Uncategorized

Why is mining major FMG so interested in this $5m capped copper explorer?

Special Report: Strategic Energy Resources (ASX:SER) is on the cusp of a major drill program at its Canobie copper project … Read More

The post Why is…

Strategic Energy Resources (ASX:SER) is on the cusp of a major drill program at its Canobie copper project in Queensland, but the sub-$6 million capped company won’t be doing it alone.

SER officially entered into a farm-in JV with Fortescue Metals Group (ASX:FMG) subsidiary FMG Resources in mid-June this year, with the bigger fish spending up to $8 million over six years to earn up to an 80% stake in Canobie.

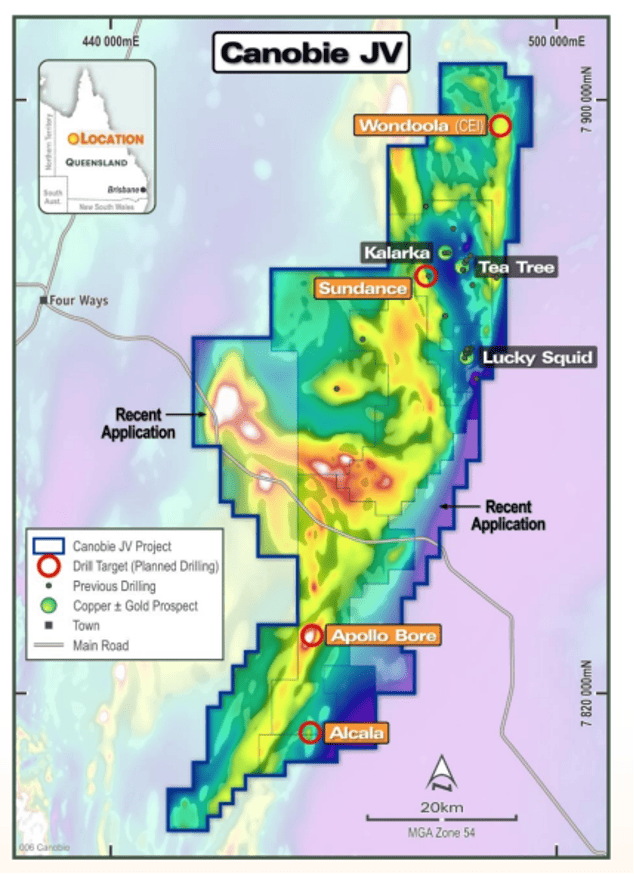

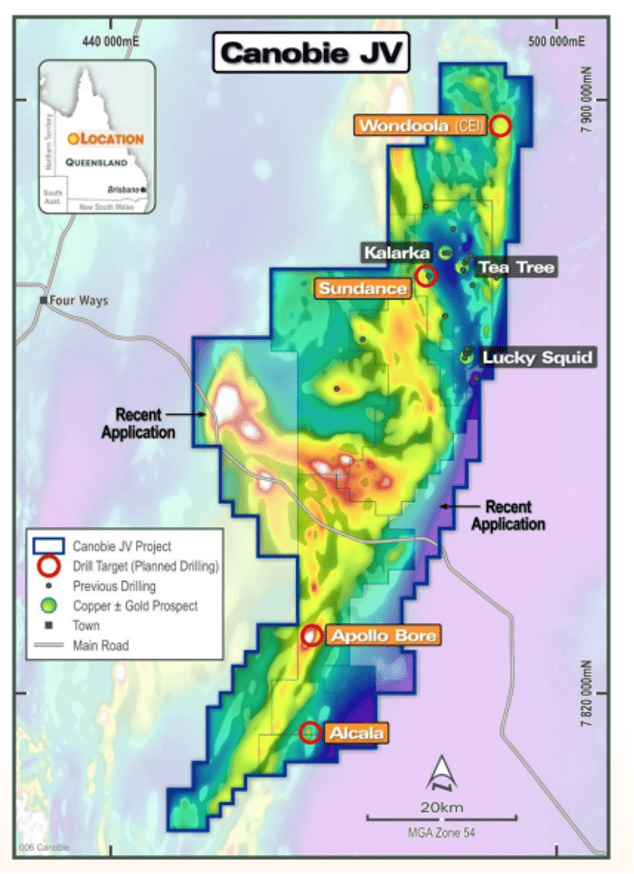

Under the agreement, FMG will fund up to 6,000m of basement drilling during that time, with the first part of the program (4,000m) due to kick off within a matter of days, seeking to test one magmatic nickel copper sulphide target and three Tier 1 Ernest Henry-type iron oxide copper-gold IOCG targets.

Farm in with FMG

FMG’s interest in SER is a major feather in the cap for the small-cap copper chaser with the Twiggy Forrest-lead mining major continuing to empty its coffers into critical minerals and investments associated with a green energy future.

The last time FMG made such a farm in agreement was in April to earn an additional 24% at Carawine’s (ASX:CWR) Paterson copper-gold-base metals project in WA through spending $6.1m in two stages over a seven-year period to the end of 2026.

SER managing director David DeTata says it’s a major endorsement to have FMG earmark its projects as important to the critical minerals space. The goal at Canobie is to find another Ernest Henry, Evolution Mining’s (ASX:EVN) successful operation to the south.

“That our flagship Canobie project has attracted a $50 billion market cap company like FMG is testament to the compelling nature of our targets” DeTata told Stockhead.

“Canobie is within the same geological domain as the Ernest Henry mine supporting the potential for Canobie to contain additional deposits.

“Ernest Henry is a magnetite IOCG deposit on the same crustal-scale fault systems that hosts several significant copper-gold deposits to the south. Canobie covers the northern extension with a lot of untested magnetic anomalies as you head undercover.

“In FMG’s search for Tier 1-style deposits of copper and nickel, they have identified our ground as being prospective for large IOCG and nickel sulphide deposits with a clear objective to continue testing targets until there’s one they can return to for follow-up drilling.”

For context, Evolution’s Ernest Henry Mine is one of the largest copper reserves in Australia with its latest PFS highlighting an increase of 126% in ore reserves to 77.4Mt since the company acquired Glencore’s stake in the mine 18 months ago.

Canobie IOCG targets

The first drill target, the Sundance prospect, is located at the northern end of the project and appears as an isolated bullseye magnetic feature.

The Apollo Bore prospect is a stand-out, high amplitude, large magnetic anomaly modelled as an elliptical pipe.

And the final drill target, Alcala, is a strong north/south oriented magnetic anomaly that models as a near vertical body and is semi-coincident with a broad gravity response.

Native Title clearance surveys and earthworks have been completed and a drill rig will be enroute to Canobie within a week to complete the four-hole program.

Ernest Henry 2.0

“These drill targets are deep but are significant in size and, on our budget, and scale, we wouldn’t be able to test anywhere near the number of targets even in the first year of this joint venture that FMG can,” DeTata says.

“In big broad terms, we hope that one of these targets is the next Ernest Henry.”

Evolution commands a $6.57 billion market cap and has seen its share price grow more than 50% over the past year.

Jake Klein, EVN executive chair, says Ernest Henry has been a huge, powerful cash generator for the company, generating a remarkable $1.8bn to its bank account, which has almost repaid its entire investment of $1.9bn with a long 17-year mine life ahead.

Rewarding shareholders

Under the arrangement with FMG, SER will be the operator which DeTata says is quite new and novel for a junior, particularly with FMG who are not accustomed to having a junior partner operate.

“In the first year, we want to demonstrate that we can efficiently get onto the ground and test the four targets FMG have identified, return all the drilling related information back to FMG, which will then be used to design a follow up drill program at one or more of these prospects, or inform future drill targeting at entirely new prospects in the coming year” he explains.

“This JV is part of our overall science-driven strategy that we’ve been building since around 2019 and is exactly what we are trying to achieve as a small cap, which is identify potential Tier-1 projects, add value to the project and then invite a major to come and assist us in the exploration.

“Ensuring that if there is something to be found at the end of the day, our shareholders are rewarded with a small slice of a much bigger pie.”

Isa North

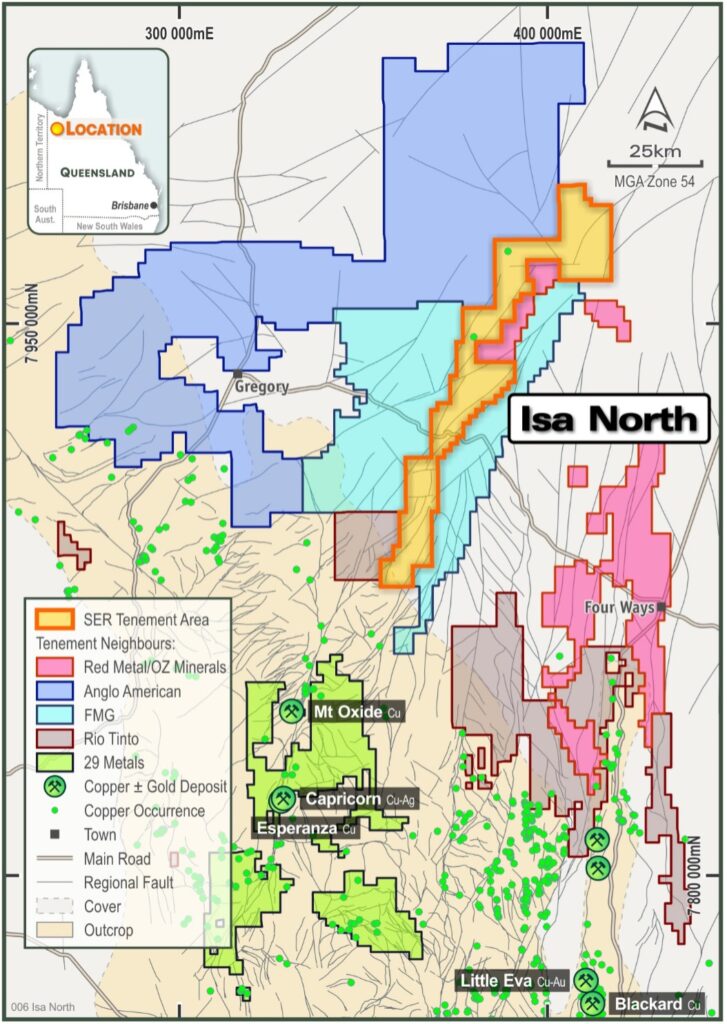

Meanwhile, 150km to the northwest of Canobie, SER is developing its Isa North project where prospectivity for undercover IOCG deposits also exists.

SER acquired the ground from Newcrest in 2021, who drilled about 5,190m across four targets.

“With Canobie now in a JV, our exploration focus has shifted to the Isa North IOCG project which lies along the undercover extension of the Mt Gordon fault which hosts several large copper deposits to the south including Mt Isa and Mt Oxide,” DeTata says.

“We are also exploring the potential for alternative mineralisation styles (particularly sediment-hosted copper mineralisation) given the sudden interest in the region by majors including Rio Tinto, Anglo American and FMG who now surround the project area.”

In June, the explorer raised $2.5m via a placement at $0.014 per share to accelerate exploration programs across its portfolio, including at Isa North where a magnetotelluric (MT) survey will take place in October, followed by a scheduled diamond drilling program.

This article was developed in collaboration with Strategic Energy Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

The post Why is mining major FMG so interested in this $5m capped copper explorer? appeared first on Stockhead.