Iron Ore

‘The scale and quality of our targets are exceptional’: GCX is proving up Tier 1 targets down the road from BHP’s $1.7bn Nebo-Babel development

Special Report: GCX Metals has been on a tear since acquiring the advanced Dante nickel-copper-PGE project, just 15km from BHP’s … Read More

The post…

- GCX recently acquired Dante near BHP’s giant Nebo-Babel project

- Project hosts advanced nickel-copper-PGE targets for drilling

- GCX backed by Tribeca Partners and Apollo Group

- Drilling also planned at Onslow project

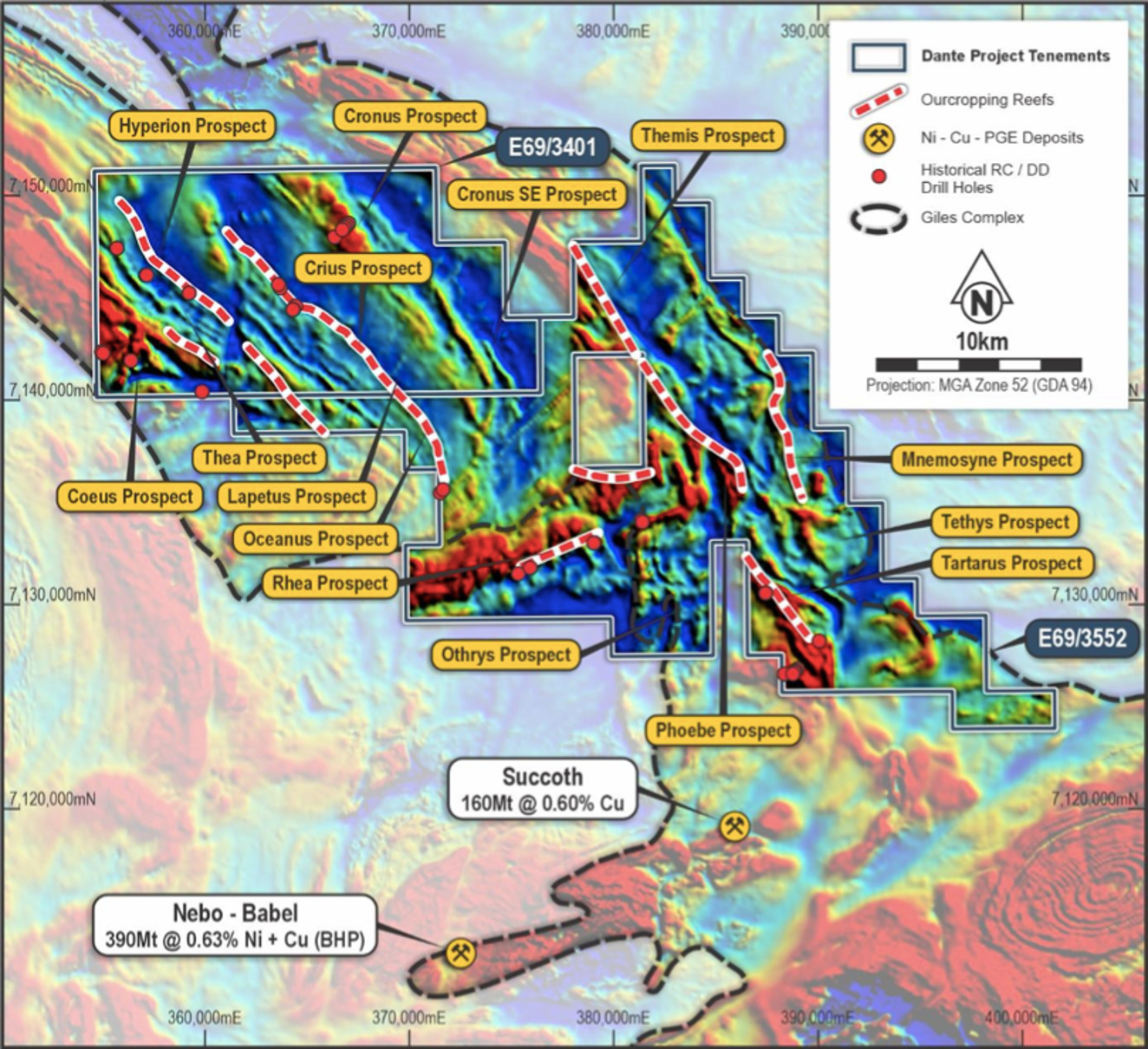

GCX Metals has been on a tear since acquiring the advanced Dante nickel-copper-PGE project, just 15km from BHP’s (ASX:BHP) massive $1.7bn 390Mt Nebo-Babel development in WA’s West Musgrave region.

In August, GCX inked a deal to acquire the Dante project in WA’s West Musgrave region – a major metallogenic province that hosts the Giles Complex, which has proven PGE reefs commonly compared to the 2.2-billion-ounce South African Bushveld Complex.

West Musgrave is also an emerging major mining hub with BHP’s $1.7bn 390Mt Nebo-Babel Ni-Cu-PGE mine development just 15km to the south.

Dante shares the same geological complex as Nebo-Babel, which is expected to deliver annual production of 28,000t of nickel and 35,000t of copper over a 24-year operating life.

Dante is not a greenfields play, either. GCX have already delineated big, advanced targets.

Those targets include ~23km of outcropping mineralised strike grading an average of 1.1g/t PGE3, 1.13% V2O5, and 23.2% TiO2, with grades up to 3.4g/t PGE3.

More recently the company uncovered the 7km-long Cronus prospect, where the strength and scale of the combined nickel, copper and platinum group element anomalism “is remarkable”.

There’s a lot more where that came from, the company says.

“We’re bringing this project to market in a company which has a very low market cap, but the scale and quality of our targets are exceptional for a company our size,” GCX Metals (ASX:GCX) MD Thomas Line says.

“We’ve got backing from major investment group Tribeca Partners who have around 20% of the company, we’ve also got the support of the Apollo Group and we also have institutional shareholders such as Australian Super Fund.

“It’s a unique scenario. We’ve got the kind of backing that normally only companies in production or going into production would have.

That means GCX has capital support through all stages of project development, from resource development toward production, Line says.

“There really aren’t any other juniors on the market right now with a project like ours,” he says.

“If you wanted to buy into a project like ours at the moment, you really only have Chalice (ASX:CHN) which is a $1.5 billion company, so it’s a rare opportunity starting from a very low base.”

Nearby Nebo-Babel project de-risks development

Line says the project will only benefit from the extensive infrastructure investment that the development of Nebo-Babel will bring into the region.

“The West Musgraves is a frontier mineral province that has one of the world’s largest mine development projects being undertaken by BHP, called Nebo-Babel.

“They’re about six months into a two-year build for the mine.

“BHP are flying 10 flights up there every single week, they’ve got about 300 people on site, and they’re bringing in a huge amount of infrastructure.”

That’s really de risking that area from an infrastructure and logistics perspective, Line says.

“Previously, people may have considered the area to be a little bit remote but now with this big mine being built, it’s really changed things out there,” he says.

“We’re in a great location, right next to Nebo-Babel, with the same geology and big, advanced targets in a proven, large mineral province with Tier 1 deposits.”

$20m worth of drill data a bonus

The Dante project comes with an extensive historical dataset including full coverage airborne electromagnetic and magnetic data, over 3,000 auger drillholes, reverse circulation and diamond drill holes, ground EM and gravity data.

The combination of this exploration data – estimated to be worth between $15m and $20m – means that GCX has advanced drilling targets that it can jump straight on to.

“One of the things that separates us from a lot of other explorers and junior companies bringing a project to the market is that the Dante project comes with millions of dollars worth of data,” Line said.

“So, before we’ve even been on the ground, we know exactly where we want to drill – we don’t need to go and spend two years collecting soil samples and doing heritage and Native Title.

“We’ve already got our Native Title agreement, we’ve already undertaken the initial heritage surveys on the ground, we’ve got access, and we’ve got a clear pathway to drilling.”

Drilling as soon as March 2024

The company plans to kick off drilling in March next year, with the program of works submitted and approval pending.

In the meantime, GCX is planning three diamond drill holes to test Iron Oxide Copper Gold (IOCG) targets at its Onslow project in the Pilbara.

“That drilling is co-funded for $220,000 by the West Australian Government,” Line said.

“We’ve got about $3.5m in the bank so we’ve got enough cash to do the all of the upcoming Dante project drilling and the Onslow drilling with our existing cash balance.”

###

This article was developed in collaboration with GCX Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

The post ‘The scale and quality of our targets are exceptional’: GCX is proving up Tier 1 targets down the road from BHP’s $1.7bn Nebo-Babel development appeared first on Stockhead.

3 Bargain Commodity Stocks to Ride the Wave of Global Energy Transition

The global focus on green energy does not mean that only renewable energy companies will benefit. There are several associated industries that are critical…

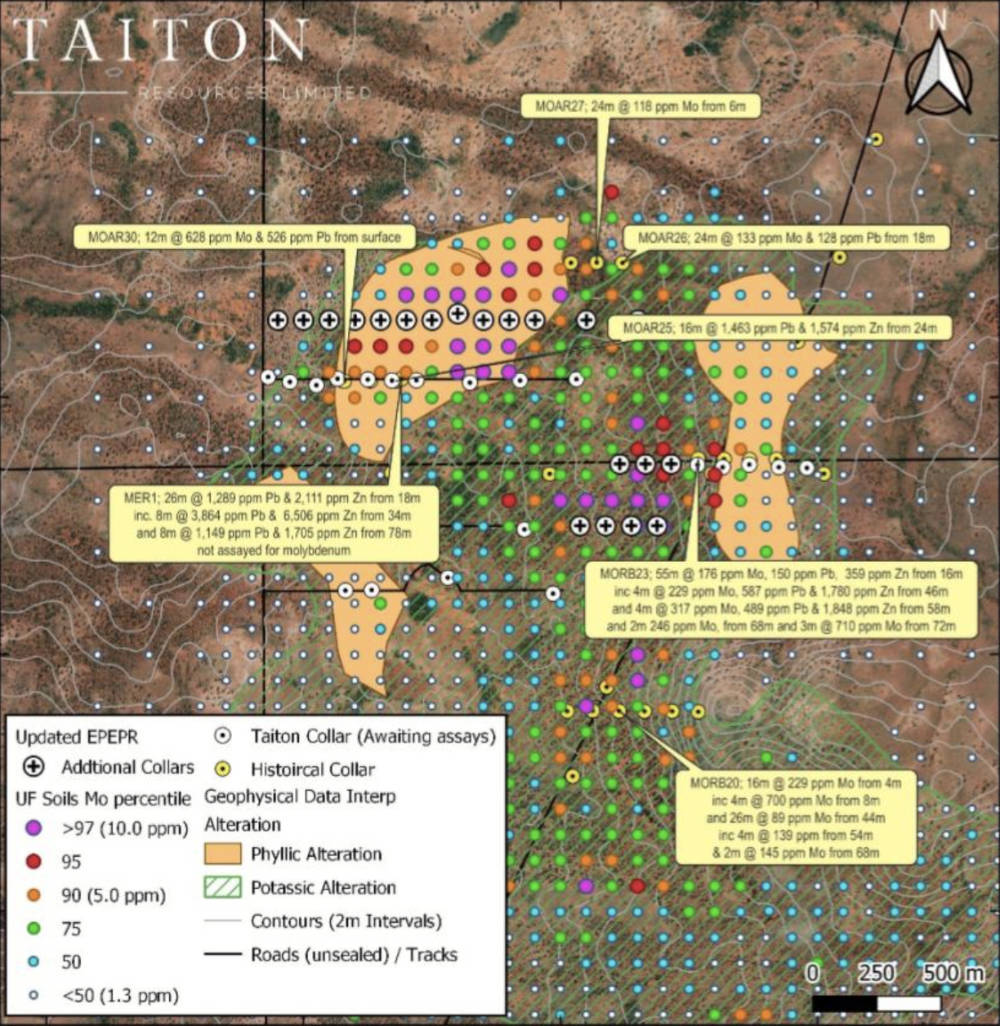

Taiton cleared to start second drill program over molybdenum anomaly at district scale Highway project, maiden assays ‘imminent’

Special Report: Taiton has the green light from South Australia’s Department of Mines and Energy to drill a significant molybdenum … Read More

The…

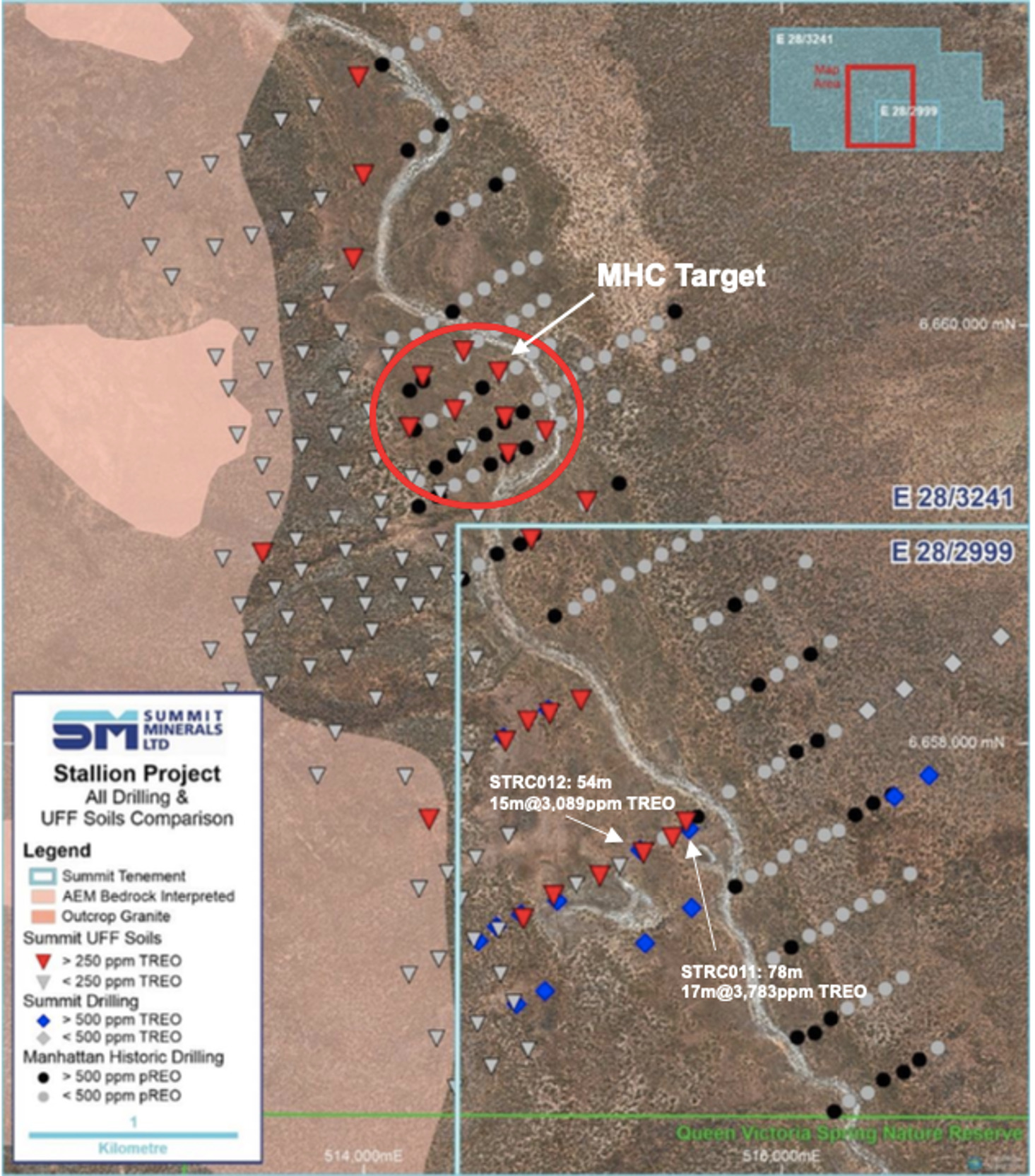

How big? Ultrafine soil sampling hints at the ‘size and scale’ of Summit’s Stallion rare earths project

Special Report: UltraFine+ soil analysis has confirmed more exploration upside to the north of Summit Minerals’ Stallion REE project in … Read More

The…