Uncategorized

Morningstar’s five potholes to look out for in 2023 and why investors should do a Bradbury

Morningstar reckons conditions in 2023 are likely to be more challenging than in 2022 Corporate earnings growth may be subdued … Read More

The post Morningstar’s…

- Morningstar reckons conditions in 2023 are likely to be more challenging than in 2022

- Corporate earnings growth may be subdued on back of forecasted slower GDP growth

- Morningstar said investors should navigate potholes, stay out of trouble and collect the rewards

After returning from a road trip with this wife and border collie, Morningstar head of equities research Peter Warnes has come back to ASX reporting season, keen to share some observations.

With his holiday still fresh in his mind he’s likened investing to a road trip with potholes along the way.

“The current reporting season is the snapshot from the rearview mirror,” he said in his latest note.

“Looking through the windscreen, the road conditions for 2023 are likely to be more challenging than in 2022 and those of the six months ended 31 December – the basis of the current reporting season.

“Investors should be focused on what lies ahead and just like the roads we recently travelled, there are many potholes.”

Pothole 1 – The times (interest rates) they are a-changin’

Warnes said generally the Australian economy performed well in 2022, buoyed by elevated household consumption.

But he said that will not be the case in 2023 as consumption adjusts to the nine RBA interest rate hikes since May 2022 bringing the cash rate to 3.25% from 0.10% with Governor Phillip Lowe forecasting more rises to come.

“While the 325 basis point tightening to date marks the sharpest annual tightening since 1989, that 275 bps increase from 4.75% to 7.50% represented a 58% jump,” he said.

“The comparative exponential percentage rise from 0.10% to 3.25% is set to deliver much more pain, particularly for those households whose debt load increased in 2021 when interest rates fell to historical lows.”

Warnes said while there is concern for the estimated 800,000+ households rolling low fixed interest loans over into significantly higher variable rates in 2023, the negatively geared property investors should also not be forgotten.

“They also will need deep pockets, sustainable cash flow or sufficient reserves to survive the rate hike onslaught,” he said.

Pothole 2 – Watch out for services inflation

Warnes said the Federal Government and the RBA are rightly focusing on the rising cost of living.

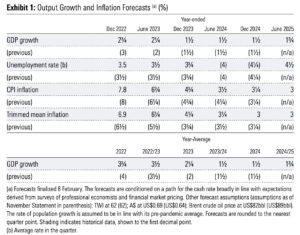

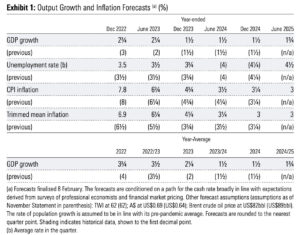

The December quarter CPI revealed annual headline and trimmed mean rates of 7.8% and 6.9%, respectively, both above consensus forecasts.

The most significant contributors to the December quarter numbers were domestic holiday travel and accommodation (+13.3%), electricity (+8.6%) and international travel and accommodation (+7.6%).

“Accuse me of being a Scrooge, but only electricity is a cost-of-living expense,” Warnes said.

“Holiday travel and accommodation expenses, particularly international, can hardly be described as a cost-of-living expense, perhaps more of an indulgence.”

Warnes said greater importance is the annual inflation in non-discretionary (necessities) items, which he terms the “cost of existence”.

“In the December quarter, the annual rate of non-discretionary inflation of 8.4% was above the rate that sent both the RBA and the government into palpitations,” he said.

“While goods inflation looks to have peaked, services inflation remains uncomfortably high, given the higher labour component and while wages demand remains unrelenting.”

“With Labor in power in Canberra and most states, trade unions are demanding wages match inflation, so a bumpy ride on the potholed highway is very likely.”

He said furthermore insurance premium rises are yet to hit, while rents “won’t be going south while immigration surges”.

Pothole 3 – Slower growth globally and domestically

Warnes said the growth outlook, domestically and globally, for the next two years is sombre with the International Monetary Fund (IMF) forecasting global growth to slow to 2.9% in 2023 and edge higher to 3.1% in 2024.

He said both are well below the historical average of 3.8% but the latest IMF figures vary slightly from October 2022 on the tail of China’s reopening.

“Recall, forecasters have been way off the mark over the past two years,” he said.

“Global inflation is expected to decline to 6.6% in 2023 and 4.3% in 2024, still above pre-pandemic levels.”

“The RBA has revised growth forecasts for the years ended December 2023 and 2024 to 1.5%, and for the year to June 2025 1.75%, hardly blowing out the lights and one could ask if the lights are even on.”

Warnes said the household savings ratio is expected to decline through 2023 and into 2024 to below 5%, before recovering in 2025 to near pre-pandemic levels.

Pothole 4 – Weaker outlook for business investment

In February’s Statement on Monetary Policy, the RBA believes the outlook for business investment remains positive.

This view is based on “a large pipeline of projects expected to support activity over 2023″, the statement said.

But Warnes is not that confident.

The bank points to an easing in materials shortages and supply chain issues but said “labour shortages remain a constraint on activity and are limiting the pace at which the pipeline of work can be worked through”.

“These projects will be in direct competition with increasing government infrastructure plans and the aggressive timeline with regards to emission reduction and investment in renewables,” Warnes said.

In addition, in a significantly higher interest rate environment, hurdle rates will have increased materially, perhaps making some projects marginal or even no-goers.

Pothole 5 – Subdued corporate earnings

Warnes said with forecast subdued GDP growth through to mid-2025 at least, corporate earnings growth isalso likely to be subdued.

“There will be outliers, probably in the commodities space, but with more volatility,” he said.

“Cash flows will be affected, and valuations will not have the luxury of low discount rates.

“Zero-bound interest rates are unlikely to repeat unless there is another global calamity.”

Warnes said high P/E multiples will also come under the microscope and will shrink as earnings growth slows.

Advice for investors – Do a Bradbury

On the 21st anniversary of Steven Bradbury’s gold medal in the men’s short track 1,000m race at the Salt Lake City Winter Olympics, Warnes said investors should pause and strategise.

Bradbury’s strategy from the semi-final onwards was to cruise behind his opponents and hope that they crashed. It happened in the semi-finals and again in the finals, winning him a gold medal.

“His reasoning was risk-taking by the favourites could cause a collision due to a racing incident and trying to challenge them directly would only increase his own chances of falling,” Warnes said.

“There is nothing wrong with missing the starter’s gun.

“The important thing is to stay out of trouble and collect the rewards.”

The post Morningstar’s five potholes to look out for in 2023 and why investors should do a Bradbury appeared first on Stockhead.