Uncategorized

‘That’s the tonnage they want to see’: +300Mt copper equivalent resource could put Southern Hemisphere on the radar of major players

Special Report: Drilling at Southern Hemisphere’s Llahuin project is to substantially increase the existing resource towards a 25 year-mine life, … Read…

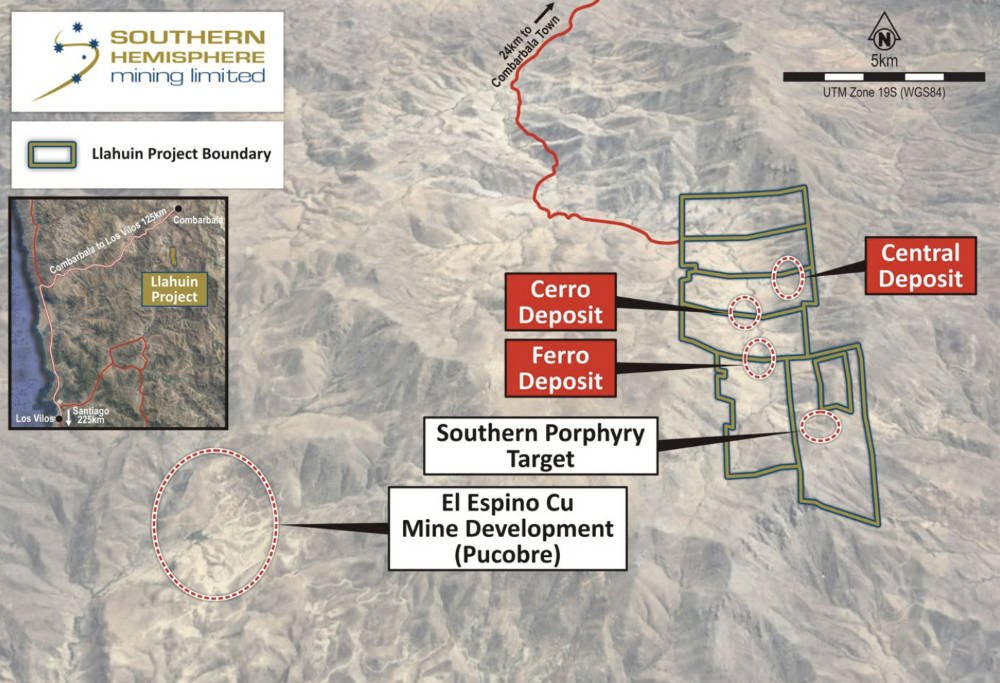

- Flagship Llahuin project has a substantial copper resource in Chile close to existing mine development

- Resource expansion drilling poised to start in October,

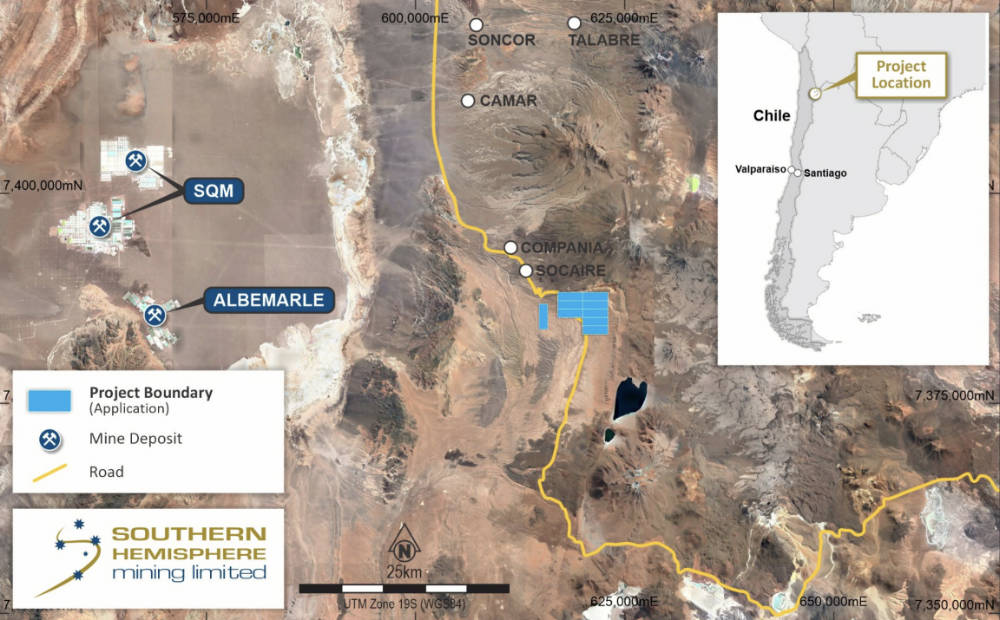

- Lago lithium brine project is located close to SQM and Albermarle lithium operations

Looking to spin-off the Los Pumas manganese project into Titan Battery Minerals Technology Pty Ltd

Drilling at Southern Hemisphere’s Llahuin project is to substantially increase the existing resource towards a 25 year-mine life, piquing the interest of copper hungry majors.

Copper’s prominence has risen in modern times – due in no small part to being the key component in electrical wiring of all types, leading to the red metal being referred to as “Dr Copper” for its (mostly accurate) ability to predict market trends.

Its star is expected to shine brighter as the pace of electrification accelerates.

Whilst prices remain subject to market whims, with weak demand from China impacting on pricing, there is plenty of evidence that the repeat growth in demand is outstripping the mining industry’s ability to keep up.

On some demand outlooks, we’d need the equivalent of an extra Escondida — ~1Mtpa, the world’s largest copper operation — each year until 2030. Impossible.

“If we’re talking about copper, we’re going to be looking in my opinion at prices that are significantly higher than where they are now,” says MineLife founder and resources analyst Gavin Wendt.

Further highlighting this likely supply crunch, the US Department of Energy recently added copper to its list of critical materials, which evaluates materials for their criticality to global clean energy technology supply chains.

Suffice to say, companies that own a copper resource are likely to enjoy a positive relationship with their balance sheets in future that isn’t terribly far off, particularly when said resource is located within what’s essentially America’s backyard.

Getting on the radar of major players

One company with such a resource is Southern Hemisphere Mining (ASX:SUH) whose flagship Llahuin copper project in Chile – the world’s largest copper producer – currently boasts an open-pittable resource of 169Mt at 0.4% copper equivalent.

Southern Hemisphere’s Llahuin has a resource of 686,000t copper equivalent (comprising 470,000t of copper and 717,000oz of gold) at 0.28% copper equivalent cut-off grade.

The project is also located just 5km from access to grid power, 200km to Coquimbo Port and about 20km from a sealed airstrip.

Whilst this is a superb combination of factors to have in a resource project, the company has plans to make it even more attractive.

The company has just completed a rights issue to raise $2.36m to support drilling at the Llahuin project that will seek to increase the resource to a 25 year mine-life.

Processing options and value indicator

Llahuin is also located just 8km southwest from the El Espino Copper-Gold mine development that is operated by Santiago-listed Pucobre.

But it is Pucobre farming out a 23.6% interest in El Espino for US$93m that is especially intriguing as it values the mine development at about US$387.5m.

With El Espino having a resource of 145Mt at 0.7% copper equivalent, or a contained resource of just over a million tonnes, a back of the envelope calculation essentially values Llahuin at a very attractive price.

Not bad at all for a company with a current market capitalisation of $10m, which also means it is highly leveraged to any resource growth.

Looking into lithium brines

Llahuin may be a worthy flagship project for Southern Hemisphere, but it certainly isn’t the only fish in its pond.

It recently pegged the 27km2 Lago lithium brine project that is located near operations run by SQM and Albermarle in the lithium-rich Atacama region in northern Chile.

With early-stage brine exploration being low-cost and quick to advance, Southern Hemisphere has already started work aimed at ascertaining the potential scale of this play.

In particular, it will target brine that is amendable to both direct lithium extraction and conventional solar evaporation (ponds).

The company also holds the Los Pumas manganese project in northern Chile which it is planning to spin-off into a new incorporated company, Titan Battery Minerals Technology.

Los Pumas currently has a resource of 30.26Mt grading 6.24% manganese and 5.74% aluminium and has plenty of upside potential as the manganese feeder zones within the orebody have seen little or no prior exploration.

This presents the new company, which will be focused on battery minerals and technology, with a flagship project capable of supplying high-quality manganese for conversion into high-purity manganese sulphate monohydrate to supply the electric vehicle and battery energy storage markets.

Southern Hemisphere will retain exposure to the Los Pumas project by remaining a major shareholder in Titan BMT.

The road ahead

Southern Hemisphere expects to start the initial 2,500m diamond drilling program at Llahuin in October.

This article was developed in collaboration with Southern Hemisphere, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

The post ‘That’s the tonnage they want to see’: +300Mt copper equivalent resource could put Southern Hemisphere on the radar of major players appeared first on Stockhead.