Uncategorized

Olympio is ready to scale the critical minerals mountain

Olympio Metals is focused on making its mark in the critical metals sector with three very special projects. … Read More

The post Olympio is ready…

- Olympio holds promising lithium and rare earths projects in Australia and Canada

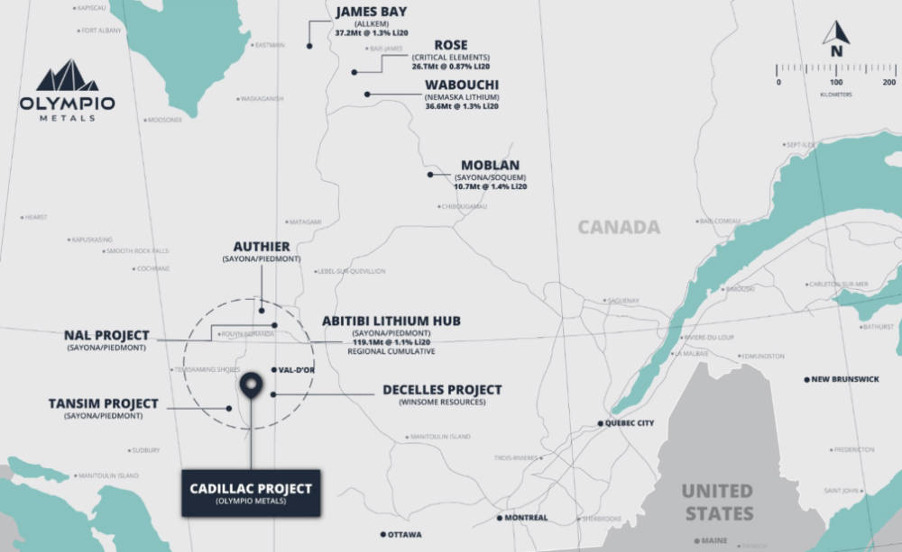

- Flagship is the Cadillac lithium project in Quebec

- Awaiting Liontown’s decision to proceed with Stage 1 farm-in of the Mulwarrie project in WA

- Drilling to start at the Eurelia rare earths-niobium project in South Australia

Olympio Metals is focused on making its mark in the critical metals sector with three very special projects.

The explorer holds lithium and rare earths assets in both Canada and Australia, although its attention is currently focused on the newest addition to its stable — the advanced Cadillac lithium project in Quebec.

Acquired from TSX-V listed Vision Lithium in early August, Cadillac has a number of things going for it that were responsible for capturing Olympio Metals’ (ASX:OLY) attention.

Firstly, initial pass drilling and channel sampling completed by Vision at the 190km2 project has already hit paydirt — including grades up to 3.14% Li2O — signalling potential for “high grade mineralisation”.

Secondly, the project is within the Abitibi lithium hub, a circle with a radius of about 100km centred around Sayona Mining’s (ASX:SYA) North American Lithium (NAL) operation — Canada’s only operating lithium mine.

Speaking to Stockhead, managing director Sean Delaney said the project’s location was one of its key strengths and couldn’t be emphasised enough.

For one, Quebec is where Ford and SK are moving to build a C$1.2bn battery cathode material plant. And besides being close to the NAL mine, Cadillac is also located close to the town of Val-d’Or, which Delaney describes as “Kalgoorlie in Quebec”.

“It is the service town for a lot of these James Bay projects, except that they are something like 800km away whereas ours is 50km by road,” he says.

The proximity to Val-d’Or also grants the company easy access to exploration services companies such as Technominex, whose services are in great demand by James Bay operators.

Cadillac is also accessible by road all year around.

“In terms of ease of exploration, I think it is a huge advantage,” Delaney says.

The Cadillac of lithium acquisitions

Olympio paid a little extra for the project for obvious reasons.

“The vendors Vision Lithium had previously spent C$1.6m on exploration, giving us a reasonable dataset, which is valuable as a base to work from,” Delaney says.

This work defined high-grade spodumene on the surface and channel samples. First pass drilling also confirmed the presence of lithium with significant grades of up to 3.14% Li2O with spodumene crystals observed in core.

“We know there’s lithium there. Pretty much everyone involved in lithium exploration pretty much agrees with the same theory — if there’s a source granite the deposit will be within 5-10km,” Delaney says.

“We have lithium there; the lithium must have come from somewhere so that means we have fertile pegmatites.

“That means we have a chance of finding a deposit because we know we have lithium in the system, at surface and at depth.”

Over the next 12 months, the company is required to spend $500,000 as part of the acquisition.

“That’s not a significant amount of money for exploration but we would like to get as much done during the field season before the snow comes and covers the rocks,” Delaney says.

“Cadillac has got hundreds of pegmatites that are still to be tested.

“It is easy to get access to, there are tracks all through there that were quite obviously used by hunters and so on.”

Banking on lithium exploration expertise

Cadillac is not the only lithium project in the company’s portfolio.

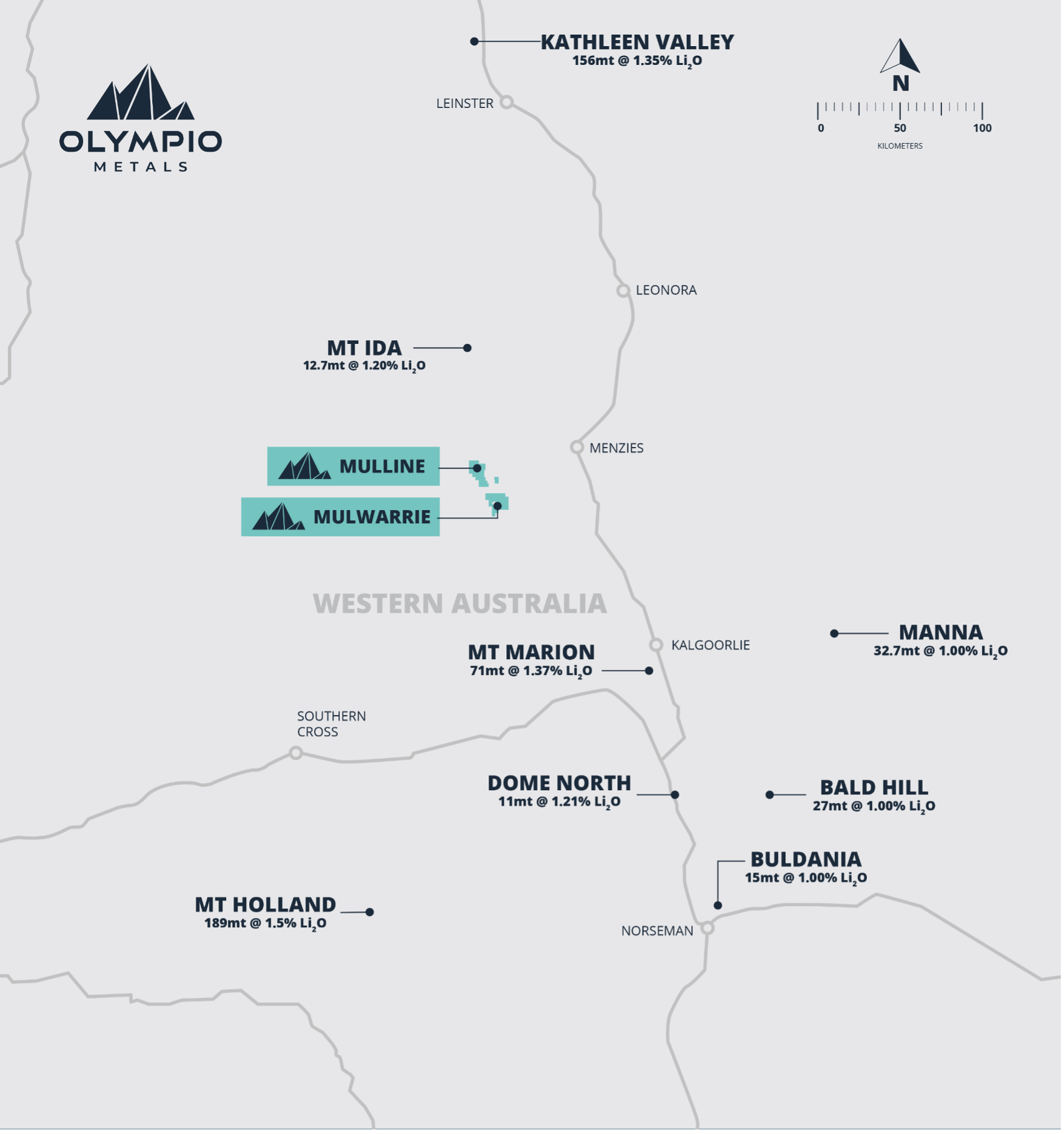

Olympio also owns the early stage Mulwarrie lithium project in WA’s Eastern Goldfields region that shares the same geology — greenstones surrounded by granites — as Delta Lithium’s (ASX:DLI) Mt Ida project.

Highlighting just how valuable Mt Ida really is, Delta is currently being fought over by Gina Rinehart’s Hancock Prospecting and Chris Ellison’s Mineral Resources (ASX:MIN).

This prospectivity was clearly reason enough for Liontown Resources (ASX:LTR) – also the target of a recommended takeover by Albemarle – to farm-into the project in April.

Liontown has since completed a soil geochemistry program that collected 1,135 samples across the Mulwarrie project and is currently awaiting results before deciding to proceed with the Stage 1 farm-in, which will require it to spend at least $400,000 on exploration over a 12-month period to earn a 51% stake in the project.

Should Liontown proceed with the farm-in, Delaney believes that cash will likely be spent on drilling, designed to follow up on priority targets generated from sampling.

“The real positive for us is that we have the opportunity to stay in that JV at 49%, which means we still have very significant exposure,” he added.

“We would have to contribute 49% of expenditure but if they have drilled into something significant, that will be easy enough to do.”

Carbonatite rare earths

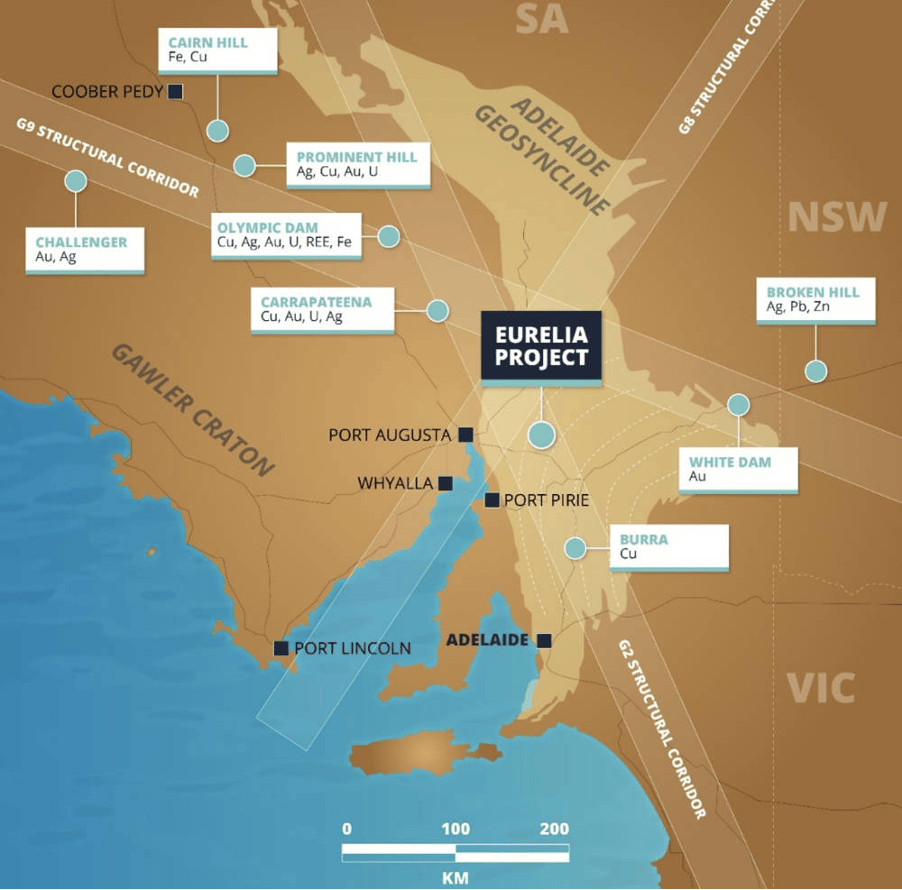

It is not all about lithium, though. Olympio also holds the intriguing Eurelia rare earths project within the Adelaide Geosyncline in South Australia.

Eurelia is located near the intersection of the G2 and G8 structural corridors, a major control on mineralisation in South Australia, and has previously been explored for diamonds and copper with little focus on the REE prospectivity.

However, limited rock chip sampling has delineated a +10km trend of coincident elevated niobium and REEs with up to 772ppm niobium and 4,754ppm total rare earth oxides (TREO), while the single hole drilled in this trend returned a 9m intersection grading 1,647ppm TREO from a down-hole depth of 7m.

Carbonatite hosted REE and niobium are all the rage since WA1 Resources (ASX:WA1) made a shock high grade discovery in WA’s West Arunta region.

“We think Eurelia is very exciting as a carbonatite hosted REE target,” Delaney says.

“You just need to look at how successful WA1 have been. They are drilling into a carbonatite at West Arunta in WA, as are Encounter, who are next door to them.

“Hastings’ Yangibana is hosted in a carbonatite and so is Lynas’ Mt Weld.

“We think that you are going to discover something in REEs, carbonatite is the best place to discover it.”

Olympio has launched a detailed aerial magnetic survey at the wholly-owned Walloway tenement directly to the south of Eurelia to cover multiple priority magnetic carbonatite targets that were defined through existing regional aeromagnetic data.

This work and its processing are expected to be completed late September, following which the company will carry out first-pass drilling.

“We are getting approvals in place, so we will be drilling there this year,” Delaney says.

“Dave Bebbington, our geologist, really likes Eurelia and is super excited about what this magnetics are going to show.”

“The REE story is going to continue, there is a push for discovery of REEs outside of the current source from China,” he concluded.

This article was developed in collaboration with Olympio Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

The post Olympio is ready to scale the critical minerals mountain appeared first on Stockhead.

tsx

asx

tsxv

lithium

rare earths

ree

rare earth oxides

niobium