Base Metals

Bulk Buys: Chinese steel mills stay busy as iron ore market waits for signals

Chinese blast furnaces are running at their strongest levels in 22 months, but iron ore demand could be showing signs … Read More

The post Bulk Buys:…

- Chinese steel and iron ore demand an opaque picture as always as strong prices remain

- Sundance continues legal fight over African iron ore project

- Could ASX-listed Siberian coal miner be falling foul of Australian sanctions?

Chinese steel demand is showing cracks in some statistics, quickly wallpapered over in others as the coin wobbles on which side its appetite for iron will drop.

Mills are losing money despite higher steel prices on their 2022 lows and port stockpiles of iron ore lifted 6% last week.

The supply crunch expected from the arrival on Australian shores of Tropical Cyclone Ilsa also failed to emerge, as the category 5 maelstrom somehow missed all the key industry infrastructure on its way through the gap between Port Hedland and Broome.

Iron ore futures headed lower in response.

“Iron ore futures across Asia edged lower after supply concerns eased. Australian producers including BHP and Fortescue said operations were running as normal after Tropical Cyclone Ilsa passed through,” ANZ’s Felicity Emmett said.

“This comes amid tepid demand. Port stockpiles in China rose 6% last week despite the onset of its usual peak construction period.”

But Singapore futures rose 0.8% to a healthy US$117.70/t yesterday and the Dalian contract for September lifted 2.08% to 3.30pm AWST Tuesday after official figures showed China’s GDP rose 4.5% in the first quarter following its reopening from Covid.

Mills are struggling with high prices for iron ore and coking coal, paying US$265/t yesterday. However, they’re chugging along.

Last week, MySteel reported China’s blast furnace capacity utilisation lifted for a 14th week in a row, rising 0.6% on the week and 5.38% on the year to 91.8%.

Get ready for reporting season

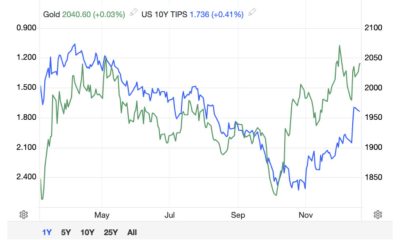

While iron ore prices are around three-month lows, they remain almost 50% higher than levels they dropped to at the ebb of China’s hardline Covid restrictions last year, falling to under US$80/t on October 31.

In that context it’s been a good year so far for the large iron ore miners, whose Pilbara iron ore fines were in high demand throughout the March quarter.

Rio Tinto (ASX:RIO) is up more than 5% year to date and is the first cab off the rank when it comes to reporting season.

The monster-cap, a notoriously slow starter when it comes to iron ore exports, will report its first quarter production tomorrow morning Australian time, with BHP, up around 2.75%, to report Friday.

Fortescue, up over 10%, has already delivered the hard news that the production of first concentrate from its Iron Bridge mine, a high grade magnetite offering due to produce 22Mtpa in full flight, will be delayed the latter part of April.

The Andrew Forrest led miner reports on Monday.

ASX iron ore stocks

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | PRICE | 1 WEEK RETURN % | 1 MONTH RETURN % | 6 MONTH RETURN % | 1 YEAR RETURN % | MARKET CAP |

|---|---|---|---|---|---|---|---|

| ACS | Accent Resources NL | 0.007 | -72% | -72% | -72% | -88% | $ 3,311,890.98 |

| ADY | Admiralty Resources. | 0.007 | 0% | 0% | 0% | -56% | $ 9,125,054.07 |

| AKO | Akora Resources | 0.175 | -3% | 25% | -8% | -44% | $ 12,272,335.70 |

| BCK | Brockman Mining Ltd | 0.03 | 3% | 15% | 11% | -38% | $ 278,406,963.93 |

| BHP | BHP Group Limited | 46.58 | 3% | 7% | 19% | 0% | $ 236,117,896,115.16 |

| CIA | Champion Iron Ltd | 7.05 | 4% | -4% | 47% | -10% | $ 3,578,976,431.92 |

| CZR | CZR Resources Ltd | 0.175 | 3% | -5% | -21% | -34% | $ 38,896,216.59 |

| DRE | Dreadnought Resources Ltd | 0.073 | 7% | 14% | -27% | 66% | $ 248,454,616.50 |

| EFE | Eastern Resources | 0.012 | 4% | 0% | -72% | -76% | $ 18,629,196.92 |

| CUF | Cufe Ltd | 0.017 | 13% | -6% | 13% | -48% | $ 16,423,910.21 |

| FEX | Fenix Resources Ltd | 0.245 | 2% | 0% | 0% | -22% | $ 143,119,670.40 |

| FMG | Fortescue Metals Grp | 22.58 | 5% | 5% | 34% | 4% | $ 69,307,500,304.18 |

| FMS | Flinders Mines Ltd | 0.45 | 13% | -4% | -21% | -13% | $ 75,981,859.65 |

| GEN | Genmin | 0.18 | -5% | 0% | -22% | -10% | $ 81,140,982.12 |

| GRR | Grange Resources. | 0.69 | 2% | -10% | -9% | -49% | $ 798,563,701.62 |

| GWR | GWR Group Ltd | 0.076 | 0% | -31% | 19% | -51% | $ 24,412,465.78 |

| HAV | Havilah Resources | 0.31 | 0% | -6% | 0% | 59% | $ 93,408,566.95 |

| HAW | Hawthorn Resources | 0.072 | 3% | -17% | -20% | -45% | $ 24,456,139.75 |

| HIO | Hawsons Iron Ltd | 0.055 | -11% | 0% | -61% | -89% | $ 54,225,192.48 |

| IRD | Iron Road Ltd | 0.1 | -7% | -17% | -23% | -46% | $ 80,454,747.20 |

| JNO | Juno | 0.085 | -8% | -1% | -11% | -43% | $ 13,158,826.10 |

| LCY | Legacy Iron Ore | 0.016 | -6% | -11% | -16% | -48% | $ 102,509,219.18 |

| MAG | Magmatic Resrce Ltd | 0.11 | 0% | 24% | 5% | 25% | $ 39,740,063.74 |

| MDX | Mindax Limited | 0.265 | 71% | 165% | 349% | 349% | $ 498,264,670.00 |

| MGT | Magnetite Mines | 0.595 | 2% | 8% | -43% | -70% | $ 44,365,352.27 |

| MGU | Magnum Mining & Exp | 0.019 | -10% | 6% | -51% | -78% | $ 14,097,569.38 |

| MGX | Mount Gibson Iron | 0.51 | 2% | 0% | 31% | -23% | $ 619,353,859.83 |

| MIN | Mineral Resources. | 82.11 | 8% | 2% | 19% | 32% | $ 15,529,512,358.50 |

| MIO | Macarthur Minerals | 0.15 | 7% | 20% | 0% | -67% | $ 24,848,023.20 |

| PFE | Panteraminerals | 0.084 | -8% | -11% | -24% | -51% | $ 4,326,094.08 |

| PLG | Pearlgullironlimited | 0.032 | -14% | -9% | 46% | -52% | $ 5,161,735.85 |

| RHI | Red Hill Minerals | 4.77 | 8% | 8% | 40% | 39% | $ 303,183,707.75 |

| RIO | Rio Tinto Limited | 121.84 | 5% | 6% | 29% | 1% | $ 45,009,965,947.50 |

| RLC | Reedy Lagoon Corp. | 0.007 | -13% | 17% | -46% | -79% | $ 3,967,037.21 |

| CTN | Catalina Resources | 0.005 | 0% | -17% | -33% | -69% | $ 6,192,434.46 |

| SRK | Strike Resources | 0.054 | -13% | -10% | -53% | -64% | $ 16,173,750.00 |

| SRN | Surefire Rescs NL | 0.023 | 5% | 28% | 77% | 15% | $ 37,952,723.45 |

| TI1 | Tombador Iron | 0.023 | -8% | -8% | -4% | -45% | $ 51,287,576.95 |

| TLM | Talisman Mining | 0.14 | 0% | 0% | 4% | -20% | $ 25,344,832.10 |

| VMS | Venture Minerals | 0.022 | 29% | 5% | -4% | -63% | $ 35,389,151.84 |

| EQN | Equinoxresources | 0.135 | -13% | -18% | 13% | -32% | $ 6,975,000.16 |

| AMD | Arrow Minerals | 0.005 | 11% | -29% | 0% | 0% | $ 15,118,825.48 |

And now for something completely different

Not reporting much of anything at all these days is Sundance Resources, which was delisted in December 2020 after becoming embroiled in an ownership dispute over its Mbalam-Nakeba project either side of the Cameroon-Congo border.

You may remember the claims of expropriation and, astonishingly, the award of the project to a former partner Sundance claimed to have introduced to its African stakeholders, probably Chinese-backed AustSingo Resources Group, from a couple years ago.

One of a number of squabbles between Australian and Chinese parties over mining rights in the ever stable continent of Africa (cough AVZ cough), these claims are now going through a bevy of courts both internationally and locally in WA.

In a statement over the weekend in equal measures comedic and frightening, Sundance says its first hearing on its International Chamber of Commerce claim against the Republic of Congo is scheduled for the first quarter of 2024.

An interim order from the ICC has been ignored on the Cameroonian side of the border, Sundance said, with a third party given the rights over Mbalam. A memorial of claim has been issued by Sundance but arbitration proceedings have been delayed after “mysterious circumstances surrounding the sudden death of the Cameroon Minister of Mines”.

Attempts to discover relevant data on the phone of AustSino executive chairman Chun Ming Ding have reportedly been delayed, meanwhile, since the man ‘lost his phone in China’.

At stake is a two-stage, 40Mtpa iron ore mine with a mine life of around 29 years where Sundance claims to have invested over $400 million in pre-development capital.

It claims independent experts have demonstrated damages of US$1.5-5.7b in the Congo claim depending on the iron ore price.

In an announcement in early April announcing a 10Mtpa supply deal from the Mbalam project with Chinese stainless steel manufacturer Tsingshan, AustSino said it “categorically denies any involvement or wrongdoing associated with Sundance losing any rights it says it had to pursue its iron ore project and infrastructure project in Congo and Cameroon.”

AustSino claims to have cobbled together a consortium of Chinese companies to deliver the project, saying it had executed binding agreements with the Republic of Cameroon and a company called Bestway Finance “to finance, design, construct and operate a railway linking Mbalam and Port Kribi, with the capacity of efficiently transporting, handling, and processing increased to approximately 125Mt of iron ore per annum.”

Seems like a big number. We’ll see.

Russian coal miner faces DFAT scrutiny

One of the weirdest stocks on the ASX is coal mining micro cap Tigers Realm (ASX:TIG), which last year mined over 1.5Mt of metallurgical and thermal coal in Siberia.

It sold over 1Mt, largely into China, with Taiwan stopping coal purchases from Russia in August 2022 and Japan exiting the market from the end of March when pre-existing contracts wound up.

Marrying two things ethicists hate — coal and Russia — always felt like a recipe for trouble.

Tigers Realm has now requested DFAT provide “an indicative assessment” on whether it is puncturing any of its sanctions regulations, put in place after Russia’s invasion of Ukraine.

“DFAT’s indicative assessment is that the operations are likely to be prohibited by, or subject to authorisation under, regulation 4A of the Australian Sanctions Regulations which relates to sanctioned imports,” the company told the market this week.

“The company does not agree with DFAT’s indicative assessment that its operations comprise a sanctioned import.”

Tigers Realm says its been invited to apply for an exemption permit from the Minister of Foreign Affairs that would allow it to continue operating in Russia.

“The company is currently considering whether applying to the Minister for an exemption permit is the most appropriate and efficient option to ensure that the company can continue its operations,” it said.

“DFAT has advised the Company that this process ordinarily takes around eight weeks to provide an outcome. Alternative options available to the company include seeking judicial relief and/or restructuring the company’s business and corporate group.”

ASX coal stocks

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | PRICE | 1 WEEK RETURN % | 1 MONTH RETURN % | 6 MONTH RETURN % | 1 YEAR RETURN % | MARKET CAP |

|---|---|---|---|---|---|---|---|

| NAE | New Age Exploration | 0.006 | 0% | 0% | -25% | -56% | $ 7,897,444.01 |

| CKA | Cokal Ltd | 0.17 | 10% | 6% | -24% | 0% | $ 178,026,581.70 |

| NCZ | New Century Resource | 1.1 | 0% | 0% | -4% | -49% | $ 148,482,094.20 |

| BCB | Bowen Coal Limited | 0.24 | -8% | -16% | -37% | -28% | $ 451,217,315.85 |

| SVG | Savannah Goldfields | 0.165 | 6% | 0% | -20% | -25% | $ 31,159,992.27 |

| GRX | Greenx Metals Ltd | 0.755 | -4% | 31% | 185% | 278% | $ 202,094,201.45 |

| AKM | Aspire Mining Ltd | 0.059 | 4% | 13% | -40% | -35% | $ 29,442,945.13 |

| AVM | Advance Metals Ltd | 0.008 | 0% | 0% | -43% | -53% | $ 5,238,396.62 |

| AHQ | Allegiance Coal Ltd | 0.013 | 0% | 0% | -74% | -97% | $ 13,063,647.08 |

| YAL | Yancoal Aust Ltd | 5.85 | -1% | 5% | 1% | 7% | $ 7,737,775,100.82 |

| NHC | New Hope Corporation | 5.26 | -10% | 1% | -23% | 48% | $ 4,631,914,754.25 |

| TIG | Tigers Realm Coal | 0.01 | -17% | -17% | -33% | -38% | $ 117,600,321.31 |

| SMR | Stanmore Resources | 3.28 | -1% | 3% | 26% | 71% | $ 2,938,536,726.84 |

| WHC | Whitehaven Coal | 6.97 | 0% | 4% | -35% | 53% | $ 6,055,807,216.41 |

| BRL | Bathurst Res Ltd. | 1.035 | 0% | 11% | 8% | -6% | $ 199,970,970.10 |

| CRN | Coronado Global Res | 1.625 | 1% | -8% | -12% | -16% | $ 2,715,855,042.60 |

| JAL | Jameson Resources | 0.079 | 13% | 10% | 13% | -6% | $ 30,929,376.90 |

| TER | Terracom Ltd | 0.63 | -6% | 11% | -40% | 5% | $ 508,613,559.23 |

| ATU | Atrum Coal Ltd | 0.005 | 0% | 0% | -44% | -60% | $ 6,958,495.86 |

| MCM | Mc Mining Ltd | 0.155 | -14% | 0% | -43% | 23% | $ 63,946,432.32 |

| DBI | Dalrymple Bay | 2.72 | 0% | 3% | 16% | 25% | $ 1,343,514,117.57 |

The post Bulk Buys: Chinese steel mills stay busy as iron ore market waits for signals appeared first on Stockhead.

White House Prepares For “Serious Scrutiny” Of Nippon-US Steel Deal

White House Prepares For "Serious Scrutiny" Of Nippon-US Steel Deal

National Economic Adviser Lael Brainard published a statement Thursday…

How to Apply for FAFSA

Students and families will see a redesigned FAFSA this year. Here’s how to fill it out.

Dolly Varden consolidates Big Bulk copper-gold porphyry by acquiring southern-portion claims – Richard Mills

2023.12.22

Dolly Varden Silver’s (TSXV:DV, OTCQX:DOLLF) stock price shot up 16 cents for a gain of 20% Thursday, after announcing a consolidation of…