Base Metals

Confessions of a Day Trader: I spy with my wonky eyes… a bargain in Aisle 2!

That feeling when you go to ALDI to buy some potatoes and come out with a TV and a garden … Read More

The post Confessions of a Day Trader: I spy with…

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday October 24

Another day, another dollar, or that’s how the theory goes. The first trade of the week is the hardest and the very last trade of the week is the easiest.

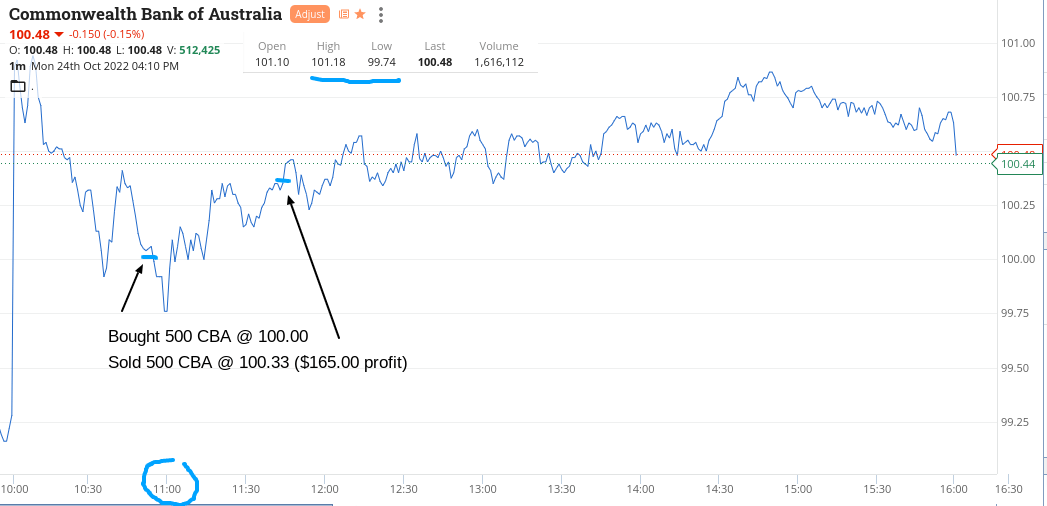

Luckily for me New Hope (ASX:NHC) go ex a nice juicy dividend and though the first trade’s timing was not so good, the timing of the doubling down was!

Got in and out early for a $260 profit and the return on capital employed would make your accountant want to quit his job and join you trading.

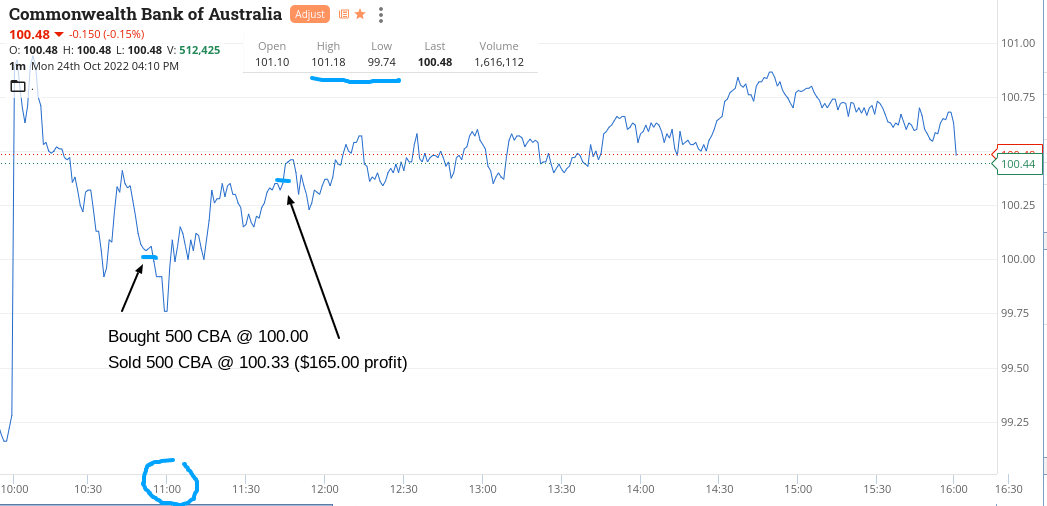

Then it was CBA’s turn. They opened at $101.10 and I bt some at $100 as thought they could go either way… and of course they dipped before reaching $100.33. Sold them and of course they kept on going up!

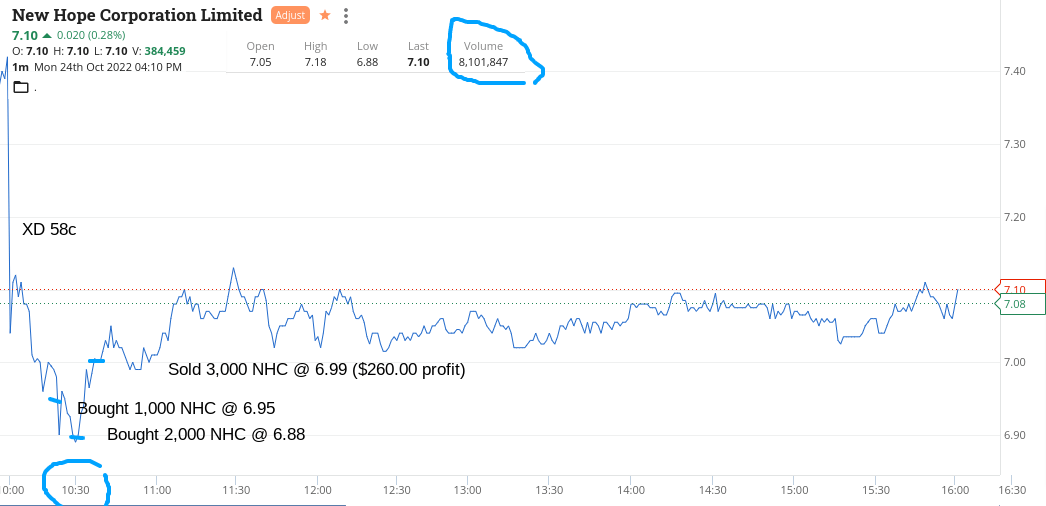

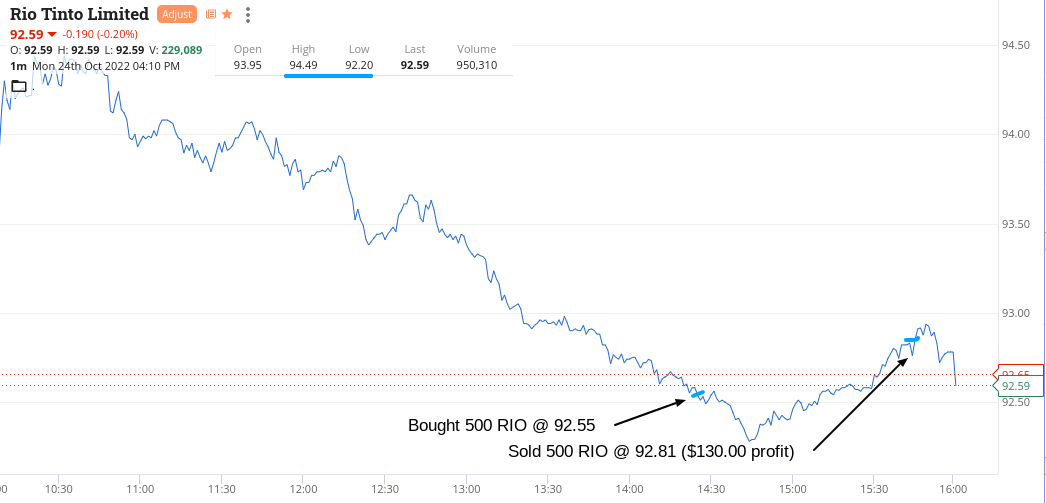

Then in the afternoon, was just having a quick peek and I can’t help myself. I call these types of trades an ‘ALDI trade’; the kind where you go to ALDI to buy some potatoes and come out with a TV and a garden seat. Your intention means nothing in those starting moves.

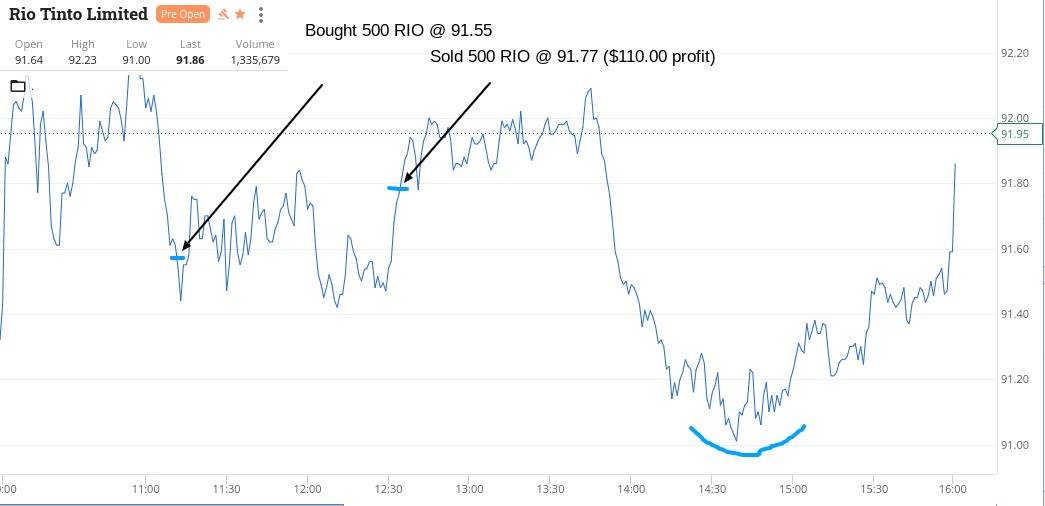

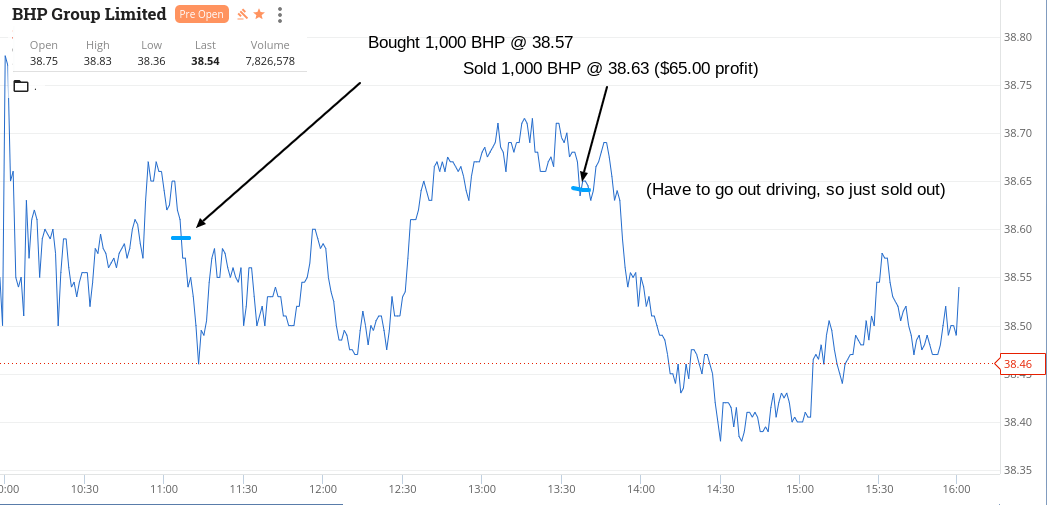

Anyway, both BHP and RIOs are skiing down a black run and I try and catch them for a bounce. It works out OK in the end and I could have doubled down in both but decided to just wait.

That worked out OK, so end the day up $625 and in the end the first trades were the best by far.

Recap

Bought 1,000 NHC @ 6.95

Bought 2,000 NHC @ 6.88

Sold 3,000 NHC @ 6.99 ($260 profit)

Bought 500 CBA @ 100

Sold 500 CBA @ 100.33 ($165 profit)

Bought 1,000 BHP @ 39.01

Bought 500 RIO @ 92.55

Sold 500 RIO @ 92.81 ($130 profit)

Sold 1,000 BHP @ 39.08 ($70 profit)

Tuesday October 25

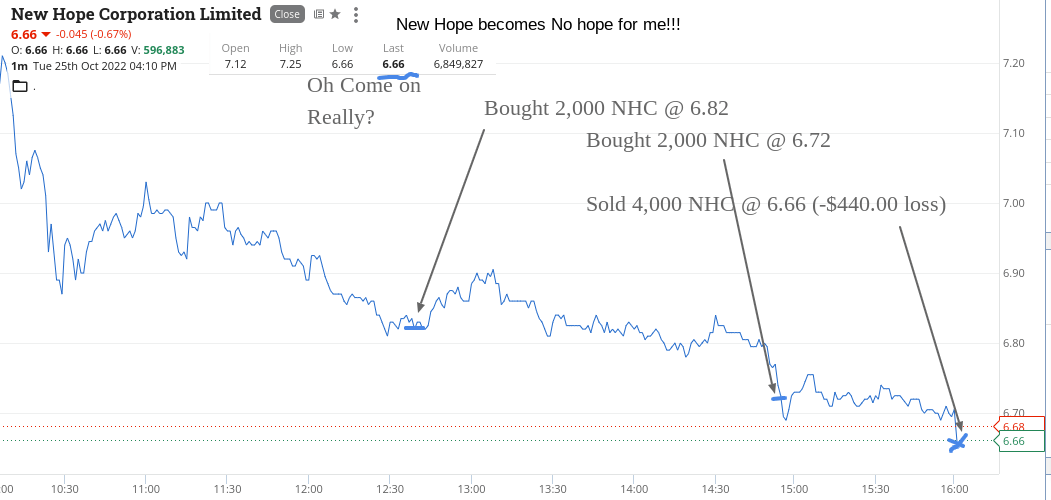

Well, one stock finished at $6.66 on me, as the trading devil giveth and then taketh away today.

Having done OK yesterday, today gave me two wins and one loss but that loss wiped out today’s gain plus some more.

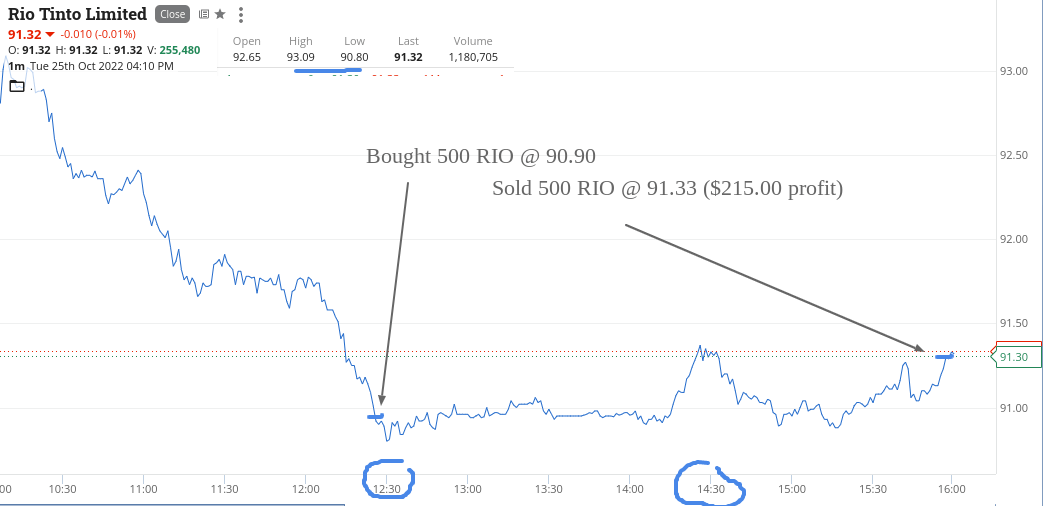

Started off in RIOs at below $91 and they swung in and out of profit before they eventually hit a sell limit minutes before the close.

Having done alright in NHC yesterday, they came back and bit me today. They had a high of $7.25, so getting set at $6.82, I thought was a good thing. Wrong.

Had to double down at $6.72 and could have cut them just before 4.00pm, but I decided to hold on till the real death but that cost me another $240 as they closed at $6.66. Ouch. New Hope became No Hope.

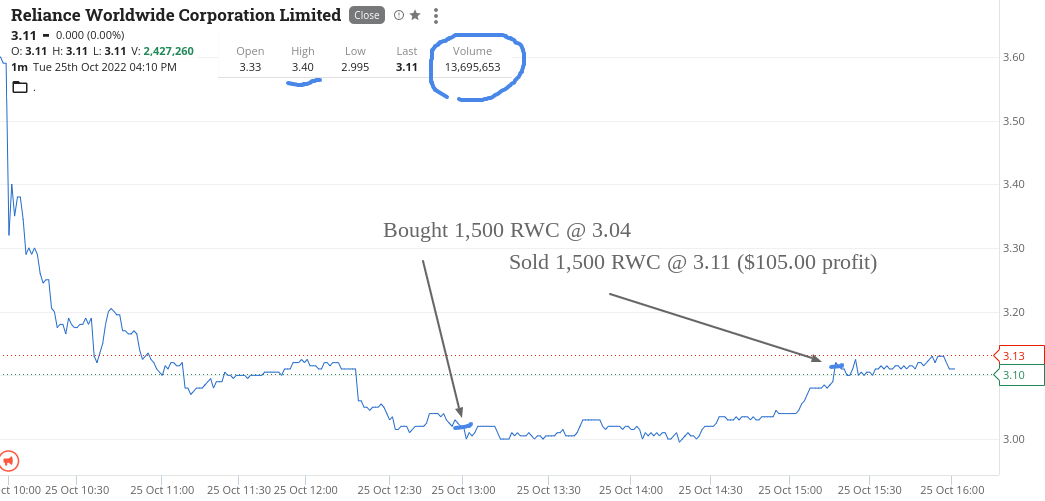

I saw some negative press on RWC, in between fighting with NHC and thought they had peaked on the sell side. They came good with a 7c turn, just to amuse me.

Finish down $120. The only highlight of the day for me is that it’s cheap arse Tuesday at the local pizza joint and they do a ‘Devil’s Supreme’, which comes with extra chilli sauce. Burnt fingers and now burnt mouth is my punishment but at half the price!

Recap

Bought 500 RIO @ 90.90

Bought 2,000 NHC @ 6.82

Bought 1,500 RWC @ 3.04

Bought 2,000 NHC @ 6.72

Sold 1,500 RWC @ 3.11 ($105 profit)

Sold 500 RIO @ 91.33 ($215 profit)

Sold 4,000 NHC @ 6.66 ($440 loss)

Wednesday October 26

Get my revenge on NHC, which gives me back half of yesterday’s losses from the devil’s $6.66 close and open.

CBA have a bit of a turnover with the day’s CPI figures coming out at 11.30am, so managed a very quick one in there.

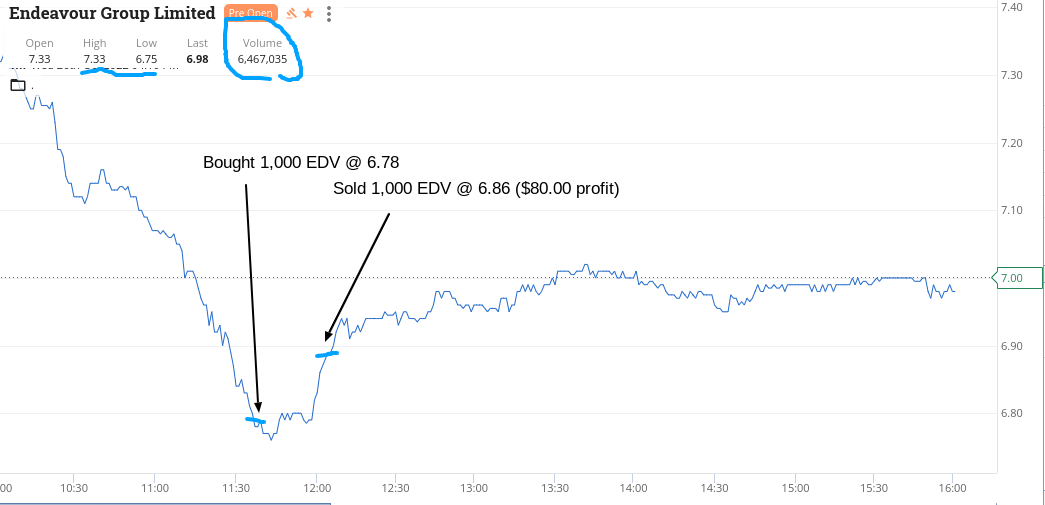

EDV were the biggest fallers out of the big caps and seeing as we Aussies love our grog, I figured all their bad news was built in to their fall. Cheers!

As I had to do some driving ahead of tomorrow’s visit to the hospital, I pull up stumps early and square everything off. BHP was the last one to go and I had to chase it down 4c just to get out, otherwise would have been up $100 on them.

Finish up $585.

Recap

Bought 2,000 NHC @ 6.48

Bought 2,000 NHC @ 6.36

Bought 1,000 BHP @ 38.57

Bought 500 RIO @ 91.55

Sold 4,000 NHC @ 6.48 ($240 profit)

Bought 500 CBA @ 101.87

Sold 500 CBA @ 102.05 ($90 profit)

Bought 1,000 EDV @ 6.78

Sold 500 RIO @ 91.77 ($110 profit)

Sold 1,000 EDV @ 6.86 ($80 profit)

Sold 1,000 BHP @ 38.63 ($65 profit)

Thursday October 27

Have to go to the hospital to have a six-month check up on my right eye. Always a bit nervous because there is a chance that I can go blind if my drops stop working.

That and the fact that they put these drops in both eyes means you can’t see properly for five hours afterwards, which means that today I do no trading.

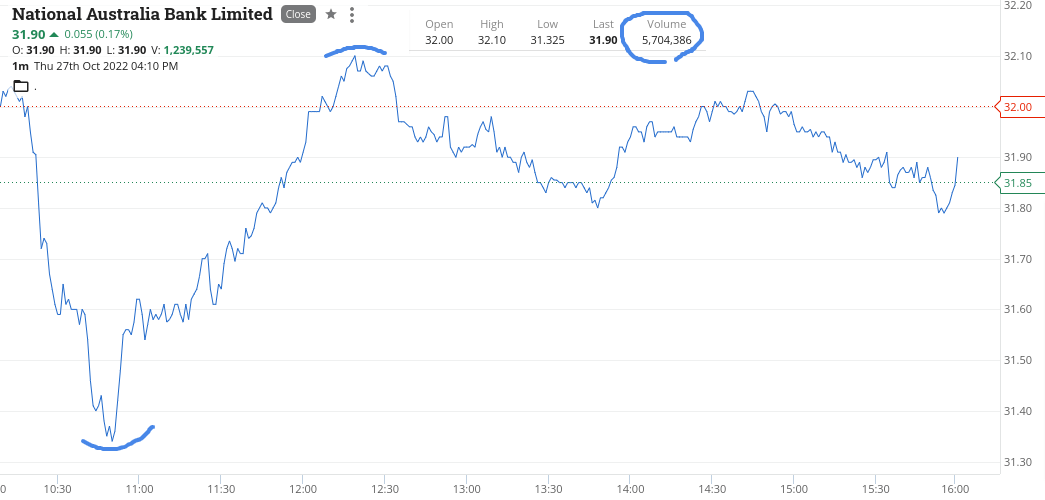

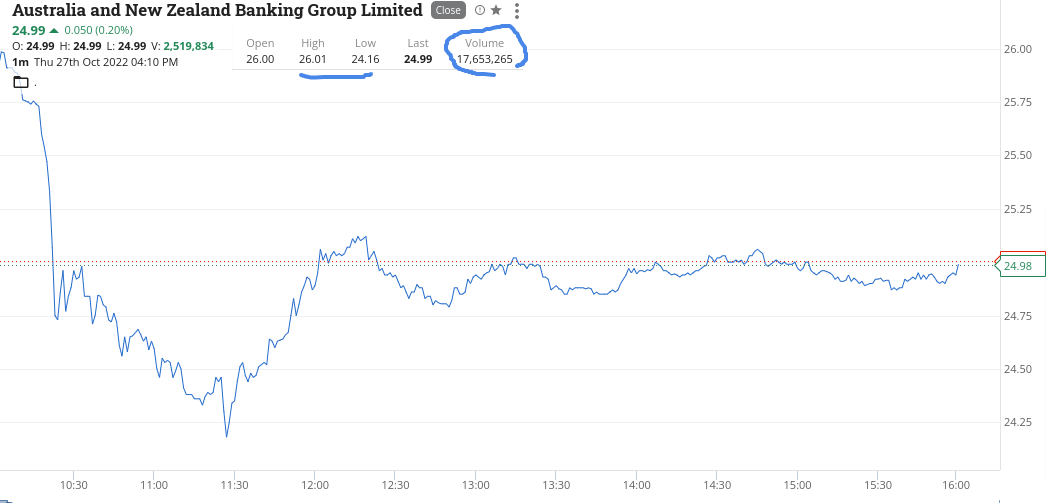

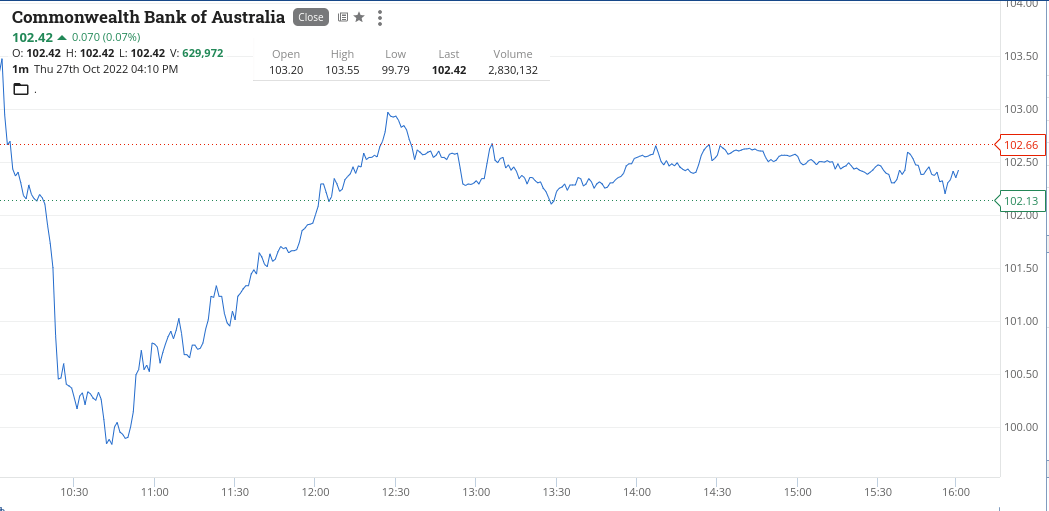

Added some charts on CBA, NAB and ANZ as they had manic day ranges and volumes.

Have a go at CBA. They almost had a $3.00 range and the volume in ANZ was way up. Back on board tomorrow, I hope.

Friday October 28

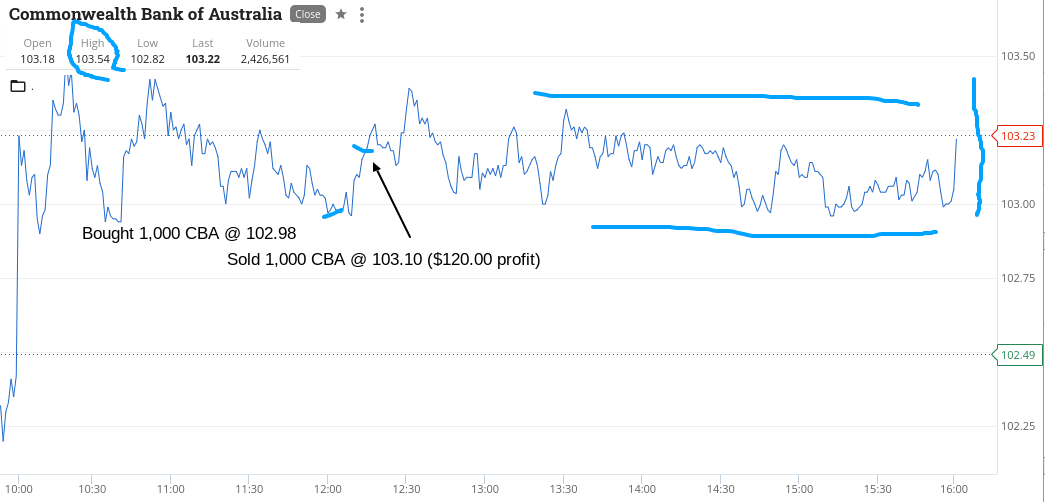

Finally get things back to normal trading-wise around midday.

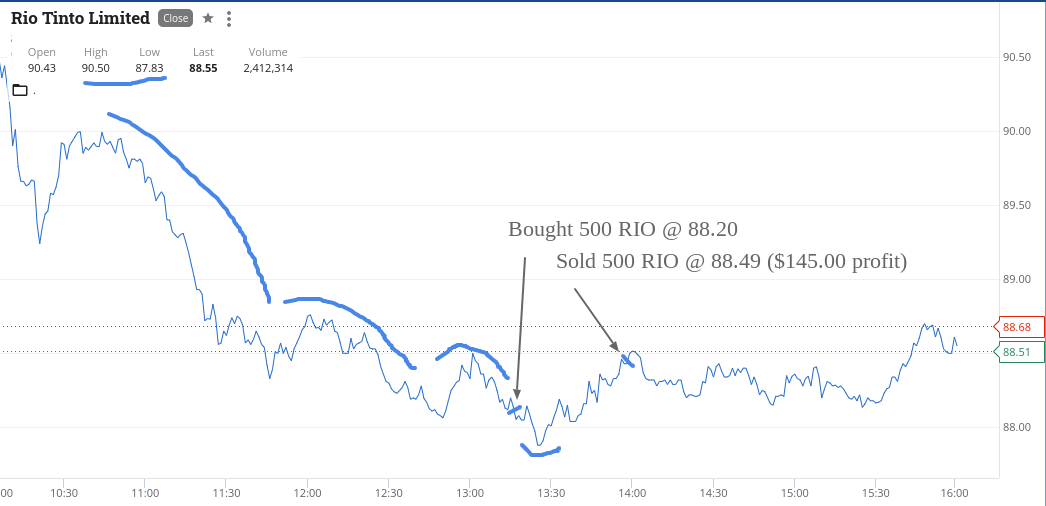

Looks like the banks holding up OK but the iron ore boys are getting a bit smacked around the head. Do OK in RIOs and FMG (small) but lose out in BHP.

CBA got below $103.00 for a bit and bounced OK. RIOs were trading at $88.20, so the gap between them has blown out to $15. Amazing.

Up $245 today and come in at $1,335 gross and $1,077 net. Let’s see if the iron ore price can have a bounce.

Recap

Bought 1,500 FMG @ 14.78

Bought 500 RIO @ 88.20

Bought 1,000 BHP @ 37.65

Sold 500 RIO @ 88.49 ($145 profit)

Bought 1,000 WDS @ 36.01

Bought 1,000 CBA @ 102.98

Sold 1,000 CBA @ 103.10 ($120 profit)

Sold 1,000 WDS @ 36.10 ($90 profit)

Sold 1,500 FMG @ 14.82 ($60 profit)

Sold 1,000 BHP @ 37.48 ($170 loss)

The post Confessions of a Day Trader: I spy with my wonky eyes… a bargain in Aisle 2! appeared first on Stockhead.

White House Prepares For “Serious Scrutiny” Of Nippon-US Steel Deal

White House Prepares For "Serious Scrutiny" Of Nippon-US Steel Deal

National Economic Adviser Lael Brainard published a statement Thursday…

How to Apply for FAFSA

Students and families will see a redesigned FAFSA this year. Here’s how to fill it out.

Dolly Varden consolidates Big Bulk copper-gold porphyry by acquiring southern-portion claims – Richard Mills

2023.12.22

Dolly Varden Silver’s (TSXV:DV, OTCQX:DOLLF) stock price shot up 16 cents for a gain of 20% Thursday, after announcing a consolidation of…