Uncategorized

Kincora Copper’s porphyry hunt strongly supported by investors

Kincora Copper has closed an oversubscribed $2.4m placement that has been cornerstoned by a mining-focused family office and strongly backed … Read More

The…

Kincora Copper has closed an oversubscribed $2.4m placement that has been cornerstoned by a mining-focused family office and strongly backed by all directors. The company is now well funded to advance its next phase of drilling focused on shallow porphyry targets in NSW, in total drilling 13 targets and discovery opportunities across 5 projects. Drilling is scheduled to commence at next month at the brownfield Trundle project.

Kincora Copper (ASX:KCC) has secured $2.4m of new cash, in excess of the targeted $1.8m raising, with a NSW based family-office with mining interests committing to $1m of the total. Directors are also adding more skin to the game, collectively contributing over $130,000 to the raising.

The capital raising, spearheaded by Morgans Corporate and Bridge Street Capital Partners, was scaled back and comprises a two-tranche placement of 43.6 million shares at 5.5c each. Interestingly, Kincora’s shares closed strongly on the TSX Venture Exchange in Canada on Friday at $C0.07/share, the equivalent of 7.7c on the ASX.

The fresh cash injection will boost Kincora’s coffers to approximately $3.6m and be used to fund diamond drilling commencing after the New Year holiday period at the flagship Trundle project in NSW’s exploration hotspot, the Lachlan Fold Belt.

CEO Sam Spring said, “following the oversubscribed offering Kincora is well funded and positioned to commence a high impact and high conviction drilling program.

The program is focused on testing more and shallower targets. In total, drilling 13 standalone targets across 5 projects, including 5 targets at Trundle, that all offer significant scale copper-gold discovery potential.”

Spring highlighted his belief that “the quantum and nature of the cornerstone support from a very reputable NSW family office and directors’ participation added substance to Kincora’s high conviction for very significant results across the NSW portfolio and potential for major new porphyry discoveries at the Trundle project”.

The LFB hosts major mines including Newcrest Mining’s (ASX:NCM) flagship Cadia operation and CMOC’s Northparkes mine.

These major porphyry systems occur in a series of deposits and have often been found in a quick succession of discoveries. For example, the Cadia Ridgeway and Far East deposits’ were discovered by Newcrest within four diamond holes of each other, and at Northparkes the original two open pits (E22 and E27) within a year of each other.

Kincora’s technical director, John Holliday, who led those discoveries at Cadia, is a foremost expert on the region, and recently discussed the company’s results and upcoming plans in an interview with CEO Sam Spring.

Cadia is one of the largest and lowest cost mines globally with an endowment of 50Moz of gold and 9.5Mt of copper, while Northparkes is Australia’s second-largest porphyry mine hosting 5.5Moz gold and 4.5Mt copper.

Hallmarks of neighbouring world-class mines

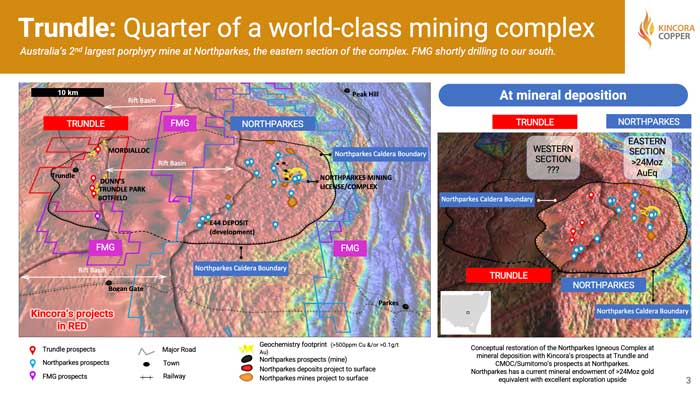

The Trundle project is estimated to host a quarter of the same mineralised system that hosts the Northparkes mine, with Fortescue Metals Group (ASX:FMG) owning and exploring the adjacent southern extension (which hosts 5% of the Northparkes Igneous Complex).

Previous drilling by Kincora has demonstrated large skarn and finger porphyry systems typical of the Cadia and Northparkes mines.

Kincora has made three discoveries at the Trundle project so far and has pinpointed a further five discovery opportunities, with increased confidence in the next phase of drilling driven by recent extensive technical reviews and results to date.

The first hole drilled into the Eastern and Central Zones intersected 51m at 1.17 grams per tonne (g/t) gold and 0.54% copper, with follow up drilling returning ore grade intervals.

Meanwhile, the most recent drill hole into the Southern Extension Zone delivered 34m at 1.45g/t gold and 0.25% copper.

In the next round of high impact and conviction drilling, the company will test five large-scale separate but adjacent zones within an existing 3.2km mineralised corridor at Trundle.

To put the scale of this 3.2km mineralised system and target zone into perspective, it is the same size as Alkane Resources’ (ASX:ALK) Boda project, which hosts over 10 million oz gold equivalent, and compares favourably to the 4.5km strike at Northparkes.

The money raised in the placement will also be used to fund diamond and reverse circulation drilling at the Condobolin project, diamond drilling at the Nevertire and Nyngan projects and aircore drilling at the Fairholme project.

Across its entire portfolio, Kincora has a pipeline of 13 standalone discovery opportunities, with each prospect showing strong potential for a significant scale copper-gold discovery.

This article was developed in collaboration with Kincora Copper, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

The post Kincora Copper’s porphyry hunt strongly supported by investors appeared first on Stockhead.