Base Metals

Monsters of Rock: Panoramic Resources sinks into administration with 10,600 investors on board

A falling nickel price has taken the scalp of Panoramic Resources, which called in administrators after efforts to sell or … Read More

The post Monsters…

A falling nickel price has finally taken the scalp of WA producer Panoramic Resources (ASX:PAN), which today called in administrators after efforts to sell or revive its Savannah nickel mine were unsuccessful.

The administrator will now look to either sell or recapitalise the business, with the mine to remain operational during this process, “at least in the short term”.

During this process the stock will remain suspended. Whatever the outcome, retail investors will probably be the biggest losers.

As of 15 September this year there were 10,608 shareholders on the register.

EXPLAINER: What happens to my shares when a company goes bust?

Panoramic survived the last nickel downturn in 2016, which saw Savannah placed on care and maintenance as prices fell below US$4/lb.

It reaching commercial production again mid 2022, but cratering nickel prices, logistic issues, busted plant parts and escalating costs has now put the stock – worth over $750m last year – to the sword.

Panoramic was unable to survive despite raising $46m in July via placement and share purchase plan.

It leave a huge gap in the ASX-listed space, with the only other pureplay nickel producer of any scale, Mincor (ASX:MCR), recently acquired by Andrew Forrest’s Wyloo Metals.

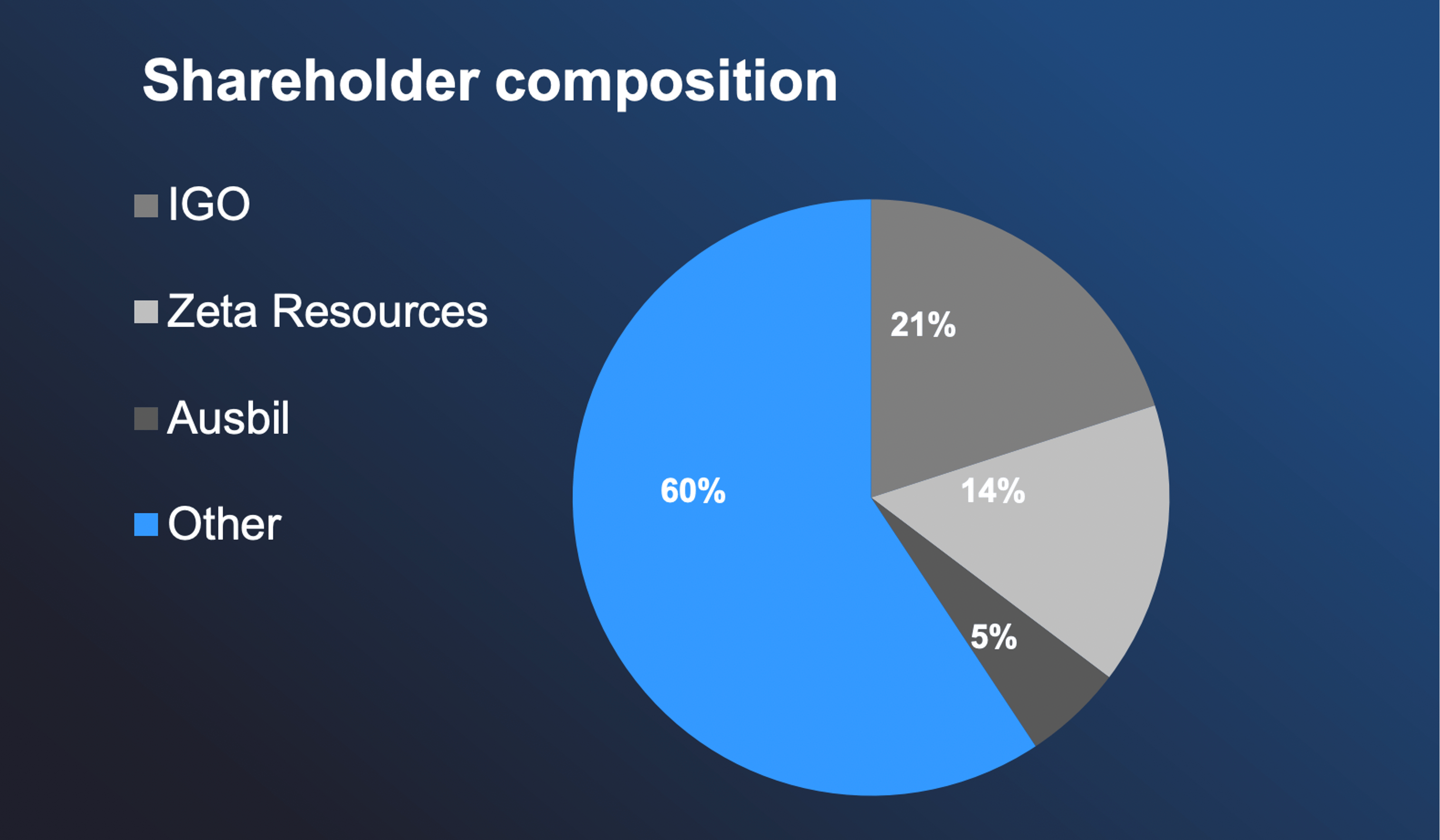

It also represents another blow to lithium-nickel major IGO (ASX:IGO), which inherited a big chunk of PAN stock via the ill-fated $1.3bn Western Areas takeover.

IGO actually lobbed a$312m takover offer at PAN in 2019, which was taken off the table after a number of subsequent announcements by PAN prompted IGO to rethink its pursuit.

The post Monsters of Rock: Panoramic Resources sinks into administration with 10,600 investors on board appeared first on Stockhead.

White House Prepares For “Serious Scrutiny” Of Nippon-US Steel Deal

White House Prepares For "Serious Scrutiny" Of Nippon-US Steel Deal

National Economic Adviser Lael Brainard published a statement Thursday…

How to Apply for FAFSA

Students and families will see a redesigned FAFSA this year. Here’s how to fill it out.

Dolly Varden consolidates Big Bulk copper-gold porphyry by acquiring southern-portion claims – Richard Mills

2023.12.22

Dolly Varden Silver’s (TSXV:DV, OTCQX:DOLLF) stock price shot up 16 cents for a gain of 20% Thursday, after announcing a consolidation of…