Uncategorized

Resources Top 5: BAT lifts again, as RTG goes for Kyrgyz Republic gold

Battery Minerals is going for gold, with two new star investors aligned. RTG is also shining, on good Central Asian … Read More

The post Resources Top…

- Battery Minerals is going for gold, with two new star investors aligned

- RTG is also shining, on the back of Central Asian gold and copper results

- Meanwhile LRS and PFE up on lithium, KP2 pushes up on potash

Here are some of the biggest resources winners in early trade, Thursday December 14.

Battery Minerals (ASX:BAT)

Battery Minerals, which appears to be more predominantly on the hunt for gold right now than actual battery minerals, has received a sweet cut-out pass from a hard-running Yesterday, and has taken the ball further up the middle with gusto this morning.

What do we mean by that? It’s increased its gains today with another +40% burst.

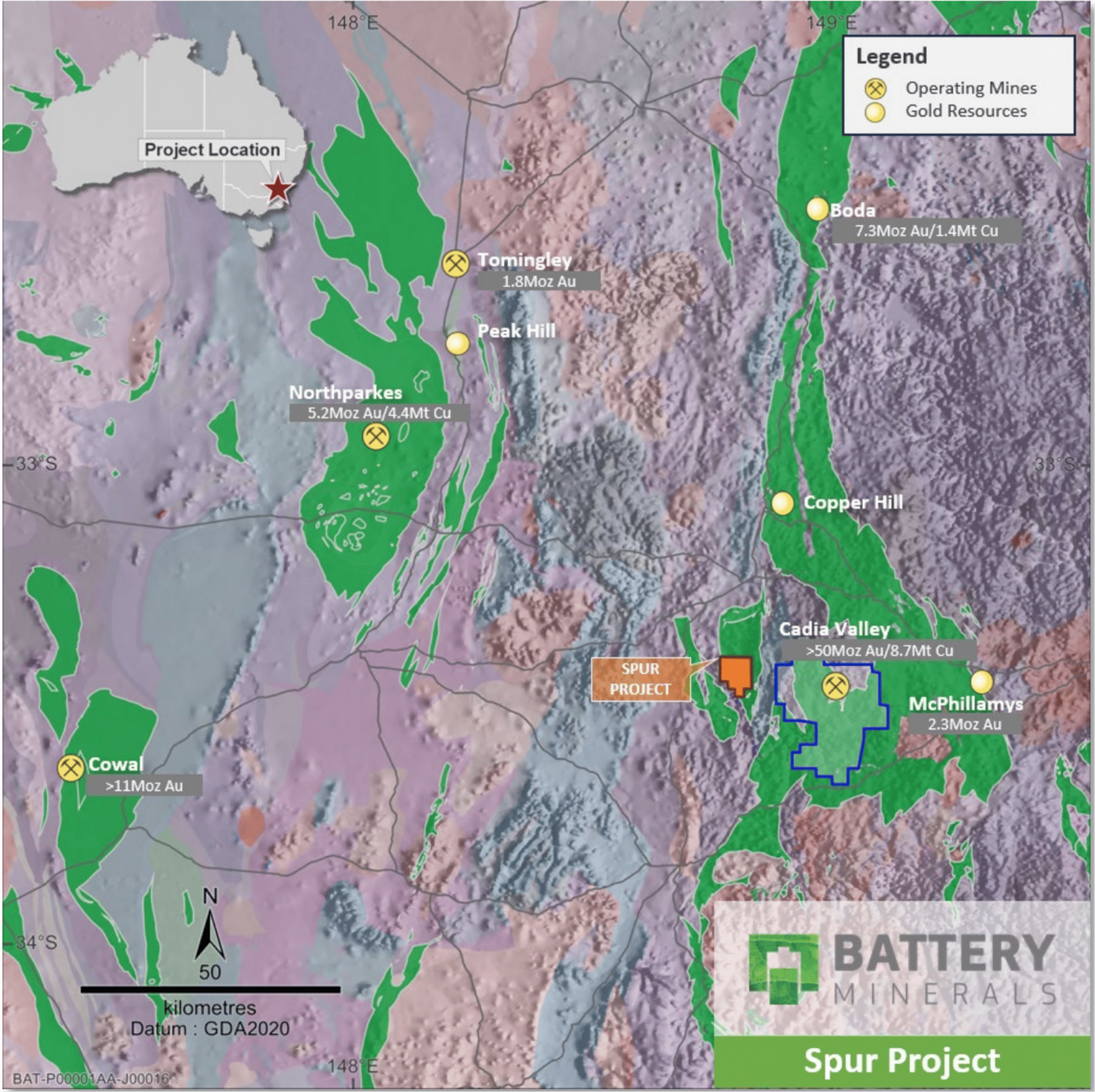

The company, soon to be renamed Waratah Minerals (ASX:WM1), recently picked up the Spur gold project near Cadia in the Lachlan Fold Belt of NSW.

What happened yesterday, and indeed earlier in the week, for the small gold-copper minerals explorer, then? This:

Notice of substantial holders in ASX announcements and a completion of a a private $560,000 placement at a premium for:

• Tim Goyder – 7.29%, Lotaka Pty Ltd

• Stuart Tonkin – 9.9%, Gladstone Mining.

Goyder needs no introduction. Tonkin is the MD of $14.1bn capped gold producer Northern Star Resources (ASX:NST). His companies Liontown Resources (ASX:LTR) and Chalice Mining (ASX:CHN) have become two of the largest explorers on the ASX over the past three years.

Our very own deep-digging Reuben Adams has more here, writing:

Their [Goyder’s and Tonkin’s] interest probably lies in BAT’s recently acquired Spur project in NSW’s East Lachlan Fold belt, home to some of Australia biggest gold and copper operations.

Just 14km from Spur is Newcrest Mining’s 32.1Moz gold, 7.2Mt copper Cadia Valley operations. But this isn’t just a nearology play.

Tied up in private hands for the last decade or so, Spur comes with a cluster of thick historic drill hits, like 86m @ 1.56g/t gold from 85m.

Historical explorers were mostly in it for the copper and this drilling doesn’t go very deep, despite old IP geophysics defining a strong southerly plunging anomaly beneath existing mineralisation.

Promising signs. An initial 2000m drill campaign to test this target at depth is due to kick off in January.

BAT share price

RTG Mining (ASX:RTG)

Thanks to the old boys and girls over at the US Federal Reserve, it’s shaping as a beaut day on the bourse for all sectors, with ressie stocks right up there.

RTG mining is no exception, knocking up a very tidy 29% gain at the time of writing.

This small-ish mining and exploration company, which is also listed on the Toronto Stock Exchange, has gold and copper things going on in the Philippines and in Central Asia.

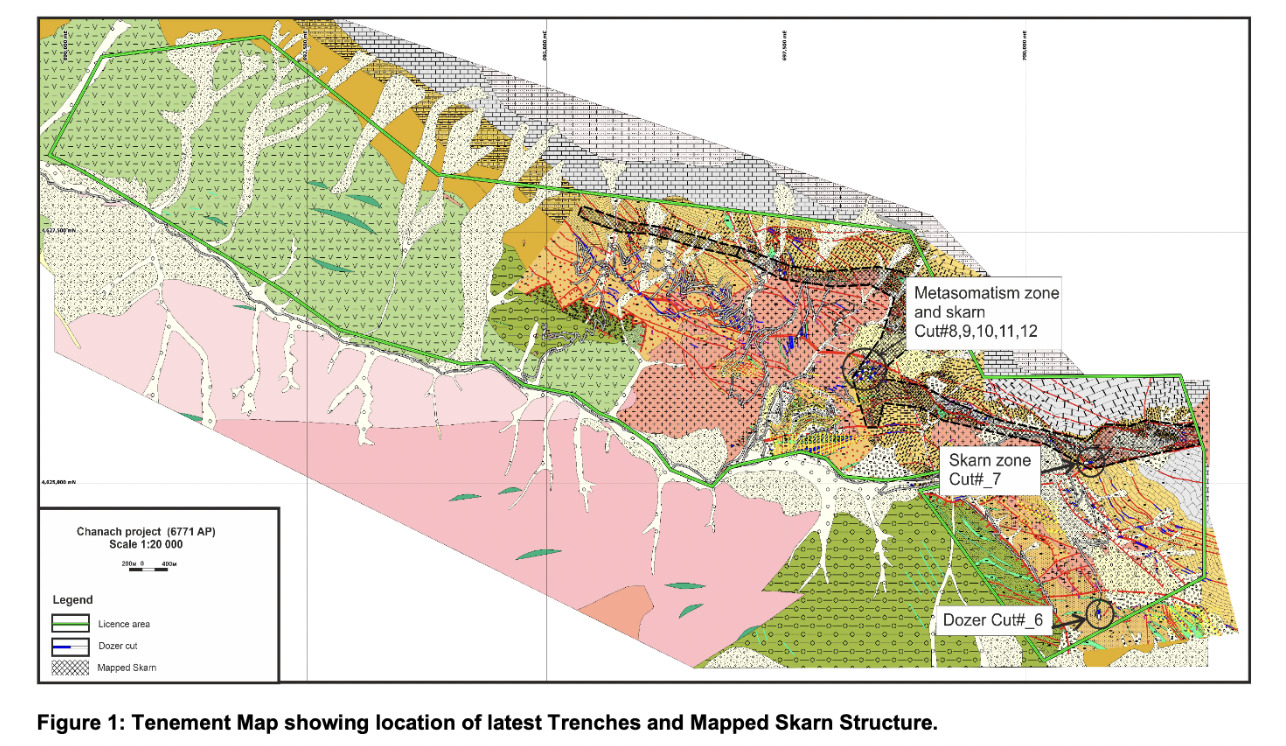

Today, it’s announced some news of the high-grade gold and copper variety regarding its Chanach project in the Kyrgyz Republic.

“Is very nyyyice.” (Yes, that’s the wrong country.)

Some fresh assay results are in at the gold-copper project, and, says RTG, they confirm multiple styles of mineralisation and further encouraging gold and copper grades along 6.5km of skarns and new structures.

High-grade trench sampling assays include: 17m at 5.13g/t Au and 0.78% Cu; 3m at 2.52g/t Au and 10.48% Cu; 11m at 1.29g/t Au (including 1m @ 3.13g/t Au and 1.03% Cu); and 3m at 4.15% Cu.

Not too shabby, and the company is of the belief that Chanach has the potential to host both a high-grade, large copper–gold porphyry skarn system, combined with a high-grade epithermal gold system.

RTG’s CEO Justine Magee said:

“These results continue to build our confidence that Chanach may be a similar opportunity to the Mabilo Project [RTG’s Philippines operation]…

“The results from the magnetic surveys have correlated well with our high grade trench sampling results providing a much stronger understanding of the significant scale and potential of the Chanach Project.

“The plan is to follow up with a 3DIP survey and a drilling program in the next field season.”

RTG share price

Latin Resources (ASX:LRS)

This prominent lithium hunter has updated its Mineral Resource Estimate (MRE) for its flagship Salinas lithium project in Brazil.

It’s talking a supersized JORC MRE of 70.3Mt at 1.27% Li2O.

And that’s a substantial increase of about 56% in its global resource, with a 41% increase in the Colina deposit, while a maiden resource was also announced for Fog’s Block.

#ASXNews$LRS.AX is pleased to release its updated presentation for December 2023, following the recent substantial increase of the Salinas #Lithium Project MRE.

View the presentation here: https://t.co/iGErhDKSP4#LRS #LatinResources #ASX pic.twitter.com/sFz4lSKHBm

— Latin Resources Limited (@LatinRes) December 13, 2023

Have a watch/listen of/to our latest edition of Long Shortz, hosted by Sarah Hughan, in which she chats with Latin Resources’ Chris Gale on, among other things, what comes next at Salinas and why Brazil is the place to be to develop a lithium resource.

LRS share price

Pantera Minerals (ASX:PFE)

This small minerals explorer is still riding high on its big news from a few days ago.

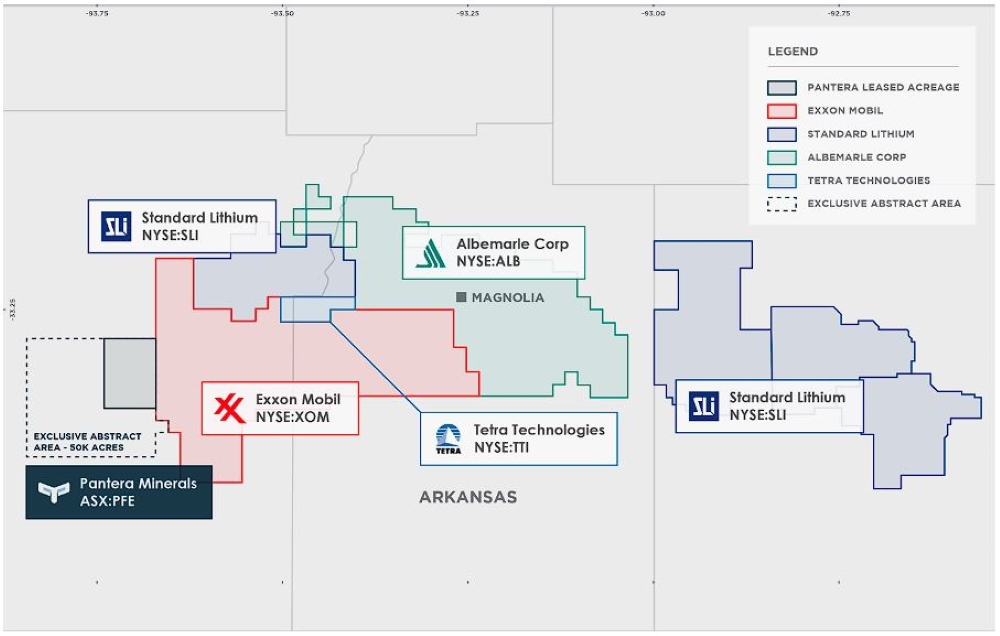

The company has moved to purchase 100% of its US lithium-focused partner Daytona Lithium and raise $2m to support land acquisitions in the Smackover formation, an emerging lithium brine precinct in Arkansas.

Per a recent Stockhead report:

Pantera is progressing its Superbird flagship lithium brine project at Smackover, where resources majors are descending to develop projects for the clean energy transition.

Superbird directly abuts ExxonMobil’s (NYSE:XON) 120,000 lithium brine project and is along trend from other big players Standard Lithium (NYSE:SLI), Tetra Technologies (NYSE:TTI) and Albemarle Corporation (NYSE:ALB).

And not only that, but brine expert Tim Goldsmith has come onboard as a strategic advisor, too. He’s the ex-CEO of Rincon Mining, which was sold to Rio Tinto for US$825m, so probably knows a thing or two about extracting a spot of lithium from salty water.

Read more > here.

PFE share price

Kore Potash (ASX:KP2)

(Up on no news)

Fertiliser-tastic potash. It just keeps working its way into the top gainers (see Reward Minerals (ASX:RWD) lately, and Highfield Resources (ASX:HFR). Good on it.

And well done Kore Potash today, with a more than handy 27% gain at time of wondering what pic to use for this article.

Fresh-as-daisies news? Nah, not at all. But the UK-based company’s share price is up 55% over the past week and 40% over the past month. YTD, it’s travelling at +16%.

KP2 is developing a big potash project called Kola, in the Republic of Congo. Last we clocked in, financing, offtake and construction talks were underway.

And in late October, the company raised US$2.5 million via placement to existing large shareholders, in order to advance work that Kore says is “expected to lead to delivery of an Engineering, Procurement and Construction (“EPC”) contract for Kola.

KP2 share price

At Stockhead we tell it like it is. While LRS and PFE are Stockhead advertisers at the time of writing, they did not sponsor this article.

The post Resources Top 5: BAT lifts again, as RTG goes for Kyrgyz Republic gold appeared first on Stockhead.