Uncategorized

Scoping Study has Matsa Resources eyeing a quick restart for the Devon project

Special Report: Matsa Resources’ Devon JV project is now on the fast-track towards a definitive feasibility study following the excellent … Read More

The…

Matsa Resources’ Devon JV project is now on the fast-track towards a definitive feasibility study following the excellent results delivered in an updated scoping study.

The Devon joint venture is a 50/50 split profit share arrangement between Matsa Resources (ASX:MAT) and Linden Gold Alliance, with Linden being appointed the joint venture manager.

Under the terms of the Devon JV, MAT is free carried on a non-recourse basis for all costs associated with permitting, financing, development and mining of the Devon Pit with Linden required to meet certain milestones.

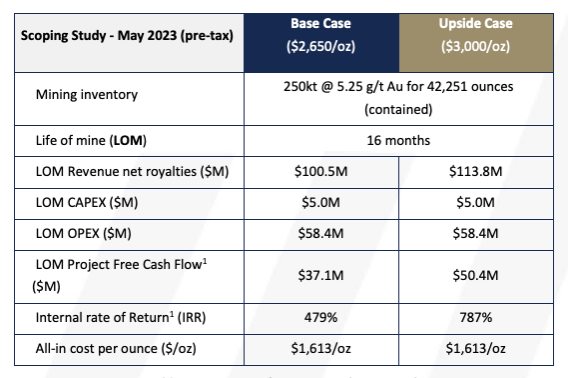

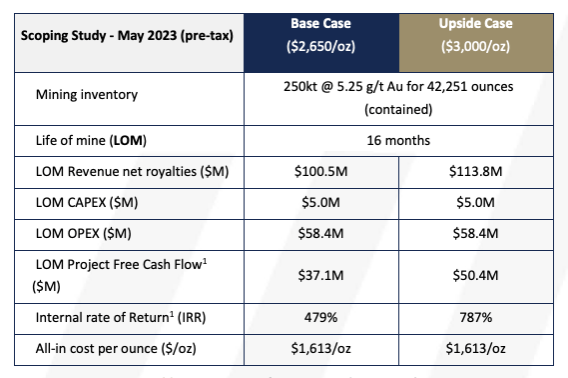

The scoping study, conducted by Linden, builds on Matsa’s findings in April 2021 and establishes key items for further work in the upcoming DFS.

At an all-in cost of A$1,613/oz, MAT says the scoping study indicates potential profit margins per ounce of +A$1,380/oz (based on current spot prices).

It also demonstrates a strong financial outcome with potential to mine the Devon Pit over a 16-month mine life and generating cash flows up to $50.4m with a pre-tax project IRR of +470%.

Strong margins and excellent grades

MAT executive chairman Paul Poli says it is encouraging that the updated scoping study illustrates the delivery of strong margins and improves on the April 2021 study.

“Encouragingly, the grades reported in the updated study of +5g/t compare favourably with the excellent historical grades reported by GME Resources in 2015 and 2016.

“Matsa now looks forward to the Devon JV progressing the DFS, due for completion by August 31, 2023.”

The Devon gold project has non-binding MoUs in place with St Barbara (ASX:SBM) and Odell Resources to process and haul Devon ore, respectively.

SBM’s Gwalia processing facility is currently where Linden processes its ore from the Second Fortune underground operation.

This article was developed in collaboration with Matsa Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

The post Scoping Study has Matsa Resources eyeing a quick restart for the Devon project appeared first on Stockhead.