Uncategorized

Traders’ Diary: Brace for impact – ’cause here comes The Fed

The Economic Week That Was On the whole, global share markets pushed through some familiar headwinds last week whence the … Read More

The post Traders’…

The Economic Week That Was

On the whole, global share markets pushed through some familiar headwinds last week whence the tide of economic data had ebbed, it seems the odds of US Federal Reserve not raising rates again had actually firmed while traders are only too willing to throw their support behind more convincing pictures of a resilient US economic outlook pull off a safe US economic landing. Thus avoiding recession, market runs, finger pointing political tantrums and social turmoil.

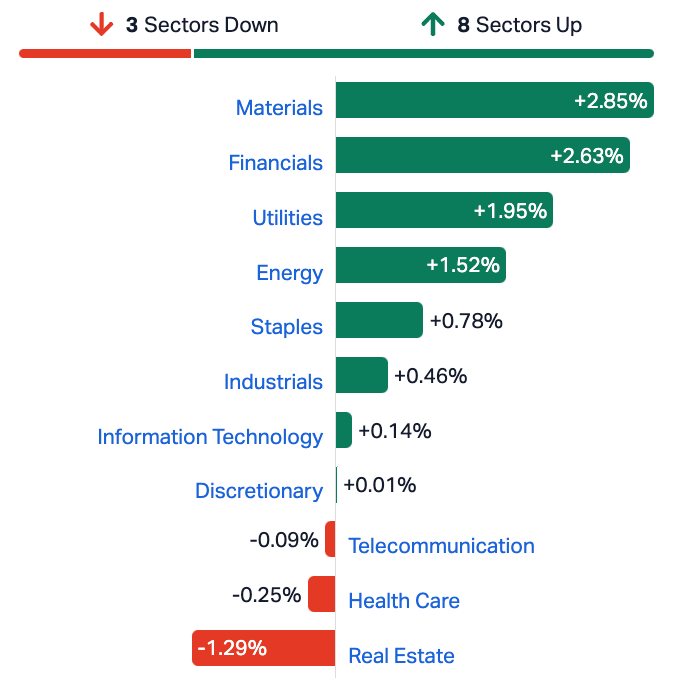

After detaching itself from one or two decent leads out of a jittery Wall Street, the ASX200 eventually got some bottle and closed Friday having banked circa +1.5% for the week, the stand-up Sectors led by Materials, Financials Staples and Utilities.

Coaxed into work by a few positive US leads, and – later in the week – less miserable Chinese economic news as well as a bunch more local jobs -consistent with the RBA leaving rates on hold next month the Australian share market rose 1.7% for the week. Bond yields, oil, metal gold, hackles and iron ore prices all rose..

On Wall Street markets ignored a testing week for big tech which saw Google (GOOGL) in court for being too dominant, Apple (APPL) in the spotlight for launching new iThings which seem less dominant, and SoftBank rolling a big dice on an untested US IPO market, where Arm Holdings’ (ARM) Nasdaq IPO, fortunately came up with the riches.

Wall Street did fluff things on Friday as a rather large auto workers strike and renewed doubts around another government shutdown for October coalesced around various expiring options which magnifies volatility and left US stocks down 0.2% for the week.

Chinese shares walked back -0.8% for the week amidst inconclusive demonstrations of growth, while Japan’s central bank continues to stage manage its return to quasi-normalcy, dormant Japanese shares are continuing to present with some serious clout, up +2.8% since Monday.

Likewise a “dovish rate hike” from the hawkish European Central Bank (ECB), gave EU markets something to not hate. Up +1.3% helped by a

The US Federal Reserve and Bank of England both meet next week. Bets and Wall St experts agree that The Fed is likely to keep rates on hold even though US inflation accelerated more than expected last month, roiling markets.

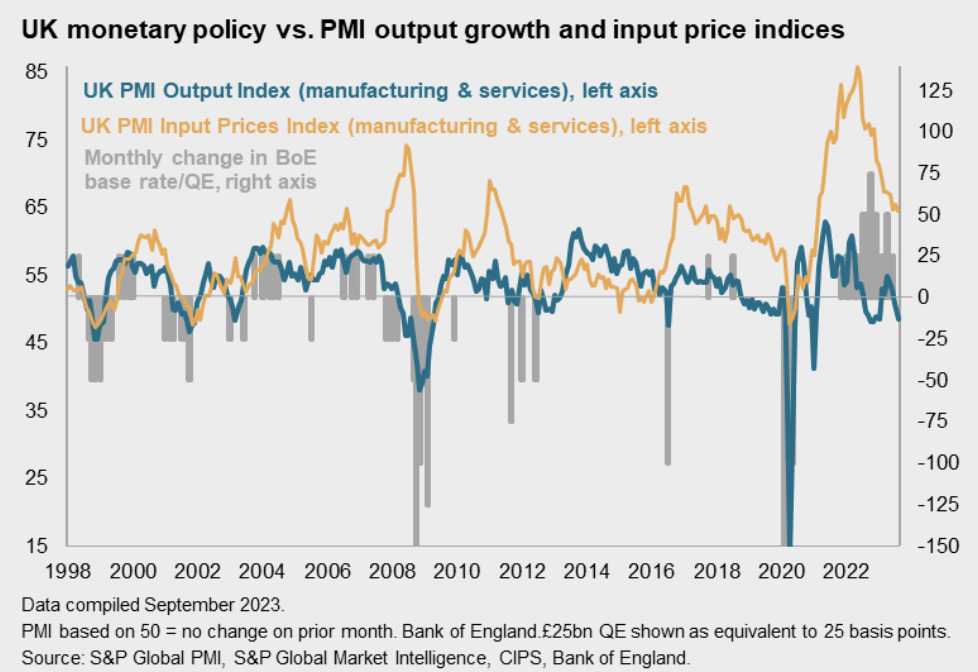

The BoE, however, could probably hike till Christmas as UK inflation hovers happily far above the bank’s target.

After 14 consecutive rate hikes, there is growing speculation than the Bank of England is coming close to pausing its rate hike cycle. The broad consensus appears to be that the MPC will hike again at its September meeting, but that this will represent a peak. A predicted 25 basis point hike will take Bank Rate to 5.5%, its highest since early 2008.

Over in Japan, The Bank of Japan (BoJ) appears to be getting closer to removing negative interest rates, core inflation is now well above the 2% target and BoJ Governor Ueda was overheard not being thoroughly dovish.

Ueda could even remove Japan’s yield curve control, likely clipping global bonds, tho Japanese yields are heaps below markets like here or in the US.

At home

Highlight of a decent week of economic osculations was I suppose the August labour force print by the familiar chart toppers at the Bureau of Stats. As expected there was a jobs rebound in August. The country added 649,000, new jobs, after a revised smaller fall of 14,000 in July.

It’s not supposed to be, but this seems nice.

I know: that last weeks comments from that widely-lambasted but probably deeply misunderstood millionaire – that Australian’s just aren’t feeling the pain enough is only because he wants whats best for us all and comes from a place of love.

More of us to love

Inflation is alive and well in the field of demography. Some 563,000 new Australians materialised during the March quarter. That’s our population rising by 2.2% in 12 months. In another hit release, the bureau says about four our of every five came from overseas, the rest were dropped off by The Storks.

Actually, the arrival data shows were careening toward Australia’s fastest net immigration since 1966.

The Week That Will Be

The ECB’s call to lift its deposit rate for the 10th consecutive meet, this time by 25 basis points to 4%, came just as President Christine Lagarde’s minions cut official growth forecasts for the EU economy. The euro hit a three-month low against the US dollar after Thursday’s decision in Frankfurt.

Aside from England, where inflations runs amok and unpunished, now most EU economists are starting to believe that the core central bank clique are twitching to be done with their rate rises – the broadening wishful view is inflation is beat, growth is slowing, and jobs are diminishing now money costs more.

That’s why when the US Federal Reserve, Bank of England (BoE), Bank of Japan (BoJ) and the banks in Norway, Sweden, and Switzerland make their decisions this week, it’ll be standing room only.

After a far from conclusive CPI read last week, The Fed’s FOMC is nevertheless expected to stay the pause, Next meet could be different. The Americans will also be watching for market moving versions of housing starts, crude oil inventories, and initial jobless claims.

The whole US government shutdown nonsense will crystallise this week, after what seems to have been a good week-and-a-half of not worrying about it. Deadline is October 1.

President Joe Biden is looking at a tough few weeks. A big union guy, he’ll be all up in the United Auto Workers (UAW) union and Detroit automakers fanfare, as the stoppages could well impact a fair few big American stocks. which could start to have ramifications for dozens of stocks.

Other key data in the week ahead will be inflation data in Japan, Canada and the UK. In the UK we expect headline inflation can lift again due to higher fuel prices. The oil price has been rising in August and into September due to OPEC supply cuts and Brent is now back above $US90 a barrel, that’s a near-term threat to top line inflation.

Despite the bounce in the last week, your fiscal physician, Dr Shane Oliver from AMP Capital says the risk of a correction in shares remains high, with the main threats coming from:

- Sticky services inflation

- Central banks still leaning hawkish

- The ongoing risk of recession

- The rebound in oil prices

- China’s economy still iffy

- The very high risk of a US Government shutdown from 1 October

- High bond yields pressuring share market valuations

- Continuing geopolitical tensions; and

- The weak seasonal period for shares into next month

Prescribing light exercise and cautious optimism, Doc Oliver adds:

“However, our 12-month view on shares remains positive as inflation is likely to continue to trend down taking pressure off central banks and any recession is likely to be mild.”

Your week on the ASX

We’re halfway through September, the seasonally weakest month of the year for the local market, and it’s so far so good, with the ASX200 up 1.5% for the week and down just -0.4% for the month-to-date.

The World Nuclear Association (WNA) didn’t need to do much other but trot out some musings about how uranium demand from utilities would just about double by 2040 and the uranium spot price just ticked over US$66 a pound, its highest level in 12 years. It’s found 40% now TYD.

Midweek, the rising local players spiked. Supply chain issues and a decaying climate among the factors shaking uranium doubters to the core.

Even amongst sceptics, nuclear energy production is increasingly becoming accepted as an environmentally friendly base-load power source in a decarbonised world.

Chinese data on Friday arvo awoke the Kraken living inside our dormant Materials Sector, stronger than expected industrial and retail activity as well as the PBoC slashing lending requirements.

By the end of the week, 8 of the market’s 11 sectors had closed higher, but it was the +3.9% move by the Materials Index which helped catapult the ASX200 up +1.7%, the Financials came in a distant second up +2.5%.

The XGD All Ords Gold index was out in front again this week, up +3.2% because of the relentless drive of instability throughout the markets for the past few months.

“We’ve been waiting for Beijing to pull the stimulus lever, which would have investors believing that the world’s second-largest economy can return to solid economic growth – We may have just witnessed this very catalyst last week,” according to Market Matters’ James Gerrish.

The Li-Files

Barry Fitz reckons the shifting alliances rippling through Lithium Land, WA “has assumed Games of Thrones-esque proportions.”

Certainly, for Gina Rineheart, Wester-Aus’ richest dragon rider, the sector does look ripe for the picking, especially given her not so secret plan to expand her empire by diversifying out of iron ore and into the weak and poorly defended WA lithium provinces.

Rineheart ambushed Albemarle’s lumbering US$6.6 billion bid for Liontown Resources (ASX:LTR) early last week by pocketing a circa 7.7% stake in the Kathleen Valley developer. Nearby, Delta Lithium (ASX:DLI) woke up to find its boardroom had been the scene of a swift and bloody putsch engineered by its very own 17.4% shareholder, Mineral Resources (ASX:MIN), a voracious where Chris Ellison’s has cultivated a survivalist of the fittest M&A mentality, when it comes to harvesting WA lithium projects.

“It seems Rinehart and Ellison, whose companies and personal fortunes have been built on iron ore, are intent on securing a double dose of wealth generation in the lithium space,” Barry remarked last week.

Hunting for future battery metals, Hancock buys Future Battery Metals

Which was why Future Battery Minerals (ASX:FBM) lifted sharply on news of a heavily oversubscribed $7.6 million placement to accelerate exploration at its Kangaroo Hills and Nevada lithium projects.

But why is it up big? Placements normally tank a share price as investors who missed the discount tap out.

Not when it’s Hancock Prospecting tipping in around a third of the cash to take up a major residence in your business.

Hancock Prospecting’s $2.65 million commitment is small change for Australia’s richest person, but looms large especially given her big plans to diversify from iron ore to WA lithium.

Rineheart’s spent many times that to grab the significant 7.72% stake in LTR and the US$6.6 billion takeover for the Kathleen Valley mine owner it’s board is right keen on.

Among both the small caps and lithium co’s it was OzAurum Resources (ASX:OZM), which took the spotlight last week, adding around 140% – almost all of it during Friday’s session – after it told the market that its shopping trip to Brazil has been wildly successful.

OZM was flying hard right from open on news that the company has snapped up the Linopolis Jaime Project – a strategically held area of over 20 Lithium-Cesium-Tantalum (LCT) bearing pegmatites that have been mined intermittently for tantalite, beryl, tourmaline, brazilianite and feldspar intermittently by the Pacheco family and other artisanal miners for over 50 years.

OZM wants the spot for its lithium, as it boasts spodumene grades of up to 7.36% LiO2 with an average spodumene grade of 6.94% LiO2 confirmed within a +7m wide spodumene zone.

As the company notes, coarse spodumene crystals are rarely seen in lithium deposits. Greenbushes and Mt Marion lithium deposits are examples where they are known to occur.

And the other thing that’s attracted the company to bust a Brazilian move – it’s an untapped site. There has been no lithium exploration within the project area previously.

Josh Gilbert’s 3 things to watch out for

eToro’s Sydney-based Cornish market analyst Josh Gilbert tells Stockhead what needs tracking this week

China rates: Going it alone

On Friday, China’s one and five-year term loan rates are up for review. With regulators increasingly concerned by the nation’s fledgling post-COVID recovery, a cut to both rates is possible. Even so, a cut of anything less than 0.10 percentage points will almost certainly not be enough to keep up with the financial turmoil.

Last month, the People’s Bank of China on (PBoC) Monday cut the one-year loan prime rate from 3.55 per cent to 3.45 per cent but left the five-year loan prime rate unchanged, stoking disappointment as the call for more decisive measures from the central bank and government grows louder.

The triple threat of dwindling demand for Chinese goods, a narcoleptic property market, and record low birth rates telegraphs a clear need for heavy policy intervention, and while there has been some stabilisation compared to earlier this year, markets seem to be growing sick of a lack of firm rehabilitative action in the Chinese economy.

RBA minutes

The release of the RBA’s quarterly bulletin on Thursday will be significant as Michelle Bullock officially steps into the role of Reserve Bank Governor. Markets will be watching closely to get a better picture of just how hawkish Bullock intends to be, with many analysts expecting at least one more hike in this cycle before the RBA calls time on its mission to facilitate a soft landing.

Following a middling earnings season across discretionary goods categories, it’s anticipated that the impact of this year’s rapid hiking cycle may be acknowledged by the Governor – but stubborn Australian unemployment figures and a surprising uptick in US consumer price data this week may serve as a warning to not ease off just yet.

Fed Reserve to make a call on rates

In the US, the Federal Reserve is slated to make its monthly call on rates on Wednesday. The meet is the third remaining scheduled rate meeting on the 2023 calendar (currently, nothing is set for October), and while markets are anticipating a pause on rates, it’s unlikely the Fed is altogether done with its hiking cycle as inflation continues to prove difficult to tame and the central bank remains firm on its 2% inflation target.

As always, the call will come down to the data on hand, and the subsequent release of the Federal Open Market Committee (FOMC) Economic Projections should give markets a clearer picture on how close the Fed is to acknowledging the peak of this current cycle.

The Australian Economic Calendar

Monday September 18 – Friday September 22

Source: Commsec, Westpac, Trading Economics, S&P Global Research, AMP

MONDAY

TUESDAY

Australia RBA Meeting Minutes (Sep)

WEDNESDAY

Westpac Leading Index

THURSDAY

RBA Bulletin

FRIDAY

Australia Judo Bank Flash PMI, Manufacturing & Services

The Everyone Else Economic Calendar

Monday September 18 – Friday September 22

Monday

Japan Market Holiday

Singapore Non-oil Domestic Exports (Aug)

Canada PPI and Housing Starts (Aug)

Tuesday

India Market Holiday

Malaysia Trade (Aug)

Hong Kong SAR Unemployment Rate (Aug)

Eurozone Current Account (Jul)

Eurozone Inflation (Aug, final)

Canada Inflation (Aug)

United States Building Permits (Aug, prelim)

United States Housing Starts (Aug)

Wednesday

New Zealand Current Account (Q2)

Japan Trade (Aug)

China (Mainland) Loan Prime Rates (Sep)

Germany PPI (Aug)

United Kingdom Inflation (Aug)

Taiwan Export Orders (Aug)

South Africa Inflation (Aug)

United States FOMC Interest Rate Decision

Thursday

New Zealand GDP (Q2)

Brazil BCB Interest Rate Decision

Hong Kong SAR HKMA Interest Rate Decision

Philippines BSP Interest Rate Decision

Indonesia BI Interest Rate Decision

Switzerland SNB Interest Rate Decision

Sweden Riksbank Rate Decision

Norway Norges Bank Interest Rate Decision

Taiwan CBC Interest Rate Decision

Turkey TCMB Interest Rate Decision

United Kingdom BOE Interest Rate Decision

South Africa SARB Interest Rate Decision

Hong Kong SAR Inflation (Aug)

Eurozone Consumer Confidence (Sep, flash)

United States Existing Home Sales (Aug)

Friday

Japan Jibun Bank Flash Manufacturing PMI*

UK S&P Global/CIPS Flash PMI, Manufacturing & Services*

Germany HCOB Flash PMI, Manufacturing & Services*

France HCOB Flash PMI, Manufacturing & Services*

Eurozone HCOB Flash PMI, Manufacturing & Services*

US S&P Global Flash PMI, Manufacturing & Services*

Japan BOJ Interest Rate Decision

Japan CPI (Aug)

Malaysia CPI (Aug)

Singapore CPI (Aug)

United Kingdom Retail Sales (Aug)

Canada Retail Sales (Jul)

The post Traders’ Diary: Brace for impact – ’cause here comes The Fed appeared first on Stockhead.