Uncategorized

Resources Top 4: Nickel hunter goes massive, Explorer of the Week drills into ‘DeGrussa style’ system

NickelSearch (ASX:NIS) surged ~90% at the open on more massive sulphide hits at Sexton, part of the Carlingup project in … Read More

The post Resources…

- NickelSearch up ~90% at the open on more massive sulphide hits at Sexton, part of the Carlingup project in WA

- First pass deeper drilling at the Revere project in WA hits a “DeGrussa style mineralised system, says Everest Metals

- Felix Gold pulls up highlight 100.5m @ 1.14g/t from 21.3m atdistrict scale Treasure Creek project

Here are the biggest small cap resources winners in early trade, Wednesday 12 July.

NICKELSEARCH (ASX:NIS)

The nickel hunter surged ~90% at the open on more massive sulphide hits at Sexton, part of the Carlingup project in WA, before abruptly entering a trading halt to answer some questions from the ASX.

‘Massive’ sulphides generally have higher grades than other sulphide types (semi-massive, disseminated, matrix etc), but eyeballing core is no substitute for actual assays, which are due for release early August.

NIS says two new diamond drillholes pulled up visual sulphides in the upper and lower mineralised horizons — two distinct mineralised bodies at Sexton — with both horizons intersected “at shallower depths than expected” in the second hole.

“The hole confirmed the presence of nickel sulphide mineralisation sitting in a structure located at relatively shallow depths of ~145m and starting quite close to surface at ~40m, which is particularly pleasing,” MD Nicole Duncan says.

Mineralisation, from textured/matrix to semi-massive/massive sulphides in hole one is spread over 9m. Hole two intersected two (variably) mineralised intervals — upper 144.85-149.55m depth (4.7m) and lower 158.9-160.75m depth (1.85m).

Follow-up downhole electromagnetic (DHEM) surveys are now planned for these diamond holes to further test the extent of the sulphide mineralisation, “which exhibits a strong DHEM anomaly response”.

DHEM maps sub-surface changes in electrical conductivity and is a useful tool for finding nickel sulphides.

The company returned to trading midday after the ASX forced it to add a table to the initial announcement, showing the relative abundance as a percentage for that sulphide mineralisation.

$11m capped NIS is down 35% year-to-date. It recently raised $2.4m at 7c/sh to fund nickel and lithium exploration.

EVEREST METALS (ASX:EMC)

The junior explorer is now up 40% since Tuesday morn on some particularly strong news flow.

Yesterday it reported that Rio Tinto (ASX:RIO) will kick off a seven-hole, 1400m lithium drilling program over the North Rover JV this week.

Today, first pass deeper drilling at the Revere project in WA hit a “DeGrussa style mineralised system”.

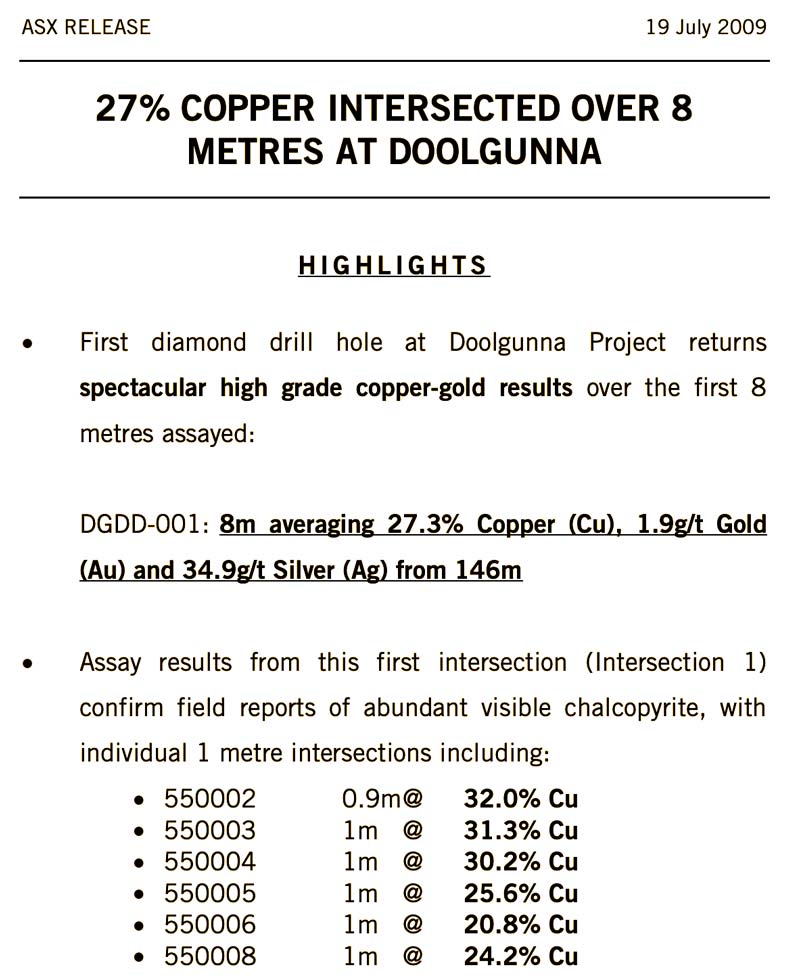

Big if true. In early 2009, struggling explorer Sandfire Resources (ASX:SFR) discovered what would later become the world-class DeGrussa copper-gold mine, rapidly transforming its fortunes from a 4c penny stock into a ~$1bn mining company.

This was the result from SFR’s maiden diamond drillhole:

Massive. EMC has a lot to live up to.

READ: This is how copper play Sandfire went from 4c to over $8 in 18 crazy months

EMC says the three-hole for 1000m drilling program completed over a huge 8.5km target area hit sulphide mineralisation in all holes.

Portable XRF results (again, no substitute for real lab assays) indicate up to 5.7% copper and up to 4.2% zinc “at varying intersections”, EMC says.

“To drill into such a large mineralised system on our first pass drilling is significant and highlights the potential of the target area,” EMC CEO Simon Phillips says.

“The first three diamond drill holes were designed to test electromagnetic conductors identified as having the potential for Volcanic Hosted Massive Sulphides at depth.

“The similarities in geological sequences when compared to the Sandfire (ASX:SFR) DeGrussa VHMS deposit is geologically very significant.

“We look forward to assays and downhole EM surveys to guide us on further testing the system.”

INCA MINERALS (ASX:ICG)

(Up on no news)

Elephant-hunter ICG is about to embark on an intensive drill campaign across its copper-lithium projects in the NT and QLD.

First up is a “high impact” program across a bunch of shallow copper and lithium targets at the MaCauley Creek copper project in QLD in mid-July, to be followed by Jean Elson in the East Arunta province in the NT.

The $13m capped stock has ~$1.2m in the bank.

FELIX GOLD (ASX:FXG)

The Alaskan elephant hunter’s live investor briefing held today appears to have gone down well.

FXG has a ~400sqkm of ground in the Fairbanks District, where historical gold production exceeds 16Moz.

The ground is literally sandwiched between Kinross’ 11.8Moz Fort Knox mine (400m away) and Freegold Ventures’ 3.17Moz Golden Summit Project (200m away).

The focus is on the Treasure Creek project, where maiden drilling in 2022 returned a “substantial discovery at NW Array [a 2.5km x 2.5km gold-in-soil anomaly] and several other potential major gold systems”.

Highlight drill hits from NW Array included 90m at 1.20g/t Au from 32.0m, and 35m at 1.81g/t Au from 16.8m.

FXG now has an exploration target of 76–92Mt at 0.4–1.1g/t gold NW Array, which it tested with a recent 45-hole drill program.

Initial results from the first 11 holes are very promising and include several big hits, including a highlight 100.5m @ 1.14g/t from 21.3m.

The remainder of the assays are pending.

The $17m capped stock is down 17% year-to-date.

The post Resources Top 4: Nickel hunter goes massive, Explorer of the Week drills into ‘DeGrussa style’ system appeared first on Stockhead.