Uncategorized

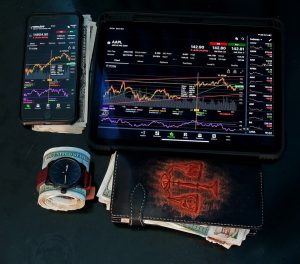

Unleashing Market Potential: Technical Analysis of Stock Trends

Technical Analysis of Stock Trends: Crack The Code May 21, 2023 Staying ahead in today’s volatile financial scene necessitates a thorough grasp of…

Technical Analysis of Stock Trends: Crack The Code

May 21, 2023

Staying ahead in today’s volatile financial scene necessitates a thorough grasp of multiple research methodologies. Technical analysis is a strategy that includes reviewing past price and volume data to detect patterns and trends. Today, we will delve into the world of technical analysis and explore how it can empower you to make informed investment decisions.

What exactly is Technical Analysis?

Traders and investors use technical analysis to forecast future price movements based on previous market data. By analyzing charts, patterns, and indicators, technicians aim to identify trends, reversals, and potential entry or exit points in the market. Unlike fundamental analysis, which focuses on company financials, technical analysis focuses solely on price action and volume.

The Basics of Technical Analysis

Chart Patterns

One of the fundamental aspects of technical analysis is the identification and interpretation of chart patterns. These patterns, such as support and resistance levels, head and shoulders, and double tops/bottoms, provide valuable insights into market sentiment and potential future price movements. By recognizing these patterns, traders can make informed decisions and capitalize on market opportunities.

What is Technical Analysis of Stock Trends?

Trend analysis is a crucial component of technical analysis as it helps investors understand the overall direction of a stock or market. Trends are divided into uptrends, downtrends, and sideways (or range-bound) trends. Various indicators, such as moving averages, trendlines, and the Average Directional Index (ADX), are used to identify and validate trends.

Technical Indicators

Technical indicators are mathematical computations that are based on price and volume data and give extra insight into market patterns and potential reversals. Popular tools in this category include the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Bollinger Bands. Each indication provides distinct information that helps traders validate or test their ideas.

Levels of Support and Resistance

Support and resistance levels on a chart are important locations where the price tends to halt or reverse. Support is a price level when buyers are likely to outnumber sellers, stopping further losses. On the other hand, resistance refers to a level where selling pressure is expected to outweigh buying pressure, preventing further advances. Identifying these levels is crucial for determining potential entry and exit points.

How to Use Technical Analysis Effectively

Timeframes and Trading Styles

Different traders utilize technical analysis in various timeframes and trading styles. Some traders prefer shorter timeframes, such as intraday or swing trading, focusing on capturing smaller price movements. Others opt for longer timeframes, like position trading or long-term investing, aiming to capitalize on significant market trends. Understanding your preferred trading style can help you select the appropriate indicators and timeframes.

Risk Management

While technical analysis can provide valuable insights, it is essential to integrate proper risk management strategies into your trading plan. Setting stop-loss orders, diversifying your portfolio, and adhering to appropriate position sizing are crucial elements for managing risk effectively. You can protect your capital and minimize potential losses by implementing risk management techniques.

Backtesting and Paper Trading

Before applying technical analysis strategies with real money, it is recommended to perform backtesting and paper trading. Backtesting involves applying your chosen indicators and rules to historical data to assess their effectiveness. On the other hand, paper trading allows you to practice your strategies in a simulated trading environment without risking real funds. These processes can help refine your approach and improve your decision-making abilities.

Technical Analysis Stock Trends: The Conclusion

Technical analysis is a strong instrument for traders and investors looking for a competitive advantage in the stock market. By learning and utilising technical analysis techniques, you may make more educated trading decisions and perhaps increase your total profitability.

Remember, successful implementation of technical analysis requires a combination of knowledge, experience, and discipline. Continually educate yourself, stay updated with market trends, and adapt your strategies as needed. Additionally, it is crucial to integrate risk management techniques into your trading plan to protect your capital and minimize potential losses.

To further enhance your understanding of technical analysis, consider utilizing online resources, attending educational webinars or seminars, and studying reputable books written by experienced traders. The more you immerse yourself in the world of technical analysis, the better equipped you will be to navigate the complexities of the stock market.

In conclusion, technical analysis is a valuable tool for traders and investors seeking a competitive advantage in the stock market. You may make more educated trading decisions and achieve more success in your financial ambitions by analysing previous price and volume data, recognising patterns and trends, and applying technical indicators.

Remember, mastering technical analysis takes time and practice. Begin by becoming acquainted with the fundamental principles and subsequently broaden your knowledge and abilities. You may use technical analysis to improve your trading methods and perhaps reach your financial goals if you are dedicated and committed to continual learning.

So, whether you are a new trader learning the ropes or an experienced investor wanting to fine-tune your strategy, technical analysis may be a useful weapon in your armoury. Embrace the power of technical analysis, stay disciplined, and always strive to improve your trading skills. The world of stock trends awaits, and with the proper knowledge and strategies, you can unlock its potential.

FAQ Of Technical Analysis of Stock Trends

Q: What is technical analysis of Stock Trends?

A: Technical analysis studies historical market data to predict future price movements based on chart patterns, indicators, and trends.

Q: What are chart patterns?

A: Chart patterns, like support and resistance levels, head and shoulders, and double tops/bottoms, provide insights into market sentiment and future price movements.

Q: What is trend analysis?

A: Trend analysis helps understand the overall direction of a stock or market using indicators like moving averages, trendlines, and the Average Directional Index (ADX).

Q: What are technical indicators?

A: Technical indicators are mathematical calculations based on price and volume data, such as RSI, MACD, and Bollinger Bands, that provide additional insights into market trends.

Q: What are support and resistance levels?

A: Support levels are where buying pressure is expected to outweigh selling pressure, while resistance levels are where selling pressure is expected to outweigh buying pressure.

Q: How can technical analysis be used effectively?

A: Use technical analysis based on your preferred trading style, implement risk management strategies, and perform back-testing and paper trading to refine your approach.

Q: What are some risk management techniques for technical analysis?

A: Implement proper risk management by setting stop-loss orders, diversifying your portfolio, and adhering to proper position sizing.

Q: What is backtesting and paper trading?

A: Backtesting involves applying indicators and rules to historical data to assess their effectiveness, while paper trading allows practising strategies in a simulated environment without risking real funds.

Q: How can one enhance their understanding of technical analysis?

A: Utilize online resources, attend educational webinars or seminars, and study reputable books from experienced traders to deepen your knowledge and skills.

Q: What is the conclusion about technical analysis?

A: Technical analysis is a powerful tool for making informed trading decisions and potentially enhancing profitability in the stock market, requiring knowledge, experience, and discipline.

Articles You’ll Love: Our Top Picks for Curious Minds

Best Stock Investing Books that Transcend Expectations

Read More

Buying Stocks When There’s Blood in the Streets

Read More

Stock market psychology books

Read More

Crude Oil Exploration

Read More

Why is Petroleum a Fossil Fuel?

Read More

Demystifying StochRSI strategy

Read More

What is Texas Tea?

Read More

Mob Mentality Psychology: Turning Negativity into Opportunity

Read More

Dow Theory: Unlocking the Secrets of the Stock Market

Read More

Understanding the Housing Market Cycle

Read More

Investment Emotions: The Psychology of A Market Cycle

Read More

Trading Psychology Books: The Key to Success in the Stock Market

Read More

Stock Market psychology chart: Unlock Your Trading Potential

Read More

Market Psychology Chart: Tips for Informed Investment Decisions

Read More

Contrarian Thinking: The Power of Challenging the Status Quo

Read More

Define Contrarian Thinking: Challenging the Norms for Success

Read More

Mastering Stock Market Psychology: Neutralizing Emotions & Biases

Read More

Investing in the Japanese Yen: A Rising Sun Currency Guide

Read More

What is Relative Strength in Investing? A Beginner’s Guide

Read More

3D printed organs: the future of medical technology

Read More

Think Different: The Power of Contrarian Thinking in Investing

Read More

The post Unleashing Market Potential: Technical Analysis of Stock Trends appeared first on Tactical Investor.