Uncategorized

Weekly Small Cap and IPO Wrap: ASX small caps down 1.91% as two new lithium plays make their IPO

The Emerging Companies index falls this week with two new lithium companies making their IPO All sectors finished the week … Read More

The post Weekly…

- The Emerging Companies index falls this week with two new lithium companies making their IPO

- All sectors finished the week in the red except for the materials sector, up 1.91%

- Graphite miner Sarytogan (ASX:SGA) led small caps gainers after announcing a breakthrough

The traditional end of year Christmas rally seems to be running out of steam with both the big end of town along with the small and mid caps on the ASX falling this week.

The S&P/ASX Emerging Companies (XEC) is a benchmark for Australia’s micro-cap companies, containing up to 200 stocks that ranked between 350 and 600 by float-adjusted market capitalisation at the time of their index inclusion.

The S&P/ASX 200 (XJO) is Australia’s leading benchmark index, home to the top 200 ASX listed companies by float-adjusted market capitalisation.

By 4pm AEDT on Friday the ASX XEC had fallen 3.17% the past five days., while the XJO fared slightly better down 1.21% for the same period.

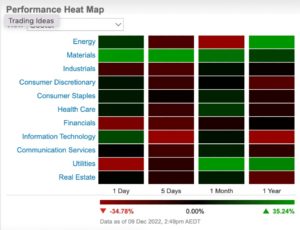

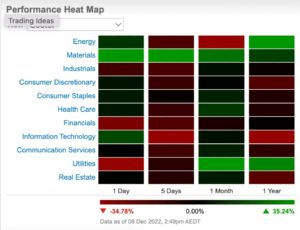

All sectors finished the week in the red, except for materials which was up 1.91% for the past five days. Leading the laggards was IT, down 4.85% for the past five days followed by financials down 2.70% and energy which fell 2.47%.

The RBA this week raised the cash rate by 25bps to 3.1%. It was the bank’s eighth straight rate rise since it started lifting the cash rate from a record low of 0.1% in early May and is now at its highest level in a decade as the RBA has worked to contain inflation.

Meanwhile, news came out that Australia’s trade surplus decreased $227m in October, according to ABS data released this week. Exports fell $568m (0.9%) driven by non-monetary gold, while imports fell $340m (0.7%) driven by fuels and lubricants.

Assistant governor for financial system Brad Jones spoke on the topic of The Economics of a Central Bank Digital Currency (CBDC) in Australia.

Jones said the RBA will keep an open mind on the development of CBDC currency, saying that many things have to still be considered.

“The bottom line here is that much will depend on CBDC design choices, and there are many complex issues that would need to be carefully weighed ahead of any decision to proceed with issuing a CBDC,” Jones said.

Australia’s GDP for the September quarter also missed expectations, increasing by just 0.6% versus forecast of 0.7%. Year on year, the GDP rose by 5.9%.

The OECD has said that Australian GDP could fall 1.9% in 2023 as consumption slows down – a view also shared by economist at AMP.

ASX IPOs this week:

Lithium explorer Patriot Battery Metals (ASX:PMT) made its dual listing on the ASX on Wednesday. Among PMT’s other listings is the Toronto stock exchange (TSXV:PMET) and Frankfurt Stock Exchange (FWB:RGA).

PMT raised $4,200,000 at an issue price of $0.60 per CDI and was near 100% returns on the day shooting up to $1.16 just before the lunch bell. However, by Friday it was also losing steam and down 26.71%.

Patriot owns 214 km2 of prime spod exploration ground including the Corvette discovery, a 50km trend littered with spodumene outcrop it hopes could be the next major North American lithium discovery.

Among the leadership team is a modern lithium legend – Ken Brinsden, who is is famed not only for helping turn Pilbara Minerals (ASX:PLS) from a penny dreadful into a $15 billion lithium giant, but also for driving development of its Battery Material Exchange auction platform to uncover the true market value of Australian lithium concentrate.

Listing: 12pm AEST December 9

IPO: $10m at 20c per share

Hot on the heels of PMT was another lithium explorer with Patriot in its name (yes, a little confusing).

Patriot will list with three US hard rock projects focused on North America – Keystone (South Dakota) and Tinton West (South Dakota/Wyoming) in the Black Hills district, and Wickenburg in Arizona.

Keystone is down the road from the historic Etta mine, an important global lithium source between 1898 and 1960.

At times, it was the main source of spodumene in the world and yielded the largest (up to 14m long) spodumene crystals ever mined.

By 1.15pm PAT was trading at 37 cents/share.

ASX SMALL CAP LEADERS:

Here are the best performing ASX small cap stocks for December 5 to 9

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| SGA | Sarytogan | 0.455 | 54% | $31,470,642.93 |

| MIO | Macarthur Minerals | 0.2 | 54% | $34,787,232.48 |

| VTI | Vision Tech Inc | 0.455 | 52% | $14,254,741.87 |

| AHN | Athena Resources | 0.012 | 50% | $9,575,143.14 |

| ANL | Amani Gold Ltd | 0.0015 | 50% | $35,540,161.69 |

| MRQ | Mrg Metals Limited | 0.0045 | 50% | $7,883,674.51 |

| LER | Leaf Res Ltd | 0.016 | 45% | $16,185,159.66 |

| APC | Aust Potash Ltd | 0.026 | 44% | $21,235,190.75 |

| DUB | Dubber Corp Ltd | 0.52 | 44% | $144,275,544.21 |

| AFL | Af Legal Group Ltd | 0.18 | 44% | $13,393,873.15 |

| GMN | Gold Mountain Ltd | 0.01 | 43% | $15,781,491.70 |

| AJL | AJ Lucas Group | 0.04 | 43% | $42,647,618.53 |

| TI1 | Tombador Iron | 0.03 | 43% | $55,561,541.70 |

| CZN | Corazon Ltd | 0.024 | 41% | $17,089,255.60 |

| CDR | Codrus Minerals Ltd | 0.19 | 41% | $4,851,600.00 |

| JPR | Jupiter Energy | 0.032 | 39% | $4,908,086.18 |

| CSE | Copper Strike Ltd | 0.135 | 36% | $17,279,327.91 |

| CLA | Celsius Resource Ltd | 0.019 | 36% | $24,045,264.69 |

| TON | Triton Min Ltd | 0.038 | 36% | $51,163,014.55 |

| KEY | KEY Petroleum | 0.002 | 33% | $3,935,856.25 |

| SIT | Site Group Int Ltd | 0.004 | 33% | $4,204,980.51 |

| PCL | Pancontinental Energy | 0.008 | 33% | $60,433,782.48 |

| MFD | Mayfield Childcr Ltd | 1.28 | 33% | $83,273,698.88 |

| VSR | Voltaic Strategic | 0.0305 | 33% | $8,886,488.82 |

| A1G | African Gold Ltd. | 0.092 | 31% | $14,580,381.12 |

| HGO | Hillgrove Res Ltd | 0.056 | 30% | $59,888,741.91 |

| WML | Woomera Mining Ltd | 0.0195 | 30% | $18,791,685.88 |

| ORR | Orecorp Ltd | 0.485 | 29% | $191,518,827.84 |

| AL8 | Alderan Resource Ltd | 0.009 | 29% | $5,204,394.72 |

| CYQ | Cycliq Group Ltd | 0.009 | 29% | $3,127,649.92 |

| STM | Sunstone Metals Ltd | 0.046 | 28% | $107,438,303.14 |

| CPT | Cipherpoint Limited | 0.007 | 27% | $5,631,082.87 |

| MAY | Melbana Energy Ltd | 0.052 | 27% | $168,510,205.20 |

| AU1 | The Agency Group Aus | 0.038 | 27% | $16,285,910.38 |

| RDM | Red Metal Limited | 0.089 | 25% | $19,647,339.44 |

| AQX | Alice Queen Ltd | 0.0025 | 25% | $5,500,625.24 |

| BDG | Black Dragon Gold | 0.05 | 25% | $10,033,502.75 |

| ESR | Estrella Res Ltd | 0.015 | 25% | $20,770,006.17 |

| MXO | Motio Ltd | 0.05 | 25% | $12,118,816.38 |

| 1AD | Adalta Limited | 0.056 | 24% | $16,965,976.28 |

| NRX | Noronex Limited | 0.036 | 24% | $8,361,605.46 |

| LM8 | Lunnon Metals | 0.98 | 24% | $108,777,365.73 |

| WR1 | Winsome Resources | 1.36 | 24% | $208,788,031.50 |

| 4DS | 4Ds Memory Limited | 0.037 | 23% | $56,231,086.80 |

| AQS | Aquis Ent Ltd | 0.16 | 23% | $5,715,068.16 |

| CMX | Chemxmaterials | 0.19 | 23% | $8,904,563.94 |

| IRX | Inhalerx Limited | 0.066 | 22% | $12,359,619.16 |

| SPX | Spenda Limited | 0.011 | 22% | $32,629,791.16 |

| BDX | BCAL Diagnostics | 0.072 | 22% | $9,798,819.12 |

| FZR | Fitzroy River Corp | 0.14 | 22% | $12,414,738.87 |

Leading the winners for small caps this week is graphite miner Sarytogan (ASX:SGA), after the company reported a breakthrough in the metallurgical test work for the Sarytogan Graphite Deposit in Central Kazakhstan.

SGA said low-temperature alkaline roasting improved to 99.70% Total Graphitic Carbon (TGC), alongside an alternative chemical purification process which separately achieved 99.70% TGC.

ASX SMALL CAP LAGGARDS:

Here are the least performing ASX small cap stocks for December 5 to 9:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| ARE | Argonaut Resources | 0.001 | -50% | $12,723,742.55 |

| VIP | VIP Gloves | 0.003 | -50% | $3,147,125.74 |

| DW8DD | DW8 Limited | 0.028 | -44% | $3,360,054.42 |

| GFN | Gefen Int | 0.045 | -41% | $3,064,505.72 |

| DTR | Dateline Resources | 0.045 | -34% | $23,172,565.24 |

| AMS | Atomos | 0.06 | -33% | $24,511,085.82 |

| AO1 | Assetowl Limited | 0.001 | -33% | $1,572,129.76 |

| CFO | Cfoam Limited | 0.002 | -33% | $2,201,521.90 |

| MEB | Medibio Limited | 0.001 | -33% | $3,320,593.79 |

| PRM | Prominence Energy | 0.001 | -33% | $3,636,913.23 |

| T3D | 333D Limited | 0.001 | -33% | $3,189,317.30 |

| MBX | MyFoodie Box | 0.0455 | -33% | $1,524,249.77 |

| WEC | White Energy Company | 0.22 | -31% | $10,750,862.12 |

| DUN | Dundas Minerals | 0.2 | -31% | $8,888,850.00 |

| LIN | Lindian Resources | 0.17 | -31% | $140,167,962.74 |

| WIN | Widgie Nickel | 0.375 | -31% | $102,915,259.48 |

| LAW | Lawfinance Ltd | 0.063 | -28% | $4,087,529.98 |

| KPO | Kalina Power Limited | 0.016 | -27% | $24,243,132.58 |

| OD6 | OD6 Metals | 0.365 | -27% | $18,749,388.48 |

| AJQ | Armour Energy Ltd | 0.006 | -25% | $16,323,987.11 |

| AVM | Advance Metals Ltd | 0.009 | -25% | $4,338,396.62 |

| CLE | Cyclone Metals | 0.0015 | -25% | $9,175,105.47 |

| GES | Genesis Resources | 0.006 | -25% | $4,697,047.76 |

| MTL | Mantle Minerals Ltd | 0.003 | -25% | $16,036,815.22 |

| THR | Thor Mining PLC | 0.006 | -25% | $8,653,277.07 |

| XST | Xstate Resources | 0.0015 | -25% | $4,822,772.48 |

| MGTDB | Magnetite Mines | 0.61 | -24% | $48,155,600.29 |

| ADS | Adslot Ltd. | 0.01 | -23% | $24,247,832.19 |

| SNX | Sierra Nevada Gold | 0.24 | -23% | $12,072,080.85 |

| MTH | Mithril Resources | 0.0035 | -22% | $10,290,815.64 |

| NVX | Novonix Limited | 1.805 | -22% | $912,524,820.00 |

| CBE | Cobre | 0.18 | -22% | $42,156,933.46 |

| AEV | Avenira Limited | 0.0235 | -22% | $27,395,941.65 |

| JXT | Jaxstaltd | 0.033 | -21% | $11,305,080.57 |

| TYX | Tyranna Res Ltd | 0.026 | -21% | $60,135,633.13 |

| TNY | Tinybeans Group Ltd | 0.205 | -21% | $11,903,676.92 |

| AYA | Artrya | 0.435 | -21% | $27,943,117.74 |

| EXL | Elixinol Wellness | 0.023 | -21% | $7,906,639.28 |

| EPY | Earlypay Ltd | 0.345 | -21% | $100,025,398.05 |

| WRM | White Rock Min Ltd | 0.073 | -21% | $18,689,062.38 |

| NMR | Native Mineral Res | 0.135 | -21% | $15,612,729.48 |

| FFF | Forbidden Foods | 0.031 | -21% | $4,136,124.08 |

| PYR | Payright Limited | 0.04 | -20% | $5,036,234.28 |

| AR9 | Archtis Limited | 0.1 | -20% | $26,422,320.70 |

| AXP | AXP Energy Ltd | 0.004 | -20% | $23,298,722.69 |

| BGE | Bridge Saas | 0.092 | -20% | $2,671,312.92 |

| M2R | Miramar | 0.08 | -20% | $6,644,083.84 |

| MOB | Mobilicom Ltd | 0.008 | -20% | $9,318,957.66 |

| TTT | Titomic Limited | 0.16 | -20% | $32,895,617.76 |

| BSA | BSA Limited | 0.56 | -20% | $44,335,567.60 |

Leading the laggards this week is Argonaut Resources (ASX:ARE), which is a mineral exploration and development company with operations in Zambia and Australia.

Its prime commodity focus is copper, to a lesser extent gold and uranium. It also holds a 100% interest in a zinc-copper resource in Queensland.

Orpheus Minerals, a spin-out from ARE was expected to close its IPO today. It plans to explore for and discover greenfield uranium deposits in South Australia and the NT.

The post Weekly Small Cap and IPO Wrap: ASX small caps down 1.91% as two new lithium plays make their IPO appeared first on Stockhead.

toronto stock exchange

tsxv

cse

asx

gold

lithium

uranium

copper

zinc

iron