Base Metals

VanEck reckons Australia might just be the ‘lucky country’ again in 2023

Aussie investors plan to stick to home shores in 2023 according to VanEck survey VanEck expects improving relative performance from … Read More

The post…

- Aussie investors plan to stick to home shores in 2023 according to VanEck survey

- VanEck expects improving relative performance from small cap and mid cap stocks

- Australia well positioned to handle economic headwinds and avoid recession in 2023

Australian equities are shaping up to be the go-to destination for investors in 2023 supported by several tailwinds which will continue to see the local market outperform globally, according to the latest VanEck Australian Investor Survey.

VanEck Asia-Pacific CEO and Managing Director Arian Neiron said Australia on balance, is much better positioned than most countries to manage economic headwinds in 2023.

“Australia also has abundant natural resources in short supply globally and with borders reopened we expect the return of immigration to offset labour inflation,” he said.

“We favour resources, REITs and consumer staples, are neutral on banks and underweight consumer discretionary.

“This dynamic bodes well for taking an equally weighted approach to Australian equities.”

For 2023 VanEck expect Australian equities to continue to outperform global equities, while it expects to see improving relative performance from small cap and mid cap stocks.

As Stockhead’s Josh Chiat reported Goldman Sachs is also bullish on the Aussie resource sector heading into 2023, particularly iron ore and base metals set to profit from China’s reopening.

VanEck forecasts RBA cash rate to peak at 3.85%

The ETF issuer forecasts the RBA cash rate to peak at 3.85% with the Australian 10 year yield to remain around the current 4% level, and we may see an inversion of the curve which could support bond proxies like REITs, infrastructure and utilities.

He said 2022 was a remarkable year with Australian equity and bond markets both down for the first time since 1994.

He said the poor performance was a result of three major themes including:

- Multi-decade high inflation and central bank rate rises

- Russian invasion of Ukraine

- China’s Covid-zero policy.

And while every almost every major asset class took a sizeable hit last year, Australian equities offered relative defence.

Australian equity, as measured by the S&P/ASX 200, was one of the better performing equity markets in 2022, with its exposure to resources helping to curb losses to 1% for the year.

Australian resource stocks have rallied over the past few months on China re-opening optimism.

“Chinese President Xi Jinping has cited infrastructure spending as the government’s main lever to rescue economic growth,” Neiron said.

“The Australian resources sector could be a major beneficiary of this investment, as it was during the GFC.

“The reopening of a country with 1.4 billion residents offers investment opportunities, particularly within Australian sectors that have high revenue exposure to China.”

Australia among few to escape recession

Neiron said Australia has lower headline inflation than the US and many European nations. This means the task of the RBA containing high inflation without triggering a recession or ‘hard landing’ will be easier relative to other countries.

Before the covid-19 recession, Australia held the longest streak of avoiding recession in 28 years among developed nations.

The nation avoided a recession during the 1997 Asian financial crisis, dot com bubble, global financial crisis and eurozone crisis.

It was also the only developed nation to avoid a recession during the GFC, defined as two consecutive periods of negative gross domestic product (GDP) growth, and why Australia is often referred to as the ‘lucky country’.

“We see Australia being the lucky country again in 2023, with Australia likely to avoid recession,” he said.

“The majority of Australian mortgages are variable which means cash rate increases immediately impact budgets and corresponding spending.”

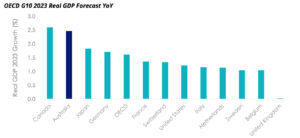

Indeed, Australia’s projected real GDP growth for 2023 is expected to be one of the highest according to the OECD.

Investors looking to stay home in 2023

According to VanEck investor survey, Australian equities are the preferred investment destination in 2023 with 70% of investors planning to start or increase their allocation.

One in two investors indicated ETFs are their preferred investment product, while 57% plan to start or increase their allocation to ETFs in 2023.

The post VanEck reckons Australia might just be the ‘lucky country’ again in 2023 appeared first on Stockhead.

White House Prepares For “Serious Scrutiny” Of Nippon-US Steel Deal

White House Prepares For "Serious Scrutiny" Of Nippon-US Steel Deal

National Economic Adviser Lael Brainard published a statement Thursday…

How to Apply for FAFSA

Students and families will see a redesigned FAFSA this year. Here’s how to fill it out.

Dolly Varden consolidates Big Bulk copper-gold porphyry by acquiring southern-portion claims – Richard Mills

2023.12.22

Dolly Varden Silver’s (TSXV:DV, OTCQX:DOLLF) stock price shot up 16 cents for a gain of 20% Thursday, after announcing a consolidation of…