Uncategorized

Not very safe: Did gold just lose its risk-lite status?

Bowie might be gone, but the precious metal did edge higher overnight at US$1915 (0.95%).

… Read More

The post Not very safe: Did gold just lose its…

Golden years bop bop. The British singer, songwriter and commodity analyst David Bowie memorably said, and that astute observation has never seemed so on the money as it does in 2023.

Bowie might be gone, but the precious metal did edge higher overnight at US$1915 (0.95%).

But the strength in the American dollar and what now appear to be easing heart rates around US recession risks are potential bugbears to the price of gold and its near-term adventures.

Troublesome US long-end yields fell sharply (that 10-yr Treasury yield is a monster), and while this did put some pressure on the strength of the US dollar, the writing is on the wall this morning for some goldies.

It’ll be worth keeping an eye on which way the ASX Gold Sector and its various diggers and explorers head to on local markets.

According to Tony Sycamore, Sleepless Market Analyst at IG, the recovery back above the 200-day moving average has weakened his own bearish gold bias to a slight degree.

“However, while gold remains below the band of resistance $1910/1930 (including the 200-day ma and former lows), the view is that the decline in gold will extend towards $1800 in the weeks ahead.”

The golden year

Well, Peter McGuire, CEO at XM, says that looking at life beyond US bond yields, the “higher for longer” narrative has actually added more drive to the greenback’s engines, which were already charged by concerns surrounding the Chinese economy.

“The recovery in the world’s second largest economy has lost steam due to a deepening property crisis, softening consumer spending and worsening credit growth, with the latest stimulus measures by Chinese authorities and the People’s Bank of China (PBoC) failing to revive market sentiment,” Pete says.

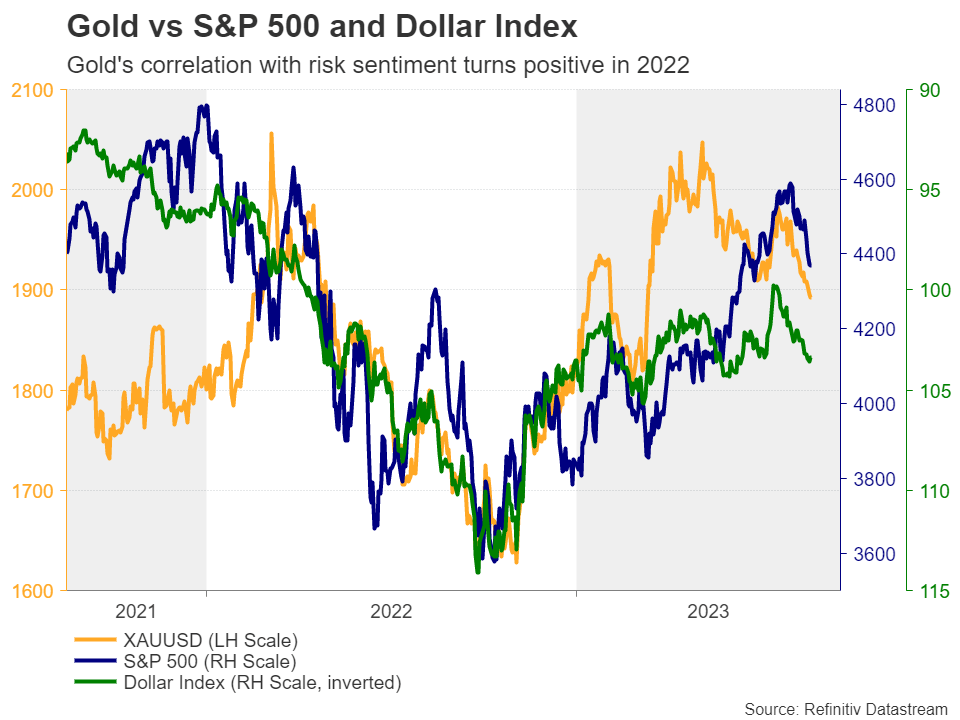

“With Treasury yields soaring and the US dollar wearing its safe-haven suit, the non-yielding gold maintained a positive correlation with the stock market, seemingly not included on investors’ list of preferred safe havens, despite being considered a top choice before central banks began this tightening journey.”

Pete’s Technical Analysis – Gold leans on the bullish side

The XM boss out of Coogee says gold is looking to exit a bearish channel in the four-hour chart after its sell-off stalled around the 1,884 level.

“Encouragingly, the precious metal has surpassed its 20- and 50-period simple moving averages (SMAs), making its latest rebound more credible.

“The positive momentum in the technical indicators is further boosting hopes for an upside reversal; the MACD has entered the positive region for the first time since the end of July, while the RSI is clearly trending up above its 50 neutral mark.”

On the other hand, McGuire warns, pulling out the stochastic oscillator argument, the gold price has edged above its 80 overbought mark, suggesting that room for improvement could be limited.

“The 1,911 constraining zone could block the way towards the 1,920 area, while higher, the 1,930 resistance could delay an extension towards the 200-period SMA at 1,936.”

He says on the downside, the 20- and 50-day SMAs may pause any declines within the 1,895-1,900 territory.

“If they fail, the bears will revisit the 1,884 floor, a break of which could sink the price towards the 1,870 barrier and the channel’s lower boundary.”

Then the 1,860 region could be the next destination.

“Gold is sending bullish signals as the yellow metal is pushing for an upside reversal. Resistance is expected to develop around 1,911.”

The post Not very safe: Did gold just lose its risk-lite status? appeared first on Stockhead.