Energy & Critical Metals

ANZ says copper supply drought could mean “significantly higher prices” will be needed to rebalance the market

ANZ commodity strategists say copper could become increasingly vulnerable to price shocks as inventories tumble to multi-decade lows. … Read More

The…

- Copper inventories are down around 26% this year, testing multi-year lows

- ANZ commodity strategists say ‘significantly higher prices’ may be needed to rebalance the market in the event of a supply or demand shock

- Rio inks infrastructure agreements to pave way for potential Simandou iron ore development

Prices of copper, nickel, aluminium and zinc have all failed to set the world alight in 2023, something that could slow the energy transition as incentive prices fail to be reached for mines desperately needed to feed the shift to EVs and renewables.

The big culprit has been rising interest rates, economic brittleness globally and a slower than expected return to growth for the Chinese economy.

“Commodity markets have been under pressure in recent time amid a weak economic backdrop. Despite this, there are signs of tightness,” ANZ’s Daniel Hynes and Soni Kumari said in a note yesterday.

“Concerns over demand in China have weighed on sentiment for several months. A weak recovery from a pandemic-induced slowdown has been exacerbated by Beijing’s reluctance to support growth with large fiscal stimulus measures.”

But take a closer look and some pretty bullish fundamentals for base metals destined for a future in your Tesla look a little more supportive than the maudlin sentiment suggested in current pricing.

Supply shocks could well be in our future.

“Even so, demand has remained robust. New sources of growth from clean energy sectors have supported metal demand. Energy has also seen strong demand amid extreme weather conditions,” Hynes and Kumari say.

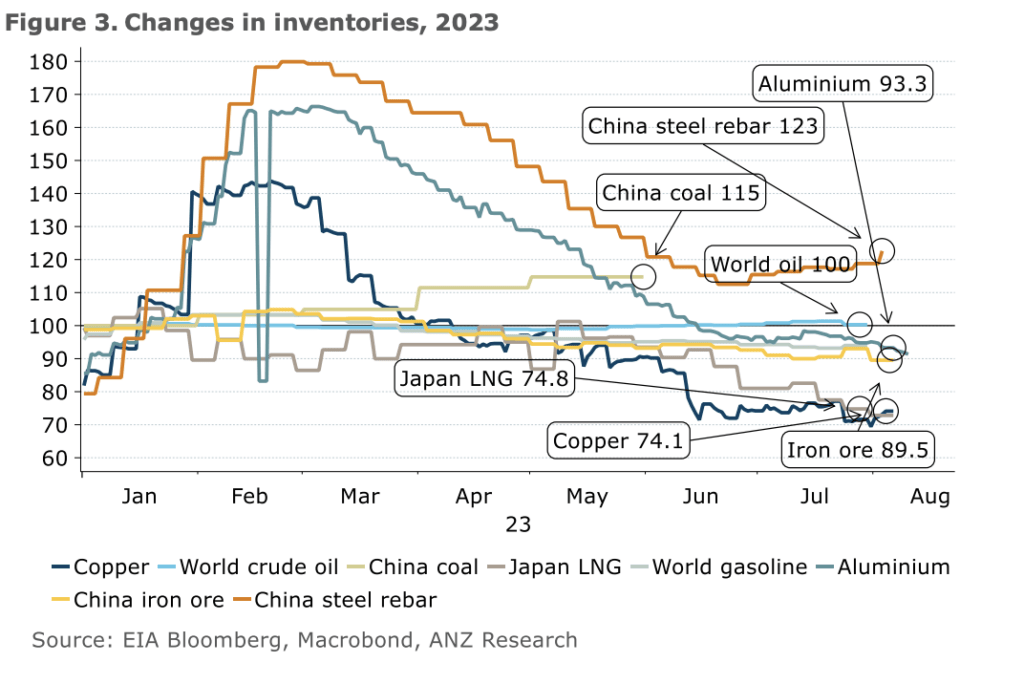

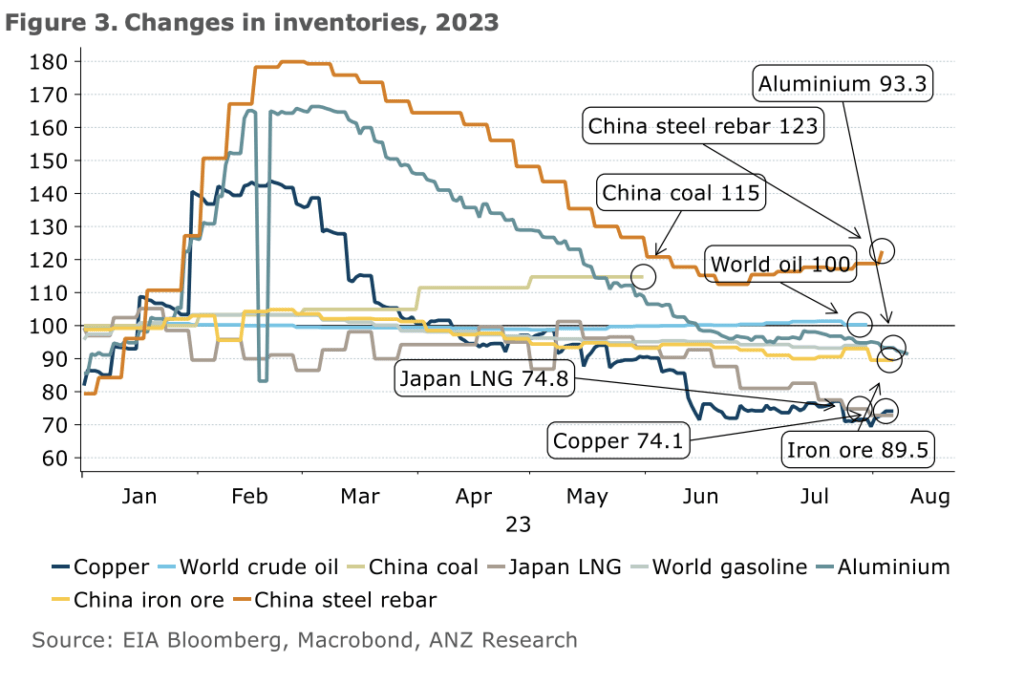

“Inventories have always been a good guide to demand; and after a shaky start to the year, are showing signs of tightness across most markets. There has been a clear drawdown across commodity exchanges and the broader supply chain.

“However, the trends are more discrete across the energy market. In industrial metals, they are now at multi-decade low levels which could trigger price rallies amid supply shocks.”

Price signals

Metals exchanges are now buyers of last resort. They take product not locked up in arrangements between suppliers and customers.

For that reason inventory levels, Hynes and Kumari say, can give a guide on market fundamentals.

“The stockpiling of commodities happens across the industry. Consumers and producers have traditionally carried a certain level of stock as a buffer from sudden supply shocks or an unexpected rise in demand,” they say.

“However, the increasing financialisation of the market has seen the impact of inventory changes diminish.

“Higher interest rates have increased the cost to hold large inventories, while the increasing activity of investors in the futures market has reduced the incentive to enter into direct contracts between supplier and consumer.

“The level of inventories these participants hold has fallen gradually over time. However, short-term changes in stockpiles are uncommon.

“The proliferation of commodity exchanges has enabled traders and investors to see the immediate impact of changes to demand and supply. Commodity exchanges have essentially become the buyer of last resort. Therefore, any changes to their storage levels can provide an immediate guide to the market.”

Copper has been among the starkest decliners, down 26% in 2023, with LME and Shanghai exchange aluminium stocks down 6.7% and portside iron ore in China off over 10%, ANZ assessed.

Copper’s supply plight may be the most obvious, with output from major producer Chile struggling, new mines proving costly to bring online and new discoveries hard to come by.

“Copper inventory, on a days-of-consumption basis, has been trending lower for several years. It’s now at a level that we have only seen four times over the past 20 years,” Hynes and Kumari said.

“At 0.5 days of consumption, an unexpected supply disruption, or sudden pickup in demand could see copper prices rally quickly as the market tries to induce a rebalancing.”

They say “significantly higher prices” may be the only way to rebalance the copper market. INTERESTING INDEED COPPER BULLS.

How are the markets looking?

The materials sector fell 0.49% today as iron ore shares stumbled, with all three of the Pilbara majors in the red.

Battery metals were little better off, with the exception of Allkem (ASX:AKE). It eeked out a 0.28% gain on the news its James Bay lithium resource up in Quebec had gotten a tidy 173% bigger.

Gold miners ran higher with inflation in the States remaining around market expectations and jobless claims rose from 227,000 to 248,000 last week, above a consensus of around 230,000.

Newcrest (ASX:NCM) delivered what could be its last full year financials, paying a US20c per share dividend on a full year profit of US$778m ($1.2b AUD), while Ramelius (ASX:RMS) declared its offer for junior explorer Musgrave Minerals (ASX:MGV) best and final, extending its offer period into September.

Mark Zeptner led 250,000ozpa RMS currently has acceptances from the Musgrave board and around a third of its shareholders. It will enable the gold miner to plug Musgrave 927,000oz Cue assets, including the super high grade Break of Day discovery, into its Mt Magnet operations.

Rio Tinto (ASX:RIO) meanwhile announced late Friday that an agreement had been reached on the infrastructure agreement to develop port infrastructure and multi-use rail over 600km to smooth the development of the massive Simandou mine with it the Republic of Guinea and its Chinese partners.

It opens a pathway to development of the massive West African orebody, the largest undeveloped iron ore deposit in the world with a grade of 65% Fe.

Negotiations are continuing on final investment agreements, while Guinea’s government will also need to approve a final feasibility study before Simandou can be approved.

Monstars share prices today

The post Monsters of Rock: ANZ says copper supply drought could mean “significantly higher prices” will be needed to rebalance the market appeared first on Stockhead.

Uranium Exploration Company Announces Additional Staking in the Athabasca Basin

Source: Streetwise Reports 12/22/2023

Skyharbour Resources Ltd. announced an update from its Canada-based Falcon Project along with additional…

Tesla Launches New Mega Factory Project In Shanghai, Designed To Manufacture 10,000 Megapacks Per Year

Tesla Launches New Mega Factory Project In Shanghai, Designed To Manufacture 10,000 Megapacks Per Year

Tesla has launched a new mega factory…

Giving thanks and taking stock after “a remarkable year”

An end-of-year thank you to our readers, industry colleagues and advertisers before Electric Autonomy breaks from publishing until Jan. 2

The post Giving…