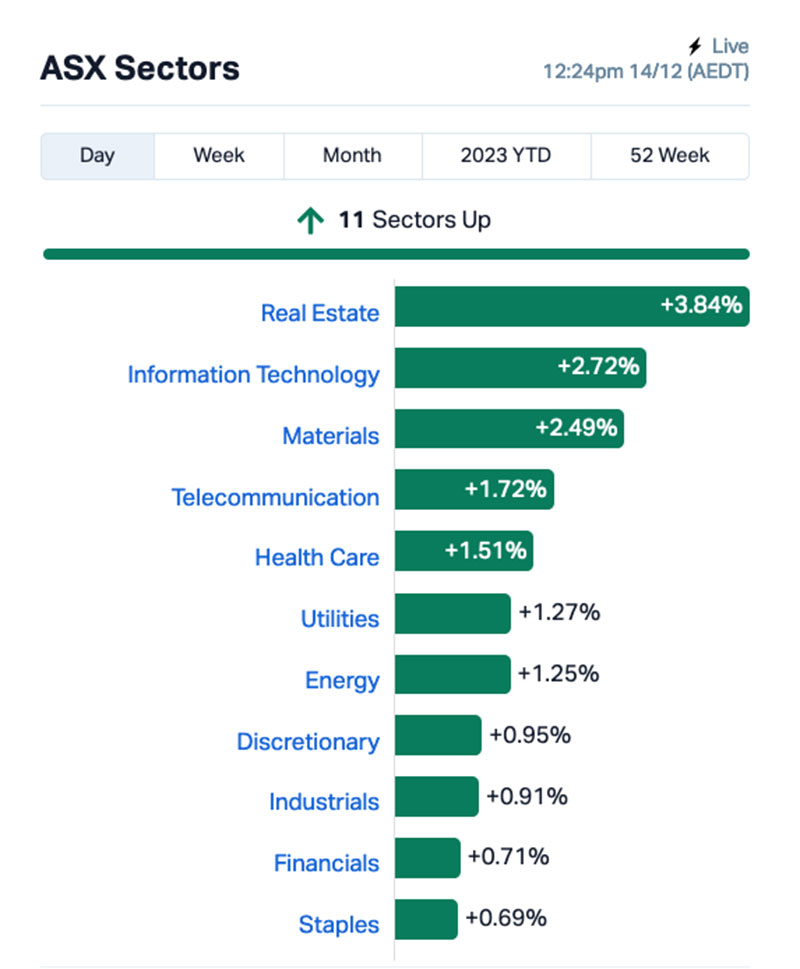

Sector-wise, everything’s in the green this morning, with Real Estate well out in front – and, on a more granular level, the XGD All Ords Gold Index is offering the most highly visible sign that things are picking up.

It’s stacked on a ball-tearing 5.8% so far today, with spot gold prices moving very quickly back above US$2,000/oz overnight because of all the excitement.

NOT THE ASX

That excitement translated into a bumper day for the major indices in the US as well, leaving the S&P 500 higher by +1.18%, the blue chips Dow Jones index up by +1.25% and the tech-heavy Nasdaq better off by +1.08% by the end of the session.

I’ve already explained the reasoning behind that, so I’ll move quickly on to US Stock news… where Tesla has banked a surprise 1.0% bump, despite news that 2 million of its cars have to come back to the factory – but they’re not allowed to drive there on their own.

Pfizer fell almost 7% after revealing that full year FY24 earnings per share will come in below prior forecasts, and online marketplace retailer Etsy fell 2% as the company announced it will cut 11% of its workforce.

In Japan, the Nikkei is down 0.42% as the nation grapples with a massive mysterious fish kill this week, which has left the coastline near Hokkaido knee-deep in dead mackerel. The current theory is a sudden, localised drop in oxygenation is responsible, but at present it’s still “just a theory”.

In Shanghai, things are looking better than that with markets up 0.53%, and Hong Kong’s Hang Seng is pushing more than 2.0% higher in early trade today.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 14 December [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| NVQ | Noviqtech Limited | 0.004 | 60% | 2,853,158 | $3,273,613 |

| CLE | Cyclone Metals | 0.0015 | 50% | 26,329,596 | $10,471,172 |

| MRQ | MRG Metals Limited | 0.003 | 50% | 3,326,681 | $4,411,837 |

| WEL | Winchester Energy | 0.003 | 50% | 139,999 | $2,040,844 |

| BAT | Battery Minerals Ltd | 0.12 | 43% | 6,737,743 | $11,286,618 |

| VHT | Volpara Health Tech | 1.095 | 41% | 4,993,549 | $197,140,089 |

| ADY | Admiralty Resources | 0.007 | 40% | 625,835 | $6,517,896 |

| FHS | Freehill Mining Ltd | 0.004 | 33% | 1,000,000 | $8,549,503 |

| JAV | Javelin Minerals Ltd | 0.004 | 33% | 5,863,498 | $3,264,347 |

| RGS | Regeneus Ltd | 0.004 | 33% | 130,000 | $919,311 |

| KP2 | Kore Potash PLC | 0.014 | 27% | 200,000 | $7,370,066 |

| PFE | Pantera Minerals | 0.064 | 25% | 2,132,857 | $5,460,700 |

| CNJ | Conico Ltd | 0.005 | 25% | 860,390 | $6,280,380 |

| DCL | Domacom Limited | 0.02 | 25% | 486,320 | $6,968,028 |

| WEC | White Energy Company | 0.042 | 24% | 81,378 | $2,325,810 |

| RTG | RTG Mining Inc. | 0.033 | 22% | 231,955 | $29,307,947 |

| CBL | Control Bionics | 0.04 | 21% | 82,078 | $4,780,764 |

| TSI | Top Shelf | 0.2 | 21% | 537,584 | $34,233,517 |

| LLO | Lion One Metals Ltd | 1.15 | 21% | 65,011 | $14,292,488 |

| MHK | Metalhawk | 0.15 | 20% | 65,666 | $12,426,806 |

| VTX | Vertexmin | 0.15 | 20% | 10,445 | $7,801,042 |

| ROG | Red Sky Energy | 0.006 | 20% | 298,333 | $26,511,136 |

| TAS | Tasman Resources Ltd | 0.006 | 20% | 315,860 | $3,563,346 |

| MRR | Minrex Resources Ltd | 0.019 | 19% | 2,372,445 | $17,357,880 |

| GPR | Geopacific Resources | 0.021 | 17% | 76,883 | $14,790,913 |

Top of the pops this morning is breast cancer detection tech company Volpara Health Technologies (ASX:VHT), which has climbed more than 42% today on news that Korean-listed cancer detection tech company Lunit wants to spend up big on a total takeover.

Lunit has offered Volpara shareholders $1.15 per share in cash, giving the deal an implied value of around $300 million, which the Volpara board has very enthusiastically endorsed.

Also doing well is Battery Minerals (ASX:BAT), which has been on a tear for the past few days and appears to be gathering even more steam, since announcing it had completed a private placement to two strategic investors at $0.038 per share, with 14.76 million new fully paid ordinary shares issued to raise $560,880 on 8 December.

Since then, Battery Minerals has raced well beyond that valuation, and at the time of writing is sitting at $0.110, making the 08 December buy-ins one of the most remarkably prescient transactions of the month.

Kore Potash (ASX:KP2) is up nicely this morning, on slim volume, a few days an after-hours announcement of management changes at the company, which saw acting CFO Amanda Farris resign and new CFO Andrey Maruta step in to replace her.

And RTG Mining (ASX:RTG) is having a belter this morning as well, on the back of news that the company has confirmed multiple styles of mineralisation and more encouraging gold and copper grades along 6.5km of skarns and new structures at its 90% owned Chanach gold-copper project in the Kyrgyz Republic.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 14 December [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| ME1 | Melodiol Global Health | 0.001 | -50% | 1,335,534 | $9,457,648 |

| KNM | Kneomedia Limited | 0.002 | -33% | 16,062 | $4,599,814 |

| AOA | Ausmon Resorces | 0.003 | -25% | 400,000 | $4,027,997 |

| BUX | Buxton Resources Ltd | 0.15 | -21% | 613,569 | $32,916,909 |

| ARU | Arafura Rare Earths | 0.16 | -20% | 23,697,114 | $422,672,938 |

| ILA | Island Pharma | 0.07 | -18% | 35,000 | $6,907,820 |

| MXR | Maximus Resources | 0.033 | -18% | 2,251,233 | $12,824,231 |

| AMD | Arrow Minerals | 0.0025 | -17% | 19,378,366 | $9,071,295 |

| AQX | Alice Queen Ltd | 0.005 | -17% | 1,621,876 | $1,327,908 |

| NVO | Novo Resources Corp | 0.13 | -16% | 155,482 | $6,965,410 |

| HXG | Hexagon Energy | 0.011 | -15% | 235,045 | $6,667,907 |

| ANR | Anatara Ls Ltd | 0.023 | -15% | 667,609 | $4,410,773 |

| NUH | Nuheara Limited | 0.0985 | -14% | 282,936 | $26,494,981 |

| TX3 | Trinex Minerals Ltd | 0.006 | -14% | 250,000 | $10,405,994 |

| VAL | Valor Resources Ltd | 0.003 | -14% | 180,000 | $13,556,672 |

| ASO | Aston Minerals Ltd | 0.026 | -13% | 100,000 | $38,851,928 |

| ALM | Alma Metals Ltd | 0.007 | -13% | 504,179 | $8,912,006 |

| AYT | Austin Metals Ltd | 0.007 | -13% | 17,480 | $8,126,997 |

| BFC | Beston Global Ltd | 0.007 | -13% | 652,936 | $15,976,375 |

| RNE | Renu Energy Ltd | 0.014 | -13% | 339,611 | $7,159,825 |

| BIM | Bindi Metals | 0.14 | -13% | 2,589 | $4,628,400 |

| NGY | Nuenergy Gas Ltd | 0.029 | -12% | 846 | $48,871,531 |

| EGN | Engenco Limited | 0.255 | -12% | 9,000 | $91,580,090 |

| CGO | CPT Global Limited | 0.11 | -12% | 578,353 | $5,237,171 |

| SVY | Stavely Minerals Ltd | 0.044 | -12% | 40,000 | $19,097,005 |

The post ASX Small Caps Lunch Wrap: How has Elon Musk packed an annus horribilus into a single week at work? appeared first on Stockhead.

Dolly Varden consolidates Big Bulk copper-gold porphyry by acquiring southern-portion claims – Richard Mills

2023.12.22

Dolly Varden Silver’s (TSXV:DV, OTCQX:DOLLF) stock price shot up 16 cents for a gain of 20% Thursday, after announcing a consolidation of…

Gold Digger: ‘Assured growth’ – central bank buying spree set to drive gold higher in 2024

Central banks will drive the price of gold higher in 2024, believe various analysts Spot gold prices seem stable to … Read More

The post Gold Digger:…

GoldTalks: Going big on ASX-listed gold stocks

Aussie investors are spoiled for choice when it comes to listed goldies, says Kyle Rodda. Here are 3 blue chips … Read More

The post GoldTalks: Going…