Precious Metals

Carlyle Commodities (CSE:CCC) Begins Newton Gold Silver Project Phase 1 Diamond Drilling

Carlyle Commodities (CSE:CCC) has commenced its Phase 1 diamond drilling at the Newton Gold Silver Project in British Columbia. The Phase 1 program will…

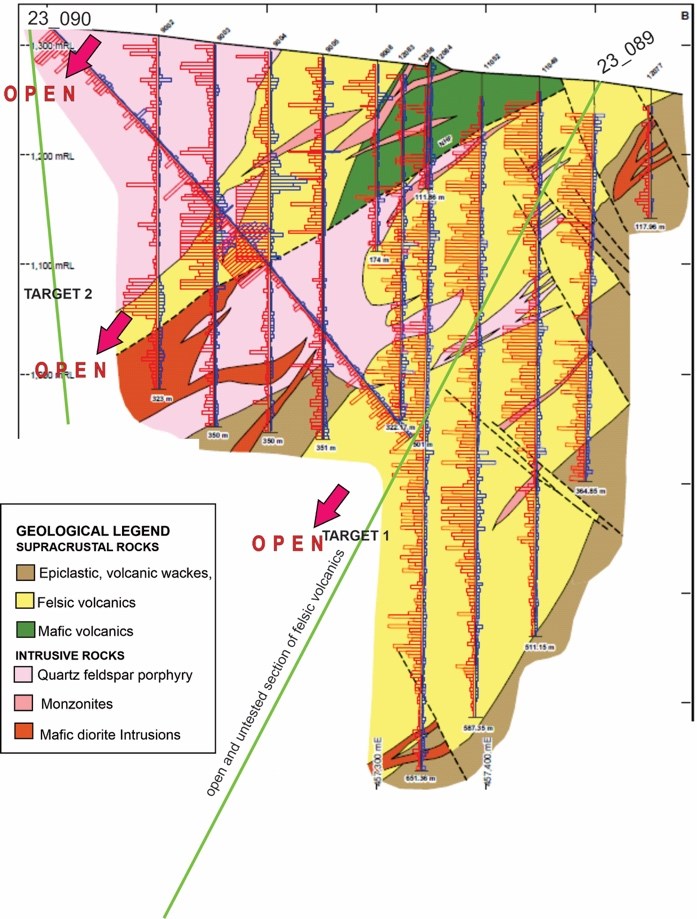

Carlyle Commodities (CSE:CCC) has commenced its Phase 1 diamond drilling at the Newton Gold Silver Project in British Columbia. The Phase 1 program will test numerous high-priority targets to increase tonnage and ounces at Carlyle’s current NI 43-101 resource calculation. The first focus will be to test multiple zones of felsic volcanic host rock outside of the current pit-constrained resource calculation to discover new mineralization zones.

The first Phase 1 initial drill targets include:

- Drill site 1: Targets continuity of the well mineralized main felsic domain, which remains open. This will be completed by a 500 meter to 1,000 meter drill hole through the current resource and extending to untested sections of the felsic domain.

- Drill site 2: Targets a potential felsic domain starting at surface and extending into a second felsic domain which remains open along trend. Geological modelling suggests that these may represent three stacked mineralized felsic domains.

- Drill site 3: Targets an additional felsic domain more than 100 metres outside of the current resource. Historical DDH 12-076 returned 171m of 0.69 Au and 2.1 Ag (288-459m) which has not been followed up on.

Mr. Jeremy Hanson, VP Exploration commented in a press release: “We are very excited to begin this first phase of drilling. We have a number of high-priority domains to test. Our modeling is indicating that these mineralized felsic domains extend significantly outside of the current resource and with potential for discoveries of new zones of mineralization.”

Carlyle President and Chief Executive Officer, Morgan Good, also commented: “We believe momentum is building across the junior resource equity markets. Carlyle’s timing with its Phase 1 diamond drill program to test high potential targets looks to position the Company well.”

Issuance of Shares and Options Grants

The company also announced that it had issued 78,606 shares of Carlyle Commodities Corp. at $0.16875 per share to two strategy and business consultants Carlyle has engaged. The shares were issued according to the terms of consulting agreements, equal to the lowest permitted price by the applicable policies of the Canadian Securities Exchange.

Carlyle Commodities also issued 1,000,000 options to a consultant for the company for the purchase of up to 1,000,000 shares according to the company’s Omnibus Equity Incentive Plan. All options were vested immediately and are exercisable for a period of five years at a price of $0.31 per share.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

The post Carlyle Commodities (CSE:CCC) Begins Newton Gold Silver Project Phase 1 Diamond Drilling appeared first on MiningFeeds.

cse

canadian securities exchange

gold

silver

diamond

cse-ccc

carlyle-commodities-corp

Canadian Silver Co. Will See Big Changes in 2024

Source: Michael Ballanger 12/22/2023

Michael Ballanger of GGM Advisory Inc. takes a look at the current state of the market and shares on stock…

EGR options out Urban Berry project in Quebec to Harvest Gold – Richard Mills

2023.12.23

EGR Exploration Ltd. (TSXV: EGR) has moved from owner to shareholder at its Urban Berry project in Quebec, this week announcing it is optioning…

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…