Uncategorized

Raiden Resources is hot on Azure’s heels in Pilbara lithium hunt

Special Report: Azure Minerals’ huge Pilbara lithium discovery ignited a rocket under neighbouring explorers. These include Raiden Resources, which fast…

- Raiden is looking for lithium at its Andover North and South projects, next door to Azure’s tier 1 Andover discovery

- Raiden is a market darling, up almost 1000% over the past 3 months

- Its nearby Mt Sholl nickel project has 4Mt resources at 0.60% nickel eq. or 1.54% copper eq

Azure Minerals’ huge Pilbara lithium discovery ignited a rocket under neighbouring explorers. These include Raiden Resources, which fast became a market darling after acquiring lithium-rich ground directly to the north and south.

Mark Creasey, SQM-backed Azure has stunned investors this year with world class hits like 209m grading 1.42% Li20 at Andover, which culminated in a 100Mt and 240Mt @ 1-1.5% Li20 exploration target and a rebuffed $900m takeover offer ($2.31 per share) from SQM itself.

The exploration target places the project “within the top 10 lithium deposits in the world”, AZS managing director Tony Rovira told Stockhead.

“If you take the upper part of the exploration target, that puts us in the top five lithium deposits in the world,” he says.

$1.3bn-capped Azure (60% ownership) is targeting a maiden MRE for Q1 next year.

Right next door is established Pilbara explorer Raiden (ASX:RDN), which – after uncovering lithium potential at its Roebourne tenement — inked a deal in June acquire an 80% interest in further tenements, which are strategically abutting Azure’s ground.

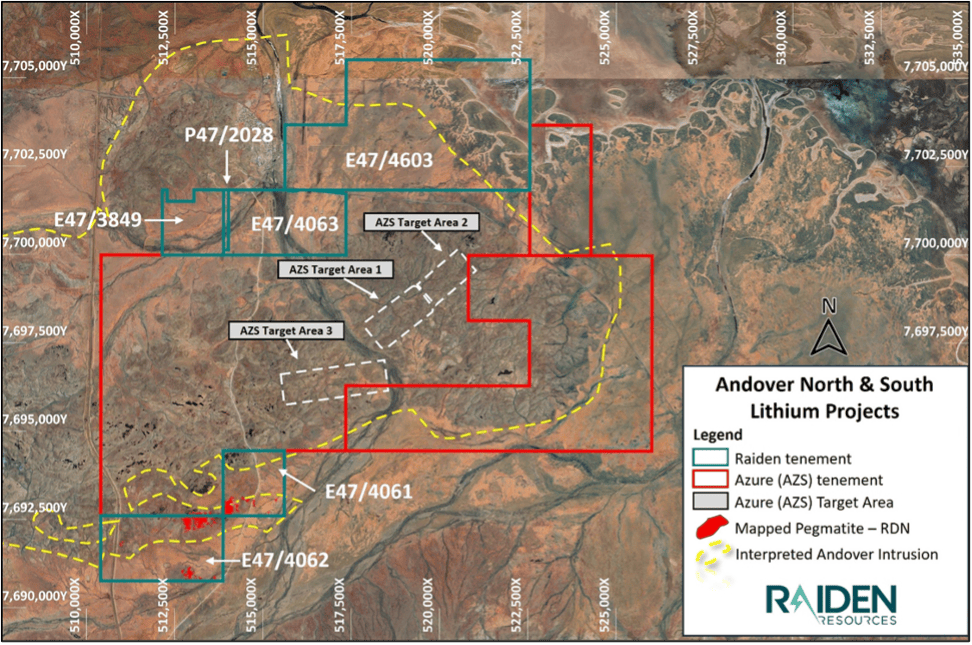

These projects are now called Andover North and South:

Right in the sweet spot.

Early-stage reconnaissance in August at Andover South immediately identified outcropping pegmatites across a ~3.5-kilometre long, 600m wide pegmatite field, with individual pegs up to 30m wide at surface.

Notable rock chip results included 2.22% Li2O (R21160), 0.98% Li2O (R21163), and 0.37% Li2O (R21168).

A subsequent $6m cap raise – supported by famous small cap investor Tolga Kumova – will supercharge exploration across Raiden’s Pilbara portfolio, which also includes the Mt Sholl (nickel-copper-lithium) and the Arrow (gold-lithium) projects.

RDN MD Dusko Ljubojevic says the explorer has uncovered “incredible lithium potential” adjacent to Andover, which will likely become a future lithium mine.

“The best deposits get developed. Andover will probably be one of them, and we’ll be right there,” he said.

Raiden: Following in Azure’s footsteps

Azure had originally partnered with the Creasy Group in a 60-40 JV to explore and develop the Andover nickel sulphide deposit, where a resource containing 51,700t of nickel metal, 21,700t of copper and 2290t of cobalt was defined last year.

But since identifying lithium bearing pegmatites at Andover, Azure has stepped up another level.

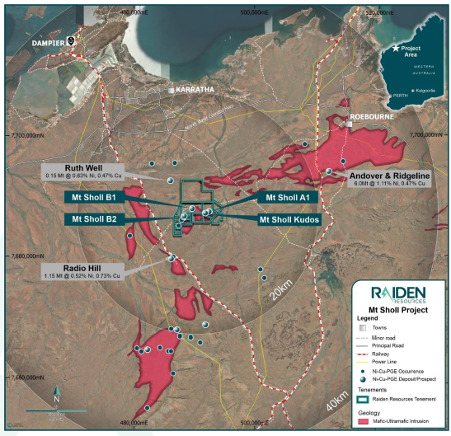

Similarly, Raiden’s main game has been the nearby Mt Sholl project — a great project in its own right — where a maiden resource of 23.4Mt at 0.60% nickel equivalent or 1.54% copper equivalent was released in April.

The Company’ initial focus at Roebourne was for nickel-copper mineralisation, which would add to the overall Ni-Cu-PGE potential within the scope of the Mt Sholl project.

Ljubojevic said, it was a similar story to Azure.

“We already most of the ground around Andover, we were exploring for nickel, and just happened to find some lithium on our ground,” he said.

“Azure was walking across these pegmatites for a couple of years before somebody realised that’s where the billion-dollar value was.

“We’ve found some incredible lithium potential right adjacent to Azure. We’re mapping, we’re sampling, and we’re looking to drill these pegmatite targets as soon as possible.”

Notably, Mt Sholl is also adjacent to the recently announced discovery of high-grade lithium bearing pegmatites by GreenTech Metals (ASX:GRE) on the Ruth Well project.

Mapping of outcropping pegmatites is also underway at the project to assess the lithium potential, while a metallurgical test work program has commenced on the nickel-copper-PGE resource.

Then there’s the Arrow project, where historic exploration identified fertile and fractionated granitic intrusions which could produce mineralised lithium-caesium-tantalum bearing pegmatites.

Earlier this month Raiden completed a $6m capital raising via a share placement at 2.2c per share.Planning for a drilling program at Andover South is underway and the Company will use the funds to evaluate the lithium potential at Arrow in parallel, where it can purchase 100% of the LCT rights, or to earn-in to 85% interest in the LCT rights.

The company already owns 100% of all other mineral rights at the Arrow project, which sits just 30km along strike from De Grey Mining’s (ASX:DEG) Hemi gold project.

Don’t sleep on Mt Sholl’s nickel upside

Back in April, Raiden released the maiden resource for its Mt Sholl nickel-copper-PGE project of 23.4Mt at 0.60% nickel equivalent or 1.54% copper equivalent.

The Mt Sholl deposit is open-pittable; 40kms from a port in the Pilbara and mineralisation remains open in every direction – with a lot of underlying value that Ljubojevic says will be realised once nickel as a commodity comes back into focus.

“Mt Sholl is a great project. More than 80,000 meters of drilling has gone into it, it had a feasibility study concluded over the project 15 years ago and when the palladium price was $300 an ounce – now it’s $1200-1300,” he said.

“It’s a very viable by-product even more so now, when you consider the geopolitical situation in the world and with majority of of Pd resources and supply sitting outside of the western supply chains..”

Not to mention, the JPORC exploration target for the project is defined at 80 – 150Mt at a grade range of 0.45% – 0.75% Ni_Eq or 1.15% – 1.95% Cu_Eq.

“We believe this mineralisation going to come out of the ground at some point, whether we do it or somebody else does it – it’s not going to sit there forever,” he added.

“We are evaluating potential strategic options to advance the project towards study and further growth phases.

“With some focused funding, my guess is it’s going to deliver significant results . I think it’s very attractive as far as Nickel sulphide opportunities are concerned.”

This article was developed in collaboration with Raiden Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

The post Raiden Resources is hot on Azure’s heels in Pilbara lithium hunt appeared first on Stockhead.