Uncategorized

Resources Top 5: Australian Silica Quartz hunts 10Mt motherlode; Aldoro delves in thick for nickel

Australian Silica Quartz is hunting a big payload in North Queensland, while Aldoro Resources is digging up thick, high-grade NSW … Read More

The post…

- Australian Silica quartz has begun a drilling program at its Quartz Hill project in North QLD.

- Aldoro Resources makes a thick, high-grade nickel discovery at its Narndee project in WA.

- Australian Pacific Coal nails $50m worth of funding for its Dartbrook coal mine in the Hunter Valley, NSW.

Here are the biggest small cap resources winners in early trade, Thursday August 17.

AUSTRALIAN SILICA QUARTZ (ASX:ASQ)

Australian Silica Quartz Group has begun a 2,000m reverse circulation (RC) drilling program at its Quartz Hill project, near Mount Surprise in North Queensland.

It’s a hunt for “Metallurgical Grade Silicon (MGSi) Quartz Lump feedstock” and it’ll be the first subsurface exploration at the project, marking the start of ongoing work under a new Project Development Heads of Agreement with Private Energy Partners (PEP).

ASQ notes it has received $1 million from PEP in return for the “exclusive right to buy 10 million tonnes of MGSi quartz from the mine gate at Quartz Hill at a 10% discount to the prevailing MGSi Quartz market price or such price that would constitute a fair market return to ASQ (whichever is the greater)”.

Funding will be used for an exploration drilling programme at Quartz Hill with an aim to establish a JORC 2012 MGSi quartz mineral resource of at least 10Mt and a scoping study and application for a mining lease within a period of one year from the agreement’s signing.

ASQ share price

ALDORO RESOURCES (ASX:ARN)

We wrote pretty much these exact words a little earlier in our early-market roundup Top 10 at 10. But they still apply, and we’ll go a fraction deeper.

Gold and nickel hunter Aldoro has made a thick, high-grade nickel find at its Narndee project, east of Paynes Find in Western Australia, and investors are very much digging it so far today.

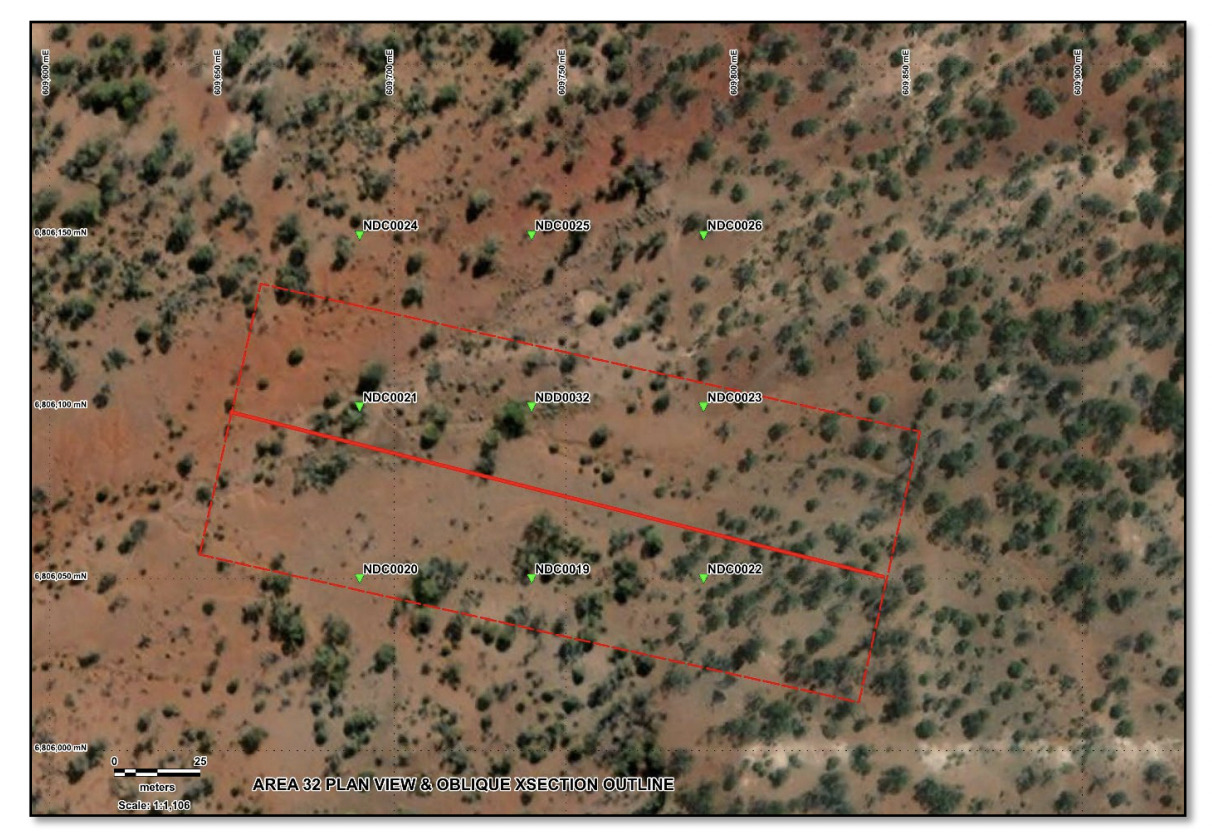

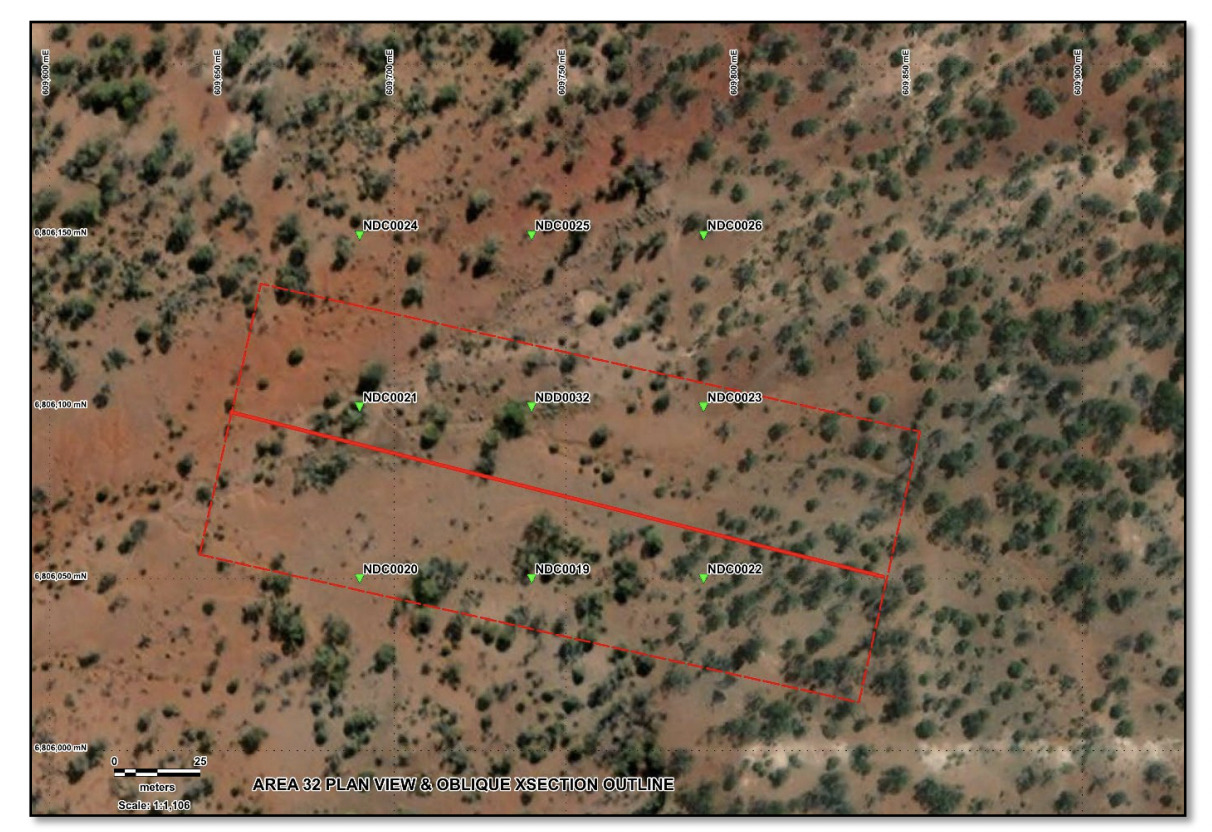

Preliminary results have come in from its third diamond drillhole, NDD0032, targeting an Induced Polarisation geophysical anomaly.

The company reports a drillhole reached a total depth of 576.3m with the upper 40m producing an anomalous Ni zone based on pXRF data.

Follow-up step out RC holes have been completed with the following results in drilling order from within 1m depth: NDC0019 – 1.3% Ni to 14m; NDC0020 – 1.0% Ni to 80m; NDC0021 – 1.2% Ni to 80m; NDC0022 – 0.92% Ni to 35m. Drilling of a further eight holes is currently ongoing at what’s been dubbed the “Area 32 Nickel Discovery”.

The anomalous nickel zone has five of the holes drilled to date, with Aldoro suggesting the zone is open to the north, south and west.

A further eight holes remain open for drilling at Area 32. And once the step-out holes there have been completed, a similar-looking nickel anomaly will be investigated about 3.4km to the southwest.

It’s tough to make new nickel sulphide discoveries these days. It’s the preferred feedstock for nickel to head into batteries used in western EVs, so there’s plenty of motivation to back a winner if it can be found.

ARN share price

AUSTRALIAN PACIFIC COAL (ASX:AQC)

The $57m capped coal-mining minnow has announced some further good news regarding its mission to secure significant debt funding for the Dartbrook coal mine in the Hunter Valley of NSW.

Australian Pacific Coal and its joint venture pardners have been working this year to get the mine recommissioned for a restart in Q4, reviving a mine closed way back in 2006.

The company has been seeking up to A$120 million for capex and working capital to enable mining operations to recommence.

To date, AQC notes, the company has provided approximately A$20 million of the A$120 million via loans to the Dartbrook Joint Venture.

“A further A$75 million is required to fund equipment purchases and refurbishment activities to achieve first coal, and initial working capital requirements are estimated at A$20-A$25 million.”

The upshot in the fresh update, however, is that AQC has received a non-binding letter of intent from a top 3 global commodities trading firm for up to US$50 million (approximately A$75 million) in debt funding, which oughta go a long way towards the restart of the underground mine. No word who though …

The company says the funding reflects “the substantial commercial and operational efforts to de-risk the project and validates the Mine Plan and yield potential.”

The funds will enable the acquisition of critical plant and equipment and commencement of mining operations in Q4 of this year.

AQC share price

SUMMIT MINERALS (ASX:SUM)

We couldn’t quite get away here without mentioning at least something happening in Canada’s lithium hotspot James Bay in Quebec. And Summit Minerals has given us that opening.

The battery-metal-hunting minnow has announced this morning it’s identified numerous targets at the Castor Lithium project, with studies (including satellite and radar analysis) showing “broadly prospective areas of interest” for pegmatite and lithium.

The results, including previously identified pegmatite, provide more than 100 targets for helicopter-based exploration activities when a fire risk in the area has subsided.

The Castor Project is located on the same greenstone belt and 18km along strike from recent exciting lithium discoveries by Toronto stock exchange-listed Ophir Gold (TSX-V: OPHR) at its Radis Project and 32km from Q2 Metals’ (TSX-V: QTWO) Mia Lithium Project.

Also worth noting, the main pegmatite trend in the region parallels the La Grande and Opinaca Sub provinces boundary and runs east-west from Patriot Battery Metals (ASX:PMT) Corvette Project, through Winsome Resources (ASX:WR1) Cancet Project, and then turns southwest right near the Castor Project where Summit is concentrating its efforts.

SUM share price

AUSTRALIAN MINES (ASX:AUZ)

(Up on not much news)

Not-quite-forgotten battery metals stock Australian Mines had a beaut year… in 2017, if you can remember that far back.

Fresher in the mind is the fact “it’s been in the doghouse over the past few years”, as Stockhead’s Reuben Adams succinctly put it recently.

Are investors finally seeing some value in AUZ again, though? The share price is, for some reason we’re trying hard to fathom this morning, up about 12%.

News? Not much, but there’s this, from yesterday:

The company has advised that its CEO Michael Holmes has tendered his resignation (effective October 13) “to pursue other interests”.

AUZ notes Holmes’ “effective leadership”, in which he helped obtain the Greenvale Mining Lease and “moved forward the Sconi Battery Mineral Project” (permitting regulatory activities).

“Michael will continue as CEO until his departure date as the company explores the market for a new CEO,” read the firm’s ASX release yesterday.

The Sconi nickel-cobalt project is a big deal for AUZ, but investment decisions surrounding it have been met with hefty delays that have frustrated shareholders.

In fact, the share price has dropped almost 97% over the past five years, which also very much has something to do with a recently settled civil complaint from ASIC over disclosures made about offtake agreements in 2017 and 2018.

Also, as Reubs reported, in 2021, AUZ inked a binding offtake with a subsidiary of battery maker LG Chem, but this deal has needed amendment after the strategic shift to develop Sconi as a nickel sulphate, cobalt sulphate, and scandium oxide project.

Still, the Sconi project has massive potential, and perhaps another regime shift at the company can get it all moving further in the right direction.

That Greenvale mining lease, by the way, was a pretty big step in the Holmes era, to be fair, resulting in approval being granted for the Sconi project’s operations for an initial 25-year term.

The project is expected to produce 46,800tpa nickel sulphate and 7000tpa cobalt sulphate over a 30-year life. It would, however, cost more than $1.5bn to build.

AUZ share price

The post Resources Top 5: Australian Silica Quartz hunts 10Mt motherlode; Aldoro delves in thick for nickel appeared first on Stockhead.

tsx

toronto stock exchange

aim

asx

tsxv

gold

lithium

cobalt

scandium

nickel

diamond