Uncategorized

With prices at decade-highs, has uranium’s time in the sun finally arrived… or is it another false dawn?

Spot uranium prices are surging. Is the hype for real, or are there more roadblocks to come after the industry’s … Read More

The post With prices at…

- Nuclear industry forecasters are more bullish than they’ve been in years with spot uranium prices hitting a decade high of US$67/lb yesterday

- Miners including Australian mid-caps Boss Energy and Deep Yellow say the tailwinds behind rising uranium prices are the real deal

- Could idled capacity put a dent in the industry’s optimism?

Uranium prices have had more false dawns than the Gold Coast Suns since their introduction to the AFL in 2011.

That was the same year the price of yellowcake began its more than half-decade long descent into a crushing bear market that knocked all but the major players out of the market, eventually cratering at US$18/lb.

Those prices are so low even the world’s biggest producers were losing money and had to idle operations to survive.

But hopes for a nuclear renaissance are being transmitted stronger than ever, as spot prices cleared a decade high yet again touching US$67/lb on Tuesday.

It followed bullish reports from the World Nuclear Association and price reporter Ux Consulting, both of whom said restarted and entirely new operations would be needed to fill uranium demand from nuclear power plants that will almost double, according to the WNA, by 2040.

Investors big on uranium have been calling conditions the best for a bull run to rival the mid-2000s surge to US$145/lb, while others are urging caution.

The opacity of pricing is particularly pronounced in uranium since pounds available on the spot market make up only a small proportion of trades and are liable to surges from physical traders and speculators like the Sprott Physical Uranium Trust and Yellowcake PLC.

Most uranium is traded between miners and utilities with enrichment facilities in the middle, containing floor and ceiling prices loosely linked to the spot price of the day.

The tailwinds are thus: Plants previously expected to run to 40 years are being extended to 60 or even 80, and countries like the USA and Canada which had been less than enthusiastic on nuclear are looking to sanction new developments because they provide baseload electricity with lower emissions than fossil fuel plants.

Contracting levels are at an 11-year high, and price collars divulged by Cameco, the Canadian giant and largest Western incumbent, suggest floors of US$50/lb and ceilings as high as US$80/lb, generally accepted as the current incentive price for new producers.

All this is coming against a backdrop of supply uncertainty following Russia’s invasion of Ukraine, with large nuclear marker like the US looking desperately to find alternative sources of supply which some players think could draw a premium.

Is Flavor Flav right that you Don’t Believe The Hype, or is the uranium sector finally ready to Bring The Noise?

&nsbp;

Sprott on board

North American fund manager extraordinaire Sprott kicked off the recent uranium run by taking a vacuum to the spot market to dry up secondary pounds in 2021.

It’s been a good bet so far, up over 80% since listing on the TSX a little over two years ago.

Research from Sprott Insights shows the uranium price is up 25.49% YTD, with uranium equities up 21.1%, outpacing the US’s top 500 companies (up 18.73%) and zagging hard against a broader 6.01% drop across the broader commodities index.

Junior miners are only up 10.88%, which makes sense given the broader struggles of developers and explorers across all commodity classes in a tough 2023 market.

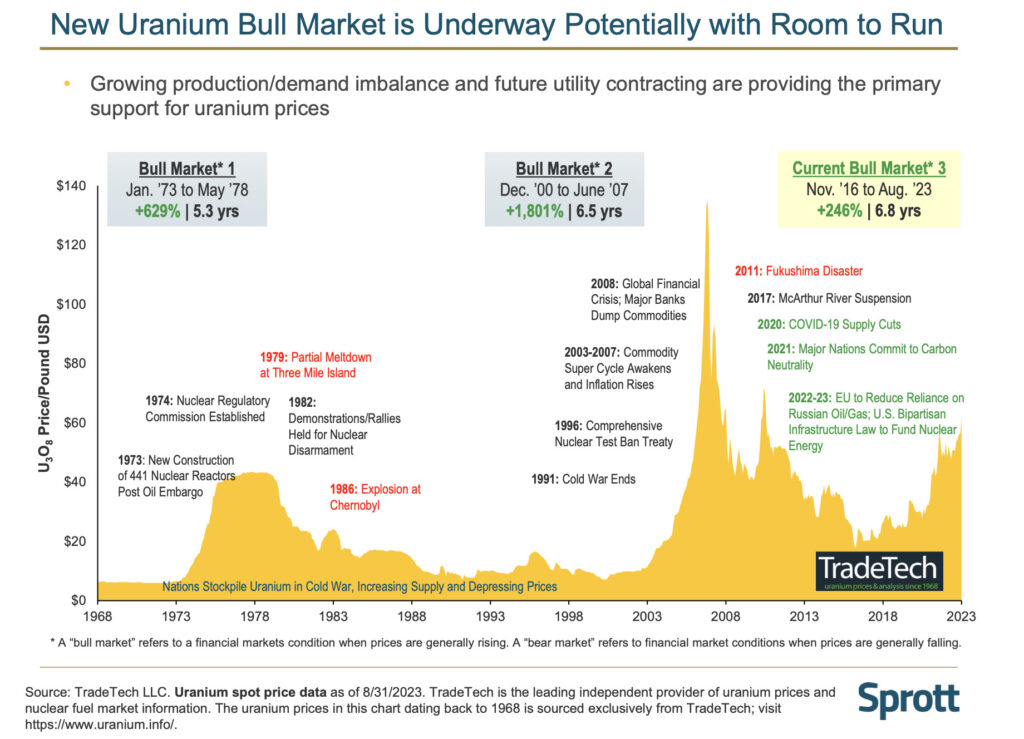

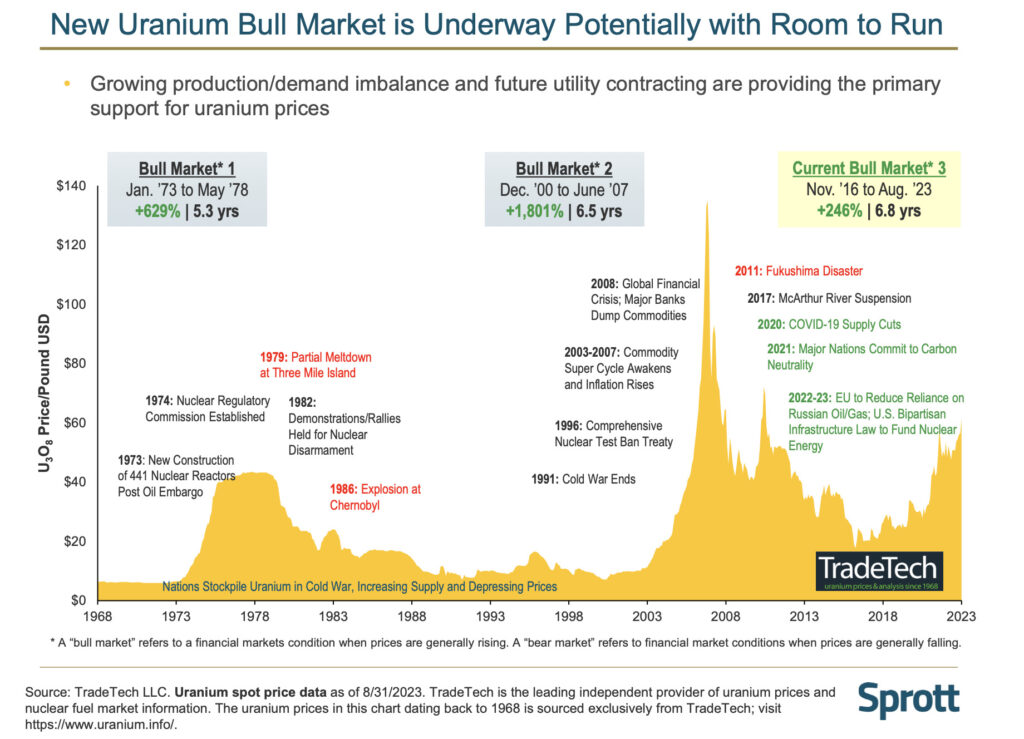

That may just be the start. Sprott believes uranium is now in its third bull market phase since 1968.

“With the global primary mine supply consistently falling short of the world’s reactor uranium needs, we anticipate even more growth potential for the commodity,” Sprott ETF product manager Jacob White said in a note.

“On the demand side, an unprecedented number of announcements for nuclear power plant restarts, life extensions and new builds are likely to create incremental demand for uranium.

“Consequently, utilities are accelerating their purchases under long-term agreements, which are on track to exceed last year’s 10-year high at 107MM lbs of U3O8e YTD.

“Notably, increasing contracting from utilities, as opposed to financial entities, has been the primary driver for the rise in the uranium price year to date.

“Primary uranium mine supply is significantly trailing demand, with a cumulative forecasted supply shortfall of approximately 1.5 billion pounds by 2040.

“The industry is recognising the need for more uranium mining. Even traditionally anti-nuclear Sweden has revealed intentions to revoke its uranium mining ban and substantially amplify its nuclear output.”

But, White says, the industry continues to grapple with “pronounced supply challenges”. That was demonstrated earlier this month when Cameco revealed it would fall around 1.7Mlb short of its production expectations of 18Mlb for 2023, including a shortfall of 1Mlb to 14Mlb at the McArthur River operation in Saskatchewan.

“Supply disruptions are becoming a trend, not an exception. Peninsula Energy (ASX:PEN) faced setbacks when Uranium Energy Corp ended a processing contract, leading to a “significant” postponement in restarting the Lance project,” White said.

“Geopolitical tensions have been significantly constricting the uranium supply.

“A case in point is the recent coup in Niger, which led to international sanctions against the ruling military junta, disrupting logistics and compelling Orano SA (Orano) to suspend uranium processing.

“In addition, Global Atomic Corp. disclosed that these circumstances might postpone the inauguration of its Dasa Project by six to 12 months. According to the World Nuclear Association, Niger accounts for 4% of the world’s uranium production.”

That is on top of self-sanctioning from western utilities, who aren’t signing contracts with Russian suppliers of enriched uranium and the US Nuclear Security Act, which aims to move the US nuclear supply chain away from Russia.

The best market since the 1970s

Boss Energy (ASX:BOE) managing director Duncan Craib said the uranium market now reminded him of the bull run when he entered the sector in the mid-2000s and was the best placed the industry had been since the 1970s.

The company is planning to bring the shuttered Honeymoon mine in South Australia back to production early next year.

“When you listen to the industry conversations, you read the reports and you see the uranium price move like it did last week — US$4 in four days — and it’s kept rising since then, it really feels like deja vu,” he said.

“Back in 2006-07, when I first entered the uranium industry, all the same conversations were taking place.

“Nuclear utilities are in denial, uranium developers are worried about missing the peak because they still have to deal with the basics of permitting, finding skilled people, actually undertaking construction activities.

“To my mind the market fundamentals are the most positive experienced in living memory.”

Craib said there was now unprecedented policy support for nuclear power, at the same time as supply security faced its biggest threat since the 1970s, miners struggle to hit their ramp up targets and the incentive price moves to a level never before seen.

“The incentive price bandied about now in the industry for new mines is north of US$80/lb,” he said.

“So if the current spot price is US$68/lb, it’s still got room to move to that US$80.

“But we believe that there’s a likelihood that the price is going to overshoot, because it takes time to build a uranium mine. You can’t simply switch it on. You’ve got to get permitted, you’ve got to find the people.

“And that’s where we think in the next one to three years it’s highly likely we’re going to see an overshoot in the uranium price.”

Uranium share prices today:

This time I know it’s for real

Deep Yellow (ASX:DYL) managing director John Borshoff, a veteran of the yellowcake game best known for his stewardship of Langer Heinrich owner Paladin Energy (ASX:PDN) in the last uranium boom, said he was convinced the spot price movements seen in the last few weeks were the real thing.

Hoping to reach an FID on the Tumas project in Namibia in mid-2024 ahead of production in 2026 and the Mulga Rock project in WA by 2028, Borshoff says the WNA’s “lower scenario” for 2040 uranium demand is now so conservative it’s no longer believable.

A substantial part of the WNA’s future supply projections is now from “unspecified supply” i.e. — in Borshoff’s terms — “code for ‘I don’t know where the f*** this stuff’s going to come from.’”

That suggests prices will need to respond to bring new sources of supply online.

“I believe it’s very real,” he said.

“I see the term price has gone up to US$62 from the US$50s that it was in, and so you’re starting to see this whole thing lift.”

While utilities were previously able to use the spot market to cover short term energy requirements, competition from ETFs like Sprott has reduced the size of the pool, a sign competition for supply was heating up.

“It might come back two or three dollars. But you’re starting to see it’s moving,” he said.

“And I’ve said when it moves, it’ll be $2-5 chunks, and not 50 cents, and everybody goes and sort of pisses themselves with excitement.

“I think we’re coming into a new era.”

False dawn?

As bullish as the industry commentary is, uranium markets have had a series of false dawns in recent years.

One downside risk, especially for new producers, is idled capacity in Canada and Kazakhstan to come back into the market, which will have lower trigger prices than new operations.

Cameco, which only recently returned its massive McArthur River mine to operation last year after mothballing the world’s highest grade deposit around five years ago, is also running the nearby Cigar Lake mine in Saskatchewan’s Athabasca Basin at 25% below capacity.

State-owned Kazakh producer Kazatomprom, the world’s largest supplier, expects to lift production next year by 2000-3000t to 25,000-25,500t after setting strict supply discipline limits a few years ago.

It produced 10,225t in the first half of 2023 and expects to deliver 20,500-21,500t for the full year at all in sustaining costs of US$20-21.50/lb.

Its contracted production capacity is between 27,500-28,000t, having instigated 20% cuts that took around 5500t out of the market a few years ago.

Far East Capital executive chairman Warwick Grigor, a former director at US uranium hopeful Peninsula Energy, warned shut-in capacity could enter the market if price rises went beyond speculation and were sustained for a longer period.

“There is still a lot of shut-in capacity with these Canadian mines and if it looked like there was going to be a sustainable rise in the uranium price they can come back onstream quite readily,” he said.

“The Kazakhstan industry has always got the capacity to bring in more production. I think the market will bear it.

“Maybe it’s not enough to effect the spot price this month or in three months’ time. But if you go out for longer periods you’ve got the spectre of offline or easily expandable capacity coming onstream.”

Not the bottleneck

Grigor said the bottleneck was less in uranium supply at the moment than enrichment, given Russia’s stranglehold on that part of the industry.

Meanwhile in China, a major growth engine for nuclear power in the years to come, many of its miners have taken interests in projects in Africa, threatening to create a closed loop for supply that wouldn’t benefit western producers.

Even if prices were to be sustained and it was more than the actions of ‘speculators’, Grigor warned the geological characteristics of different uranium deposits meant it was not simple to mine and operate them.

“I think there’s also a lot of naivety and oversimplification for these uranium companies as to how easy it is to handle the metallurgy and produce the uranium,” he said.

“Each project has got different chemical characteristics.”

And while we are now 12 years on from Fukushima and Japan is returning to the nuclear power market, Grigor warned sentiment in nuclear was always beholden to public concerns about the dangers of industrial accidents like it, Three Mile Island and Chernobyl.

While he described Fukushima as a ‘black swan’ event, the prospect of a nuclear incident at a Ukrainian power plant could be much higher.

The Times recently reported Russian control of Ukraine’s largest power station, the Zaporizhzhia nuclear facility, had led to heightened risks of a meltdown as an exodus of properly trained officials left inexperienced staff with the keys.

“That’s not a black swan event, that’s a white swan,” Grigor said. “We know that it’s possible.

“It’ll have a negative effect on sentiment if it does happen. So anyone who loses money on uranium because it does happen can’t plead ignorance. You’ve got to factor that into your potential volatility.”

Contracting ramping up

While Boss’ Honeymoon was one of those mines that saw technical challenges in a former life, Craib says a shift from solvent extraction to ion exchange to deal with the saline geological environment had been devised and tested for years going back to work with ANSTO in 2017.

Its first drum of yellowcake is expected to be ready between late January and early February, with Boss aiming to announce a first contract by the end of the year.

While spot price movements have been positive, it is all in the terms negotiated between miners and utilities where the true health of the industry will be revealed.

“We’ve been very disciplined on entering into contracts, we’ve deliberately withheld from entering into contracts since we announced FID in June last year because we believde the price would rise and fortuitously here we are,” he said.

“That strategy’s paid off because now we are seeing the prices rise.”

As for suggestions latent supply could put a pause on the entry of new producers into the space, Craib points to the issue Cameco has had finding suitable staff to ramp up its high grade operations in the Athabasca.

“One of the reasons they gave is that they didn’t have enough experienced people and that’s one of the biggest uranium producing companies in the world,” he said.

“So if they’re struggling, you can imagine how the developers and juniors are going to find it.”

The post With prices at decade-highs, has uranium’s time in the sun finally arrived… or is it another false dawn? appeared first on Stockhead.