Uncategorized

Small Cap Recap and IPO Wrap: An ASX affair to remember

Market sentiment is high following data release showing that US CPI and PPI are at their lowest levels in at … Read More

The post Small Cap Recap and…

The benchmark Aussie index closed 0.8% higher on Friday, the ASX 200 delivering its best week of work in more than nine months.

The ASX 200 index was up by almost 4%.

Market sentiment is high following data release showing that US CPI and PPI are at their lowest levels in at least 12 months.

Goldman Sachs reckons the data are “consistent with our view that Fed tightening is in its final innings”.

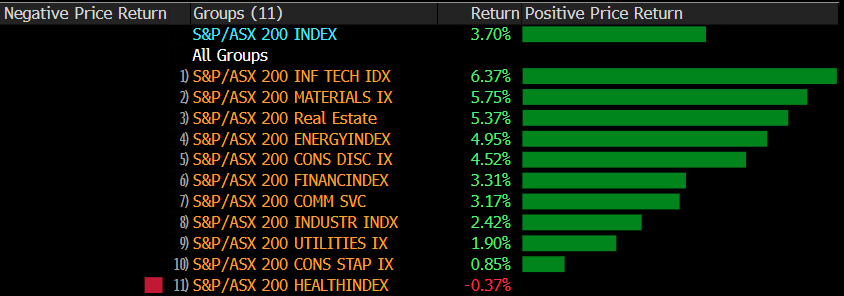

On the ASX, all sectors rose except for Healthcare, which was weighed down by a 1% drop in sector heavyweight CSL (ASX:CSL).

These last five days have been a refresher course on what happens when the greenback falls out of favour and homespun bond yields sink. In this case, they helped push the ASX to a three-week high.

The S&P ASX Emerging Companies index (XEC) – a benchmark for Australia’s micro-cap companies – was also up Friday, closing 1.3.% higher.

Overnight, the Dow was up 0.1%, the S&P 500 rallied by 0.85%, while the tech-heavy Nasdaq surged 1.9% in typical techy-style.

At home, the Tech stocks, Miners and Resource names led the rally.

ASX Sectors Weekly Performance

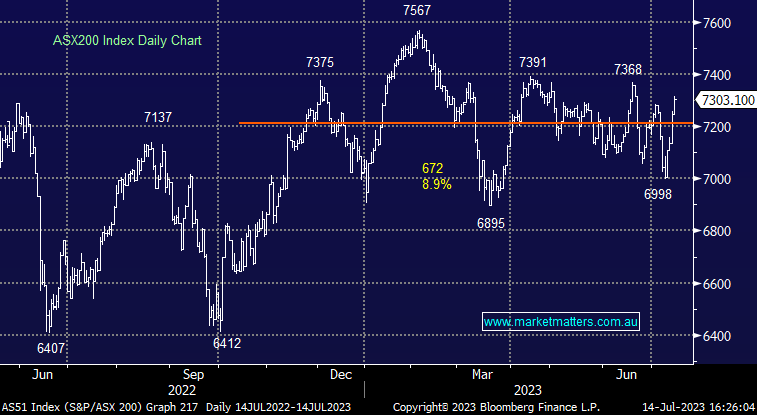

As for the ASX benchmark, that bad boy crossed back into enemy territory, planting a flag in the rarefied territory above 7300, for the very first time since giving ground away more than a year ago.

ASX200: Going Big

Aussie 2-year bond yields fell back below 4% Friday in Sydney for the first time in more than a month, a sure sign of the fiendish hunt for risk happening over in equities land.

The risk-on attitude followed Wall St leads where once again the confidence first played out in a run on major US tech names.

The Nasdaq had a lovely time of it while on the other broader US indices it was still tech which delivered sectoral performances of the week.

The ASX200 added 3.7%/260pts this week, its best result since November.

Around the ground, Leo Lithium (ASX: LLL) gave away -1.25%, despite signing a contractor to knock-up their big money mine in Mali; Neuren Pharmaceuticals (ASX:NEU) jumped +16.75% after renewing their licence with Acadia for a global (Rhett’s syndrome) treatment – where sales are forecast to more than double between now and Q3.

Finally, Netwealth (ASX:NWL) down -5.5% gave back all of Thursday’s gains, with two broker downgrades coming through Macquarie citing lower cash balances on FUA and some underwhelming outflows.

There’s been some love for iron ore late this week too. The bedrock of Aussie business rose 2% across Asia again Friday.

The three local majors followed suit – BHP Group (ASX:BHP), Fortescue (ASX:FMG) and RIO (ASX:RIO) – all 1.5%-2.5% higher. Pleasantly the brokers at JPMorgan have been forced to eat their ill-chosen outlooks for several key Aussie diggers – upgrading BHP, Sandfire (ASX:SFR) and FMG.

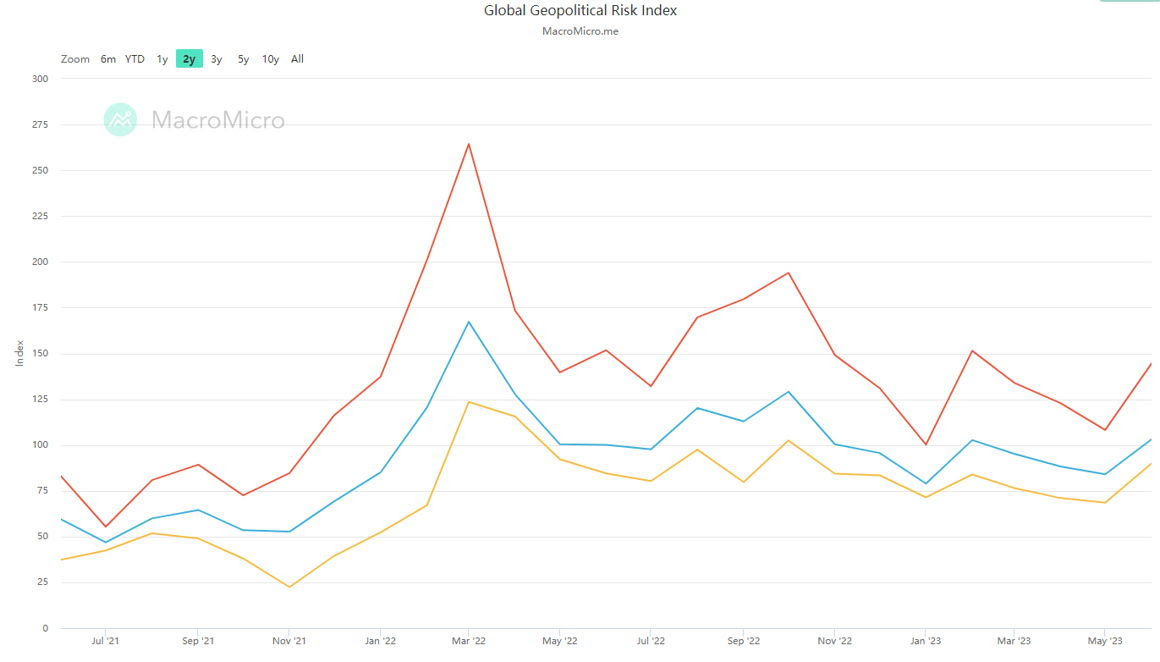

Golden days: Spot surges on geo risk

Spot gold found +3% over the last 10 days and looks comfy around US$1960/oz.

OANDA analyst Kelvin Wong plants this on increased geopolitical risk factors with more anxious punters heading back to the safe haven, where gold prices tend to life as risk does.

The Russian invasion of Ukraine on 24 February 2022, saw gold briefly spike into the mid-US$2000’s per ounce.

Wong says the latest reading of the Geopolitical Risk Index (GPR) for the month of June 2023 (the blue line) has started to tick up above the 100 level to 103.10, its highest level in eight months:

The GPR measures the social mood of impactful geopolitical events, threats, and conflicts since 1985 by counting the keywords used in the press.

The other factor, of course, is much tamer CPI figures out of the US, which suggest a pivot to rate cuts is not far off. This is good for gold, as is the associated fall in the US dollar.

Softness in the the USD has supported commodity markets where Materials and Energy were clear beneficiaries and the decent run for Healthcare names came to an end, where constituents tend to have a reasonable exposure to the US, according to James Gerrish at Market Matters.

ASX producers lead, juniors follow

Resources veteran Mr Barry Fitzgerald told Reuben this week gold equities have responded accordingly.

“Leading producers stacked on gains of 3-8% on Thursday to outperform the broader market, finally.”

Leading lights this week include Evolution Mining (ASX:EVN) (+14%), De Grey (ASX:DEG) (+11%), Bellevue Gold (ASX:BGL) (+13%), Capricorn Metals (ASX:CMM) (+12%), and Regis Resources (ASX:RRL) (+18%).

How did this week’s IPOs perform?

I don’t know. I don’t think anyone did.

But, elsewhere, according to our mates at Bloomberg, our mates in China took over the IPO front over the first half of this year.

The world’s second most bad-mannered global economy accounted for almost half of global fundraising, with China’s latest loosening of market regulations opening the floodgates for state-related firms to get public and flog some new shares.

The Chinese Communist Party has shown a willingness to reopen the flow of cash with recent capital market reforms which fast-track public floats.

IPOs across Shanghai, Shenzhen and Beijing exchanges in the six months to June, came to reap around US$31 billion from a global total of US$67.9 billion.

Mainland China’s three stock exchanges handled 172 IPOs in the first six months of the year, compared with 166 in the same period last year, according to Bloomberg data.

By sector, industrials led with 75 billion yuan (US$10.5 billion) of funds raised, followed by tech which raised 51.8 (US$7.6bn) billion yuan as China ramped up its tech self-reliance campaign all the while as US export sanctions closed their fingers around the economy.

ASX SMALL CAP WINNERS:

Here are the best performing ASX small cap stocks

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| 1CG | One Click Group Ltd | 0.016 | 100% | $5,526,638 |

| AXP | AXP Energy Ltd | 0.002 | 100% | $11,649,361 |

| CCE | Carnegie Clean Energy | 0.002 | 100% | $15,642,574 |

| NOU | Noumi Limited | 0.135 | 78% | $27,710,932 |

| MOB | Mobilicom Ltd | 0.014 | 75% | $17,246,797 |

| RRR | Revolver Resources | 0.2 | 74% | $20,042,839 |

| HVY | Heavy Minerals | 0.185 | 68% | $6,752,419 |

| AOA | Ausmon Resorces | 0.005 | 67% | $4,846,447 |

| FRB | Firebird Metals | 0.15 | 63% | $10,961,250 |

| COB | Cobalt Blue Ltd | 0.465 | 60% | $144,322,437 |

| CHK | Cohiba Min Ltd | 0.004 | 60% | $8,452,977 |

| AAP | Australian Agri Ltd | 0.019 | 58% | $5,186,691 |

| TMB | Tambourah Metals | 0.225 | 55% | $7,608,457 |

| SNG | Siren Gold | 0.125 | 52% | $16,940,684 |

| SWP | Swoop Holdings Ltd | 0.335 | 52% | $65,234,191 |

| A8G | Australasian Metals | 0.19 | 52% | $9,642,291 |

| BP8 | Bph Global Ltd | 0.003 | 50% | $4,004,189 |

| RBR | RBR Group Ltd | 0.003 | 50% | $4,855,214 |

| VPR | Volt Power Group | 0.0015 | 50% | $10,716,208 |

| DTC | Damstra Holdings | 0.135 | 48% | $28,346,603 |

| EOS | Electro Optic Systems | 1.09 | 47% | $187,503,427 |

| MKL | Mighty Kingdom Ltd | 0.022 | 47% | $7,829,270 |

| OPL | Opyl Limited | 0.053 | 43% | $4,365,753 |

| GED | Golden Deeps | 0.01 | 43% | $11,552,267 |

| WCN | White Cliff Min Ltd | 0.01 | 43% | $12,729,404 |

| WYX | Western Yilgarn NL | 0.17 | 42% | $8,441,776 |

| TSI | Top Shelf | 0.2475 | 41% | $46,932,207 |

| NNG | Nexion Group | 0.021 | 40% | $3,641,541 |

| SIS | Simble Solutions | 0.007 | 40% | $4,220,655 |

| 3DA | Amaero International | 0.14 | 40% | $45,852,973 |

| WWI | West Wits Mining Ltd | 0.018 | 38% | $42,617,327 |

| TRE | Toubani Resources | 0.205 | 37% | $11,511,904 |

| ICG | Inca Minerals Ltd | 0.03 | 36% | $14,065,289 |

| ABE | Australian Bond Exchange | 0.21 | 35% | $8,138,152 |

| AR9 | Archtis Limited | 0.135 | 35% | $35,697,541 |

| MVP | Medical Developments | 1.485 | 35% | $104,860,788 |

| SOV | Sovereign Cloud Hldg | 0.094 | 34% | $28,849,057 |

| AL8 | Alderan Resource Ltd | 0.008 | 33% | $4,316,863 |

| CTN | Catalina Resources | 0.004 | 33% | $4,953,948 |

| FAU | First Au Ltd | 0.004 | 33% | $4,355,980 |

| YPB | YPB Group Ltd | 0.004 | 33% | $2,230,384 |

| IVX | Invion Ltd | 0.008 | 33% | $44,951,425 |

| MDI | Middle Island Res | 0.025 | 32% | $2,570,783 |

| MRI | My Rewards International | 0.021 | 31% | $6,630,781 |

| NYR | Nyrada Inc. | 0.038 | 31% | $5,148,287 |

| WMG | Western Mines | 0.615 | 31% | $28,234,078 |

| IMI | Infinitymining | 0.17 | 31% | $13,001,314 |

| ASQ | Australian Silica | 0.061 | 30% | $17,181,283 |

| BGT | Bio-Gene Technology | 0.105 | 30% | $17,294,736 |

| MGU | Magnum Mining & Exploration | 0.035 | 30% | $24,452,930 |

ASX SMALL CAP LOSERS:

Here are the worst performing ASX small cap stocks

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| ZEU | Zeus Resources Ltd | 0.019 | -47% | $9,145,620 |

| RGS | Regeneus Ltd | 0.01 | -41% | $2,757,932 |

| MCL | Mighty Craft Ltd | 0.052 | -36% | $17,493,240 |

| AT1 | Atomo Diagnostics | 0.036 | -33% | $21,693,858 |

| SRY | Story-I Limited | 0.004 | -33% | $1,882,024 |

| TD1 | Tali Digital Limited | 0.001 | -33% | $3,295,156 |

| SRJ | SRJ Technologies | 0.061 | -32% | $6,424,279 |

| ODE | Odessa Minerals Ltd | 0.009 | -31% | $9,471,118 |

| NKL | Nickelx | 0.061 | -28% | $5,791,164 |

| DRA | DRA Global Limited | 1.41 | -26% | $77,050,815 |

| AUZ | Australian Mines Ltd | 0.029 | -26% | $19,614,671 |

| CMD | Cassius Mining Ltd | 0.032 | -26% | $17,385,487 |

| LDX | Lumos Diagnostics | 0.064 | -26% | $21,818,885 |

| IRX | Inhalerx Limited | 0.035 | -26% | $6,641,843 |

| ADD | Adavale Resource Ltd | 0.021 | -25% | $10,988,472 |

| BEX | Bikeexchange Ltd | 0.006 | -25% | $7,846,884 |

| CLE | Cyclone Metals | 0.0015 | -25% | $20,529,010 |

| CUS | Copper Search | 0.21 | -25% | $11,878,851 |

| DMG | Dragon Mountain Gold | 0.009 | -25% | $2,762,702 |

| DXN | DXN Limited | 0.0015 | -25% | $3,442,630 |

| GRE | Greentechmetals | 0.42 | -25% | $22,638,222 |

| HAS | Hastings Tech Met | 1.28 | -24% | $171,937,947 |

| NC6 | Nanollose Limited | 0.057 | -23% | $8,188,750 |

| BOA | Boadicea Resources | 0.041 | -21% | $5,539,064 |

| DCL | Domacom Limited | 0.03 | -21% | $13,065,053 |

| G88 | Golden Mile Res Ltd | 0.045 | -21% | $15,810,696 |

| TNY | Tinybeans Group Ltd | 0.15 | -21% | $11,634,905 |

| DTM | Dart Mining NL | 0.034 | -21% | $6,374,627 |

| KZA | Kazia Therapeutics | 0.135 | -21% | $35,344,513 |

| AQXDB | Alice Queen Ltd | 0.016 | -20% | $2,150,744 |

| IAM | Income Asset | 0.1 | -20% | $28,002,082 |

| KNM | Kneomedia Limited | 0.004 | -20% | $5,266,749 |

| LSR | Lodestar Minerals | 0.004 | -20% | $9,216,987 |

| MRD | Mount Ridley Mines | 0.002 | -20% | $19,462,207 |

| MTB | Mount Burgess Mining | 0.004 | -20% | $3,091,099 |

| MXC | MGC Pharmaceuticals | 0.004 | -20% | $16,753,465 |

| NSM | Northstaw | 0.08 | -20% | $10,571,176 |

| WFL | Wellfully Limited | 0.004 | -20% | $2,464,721 |

| BDM | Burgundy D Mines Ltd | 0.24 | -20% | $346,929,772 |

| OCN | Oceana Lithium | 0.31 | -19% | $13,057,363 |

| NXD | Nexted Group Limited | 1.185 | -19% | $257,903,941 |

| PGL | Prospa Group | 0.275 | -19% | $49,012,667 |

| AIS | Aeris Resources Ltd | 0.4 | -18% | $269,468,782 |

| ONE | Oneview Healthcare | 0.205 | -18% | $96,024,091 |

| DVL | Dorsavi Ltd | 0.014 | -18% | $7,793,263 |

| G50 | Gold50 | 0.19 | -17% | $9,965,025 |

| REZ | Resources & Energy Group | 0.019 | -17% | $9,996,116 |

| AHI | Advanced Health | 0.22 | -17% | $45,717,833 |

| 1AD | Adalta Limited | 0.025 | -17% | $13,245,789 |

| 1ST | 1St Group Ltd | 0.005 | -17% | $8,501,947 |

The post Small Cap Recap and IPO Wrap: An ASX affair to remember appeared first on Stockhead.