Uncategorized

Traders’ Diary: Some Closing Remarks

It’s back to Central Bankland for us this week as the Reserve Bank of Australia meets on Tuesday for Governor … Read More

The post Traders’ Diary:…

The Week On Markets

It was a maudlin first session of September trade on Friday, ending the week with a -0.4% loss, but coming home from Monday morning about 1.35% the better.

The ASX Small Ordinaries Index (XSO) fell by -1.2% on Friday, losing circa -0.3% for the week, while the ASX Emerging Companies Index (XEC) lost -1.1.% to close the week -0.9% the worse.

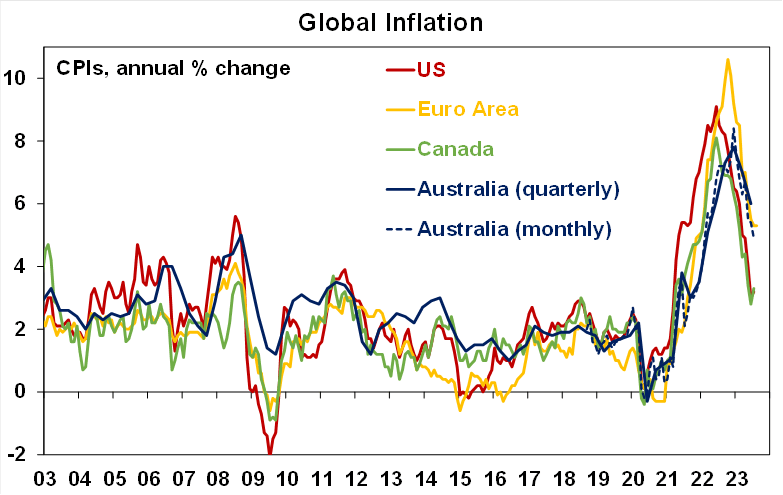

Global share markets rose further over the last week helped by US data showing a softening jobs market and continuing moderation in underlying inflation in the US adding to expectations that the Fed and European Central Bank will tap out on interest rates this month.

Last week in the States, markets watched the Fed watch the (Friday NT time) jobs report with its slight bump in the jobless rate, its weak jobs outlook and stiff wage rises, and thought: this is good.

With September already a shoe-in for a pause, futures markets in the US cut the probability of a Fed rate rise at the following November meet from circa 50% to less than 40%, thanks to that maudlin non-farm payrolls drop.

For the week US shares rose 2.5%, saving August from being all too awful, down as Wall St was by almost 5% before the last comeback. US markets ended circa -1.9% down for the month. In the EU markets rose 1.4%

Around the ‘hood, Japanese shares rose 3.4%. Chinese mainland markets found 2.2%, boosted by the halving in stamp duty costs for share transactions as well as the distribution of a few incentives (tax cuts) masquerading as property stimuli.

On Friday, China’s biggest banks cut interest rates on a range of deposits after instructions from HQ to do their bit to ease pressure on margins and hopefully inspire some action on the domestic spend side of China’s equation.

The Economic Week That Was

Last week we saw Aussie inflation ease a fair bit more than expected in July, adding to the likelihood that the RBA’s cash rate peaked at 8.4% yoy in December.

The Monthly Inflation Indicator has now fallen to 4.9% yoy in July.

Further afield, following last week’s Jackson Hole symposium with its central bank guidance on monetary policy, this week’s focus will be on European and US inflation, consumer confidence and unemployment data. China and US manufacturing purchasing managers index (PMIs) and Japan/German retail sales will also be of interest to market participants.

“Uncertainties, both old and new, complicate our task of balancing the risk of tightening monetary policy too much against the risk of tightening too little… As is often the case, we are navigating by the stars under cloudy skies.”

– US Federal Reserve chair Jerome Powell at the Jackson Hole Economic Symposium

The good/bad news of more disappointing US data eased fears of further interest rate rises on Wall Street adding to weaker flash PMI data across major developed economies helping buoy US and APAC markets.

“A fuller picture of developments on growth, employment and inflation trends will be sought with the services and composite PMI updates in the coming week,” according to S&P Research. “Furthermore, sector PMI data will offer more detailed clues on which parts of the economy fared better midway into the third quarter and provide insights into investment strategies into the rest of the year.”

Last week oil futures edged closer to monthly highs. There could be further gains for crude oil this week with Russia likely to announce a new round of supply cuts, just as the market is tightening on the demand side.

WTI oil was last trading slightly above US$84 a barrel.

Gold headed higher too as the precious metal seeks to extend its two-week rebound amid the sharp reversal in bond yields.

XM’s Peter McGuire says there’s still legs in the gold price this week too.

“The Gold Bulls are likely to keep targeting the $1,950/oz level after failing to clear $1,949/oz on Wednesday.”

The Week that Will be

It’s back to Central Bankland week as the Reserve Bank of Australia (RBA) meets on Tuesday.

“The latest inflation data, together with the data on wages and unemployment, have generally undershot market expectations and are broadly in line or weaker than the RBA’s own expectations. As such, there is no ‘smoking gun’ for the RBA to raise rates again at the September Board meeting, especially after having kept rates unchanged over the past two meetings. A deteriorating outlook for the Chinese economy will also likely mean the RBA are content to maintain their wait‑and‑see approach on rates.

“We expect the RBA to leave the cash rate unchanged, but in the post‑meeting Statement to continue to discuss the case for a further rate hike.”

– Stephen Wu, CBA Economics

The National Accounts data will also get a look in, which CBA reckons will show a local economy continuing to grope ahead ‘at a subdued’ pace.

Certainly, the recent PMI reads have described Aussie economic growth as sustained – in its own subdued way – though the latest August flash data implied a potential slowdown into Q3. There’s been enough on inflation, wages and jobs for markets to play the odds that the RBA will maintain the pause on Tuesday where RBA Governor P.Lowe will pass on the flame to Michele Bullock.

Her seven‑year term begins officially on 18 September.

Before his term ends, Governor Lowe will deliver a final absolution at the annual bankers Anika Foundation shindig in Sydney.

His speech is imaginatively called ‘Some closing remarks’.

Further afield, we also have the Canucks being given their medicine when the Bank of Canada hunkers down for its monetary policy decision.

Data for Chinese inflation, Japanese cash earnings, and Canadian employment will round out a fairly fat run of news.

Meanwhile GDP figures are also due for the EU, Japan and South Korea.

Mainland China releases both trade and inflation numbers for August, which follow an actually upbeat Caixin Manufacturing PMI which landed on Friday and this Tuesday respectively.

In particular, the entrails of Chinese inflation will be picked through amid growing concerns Beijing is asleep at the wheel as signs of deflation start to emerge.

The Australian Economic Calendar

Monday September 4 – Friday September 8

All sources from Commsec, Trading Economics, S&P Global Research, AMP

MONDAY

Business indicators, Q2 23

Inventories

Company profits

TUESDAY

RBA Interest Rate Decision

Australia Current Account (Q2)

WEDNESDAY

Australia GDP (Q2)

THURSDAY

Judo Bank SME PMI Activity Report (Aug)

Australia Balance of Trade (Jul)

Australia Trade (Jul)

Anika Foundation, RBA Governor speech ‘Some Closing Remarks’

FRIDAY

Nada

The Everyone Else Economic Calendar

Monday September 4 – Friday September 8

Monday

United States, Canada Market Holiday

Germany Trade (Jul)

Switzerland GDP (Q2)

Turkey Inflation (Aug)

Tuesday

Worldwide Services, Composite PMIs, inc. global PMI

(Released across 5-6 Sep)

ASEAN S&P Global Manufacturing PMI (Aug)

South Korea GDP (Q2, final)

South Korea CPI (Aug)

Thailand Inflation (Aug)

Philippines Inflation (Aug)

Singapore Retail Sales (Jul)

Eurozone PPI (Jul)

South Africa GDP (Q2)

Brazil Industrial Production (Jul)

United States Factory Orders (Jul)

Wednesday

Germany Factory Orders (Jul)

Taiwan Inflation (Aug)

Eurozone HCOB Construction PMI* (Aug)

Eurozone Retail Sales (Jul)

Canada Trade (Jul)

Canada BOC Interest Rate Decision

United States Trade (Jul)

United States ISM Services PMI (Aug)

United States Fed Beige Book

US, Europe S&P Global Sector PMI (Aug)

Thursday

China (Mainland) Trade (Aug)

Malaysia BNM Interest Rate Decision

Germany Industrial Production (Jul)

Eurozone Q2 GDP (final)

United Kingdom Halifax House Price Index (Aug)

United Kingdom KPMG/REC Report on Jobs (Aug)

United States Initial Jobless Claims

Worldwide and Asia S&P Global Sector PMI (Aug)

Friday

Japan Q2 GDP (final)

Philippines Trade and Unemployment (Jul)

Germany Inflation (Aug, final)

Taiwan Trade (Aug)

Canada Employment (Aug)

United States Wholesale Inventories (Jul)

Worldwide Metal Users and Electronics PMI (Aug)

The post Traders’ Diary: Some Closing Remarks appeared first on Stockhead.