Iron Ore

Iron Ore Hits 5-Month High Despite Impending Steel Caps

China has steel caps coming in the second half of 2023 according to its biggest producer. Why is the iron … Read More

The post Bulk Buys: Iron ore hits…

Iron ore has in recent memory performed extraordinarily poorly in the second half thanks to a recent cycle of unfettered steel output in the first half of the year in China followed by a string of Government controls to keep output falling ever so slightly.

It means output has to be far weaker in the last six months, something that was confirmed by Chinese steelmaker Baosteel last week.

“This year, there is still the policy to keep steel output flat, and the output this year will not exceed last year’s level,” GM Wu Xiaodi said reporting the company’s earnings last week.

The drop will likely be between 30-40Mt.

That is worth looking out for, given Baosteel is plenty connected. Part of China’s State-owned Baowu Group, the steelmaker has stakes in iron ore projects in Australia and elsewhere, including a role in the development of the Simandou mine championed by Rio Tinto (ASX:RIO) in Guinea.

The aims of the policy are largely read as environmental in nature.

Steel is one of the main emitters in China, and globally the industry contributes around 7-8% of the world’s CO2 emissions.

China currently produces almost 60% of the world’s steel largely through the blast furnace method, which uses met coal and iron ore to produce crude steel, sold primarily in two products, rebar and hot rolled coil.

While other, less carbon intensive forms of steelmaking exist, like electric arc furnaces, they aren’t in high penetration in China due to the age of its industry and a lack of scrap steel supply.

Additionally, when power prices are high it can cause China to idle EAF output. By 2025 China plans to lift EAF’s share of steel production from around 5% to 15% and further to 20% by 2030.

But prices continue to rage

Supply of seaborne iron ore continues to increase as well.

According to MySteel, August 28 to September 3 saw the fourth straight week of shipment increases out of Australia and Brazil.

Aussies shipped 3.9% more taking their supply to 18.9Mt for the week, with global seaborne trade up 1.3% to 27.6Mt.

Yet traders are looking longingly at the demand side of the equation.

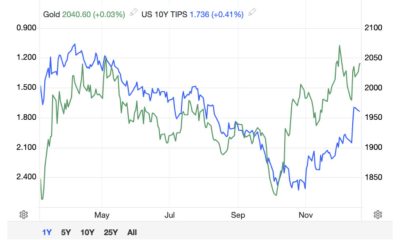

For the first time in five months prices eclipsed the US$115/t barrier in Singapore, hitting US$117/t briefly yesterday before falling back to US$115.30/t when we put down out pens.

ANZ’s Adam Boyton pinpointed a string of property support measures, which include lowering deposit requirements nationwide along with planned rate cuts as the backbone of the iron ore revival.

“Sentiment was more buoyant in the iron ore market following last week’s property measures, with futures pushing above USD115/t in Singapore,” he said, noting the steel sector’s plans to reduce production still hovered over iron ore fundamentals.

“However, the spectre of production cuts continues to hang over the market. China’s largest steel maker, Baoshan, reaffirmed Beijing’s policy to keep this year’s steel production flat or slightly lower than last year.

“However, in the seven months to July, output is up 3%. With the industry seeing the worst profit levels in over a decade, cuts may come over early Q4 when increasing construction activity brings better prices.”

There was some joy from China’s PMI reading in August, with the non-manufacturing PMI growing from 51.2 in July to 53.8 in August.

On the ASX all the focus in recent days in iron ore has been on the revolving door at Andrew Forrest’s Fortescue (ASX:FMG), where its two most senior iron ore executives exited stage left after just months with the company.

It comes as the major shareholder and executive chairman tries to bed down a massive shift in focus to become a major green energy producer, something that is currently seeing hundreds of millions in cash redirected each year from its iron ore earnings into green energy arm Fortescue Future Industries.

What may have slipped under the radar was a little sell-off from another big (but far more modest) iron ore chairman in Champion Iron’s (ASX:CIA) Michael O’Keeffe.

The $3 billion stock has been on a decent run of late. It runs the high grade magnetite operations at Bloom Lake in Canada, where it is ramping up to a full run rate of 15Mtpa after a Phase 2 expansion.

The 2 million share sale by O’Keefe on August 31 will net the CIA exec chair $11.9m.

The next leg of their growth appears to be an FID on a decision to produce 69% Fe direct reduced iron grade iron ore from Bloom Lake from 2025, which would make the company a major supplier to DR plants, able to produce steel at half the CO2 intensity of a basic oxygen furnace.

The company noted in a presentation today that just 2.3Bt of iron ore of DR grade has been produced historically. Six times that will be needed to be produced by 2050 to help reduce steel industry emissions, a 348Mtpa market equivalent to 40 “average scale mines”.

ASX iron ore stocks

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | PRICE | WEEK RETURN % | MONTH RETURN % | 6 MONTH RETURN % | YEAR RETURN % | MARKET CAP |

|---|---|---|---|---|---|---|---|

| ACS | Accent Resources NL | 0.008 | 0% | 0% | -68% | -81% | $ 3,785,018.26 |

| ADY | Admiralty Resources. | 0.006 | 0% | -14% | -14% | -40% | $ 7,821,474.92 |

| AKO | Akora Resources | 0.185 | 0% | -10% | 32% | 23% | $ 17,571,820.59 |

| BCK | Brockman Mining Ltd | 0.0265 | 6% | -12% | 2% | -9% | $ 245,926,151.47 |

| BHP | BHP Group Limited | 46.1 | 6% | 1% | -5% | 25% | $ 232,807,218,416.91 |

| CIA | Champion Iron Ltd | 6.23 | 8% | 9% | -22% | 24% | $ 3,269,309,045.20 |

| CZR | CZR Resources Ltd | 0.15 | 0% | 7% | -25% | -44% | $ 35,360,196.90 |

| DRE | Dreadnought Resources Ltd | 0.057 | 36% | 12% | -27% | -59% | $ 183,962,802.16 |

| EFE | Eastern Resources | 0.009 | -10% | -10% | -44% | -70% | $ 11,177,518.15 |

| CUF | Cufe Ltd | 0.014 | 0% | 8% | -30% | -30% | $ 14,899,460.75 |

| FEX | Fenix Resources Ltd | 0.235 | -20% | -22% | -6% | -10% | $ 163,128,051.20 |

| FMG | Fortescue Metals Grp | 20.05 | 1% | -6% | -12% | 17% | $ 62,195,091,343.60 |

| RHK | Red Hawk Mining Ltd | 0.75 | -6% | 53% | 56% | 42% | $ 133,390,375.83 |

| GEN | Genmin | 0.18 | 0% | -5% | -13% | -28% | $ 81,275,982.12 |

| GRR | Grange Resources. | 0.475 | 9% | -11% | -52% | -36% | $ 538,162,494.57 |

| GWR | GWR Group Ltd | 0.09 | -4% | 3% | 45% | 12% | $ 27,945,848.99 |

| HAV | Havilah Resources | 0.255 | -2% | -15% | -28% | -31% | $ 85,492,586.70 |

| HAW | Hawthorn Resources | 0.115 | 0% | 5% | 15% | 20% | $ 38,526,795.50 |

| HIO | Hawsons Iron Ltd | 0.034 | -3% | -6% | -51% | -91% | $ 30,329,344.95 |

| IRD | Iron Road Ltd | 0.078 | -13% | -13% | -22% | -46% | $ 67,778,883.65 |

| JNO | Juno | 0.072 | -4% | -3% | -9% | -45% | $ 9,767,376.07 |

| LCY | Legacy Iron Ore | 0.016 | 0% | -6% | -11% | -24% | $ 102,509,219.18 |

| MAG | Magmatic Resrce Ltd | 0.06 | -2% | -15% | -34% | -69% | $ 18,341,567.88 |

| MDX | Mindax Limited | 0.05 | 0% | -11% | -22% | -15% | $ 102,277,939.00 |

| MGT | Magnetite Mines | 0.38 | -3% | -10% | -40% | -70% | $ 29,170,718.62 |

| MGU | Magnum Mining & Exp | 0.04 | 21% | -22% | 111% | 11% | $ 29,589,856.91 |

| MGX | Mount Gibson Iron | 0.445 | 2% | -4% | -26% | 1% | $ 534,344,506.52 |

| MIN | Mineral Resources. | 73.45 | 14% | 5% | -18% | 25% | $ 14,372,119,591.60 |

| MIO | Macarthur Minerals | 0.19 | 0% | -10% | 36% | 6% | $ 35,701,499.92 |

| PFE | Panteraminerals | 0.068 | -19% | -6% | -38% | -43% | $ 6,665,787.58 |

| PLG | Pearlgullironlimited | 0.023 | 0% | -8% | -39% | -20% | $ 3,597,573.47 |

| RHI | Red Hill Minerals | 4.24 | -1% | -5% | -7% | 15% | $ 267,439,944.31 |

| RIO | Rio Tinto Limited | 117.32 | 8% | 2% | -7% | 30% | $ 43,476,842,983.68 |

| RLC | Reedy Lagoon Corp. | 0.006 | 0% | -25% | -31% | -61% | $ 3,700,101.53 |

| CTN | Catalina Resources | 0.0035 | -30% | -13% | -50% | -56% | $ 4,953,947.57 |

| SRK | Strike Resources | 0.059 | 9% | -2% | -23% | -40% | $ 15,322,500.00 |

| SRN | Surefire Rescs NL | 0.0155 | 3% | -3% | 11% | 29% | $ 24,770,452.16 |

| TI1 | Tombador Iron | 0.02 | -9% | -13% | -13% | -26% | $ 45,301,879.83 |

| TLM | Talisman Mining | 0.145 | 4% | -9% | 0% | -9% | $ 28,248,052.35 |

| VMS | Venture Minerals | 0.012 | -11% | -20% | -45% | -57% | $ 23,400,156.42 |

| EQN | Equinoxresources | 0.15 | 0% | -3% | -19% | 0% | $ 6,300,000.14 |

| AMD | Arrow Minerals | 0.0025 | -17% | -38% | -58% | -38% | $ 9,071,295.29 |

We’ve got new emissions targets but coal mines aren’t on the chopping block yet

For all the talk of anti-coal sentiment and lengthening approvals processes from Federal and State Governments, met coal miners continue to have a way with the Albanese Labor Government.

The most recent is the extension of the Japanese owned Gregory Crinum mine near Emerald in Queensland.

Purchased by Sojitz Blue a few years ago after BHP and Mitsubishi placed the Bowen Basin operation into care and maintenance, the extension of the mine to 2073 was approved with 57 conditions last week.

It was, understandably, criticised by the Climate Council, whose CEO Amanda McKenzie claimed Australia’s environment laws were “broken”.

“There are at least 21 more fossil fuel projects currently in the EPBC approval pipeline. Will the Albanese Government wave every one through before it gets around to delivering on its promise to strengthen this law?” Climate Council head of advocacy Jennifer Rayner added in a statement.

“The cognitive dissonance is stunning. It makes zero sense to have one hand claiming Australia is a global leader on action on climate while the other is busy rubber stamping 50 more years of coal.”

On the other hand it seems unlikely that Canberra or Brisbane will show a heavy hand when it comes to met coal mines, one of the largest industries in regional Queensland.

The product remains in high demand in Asia, where it is an essential input to their steel sector, and where prices have been lifting alongside iron ore in recent days on the Chinese stimulus outlook.

Companies including BHP, BlueScope Steel (ASX:BSL), which recently approved a $1.15 billion life extension of the No.6 blast furnace at the Port Kembla Steelworks, and South32 (ASX:S32) have all expressed pessimism that steelmakers will be able to shift away from coal for decades to come.

Coking coal futures have lifted to more than US$270/t from around US$220/t a little over a month ago.

Newcastle 6000kcal thermal coal prices rose around 13% over the past month to US$158.50/t, as higher gas prices stoked increased demand for energy coal.

ASX coal stocks

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | PRICE | WEEK RETURN % | MONTH RETURN % | 6 MONTH RETURN % | YEAR RETURN % | MARKET CAP |

|---|---|---|---|---|---|---|---|

| NAE | New Age Exploration | 0.006 | 33% | 20% | 0% | -14% | $ 7,179,494.55 |

| CKA | Cokal Ltd | 0.13 | 24% | 13% | -26% | -41% | $ 129,473,877.60 |

| BCB | Bowen Coal Limited | 0.1 | -20% | -9% | -63% | -75% | $ 183,694,785.51 |

| SVG | Savannah Goldfields | 0.073 | 4% | -20% | -58% | -64% | $ 14,030,815.89 |

| GRX | Greenx Metals Ltd | 0.95 | 0% | 3% | 25% | 296% | $ 255,141,807.97 |

| AKM | Aspire Mining Ltd | 0.096 | -1% | 23% | 66% | 7% | $ 47,717,876.59 |

| AVM | Advance Metals Ltd | 0.006 | 0% | -14% | -33% | -40% | $ 2,942,793.63 |

| YAL | Yancoal Aust Ltd | 5.29 | 5% | 4% | -10% | -9% | $ 6,839,876,283.66 |

| NHC | New Hope Corporation | 5.68 | -0% | 6% | 5% | 11% | $ 4,750,785,307.68 |

| TIG | Tigers Realm Coal | 0.006 | 0% | 20% | -45% | -71% | $ 65,333,511.84 |

| SMR | Stanmore Resources | 2.86 | 1% | 0% | -19% | 18% | $ 2,577,980,073.24 |

| WHC | Whitehaven Coal | 6.62 | -9% | -6% | -8% | -17% | $ 5,437,905,096.00 |

| BRL | Bathurst Res Ltd. | 1.015 | 0% | 3% | -6% | 4% | $ 196,143,774.50 |

| CRN | Coronado Global Res | 1.56 | 0% | -6% | -18% | -5% | $ 2,648,796,893.40 |

| JAL | Jameson Resources | 0.051 | 0% | 0% | -30% | -36% | $ 19,967,066.10 |

| TER | Terracom Ltd | 0.47 | 2% | 12% | -38% | -58% | $ 392,473,455.15 |

| ATU | Atrum Coal Ltd | 0.005 | 0% | 0% | -29% | -33% | $ 6,958,495.86 |

| MCM | Mc Mining Ltd | 0.145 | 0% | -12% | -36% | -34% | $ 57,951,454.29 |

| DBI | Dalrymple Bay | 2.74 | 1% | -1% | 9% | 28% | $ 1,363,344,584.25 |

| AQC | Auspaccoal Ltd | 0.13 | -10% | -16% | -28% | -64% | $ 45,150,423.89 |

The post Bulk Buys: Iron ore hits five-month high despite impending steel caps appeared first on Stockhead.

3 Bargain Commodity Stocks to Ride the Wave of Global Energy Transition

The global focus on green energy does not mean that only renewable energy companies will benefit. There are several associated industries that are critical…

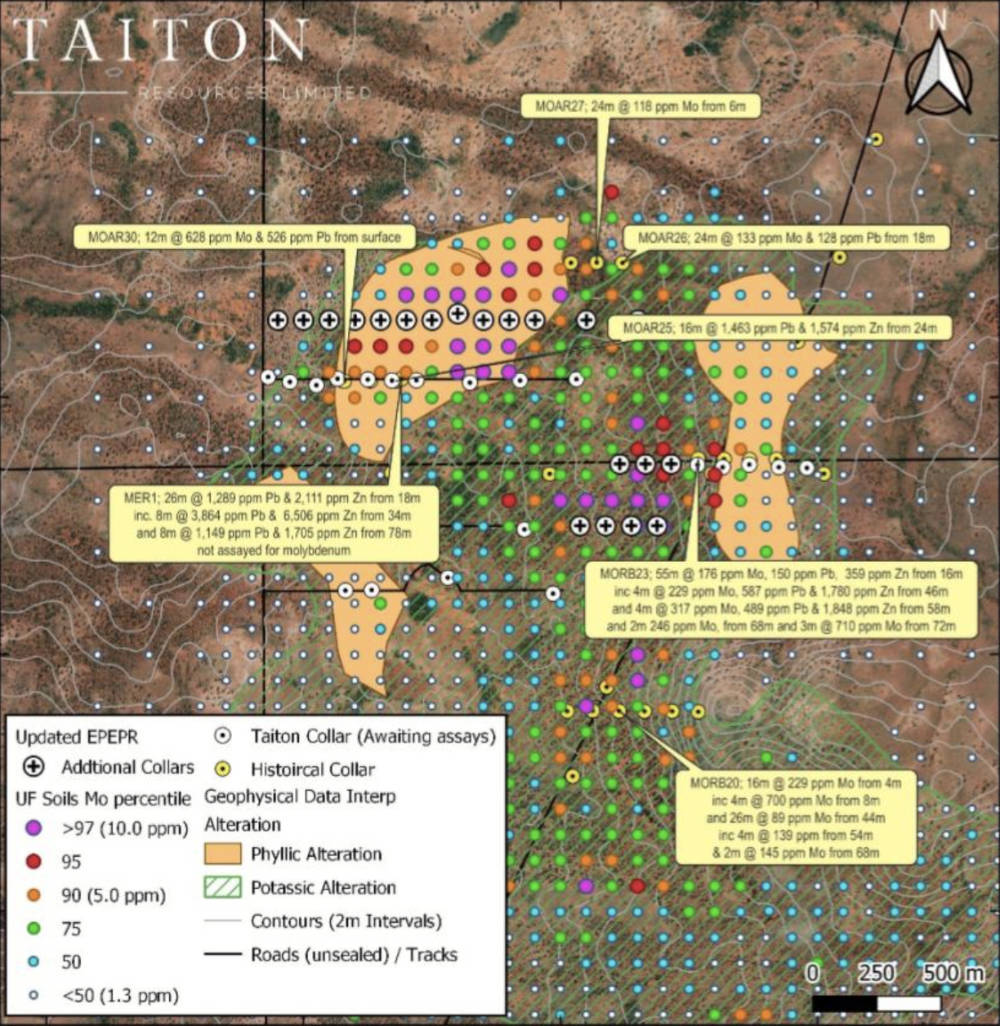

Taiton cleared to start second drill program over molybdenum anomaly at district scale Highway project, maiden assays ‘imminent’

Special Report: Taiton has the green light from South Australia’s Department of Mines and Energy to drill a significant molybdenum … Read More

The…

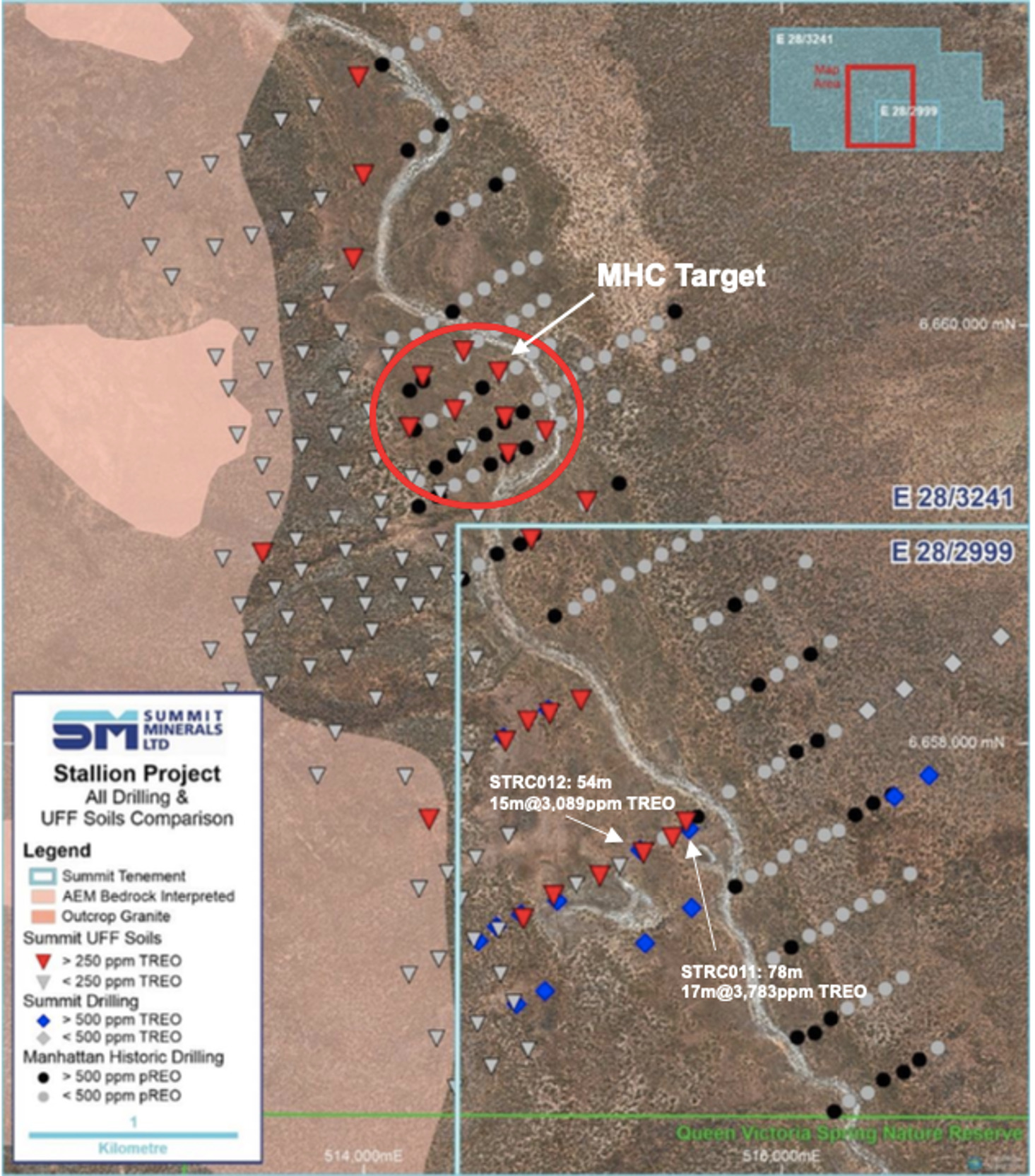

How big? Ultrafine soil sampling hints at the ‘size and scale’ of Summit’s Stallion rare earths project

Special Report: UltraFine+ soil analysis has confirmed more exploration upside to the north of Summit Minerals’ Stallion REE project in … Read More

The…