Uncategorized

Tech-Heavy: US recession or Wall St soft-landing? This could be the week that bares all

The S&P 500 closed enthusiastically higher on Friday in a stupendous week of winning for the 3 x major US … Read More

The post Tech-Heavy: US recession…

The S&P 500 closed enthusiastically higher on Friday in a stupendous week of winning for the 3 x major US equity benchmarks.

Formerly timid traders, torn from their protective shells after a torrid run on rates, came burning back onto the buyers floor – in force – after US inflation data for October showed some signs that rising cost pressures could be easing.

The Dow Jones Industrial Average smashed out a 0.01% Friday, but snark aside, posted a heroic 4.2% weekly jump.

The S&P 500 index found 1% Friday for a nigh 6% weekly take home. The ever explosive tech-heavy Nasdaq Composite Index booked at 1.9% gain Friday and fairly laudable 8.4% weekly award, its first Best Week Since Mid-March trophy since mid-March.

The rally on Wall Street followed the celebratory October annual rate of inflation (CPI) read of 7.7%, down like Shane Warne’s trousers from a US summer high of 9.1%.

You can fix a match that the Asia-Pacific equity ‘hood followed Wall Street’s delerium across the board.

Slightly softer CPI read? Tick: India’s Sensex rose 2%. The Nikkei jumped 3%, South Korea’s KOSPI and Taiwan’s TAIEX closed 3.4% and 3.7% the better.

The unhinged, happy global lead helped boost the Australian share market by 3.9% , gains led by utilities (which also got a bump from M&A activity), materials, health and property stocks.

The lower US inflation data also pushed bond yields down sharply. While oil prices fell, metal, gold and iron ore prices benefitted from the risk on tone which also saw the $US fall. As a result, the $A rose to around $US0.67, and may it rise like a Skywalker ’till Christmas, I say.

Across China, the Shanghai Composite lifted 1.7%, and the Hang Seng kept fighting, closing almost 7.8% on COVID-reopening whispers.

Honkers found 13% Friday-to-Friday, making it flat for the last 30 days of trade, and while still short 12% on the last half, it’s making up ground quickly.

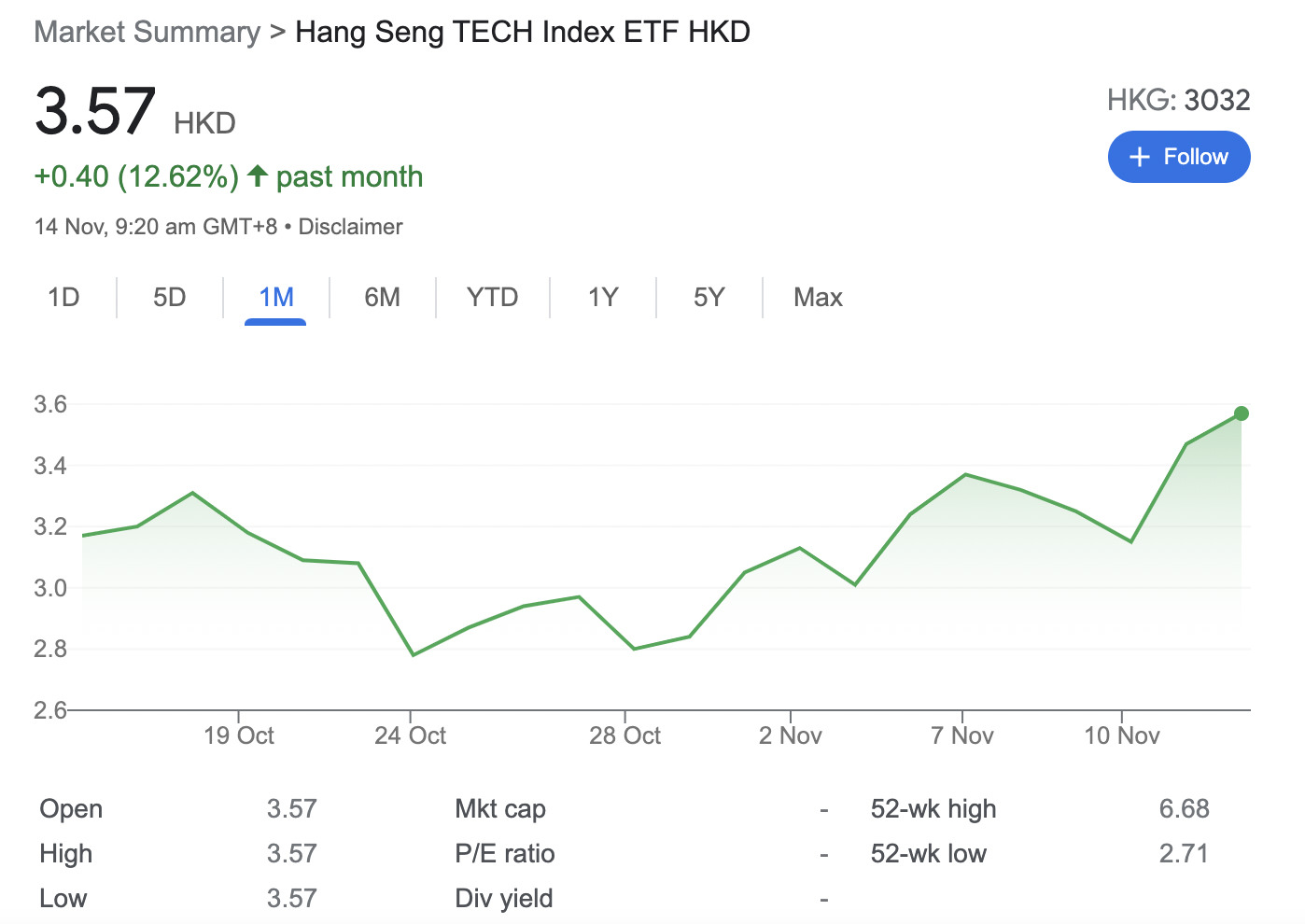

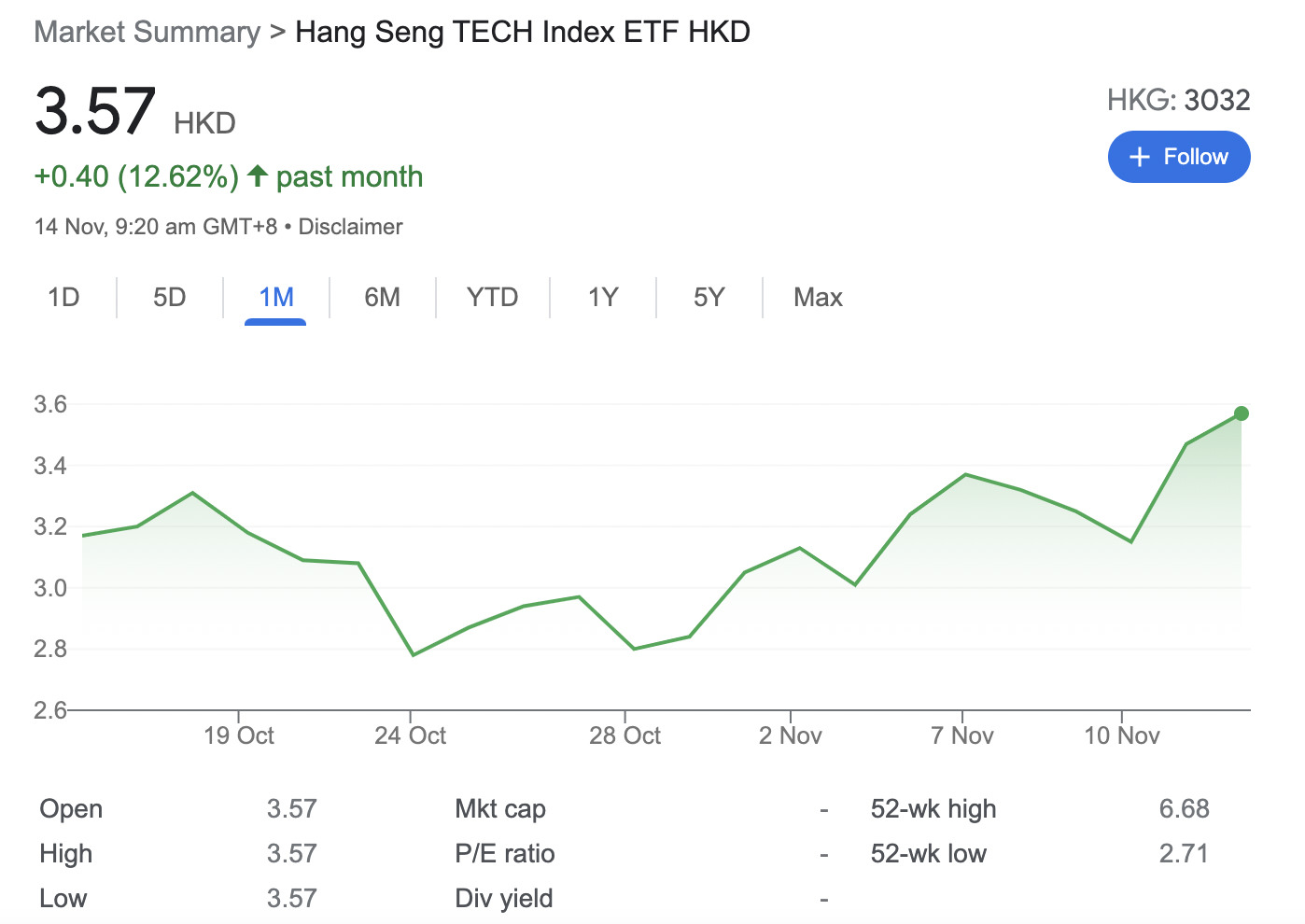

And there’s life yet, apparently, in the tech that time forgot (Chinese, that is):

Wild thing, you make my chart sing

This week in global markets has been one of the maddest of a year rich in insanity.

Most of the punters were rightly distracted by the loopy drama between two of the most prominent crypto firms, FTX and Binance, to start the week.

That rapidly evolved into a crypto currency crisis that threatens to cause losses for investors big and small, with FTX filing for bankruptcy on Friday in a stunning fall for the second giant of the entire crypto market.

Even equity investors were bunny-headlight-frozen by the sight of Sam Bankman-Fried, (known as SBF) and his crypto-toy FTX bleeding out from fatal wounds of sheer hubris, leading to a the midweek market sell-off so eloquently described in the charts above.

FTX on Friday filed for bankruptcy. And Bankman-Fried, kicking back in the Bahamas resigned as CEO, as good a place as any for the transfixed world to watch the 30-year-old entrepreneur’s net worth (clocked at about $26 bn a few months ago) and chained to his various guises of digital assets, evaporate over a few hours of real-time cautionary telling.

Regardless, by Thursday sexy data on inflation sent stocks rocketing higher. That enthusiasm continued in early trade, Friday.

US Mid-Terms

Exciting results for fans of democracy. However, the US is still looking like bringing home a plagued and divided government in both its Houses.

Implications for markets would be manifold:

- Getting the mid-terms out of the way and legislative gridlock in Congress (which prevents extreme economic policies) have historically been good for US shares

- Historically Wall St lifts well in the 12 months after mid-terms for the last 70 years

- Also expect higher than average returns in the year 3 of presidential cycle

- Divided government will see a return to battles over Gov’t funding (Dems are already manouvering to avoid a shutdown) and raise debt ceiling (to avoid default, yes we’re back there)

- Legislation through Congress likely more difficult

- President Biden is likely to adopt a more hawkish foreign policy stance keeping geopolitical risk high.

- Even more hawkish US stance toward China could impact us here via increased sanctions and increased risk of conflict over Taiwan

Elon Watch

The very latest out of Planet Elon is that thousands of contract jobs have been slashed at Twitter as Elon continues to do what no-one knows.

According to CNBC, 4400 out of 5500 Twitter contractors have been laid off without a heads up, and that includes Twitter’s internal comms team which probably explains the lack of comms.

CNBC says the sacked workers only discovered they’d been let go after losing access to Slack and other work platforms over the weekend.

Elon, you’ll recall, sacked around half of Twitter’s workforce soon after claiming his trophy social media plaything on October 28, after possibly overpaying for the thing to the tune of $US44 billion.

This all follows hot on the heels of the un-launch of Elon/Twitter’s re-launch of a premium service, which grants blue-check “verification” labels to anyone willing to pay $US8.

The concept was a dead duck on Friday after Elon was flooded and twitter almost drowned in a tsunami of imposter accounts which Twitter itself had approved.

Nevertheless…

Twitter feels increasingly alive

— Elon Musk (@elonmusk) November 13, 2022

Indeed. pic.twitter.com/7UHJHIMyzQ

— Larry Lart (@larryolart) November 13, 2022

The week ahead

US inflation is still too high so the Fed will remain hawkish and wary for a while yet, says Shane Oliver at AMP Capital, but October’s lower than expected inflation outcome and increasing signs that the cyclical peak is in the rearview mirror is consistent with a downshift to a 0.5% hike at the Fed meeting next month.

“Money market expectations for a peak in the Fed Funds rate near 5% next year may be a bit too hawkish,” he added.

A boatload of US companies are now between a rock and a hard place with the week ahead full to overflowing with investor updates due to drop on how the remaining FY 2022 outlook, looks.

Now that there’s a sniff of sanity about inflation, it looks good. And that might read badly for a few of these announcements. Investors might forget reality – crazy, I know – and start imagining the instant return to unhooked consumer spending and fast-moving economic recovery.

Calendar & US Q3 reports, continued

Monday:

FTX and SBF continue to roil humanity after the crypto firm filed for Chapter 11 on Friday and the net worth of either acronym was estimated at zero (from many billions USD moments earlier).

Former US Treasury Secretary Larry Summers reckoned it’s another ‘Enron’ and current Treasury Secretary Janet Yellen says we might need some cryptocurrency regulation.

Earnings due for Oatly Group, Tyson Foods

Tuesday:

Walmart – where shares are down a teeny-tiny 1.5% this year vs the S&P’s 16%- reports earnings on Tuesday and the nation will be watching the nation’s biggest retailer for clues on inflation and insights on Christmas

Energizer, Home Depot, Krispy Kreme and Tencent Music Ent will also report ahead of the US open.

Wednesday:

Lowe’s, NVIDIA, Target and TJX will report earnings ahead of the US open.

Thursday:

Pre-market includes Alibaba, BJ’s Wholesale Club, Helmerich & Payne, Kohl’s, Macy’s and NetEase.

Friday:

Earnings before markets open: Foot Locker, which is considered a poor cousin but close barometer for Nike itself a weather vane for retail, as well as JD.com.

The post Tech-Heavy: US recession or Wall St soft-landing? This could be the week that bares all appeared first on Stockhead.