Uncategorized

Peter Strachan: Low carbon energy plus diversity of supply boosts nuclear power

The World Nuclear Association anticipates that nuclear power generating capacity will rise 14% by 2030, and by 72% to 686GWe … Read More

The post Peter…

Utilities operating and expanding nuclear power capacity are driven by a desire to diversify power supply, reduce exposure to unreliable sources of energy while reducing reliance on carbon dioxide emitting fossil fuels.

Nuclear energy accounts for 4% of the world’s primary energy supply and according to the IEA produces 10% of global electrical power.

Chinese power utilities have established a reliable construction conveyor belt of nuclear generation systems with efficient operating procedures that deliver a path to lower power costs. The cost of uranium oxide sold by miners to refiners and fuel rod makers is not the main cost for the nuclear power industry. Given the enormous energy content of uranium fuel, enriched to 4% to 5% of the fissile U235 isotope from a naturally occurring 0.7%, the cost of uranium fuel for most reactors represents roughly 10% of the total cost of power produced for sale.

Developing markets for uranium oxide

According to the World Nuclear Association (WNA), global nuclear capacity at the end of September 2023 was ~399 gigawatts of electricity (GWe) from 440 units, with another 60 GWe of capacity under construction. The WNA anticipates that nuclear power generating capacity will rise 14% by 2030, and by 72% to 686GWe by 2040.

Capacity growth arises from new reactors, mostly in China and India, while extending the operating life of some existing plants.

Each gigawatt of new capacity will require about 150 tonnes of uranium per year (tU/yr.) of extra mine production, and about 300-450tU for the first fuel load in new reactors.

Despite some decommissioning of power plants built in the ’60s, ongoing new capacity looks set to more than compensate for retirements.

Demand for uranium oxide is expected to climb to 83,840 tonnes by 2030 and will nearly double to 130,000 tonnes by 2040 as governments ramp up nuclear power capacity to meet zero-carbon targets.

Over the longer term, planners in Indonesia, Norway, the Philippines, and Sri Lanka, are considering the introduction of nuclear power plants, including both conventional and small modular reactors (SMR), to boost national energy grids.

Contracting of U3O8, supply by utilities in 2022 was at the highest level seen in a decade. During the first half of 2023, power utilities worked to secure enrichment and conversion services in the presence of Russian sanctions, prior to signing uranium supply contracts. Recent price strength indicates that contract activity appears to be ramping up as we approach 2024.

In support of this thesis, the US’s Energy Information Administration’s 2022 Uranium Marketing Annual Report, estimates that US civilian power utilities will need to contract for supply of 179Mlbs U3O8e product over the coming 10 years.

Logistics and security of supply

Russia’s invasion of Ukraine has turned the uranium market upside down, while a coup in significant uranium supplier, Niger, cast additional doubt on security of supply. Only seven nations, including Kazakhstan, Namibia, Uzbekistan, Russia, and Niger, along with Australia and Canada produce around 94% while seven companies control 79% of uranium oxide supply, leaving the market open to disruption.

Alongside logistical challenges, the industry has witnessed an improvement in public sentiment towards the adoption of nuclear energy around the world. A national survey in the US found that 76% of respondents favour nuclear energy due to its affordability, reliability, efficiency, and environmental benefits, and 71% of respondents agreed that more nuclear power plants should be built in the future. Similar swings have been seen in Finland, and Estonia, where support for nuclear power has risen as threats from climate change are witnessed.

U3O8 pricing outlook is buoyant

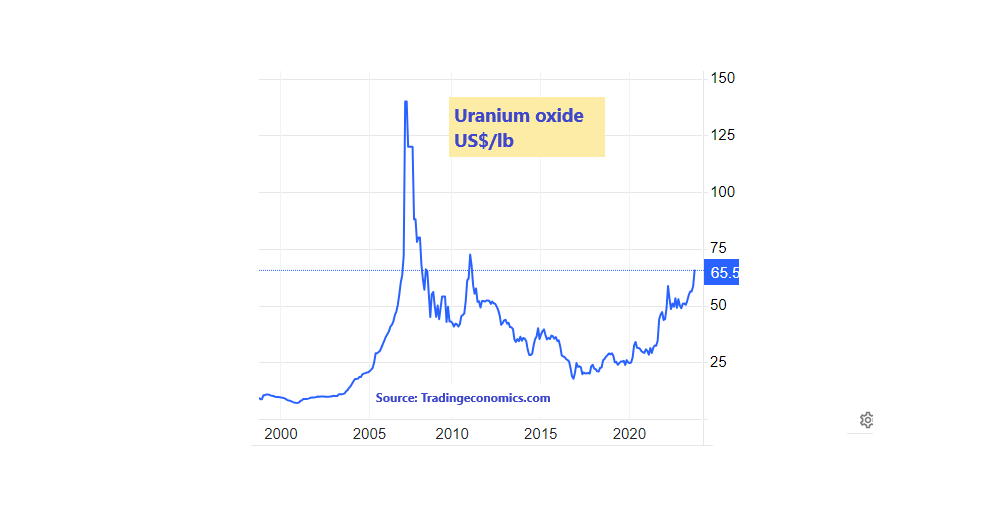

The spot price of uranium oxide has risen to its highest level since the Fukushima tsunami, trading at US$65.5/lb in recent weeks.

In Canada, Bruce Power is studying addition of 4.8GW of capacity at its Ontario facility, while Japanese power plants are planning to restart as the country seeks to reduce its reliance on imported fossil fuels.

Tellingly, the United States, France, Japan, Canada, and the UK have formed the Nuclear Fuel Alliance to develop a shared supply chain for nuclear fuel.

For more than a decade, the nuclear power industry has been consuming more uranium fuel each year than has been mined, leaving inventories of at low levels while reprocessing filled the gap. More long-term supply contracts will be required, which is likely to support a price of between US$60 and US$80/lb over coming years.

ASX-listed uranium producers and developers

BHP (ASX:BHP): Sells around 3,400tpa of uranium oxide as a by-product from its Olympic Dam copper mine. While this is a significant volume from a global perspective, even a price rise of US$40/lb, lifting pre-tax profit by ~US$300 million would not significantly move the dial for BHP.

Boss Energy (ASX:BOE): The South Australian focused, $1.6 billion project developer is restarting the Honeymoon Well insitu uranium recovery project. Boss is on track to commence production by December 2023, building to a capacity of over 2Mlb pa of U3O8e at an all-in sustaining cost of US$25.62/lb as it focuses on an initial 36 Mlb of product within a larger Mineral Resource area containing 71.5Mlb of U3O8. Drilling at Gould’s Dam, 80km from Honeymoon has delivered results that could support both expansion and an extended project life.

Boss took an early initiative to secure its ability to fulfill contractual supply obligations through project commissioning by purchasing 1.25Mlb of uranium oxide on the spot market at US$30.15/lb. Boss now sits on a handy US$40 million profit on this stockpile alone.

Bannerman Energy (ASX:BMN): The Namibian project developer has a $381 million market capitalisation ahead of finalising engineering and metallurgical design, along with product off-take contracts and financing options at its Etango-8 project, where a final investment decision is expected by June 2024. The project aims to produce 3.5Mlb pa of uranium oxide by 2027 at a cash operating cost of US$35/lb, from a Mineral Reserve containing 59.9Mlbs of U3O8.

Paladin Energy (ASX:PDN): Another Namibian based $3bn market capitalisation project, Paladin is working to recommission its 75% owned Langer Heinrich mine in Namibia during the March quarter of 2024. Reserves containing 83.8Mlb of U3O8 are expected to support initial production of 3.6Mlb pa with a C1 cost of US$27.4/lb.

Deep Yellow (ASX:DYL): The $840 million market capitalised DYL aims to be the largest, ASX listed, pure uranium oxide producer with a production target of 7Mlb pa of uranium oxide from Mineral Reserves of 42Mlb at Mulga Rock in Western Australia and 67Mlb at the Tumas project in Namibia, which neighbours Paladin’s Langer Heinrich. The company aims to achieve a financial investment decision at Tumas in mid-’24, where an AISC of US$38.72/lb is estimated for production in 2026 and will also revise previous Definitive Feasibility work over the polymetallic, Mulga Rock deposit during 2024, with a target for production in 2028.

Elevate Uranium (ASX:EL8): Another Namibian project developer, having a suite of projects with Mineral Resources in Western Australia and the Northern Territory. The company is promoting its U-pgrade process to render lower grade sedimentary deposits more viable.

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

The post Peter Strachan: Low carbon energy plus diversity of supply boosts nuclear power appeared first on Stockhead.