Uncategorized

Kingsland is unlocking the potential of this Northern Territory uranium play

Special Report: With uranium prices continuing to trend upwards the time is right for a company to take a project … Read More

The post Kingsland is unlocking…

With uranium prices continuing to trend upwards the time is right for a company to take a project with a haphazard exploration track record and realise its potential.

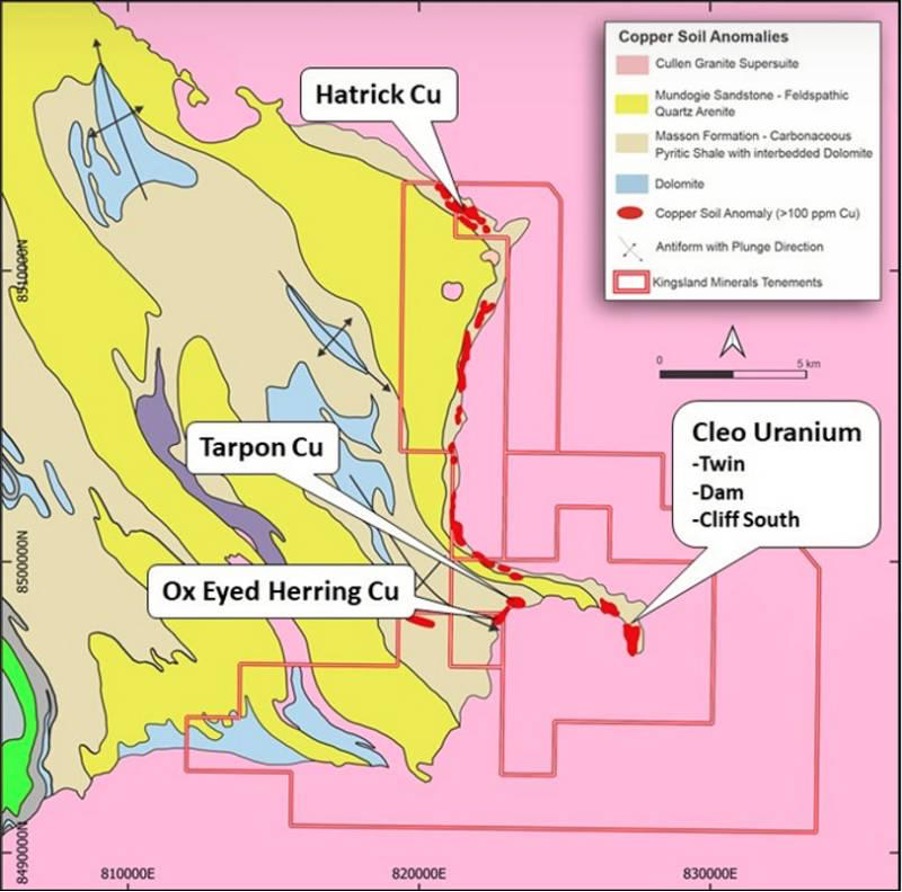

That’s exactly the strategy that Kingsland Minerals (ASX:KNG) is taking with its Allamber project near Pine Creek in the Northern Territory, which has seen a significant amount of exploration and drilling carried out in fits and starts over the past 40 years.

While this work has been sufficient to give the company enough confidence that uranium (and copper) is present – not hard given that enough work was done for a previous owner to define a uranium resource under the older JORC 2004 code, more needs to be done to unlock its potential.

Speaking to Stockhead, managing director Richard Maddocks said that while Allamber had a lot of historical drilling done on it, none of that work had really finished the project.

“It’s always stopped and started due to various factors, uranium price and access to the ground and things like that, but now that we’ve got free reign over there, we’re going to get enough drilling done to build up a resource estimate by this time next year and just realise its potential,” he added.

“There are no Native Title claims or determinations over the project and the Pine Creek area has a long history of mining, a very supportive community, and existing infrastructure and support like roads, accommodation, fuel and drilling companies already available.

“So it’s a good place to do work here and we’ve got no restrictions at all other than the wet season, which starts around November and continues to March or April.”

Drilling off to an impressive start

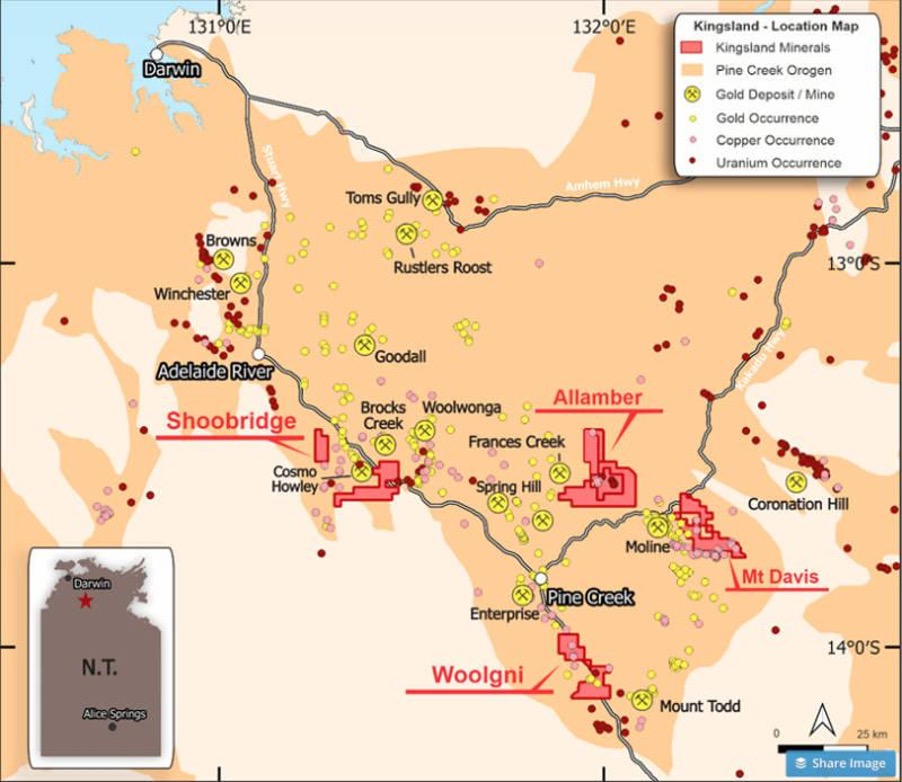

Kingsland has wasted no time getting started on what it set out to do and if the initial results from its maiden drilling at the highly prospective Cleo uranium project within the broader Allamber project area is any indication – it is very much on the right track.

Composite samples from the first 16 holes from the 30 hole drill program returned thick intersections of mineralisation such as 42m grading 679 parts per million (ppm) U3O8 including 8m at 1,655ppm U3O8, 54m at 447ppm U3O8 including 4m at 1,706ppm U3O8, and 16m at 747ppm U3O8.

These very wide, shallow, high-grade results are just what the doctor ordered and represent the perfect foundation for the company to grow the footprint of the Cleo uranium mineralisation, which remains open along strike and at depth.

While the company has completed RC drilling, it still has a rig carrying out about 900m of diamond core drilling.

This work is expected to confirm earlier drilling intersections regarding width and grade, extend known mineralised zones, and provide important geological information to enable a thorough geological interpretation and model to be generated.

Needless to say, the company is already looking to start planning to carry out drilling to target strike extensions at Cleo.

More than just uranium

Uranium is currently the company’s focus thanks to the strong outlook for nuclear power as energy security becomes increasingly important in the international arena.

However, the company’s tenements in Pine Creek host more than just uranium.

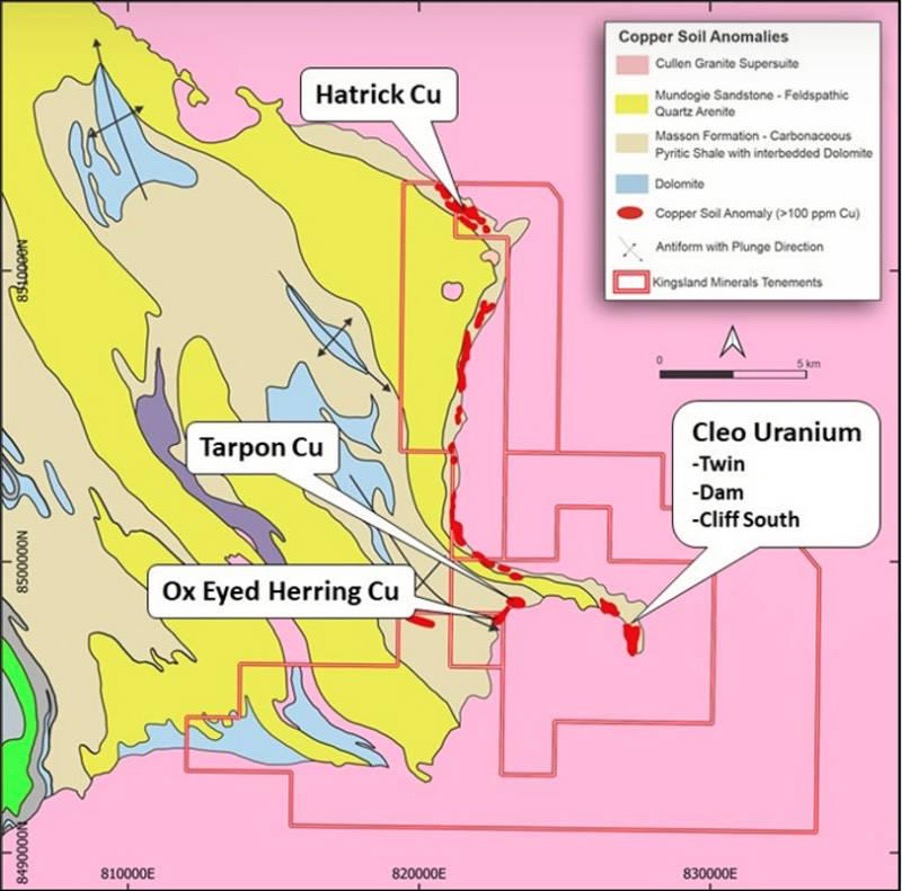

Allamber itself is known to be prospective for copper with previous drilling having returned significant assay results from the Hatrick, Nipper, Tarpon and Ox-Eyed Herring prospects.

Kingsland plans to carry out geophysical surveys along the granite/intrusive contact which was the focus of previous drilling to test for the presence of massive sulphide mineralisation containing copper.

Previous drilling had intersected such sulphides and the Independent Geologist in the IPO prospectus considers there is potential to delineate additional sulphide mineralisation.

But there’s more, Maddocks also pointed out that there is evidence of graphite mineralisation as well.

“The geological information that we’ve seen looks encouraging, so we’ll try and build on that.”

Nor is Allamber the only project in the company’s stable.

Another project on the go

It also owns the Woolgni project in the Northern Territory that is prospective for gold.

“There’s some old gold workings and historical gold hits, which had some high grades,” Maddocks noted.

“And there’s also the early stage Shoobridge lithium project which has potential for pegmatites.

“There’s been some historical mining in the past for things like tin and tantalum, which are found in pegmatites, but there’s been no work done for lithium, so we’re aiming to build on that historical data and try and find some pegmatites.”

Plans are in the works for drilling at each of these projects as well, come the dry season in 2023.

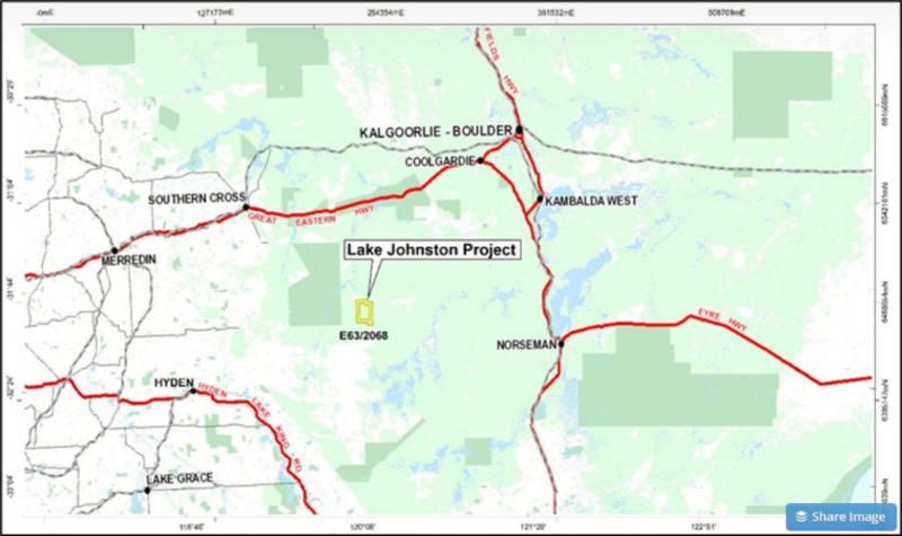

Kingsland also holds the Lake Johnston project in Western Australia that is prospective for nickel and lithium pegmatites.

“We’ll do some early stage exploration work on Lake Johnston later this year as we can work on it during the wet season in the Northern Territory.”

Corporate Strength

Besides its projects, the company’s other strength is its management.

Maddocks is a geologist with over 30 years’ experience in exploration, production, and development of mainly gold and nickel projects.

“Most of my experience has been in Western Australia, but also a bit of a stretch in South America and Papua New Guinea,” he added.

Company chairman Mal Randall has more than 45 years’ experience in corporate, management and marketing in the resource sector.

“He’s a very experienced corporate director who is also a director with Hastings Technology Metals, Argosy Minerals, Magnetite Mines and Ora Gold, and we can utilise his experience and investment contacts as well,” Maddocks added.

The other two non executive directors are Bruno Seneque, who has been the managing director of other ASX-listed companies, and Nick Revell – a geologist with about 30 years’ experience in exploration and development.

Kingsland, which listed in June following a successful $5m initial public offering, also remains cashed up for its exploration programs over at least the next 12months.

This article was developed in collaboration with Kingsland Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

The post Kingsland is unlocking the potential of this Northern Territory uranium play appeared first on Stockhead.