Uncategorized

S&P 500 Downswing, Following Monday

S&P 500 was slated to swing higher, but couldn‘t reach even 4,480s only as rotations into cyclicals didn‘t kick in … Read more

S&P 500 was slated to swing higher, but couldn‘t reach even 4,480s only as rotations into cyclicals didn‘t kick in really. With the 10y yield sitting on the mid 4.20s% fence (not confirmed it would be done going up) and oil rising, it‘s understandable that risk-on sectors are lagging as it becomes a question of not if but rather when, the Fed raises again. I still think it would happen in Nov, but the equally important question at odds with market expectations, is that no rate cuts are coming any time soon.

As I wrote in Thursday‘s analysis:

(…) Likewise the fact that still solid consumer spending is the result of both almost fully depleted excess savings and the current savings rate dip to merely 3.5%. Add in stubborn inflation expectations, the gap between core and headline inflation to be resolved by again rising headline CPI, and still relatively solid job market, all of which goes to highlight more tightening needs, and rising rates reflect that. 10y yield has still a way to go (in time) before declining – and if not earlier, then the Sep FOMC with no hike, would do the job of bringing yields down.

Besides, housing is getting concerning, and JOLTS sign of the times (let‘s remember not only dismal current but also) last month‘s data had been revised down by 417,000 and that‘s the largest revision ever.

At the same time, the real economy isn‘t slowing down sharply, recession won‘t arrive before December, and the difference in momentary economic performance to Europe and China (saw those troubling (saw also the data about international trade contracting sharply, looking both at German and China export-import data?), is significant. Coupled with shrinking global liquidity and dollar shortage helping USD up, that‘s conducive no the inflation fight. Make no mistake though, down the road when it becomes necessary, the Fed opts for financial (banking) system stability and Treasury financing needs in our fiscal dominace era (much of the tightening is being negated by expansive fiscal policy).

I‘ve developed these thoughts further in the well received Saturday video, check it out. Also as I have stated in Saturday‘s 8-part Twitter thread, the job market is still tight even if job openings came much down, the wage pressures remain, and the realization of sticky inflation and headline to turn up to meet the core, is underpinning bond yields too. As the stock market correction is far from finished, it remains to be seen how much of a safe haven bid this would result in for Treasuries and gold.

Last but not least, explaining today‘s title with “Following Monday” part, meaning after today at least – I‘ve called a few times in the day for Monday‘s upswing in stocks, to the benefit of Intraday Signals subscribers.

Keep enjoying the lively Twitter feed via keeping my tab open at all times (notifications on aren’t enough) – combine with subscribing to my Youtube channel, and of course Telegram that always delivers my extra intraday calls (head off to Twitter to talk to me there), but getting the key daily analytics right into your mailbox is the bedrock.

So, make sure you‘re signed up for the free newsletter and make use of both Twitter and Telegram – benefit and find out why I’m the most blocked market analyst and trader on Twitter.

Let‘s move right into the charts (all courtesy of www.stockcharts.com) – today‘s full scale article contains 4 of them.

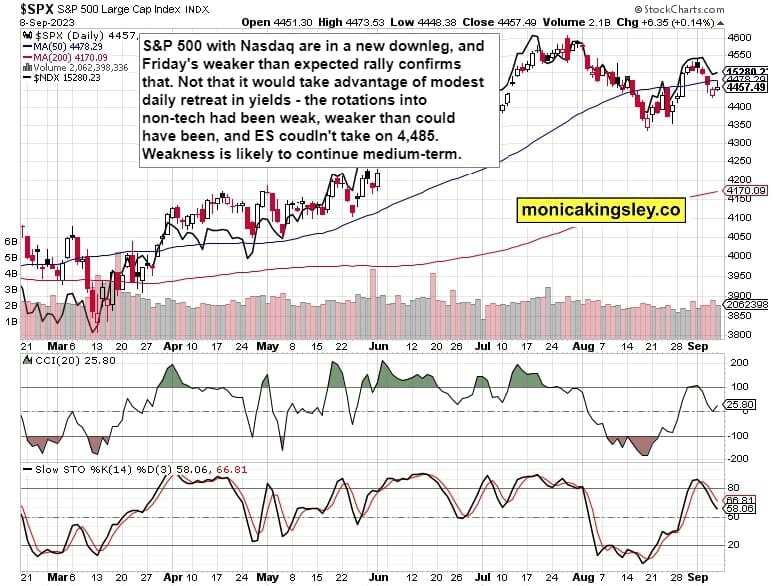

S&P 500 and Nasdaq Outlook

4,462 support is practically where stocks closed Friday, and I favor clearly bearish resolution latest by Wednesday‘s CPI, where 3.7% YoY would be a nice present for the bears. With disinflation in trouble, that means more tightening and difficulty expanding P/E multiples. 4,345 represents only the first target in the downswing, but first comes 4,432 and especially 4,415.

Today though, stocks are going to go up, probably above 4,485 decidedly.

To illustrate, Nvidia (NASDAQ:NVDA) is clearly in distribution phase, and Apple (NASDAQ:AAPL) is similarly hit by the China ban. While I would think about 4,225 as the autumn correction target, which is a safer, more reasonable expectation to make than to think about 3,800 or similar. First though 4,345.

Thank you for having read today‘s free analysis, which is a small part of my site‘s daily premium Monica’s Trading Signals covering all the markets you’re used to (stocks, bonds, gold, silver, miners, oil, copper, cryptos), and of the daily premium Monica’s Stock Signals presenting stocks and bonds only. Both publications feature real-time trade calls and intraday updates.

While at my site, you can subscribe to the free Monica‘s Insider Club for instant publishing notifications and other content useful for making your own trade moves.

Turn notifications on, and have my Twitter profile (tweets only) opened in a fresh tab so as not to miss a thing – such as extra intraday opportunities. Thanks for all your support that makes this great ride possible!

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Copper Trading Signals

Bitcoin Trading Signals

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice.

Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind.

Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make.

Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

nasdaq gold copper