Uncategorized

The Boundaries of Fiscal and Monetary Policy

The members of the Philadelphia Convention1 had a few fundamental purposes they hoped to achieve with the Constitution they created. Some of their ideas…

The overarching purpose the framers had in mind was the establishment of limited and representative government for the recently united former colonies. All the elements of the new Constitution should be understood as instruments performing, in their totality, that function.

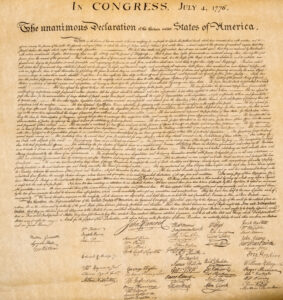

Popular sovereignty, the rule of law, political representation, federalism, checks and balances, the division of power between the legislative, executive and judiciary branches were all considered by the framers of the constitution to constitute the ideal form to function as the guarantor of those self-evident truths stated a few years earlier in the Declaration of Independence.

Two of the elements of the American constitutional order that I wish to discuss here, fiscal and monetary policies, are today among the least understood elements of that order. If it is true that at the time of the Founding, the boundaries between these two prerogatives of the state were well-defined, over the course of history the demarcation between them has been increasingly blurred. So much so that, nowadays, it is excusable that many policymakers, and even some academics no longer can distinguish where lies the border between those fields of state action.

Early in the Republic, the “power of the purse” held by Congress meant that no money could leave the coffers of the federal government without the explicit and periodic consent of the legislature. That soon became formalized in authorization and appropriation bills by which Congress would define the scope and size of actions that the executive branch was authorized to engage. This is an application of the principle of legality, that part of the rule of law that establishes that any private individual is only prevented from doing something if forbidden by law, while any public agent is only authorized to do something if determined by law. The determination of any action by the federal government was intended to be given in the annual appropriations process.

From this perspective, all “mandatory” and “back-door” spending are all infringements on popular sovereignty and violations of the rule of law. If a dollar leaves the coffers of the Treasury, whatever the justification, under the Constitutional order in which we supposedly live, it should be first authorized and then annually appropriated. The retirement of the federal debt, the payment of pensions to military veterans, the concession of loans, or subsidies to whatever sector of society all should be weighed by the sitting Congress. Such expenditures should further be considered in comparison with possible alternative uses of public funds before Congress authorizes the executive to spend a single penny of those funds.

Consider the way the Federal Reserve and the CFPB (Consumer Financial Protection Bureau) are funded. Their expenses are paid from the proceeds of the Fed’s operations; Congress does not appropriate them. If they were, many would argue, they would lose their independence to conduct monetary policy and to exercise oversight of relations between financial companies and their customers, respectively. Yet the judiciary branch is funded by annual appropriations. Is anyone prepared to argue that because of that, the judiciary is not independent in the United States?

Think about the operation of the FFB (Federal Financing Bank). They facilitate the ability of many federal agencies to borrow money in the market, and the Treasury, supported by the Fed, is compelled by law to fund its operations. From these funds, subsidized loans to agriculture, real estate development, exports, infrastructure, and a myriad of other programs are funded off-budget.

The list of ways in which Congress’ constitutional power of the purse is disregarded in both spirit and intent goes on and on. To be clear, Congress is left out of the loop concerning which programs are funded by the executive branch and its agencies directly. These policies are also executed without being subject to previous authorization and annual appropriations by Congressional representatives. Voters complain that they disagree with most of the actions of the Federal government. No wonder, if more than 85% of the money disbursed by our national government is not appropriated by our representatives.

Monetary policy today is also far removed from what was originally envisaged by Alexander Hamilton. The edifice of American finances was established on solid and eminently practical foundations. However, before we discuss what was originally established and what we have today, let us start by going back to an idealized model. Although ahistorical, this idealization is modeled on the same British arrangements that inspired Hamilton and the other Founding Fathers.

Under this model, money, as the ultimate form of payment, was created by the state through the coinage of precious metals. At the same time, commercial banks would expand and contract the supply of banknotes redeemable in money proper according to the existence of profitable opportunities for short-term lending against good collateral, what was known as Real Bills. Under this model, the fluctuations in the demand and supply for liquidity in the economy would be produced, in part, from “outside” the market, by the state coinage, and, in part, from “inside” the market, by bank lending.

Thanks to Hamilton, ever the practical man, taking into consideration the immense burden of the Revolutionary War debt, and following the example of the Bank of England, the new Constitution counted among the exclusive powers of the legislative branch, “To coin Money, regulate the Value thereof, and of foreign Coin.”

Later, with the establishment of the United States Mint and the authorization for the creation of the First Bank of the United States (the first of three attempts to create a central bank in the country), the foundations of our financial system were established. The national debt would be purchased by banks to invest their capital, and they would be authorized to issue banknotes redeemable on demand in coins issued by the Mint to supply credit to private enterprise.

Note that at the very beginning, there was already a close relation between the public debt, eminently an instrument of fiscal policy, and the arrangements by which money and other liquid instruments were supplied in the country, ostensibly the object only of monetary policy. However, the boundaries between them were still clearly defined. Banks would purchase Treasury bonds as long-term investments, funded by capital raised from their shareholders, while their credit operations were to be funded from their deposits on demand, with banknotes being issued against the discount of short-term commercial paper, that is, Real Bills.

This ahistorical, schematic presentation is a good proxy for what was the history of our fiscal and monetary policies all the way up to the Civil War. There were still periods in which the “central bank” was abolished. For example, there was a short period during the Andrew Jackson administration in which all public debt was retired, but, by and large, this was the picture.

Then came the Civil War. To fund the war effort, banks were required to buy Treasuries not only to constitute their capital, but also to have the ability to issue banknotes. In addition, the Treasury started to issue its own paper money, “greenbacks,” and last but not least, convertibility of bank deposits and notes in gold was suspended. Eventually convertibility was resumed and some of the war debt was paid. However, this created problems of its own under the banking arrangements put in place in 1862 which remained in place until the creation of the third “central bank” of the United States, the Federal Reserve (Fed), in 1913.

After the creation of the Federal Reserve, the fiscal requirements brought about by the Great War, the Great Depression, and World War II forced an immense coordination between fiscal and monetary policy—so much so, that the Fed only regained operational independence inside the government in 1951. Another contradictory period occurred when, due to the Vietnam War and the Great Society programs of the Johnson administration, the Fed continued to accommodate the fiscal needs of the Treasury while still somewhat constrained by the gold redemption clause of the Bretton Woods treaty.

The contradiction eventually became unsustainable, and the Nixon administration defaulted in the U.S. obligations under that treaty in 1971. With that, an inflationary period began. It lasted until some prudence was restored, if not to the fiscal policy, at least to the execution of monetary policy. Once sober monetary policy was implemented, the period known as the Great Moderation ensued.

Fiscal profligacy, which had been practically uninterrupted since the 1960s and was only accelerated by the Financial Crisis of 2008 and the Covid-19 Pandemic, brought us to the situation that we face nowadays.

There are some instruments, such as the public debt and the prerogatives to create money and regulate finances, which are tools of both monetary and fiscal policy. The goals of those policies are different, though. Monetary policy is concerned with price stability and a balance between the supply and demand for loanable funds, whereas fiscal policy is concerned with funding the government. For these different goals to be achieved at the same time using essentially the same tools, clear boundaries about what is permissible in each field are necessary.

Those boundaries continue to be blurred in recent decades. In this article, I have tried to describe the institutional setting in which this has been taking place, what the consequences are, and what might be done to preserve, restore, and strengthen the foundations of a society of free and responsible individuals as envisioned by the Founding Fathers. We began with a discussion of the constitutional disposition about the power of the purse that Congress has, which requires annual authorizations and appropriations for any money to be disbursed by the Federal government. From that point, we discussed some ways in which “back-door” expenditures happen.

We may well associate the gradual erosion of the Congressional power of the purse with a “democratic deficit”, that is, with a decrease in the accountability of political agents. That is, changes in the institutional setting have led to a change in the structure of incentives, and the checks and balances that used to maintain the boundaries between monetary and fiscal policy have been eroded. At the same time, that “old time fiscal religion” (the idea that deficits may rise in times of emergencies but are to be repaid after the emergency ceases) has been almost totally abandoned.

This suggests the idea of fiscal “dominance.” That is, as long as fiscal prudence is not restored, it is pointless to try to tweak the institutional constraints on the abuses of monetary instruments for fiscal purposes. On the contrary, the current trend is not to reverse an unsustainable path that will end in disaster, but to accelerate further the trend, with ESG (Environmental, Social, and Governance) mandates for the Fed on top of the existing ones of price stability and full employment.

To realize how far we are from the original constitutional arrangements of the United States, you just need to realize that, theoretically, the Fed is “a creature of Congress.” That is not to say that, like the FCC or the FDA, it is an agency created via a law passed by Congress. No, that is to say that the Fed is technically part of the legislative branch of power, the one with the exclusive coinage power as defined by Art I, Section 8, Clause 5, mentioned above.

Mind you, the Fed does not acknowledge this. They present themselves as independent from both the Executive and the Legislative branches.2 The last time I checked, there are just three branches of power in the constitutional structure of the United States. If an agency claims to be independent from both the executive and legislative branches, while also being clear that it is not part of the judiciary, then it is claiming to be a fourth branch of power. This is something that is clearly unconstitutional, not to mention that pesky thing about the “exclusive power of coinage” given to Congress by the Constitution.

Of course, the way the Fed funds its operational expenses or the compatibility of its institutional design with the putative constitutional order of this country say nothing, at first glance, about the blurring of the lines between fiscal and monetary policy. Let us think about that. Some say that Congress is not to be trusted with responsible monetary policy, so, it is a good thing that the Fed is insulated from Congress’ direct oversight. That is a logical mistake. In the same way that Chief Justice Roberts once said, “the way to stop discrimination on the basis of race is to stop discriminating on the basis of race,” the way to have a responsible Congress is to give responsibility to Congress for their decisions. The meaning of Congress’ power of the purse is not only that it is a prerogative; it is also a duty, as brilliantly explained by Professor Katie Stith.3

For more on these topics, see

- “The Declaration of Independence: A Study on the History of Political Ideas,”, by Carl Becker. Harcourt, Brace, and Co., 1922.

- Alexander Hamilton. Online Library of Liberty.

- Fiscal Policy, by David N. Weil. Concise Encyclopedia of Economics.

- Monetary Policy, by James Tobin. Concise Encyclopedia of Economics.

- Money Supply, by Anna J. Schwartz. Concise Encyclopedia of Economics.

- New Keynesian Economics, by Gregory N. Mankiw. Concise Encyclopedia of Economics.

- Benn Steil on the Battle of Bretton Woods. EconTalk.

The fact that we have drifted so far away from the constitutional constraints established by the Founding Fathers in the all-important questions related to taxation, public expenditure, finances, and money, says volumes about the powerful political forces against such checks on the government and does not bode well for the future.

However, contrary to what may be inferred from what I have just said, there is a solution to avoid the tragedy of the US government losing its “full credit.” It is after all one of the most important weapons in the “arsenal of the Republic.” To not to alienate Congress further from the decision process, but to return the power to Congress, and with that, the responsibility of the purse.

Footnotes

[1] To learn more about the Philadelphia Convention, see Max Farrand’s edited volume, The Records of the Federal Convention of 1787. Available online at https://oll.libertyfund.org/title/farrand-the-records-of-the-federal-convention-of-1787-3vols.

[2] See “About the Federal Reserve System” online at https://www.federalreserve.gov/aboutthefed/structure-federal-reserve-system.htm

[3] Katie Stith, “Congress’ Power of the Purse,” The Yale Law Journal. Volume 97 (1988).