Uncategorized

Stocks, Bonds, Gold, & Crypto Slide As US Sovereign Risk Roars To Record High

Stocks, Bonds, Gold, & Crypto Slide As US Sovereign Risk Roars To Record High

A glimpse at the short-end of the yield curve shines a bright…

Stocks, Bonds, Gold, & Crypto Slide As US Sovereign Risk Roars To Record High

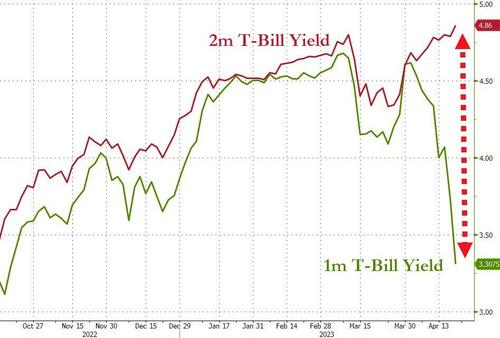

A glimpse at the short-end of the yield curve shines a bright light on market stress around the debt-ceiling X-Date being dragged closer. Bills that mature within a month are dramatically bid, while Bills that mature after a potential sooner-than-expected X-Date are bidless…

Source: Bloomberg

The yield curve itself shows that huge kink more clearly…

Source: Bloomberg

And that is reflected in the surge to record highs for short-dated USA sovereign protection costs…

Source: Bloomberg

But while USA risk is rising, US equity risk has been falling all week (to its lowest close since Nov ’21)…

Source: Bloomberg

However, as VIX tumbled to cycle lows this week, VVIX is notably decoupling from it across today’s OpEx…

Source: Bloomberg

Stocks suffered their worst week since March 10th (SVB collapse) with Nasdaq the biggest loser and Small Caps actually managing small gains…

Despite squeezes everyday this week, ‘Most Shorted’ stocks ended lower…

Source: Bloomberg

Energy stocks were the weakest this week while Staples and Real Estate outperformed…

Source: Bloomberg

As Defensives outperformed Cyclicals…

Source: Bloomberg

FSOC voted to tighten up regulation on the financial system (including non-banks) but while regional banks were up on the week, marginally, they are well off the week’s highs…

…and remain just drooling along at the post-SVB lows in context…

Source: Bloomberg

Treasury yields ended the week higher (with the short-end underperforming) after today’s post-PMI spike changed the week…

Source: Bloomberg

Fed Chair Powell’s favorite yield-curve-based recession-signal (18m fwd 3m to spot 3m yield spread) hit its most inverted ever this week….

Source: Bloomberg

Rate-hike expectations continue to rise for next week (now 92% odds of a 25bps hike) but we also saw the entire STIRs curve shioft hawkishly (with June now at 25% odds of a 25bps hike) and the terminal rate back above 5.00%…

Source: Bloomberg

The dollar saw its first weekly gain since 3/10 (but remains only marginally off the February lows). NOTE that during the week though every impulse higher in the dollar was sold into…

Source: Bloomberg

Cryptos had an ugly week…

Source: Bloomberg

With Bitcoin surging back above $30,000 and then running out of steam fast, tumbling back to support at $28,000…

Source: Bloomberg

Spot Gold closed back below $2000 this week, having tried and failed to rally back above it a few times…

Source: Bloomberg

NatGas and Crude were lower on the week, along with copper, as growth fears were resurrected modestly. Silver ended the week unchanged…

Source: Bloomberg

And we note that WTI has erased most of the post-OPEC+ production-cut spike gains…

Source: Bloomberg

Finally, with one week left in the month of April, data back to 1985 shows that May is historically quite good for risk…

As Goldman notes, SPX is positive 76% of the time during the month of May with a median return of 122bps, and NDX is positive 66% of the time during the month of May with a median return of 325bps.

But only one thing matters…

So BTFD next week after Gamma unclenches as 42% of the market cap of the S&P 500 reports earnings?

Tyler Durden

Fri, 04/21/2023 – 16:00

nasdaq

gold