Uncategorized

US stocks gyrate on hot PPI report and anchored inflation expectations; Oil rallies and gold softens

US stocks are mostly gyrating over economic data points and surveys that remind us that the disinflation process is going to struggle reaching the Fed’s…

US stocks are mostly gyrating over economic data points and surveys that remind us that the disinflation process is going to struggle reaching the Fed’s 2% target. A slightly hotter-than-expected PPI report sent Treasury yields initially higher as Wall Street started to fret over a potential reacceleration with inflation. It is easy to make the hawkish case for the Fed as we are still expecting rising wages from labor disputes, higher energy prices, and a gradual weakening of the labor market. The other side of that trade however strongly argues that writing is on the wall that this economy is going to continue to slowdown and that will do the trick for keeping the disinflation process going.

What is interesting is how the mega-cap tech trade is evolving. Nvidia is down over 13% from its high from just a month ago and investors are hesitant to buy back in despite this still being an early stage for the AI trade. Apple also has not recovered from their earnings outlook and the next big move might come from how well the mid-September launch goes. The Nasdaq is vulnerable to further downside until both Apple and Nvidia stabilize.

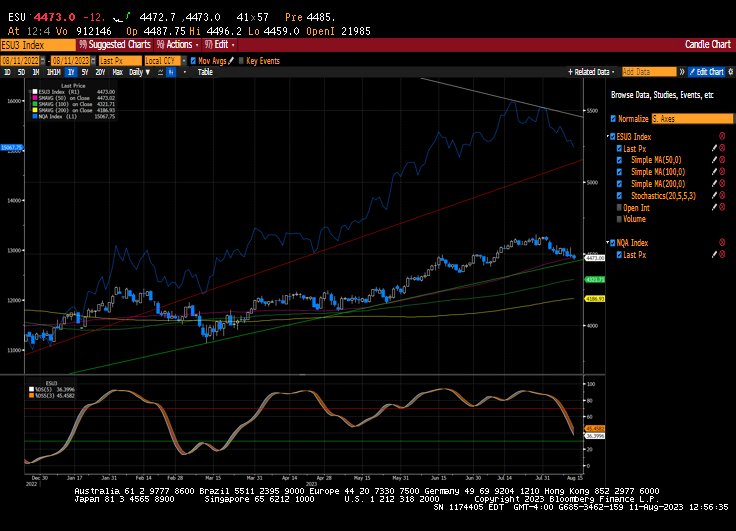

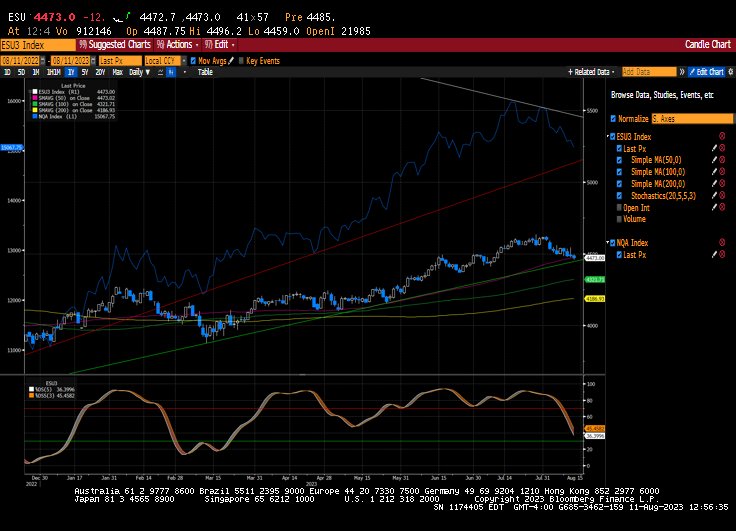

The S&P 500 and Nasdaq chart is showing that the August slump is approaching key trendline support and approaching oversold conditions. Summer doldrums could be settling in, so that might provide some added support. Key support resides at the 4400 level for the S&P 500, but if soft landing hopes remain intact, downside might be limited. If selling momentum intensifies, bearishness could target the 4,312 level.

Oil

Crude prices are resuming their bullish ascent as energy traders remain overly confident the oil market will remain tight. The oil rally is poise for a seventh straight week of gains and it doesn’t seem like exhaustion is settling in yet. When the market gets complacent, sometimes that is when you get a decent pullback, but for now it seems any oil dips will be bought.

Gold

Gold prices are tentatively breaking down below key support at the $1950 level. A stronger dollar is knocking gold down after both a hot PPI report and as easing long-term inflation expectations stay within the range that was set from the past two years. Gold is waiting for its day in the sun, but that might not happen until the dollar rally cools. There is a mountain of risks that could support safe-haven flows, but gold needs to see the right ones. The resumption of the bond market selloff is short-term trouble for gold, which could trigger some further technical selling.