Base Metals

West Musgrave goes ahead, Anglo Pacific should benefit

In September, OZ Minerals (OZL.AX), which currently is the subject of a buyout offer by BHP (BHP) announced it has made the final investment decision on…

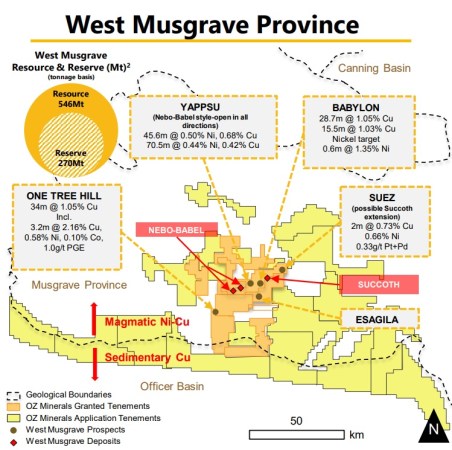

In September, OZ Minerals (OZL.AX), which currently is the subject of a buyout offer by BHP (BHP) announced it has made the final investment decision on the West Musgrave copper-nickel project in Australia. Based on the timing of the FID and the relatively long construction period, the first production of copper and nickel is now planned for the second half of 2025.

The project will produce 41,000 tonnes of copper (90 million pounds) and 35,000 tonnes of nickel (77 million pounds) in the first five years of the mine life before production levels decrease. Thanks to the high copper output, the C1 cost on a by-product basis is estimated at just $0.50 per pound of nickel. With a total reserve of 270 million tonnes (at an average grade of 0.34% copper and 0.31% nickel) and an anticipated throughput of 13.5 million tonnes per year, the reserves underpin a mine life of 20 years. However, there are an additional 120 million tonnes in the resource categories which means the mine will likely be operational for a few additional years.

Unfortunately Oz Minerals is feeling the impact of inflation first hand as the initial capex increased from A$1.1B to A$1.6B as for instance the cost of the processing plant increased by 80% compared to the pre-feasibility study although the throughput increased by less than 15%. The A$1.6B does include A$190M in contingency. The after-tax NPV6.5% comes in at A$1.5B which is twice as high compared to the A$1B after-tax NPV in the pre-feasibility study, which had a higher discount rate of 8.5%. The base case scenario uses a nickel price of $7.83 per pound and a copper price of $3.44 per pound. If a copper price of $4.35 per pound would be used, the after-tax NPV6.5% increases to A$2.2B and the IRR increases to 22%.

The decision of OZ Minerals to go ahead with this project is important for Anglo Pacific Group (APY.L, APY.TO) as well, as Anglo owns a 2% NSR on the project. Using a nickel price of $8/pound and a copper price of $3.50 per pound, a 2% NSR will contribute almost $20M per year during the first five years of the West Musgrave mine life.

Disclosure: The author has no position in OZ Minerals or Anglo Pacific Group. Please read our disclaimer.

White House Prepares For “Serious Scrutiny” Of Nippon-US Steel Deal

White House Prepares For "Serious Scrutiny" Of Nippon-US Steel Deal

National Economic Adviser Lael Brainard published a statement Thursday…

How to Apply for FAFSA

Students and families will see a redesigned FAFSA this year. Here’s how to fill it out.

Dolly Varden consolidates Big Bulk copper-gold porphyry by acquiring southern-portion claims – Richard Mills

2023.12.22

Dolly Varden Silver’s (TSXV:DV, OTCQX:DOLLF) stock price shot up 16 cents for a gain of 20% Thursday, after announcing a consolidation of…