Uncategorized

Paradox poised to supply lithium carbonate to US battery market as demand soars

Special Report: Global Lithium demand (LCE basis) is estimated to reach 1.5Mt by 2025, requiring a 60% increase in supply … Read More

The post Paradox…

Global Lithium demand (LCE basis) is estimated to reach 1.5Mt by 2025, requiring a 60% increase in supply in the next two years, according to Fastmarkets.

By 2030, demand is flagged to increase to 3Mt, and if you look at North America alone, Benchmark Minerals Intelligence says the demand for lithium is forecast to exceed 390kt LCE in 2025 and further grow to over 900kt LCE in 2030.

Compare that with only 10kt of estimated LCE production in 2022.

You can see why the US is pushing hard to establish a domestic supply chain with incentives like the Inflation Reduction Act (IRA) providing significant benefits and impetus for US automakers to source domestically mined lithium.

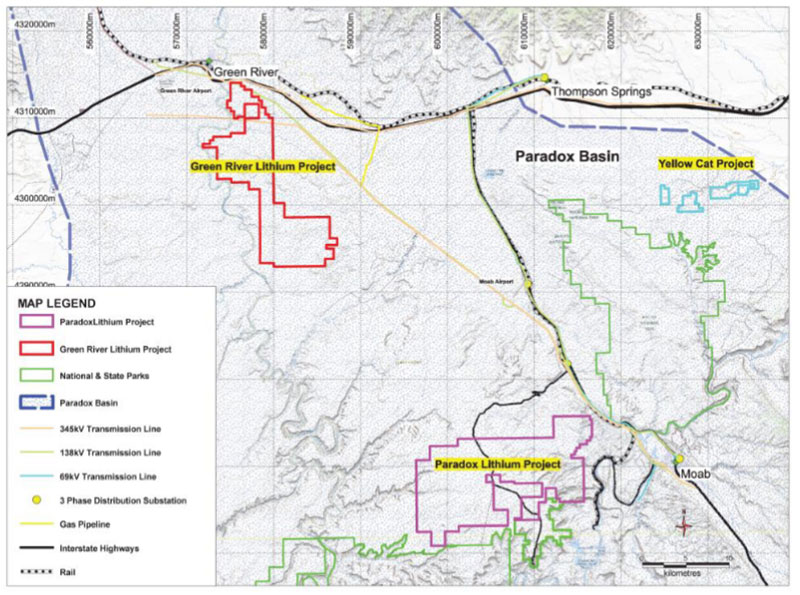

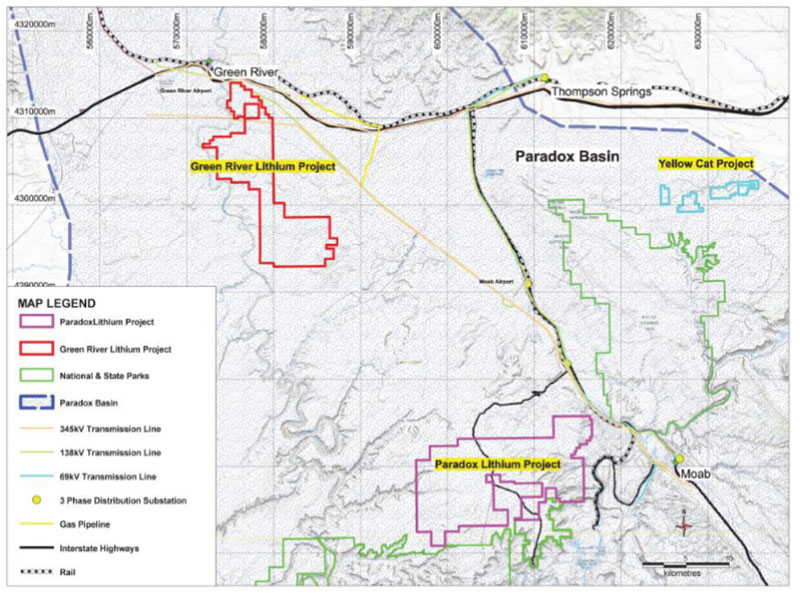

That’s where lithium plays like Anson Resources (ASX:ASN) come in – with its Paradox Project in Utah one of very few advanced stage lithium projects in the United States with a Definitive Feasibility Study (DFS) complete and over 1Mt of Lithium Carbonate Equivalent (LCE) resource.

Primed to supply to North American battery market

The DFS completed late last year confirmed strong project economics as a low-cost, long-life project with Pre-tax NPV and IRR estimated at US$1,306 million and 47% respectively from revenues of US$5,080m over 23 years of operations.

“Anson is focused on developing the Paradox Project into a significant lithium producing operation, to provide high-quality lithium carbonate for the massive global EV battery market,” executive chairman and CEO Bruce Richardson said.

“The project also hosts large quantities of high-value bromine, and the company also plans to deliver significant further value via the commercial extraction of the bromine.”

Not to mention, Paradox will use commercially proven Direct Lithium Extraction (DLE) technology provided by DLE industry leader Sunresin who’s technology is producing 32,000 ton per year of lithium carbonate at 7 projects.

“Furthermore, testing confirmed 99.95% pure lithium carbonate produced from Paradox Project, exceeding battery grade requirement making it appealing to US battery manufacturers,” Richardson said.

Major resource expansion program underway

The company has a major resource drilling campaign underway at the Western Region of the project – where it hopes to deliver a similar mineral resource estimate as the Eastern Regions’ whopping 1Mt of Lithium Carbonate Equivalent (LCE) and 5.275Mt of Bromine.

The Exploration Target for the Western Strategy area is between 2.1Bt and 2.56Bt of brine grading 108 parts per million to 200ppm lithium as well as 2,000ppm to 3,000ppm bromine.

This works out to between 1.1Mt and 2.7Mt of lithium carbonate equivalent and 4.2Mt to 7.68Mt of bromine.

Added to that, the company has recently added the nearby Green River lithium project to its Utah landholdings which has an exploration target of 2-2.6Bt of brine, grading 100 – 150ppm lithium and 2,000 – 3,000ppm bromine.

“Anson is adopting a similar exploration strategy at the Green River Project as it successfully adopted at the Paradox Project by re-entering existing oil wells to define lithium brine resources,” Richardson said.

“This is designed to contribute significant additional Resources to Anson’s global Paradox Mineral Resource base.”

Anson plans to conduct a drilling and sampling program of existing wells within the Green River project area in the near term, with the plan to include the results from these horizons in a further JORC Resource upgrade that will be confirmed at the Paradox project on completion of the Western Strategy exploration program.

Offtake discussions underway and ongoing

Funding discussions are underway and ongoing, with target groups including international banks and export credit agencies.

“We’re working with international banks, export credit agencies, and a number of other organisations,” Richardson said.

“We’re looking at a 60/40 split there for the funding of $500m and we estimate that will take us through to the second half of this year.

“One of the other important factors of the project is approvals, which are all progressing well.”

While Richardson said the lithium market is looking a little soft at present, he expects that to come back in the near term to coincide with the company’s expected timelines – namely a Final Investment Decision (FID) this year and production of first battery grade lithium carbonate in 2025.

This article was developed in collaboration with Anson Resources Limited, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

The post Paradox poised to supply lithium carbonate to US battery market as demand soars appeared first on Stockhead.