Uncategorized

What the ETF? Global sharemarket gains help Aussie ETF industry set FuM record of $142.6 billion in March

Australia’s ETF industry set a new record for assets under management in March of $142.6 billion as global share markets … Read More

The post What the…

- Australian ETF industry sets a new all-time high in funds under management (FuM) in March to $142.6 billion

- Global sharemarket gains helps industry capture new highs, but investor sentiment remains cautious

- Total ASX ETF trading value was $11.1 billion in March, the highest recorded for the past 12 months

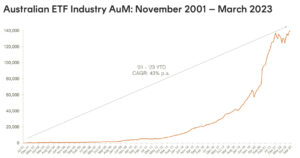

A strong rise in global sharemarkets together with continued investor flows saw the Aussie ETF industry set a new all-time high in funds under management (FuM) in March to $142.6 billion.

According to the latest BetaShares monthly Australian ETF industry report, FuM grew by 2% month-on-month, for a total monthly market cap increase of $2.8 billion in March.

BetaShares chief commercial officer Ilan Israelstam said growth in March came primarily from asset value appreciation, although investor flows remained positive, at $700 million or 25% of the monthly growth.

ASX ETF trading value increased strongly during March and was 23% higher than February for total value of $11.1 billion, the highest ASX ETF trading value recorded for the past 12 months.

“Over the last 12 months, we’ve seen the industry grow in size, albeit at a far slower pace than previous years – with an increase of 5.3% year on year, or $7.2bn,” Israelstam said.

Two new products launched

In March two new products were launched, both active ETFs, including an ESG orientated credit strategy from Janus Henderson.

The Janus Henderson Sustainable Credit Active ETF (managed Fund) (ASX:GOOD) consists of a portfolio of Australian and global investment grade and sub-investment grade credit securities issued by companies with robust sustainable practices or the potential to “enhance outcomes for society or the planet”.

Intelligent Investor Select Value Share Fund (ASX:IISV) was also launched in March, with the company describing the ETF as designed for medium to long term investors focused on capital growth.

The company said on its website the IISV will be a diversified portfolio of listed Australian and international equities that the Intelligent Investor analysts consider:

- are undervalued

- are high growth where we believe earnings will grow faster for longer than the market expects

- have had slower and more stable earnings growth that have been excessively discounted for temporary reasons resulting in a depressed valuation.

There are now 327 Exchange Traded Products trading on the ASX.

Global growth exposures back in vogue

Israelstam said global growth exposures were back on the catwalk in March, leading to strong gains in Bitcoin and crypto products, as well as tech exposures more generally.

Gold mining products also rallied strongly in March as continuing economic uncertainty along with fears of a global banking crisis following the collapse of banks in the US and Swiss bank Credit Suisse saw demand for safe haven assets like gold rise.

WORTH READING: As gold price trends upwards what ETFs offer a simple, cost-effective exposure to the precious metal?

New entrant to Top 10 league table

BetaShares Australia 200 ETF (ASX:A200) became a new entrant to the top league table – the largest 10 products by market cap in the industry.

A200’s entrance coincided with a reduction in management fees in late February to 0.04% annually.

Fixed income leads inflows, while global equities lead outflows

Fixed Income exposures lead the way in terms of flows with the category recording the highest level of net flows in March and also 2023 year to date.

Broad Australian equities products also continued to receive flows, as has been the case for the year more broadly.

Global equities exposures led category outflows in March, which Israelstam said is a sign investor sentiment remains cautious.

“This marks a very striking change to previous years, with international equities flows being exceptionally light in the year to date, with investors continuing to take a cautious stance towards equities more generally in preference to fixed income and cash exposures,” he said.

The post What the ETF? Global sharemarket gains help Aussie ETF industry set FuM record of $142.6 billion in March appeared first on Stockhead.