Uncategorized

Monsters of Rock: Is it time to be concerned about the health of Dr Copper?

Copper hits seven month low, but ANZ says fundamentals for the red metal are strong The big bank’s experts see … Read More

The post Monsters of Rock:…

- Copper hits seven month low, but ANZ says fundamentals for the red metal are strong

- The big bank’s experts see demand rising 4.1% against a lift in refined supply of 3.5%, keeping market in deficit

- News from Bowen Coking Coal, Chalice Mining and AngloGold Ashanti

Copper is commonly known as Dr Copper, a phrase best described as the slant rhyme of metaphors.

It is said the copper price is able to provide a diagnosis of the health of the world economy with its price generally tied to global industrial growth.

We contend this makes it more of a thermometer than anything.

Regardless, it’s been looking underwhelming of late, tumbling below US$8500/t to a seven month low overnight.

That isn’t surprising if you take the health of the world economy angle as the greater meaning of the copper price. Amid a hush-hush banking crisis, inflationary environment and rising interest rates, things really don’t look that great.

But copper had been tipped for better things this year, with China reopening after a year of Covid lockdown austerity and a challenging supply situation in major production centres like Chile, Peru and Panama.

Is it time to call a real doctor to see what’s going on?

Not just yet, according to ANZ commodity strategists Daniel Hynes and Soni Kumari, who think the demand scenario is more promising than it appears at first glance.

“A failure to meet expectations of a surge in demand for copper has seen it give up most of its gains this year. However, demand remains robust, with an acceleration in growth in coming months,” they said.

“Physical indicators suggest demand has been improving in recent months.

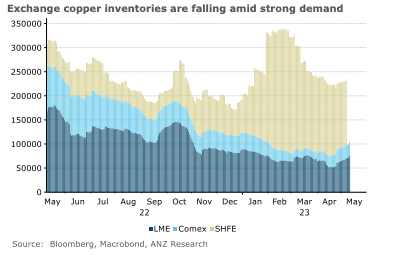

“Stockpiles held on exchange are down, while premiums are rising. In China, operating rates of downstream processors have bounced sharply after a rocky start to the year. Our copper demand indicator is also showing signs of improvement.

“The outlook for the rest of the year remains strong, despite the economic headwinds. Investment in clean energy technologies will start to drive copper demand. With energy security still high on the agenda for most governments, investment in renewable energy capacity is accelerating. And governments are strengthening power networks.”

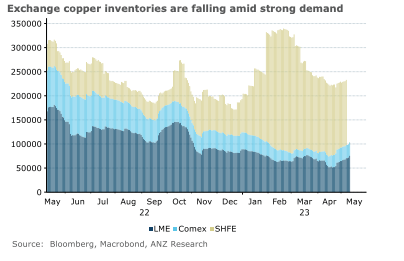

Hynes and Kumari say copper demand growth will hit 4.1% this year, its highest read since 2014.

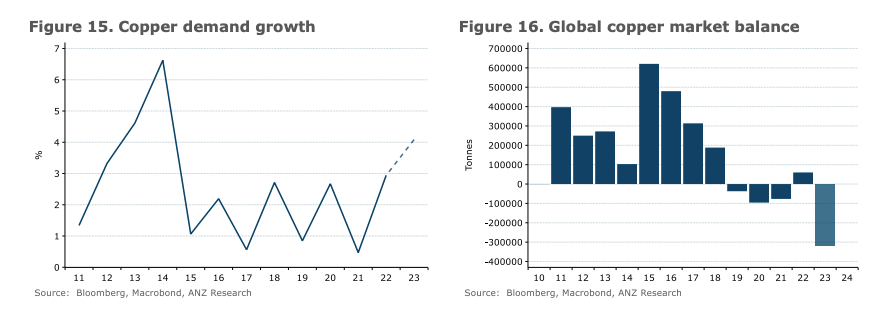

“With supply side constraints still prevalent, we see the copper market moving back into a deficit this year,” they say.

Inventories down, premiums on the rise

While sentiment may be low, fundamentals are starting to look brighter, Hynes and Kumari say.

“The reopening of the Chinese economy in late 2022 saw consumers rush to restock ahead of what they expected to be a sharp rebound in demand. Refined copper purchases rose by 5.8% y/y or 33.5% m/m to 540kt, the highest for this year,” they said.

“With demand growth initially lacklustre, inventories started to build. Stockpiles in Shanghai Futures Exchange warehouses increased by more than 280% to 250kt.

“Since then, however, inventories have steadily decline. Total global exchange inventories have fallen 32%.”

Physical premia, a sign of real-time demand, are looking stronger too.

“In another sign of strength in the physical market, the Bloomberg global composite copper premium has risen from the recent low of USD70/t to the mid 90s,” Hynes and Kumari said.

“Our copper demand indicator is also showing signs of improvement. It tracks downstream copper demand, weighing activity growth against the total market share of consumption across various sectors.

“It has traditionally been a good guide to phases of tightening and loosening in the Chinese market. It signalled falling demand in H1 2022 as Beijing stuck to its zero-strategy.

“However, it started recovering in August last year. Following a brief retreat in January, it pushed further into positive territory in March.”

EVs should provide support for copper demand growth both in the cars themselves, and in electricity infrastructure to support the associated increase in grid demand.

“Overall, we expect China’s EV sales to reach 8m units in 2023,” Hynes and Kumari said.

“Correspondingly, EV charging stations will need to support 20m EVs by 2025, which is three to four times the number in 2021.

“As such, we expect copper demand growth to rise to 5.2% in 2023.”

Bottlenecks

European and US copper demand is also expected to lift, driven by rising renewable capacity and EV sales.

While copper in concentrate supply is forecast to rise 9% as new mines come on stream, that will be curbed by smelting capacity issues.

“The commissioning of new operations over the course of the year should see global copper in concentrate supply rise by 9% in 2023,” Hynes and Kumari said.

“However, due to bottlenecks in the smelting and refining industry, growth in refined copper output will be only 3.5%. As such, we see the copper market moving back into a

deficit this year, which should provide support to prices in H2.”

Bowen gets the coal all clear at Isaac River

Bowen Coking Coal (ASX:BCB) shares rose today after the coal junior received news the Department of Climate Change, Energy, the Environment and Water intended to approve its proposal to develop the Isaac River project in Queensland.

Bowen, which has mined over 1.3Mt of coal since mid last year, aims to produce 5Mtpa of met coal by 2024.

“As the Bowen Basin’s newest independent coal producer,

we’re here to meet the growing demand for energy and steelmaking coal,” Bowen chair Nick Jorss said.

“We are confident that world steel and energy demand will continue its rapid growth, driven by on-going industrialisation in the developing world, and the drive for decarbonisation in the developed world.”

Isaac River is located immediately next to BHP’s Daunia mine, one of two operations in its BMA business along with Blackwater that the mining giant currently has on the market.

Bowen Coking Coal (ASX:BCB) share price today:

Chalice restocks with $70 million raising, AngloGold exits ASX stage-left

Rounding out the news from the large cap end of the market today, Chalice Mining (ASX:CHN) has tapped “a select group of major, long-only institutional investors and significant existing shareholders” to raise $70 million in a private placement to ramp up exploration at its Julimar nickel-copper-PGE project and other targets along the West Yilgarn mineral province.

Chalice has raised over $300 million in placements since making the Gonneville discovery in early 2020, now regarded as one of the largest nickel sulphide discoveries in two decades.

It will raise another $10m from existing shareholders through an SPP. The cap raising for the once Tim Goyder chaired explorer comes ahead of a scoping study and PFS for Gonneville as well as a process to find a strategic partner for the development of the operation.

Meanwhile, Sunrise Dam and Tropicana gold mine owner AngloGold Ashanti’s (ASX:AGG) time on the ASX is nearing an end.

The gold major will dump its Australian listing in a major corporate restructure that will see the company also shed its South African skin three years after selling out of its troubled home country.

AGG will now be based in the UK with a primary listing on the New York Stock Exchange and secondary listing in Johannesburg and Ghana.

It is expected its chess depositary interests will stop trading on the ASX on June 23, two working days before its voluntary delisting on June 27.

It follows the delisting of overseas headquartered gold miners OceanaGold and Kirkland Lake in recent years, the latter after its merger with fellow Canuck Agnico-Eagle to create the world’s third most productive gold miner.

Chalice Mining (ASX:CHN) and AngloGold Ashanti (ASX:AGG) share prices today:

The post Monsters of Rock: Is it time to be concerned about the health of Dr Copper? appeared first on Stockhead.