Uncategorized

If your ETF performed badly last year, it’s name and ticker code may be… too long?

Stockspot said Australian ETFs with longer names tend to have higher fees Over the past year ETFs with shorter names … Read More

The post If your ETF…

- Stockspot said Australian ETFs with longer names tend to have higher fees

- Over the past year ETFs with shorter names have fallen less

- Lucky number 8 often in ticker codes of ASX stocks with Chinese links

What is in a name? If you ever had a baby you know the angst of choosing a name. Do you go unusual, one with a special meaning, or choose one of the top 10 most popular so when your child goes to school they’re guaranteed to have at least one other in the class with their name?

What about spelling – is it Chrissie, Christina or Khrystynah?

Spare a thought for companies or ETF issuers choosing a name or ticker code. According to Stockspot a name and ticker code can have bigger repercussions than you may think.

ETFs with longer names have higher fees

Stockspot, an online investment advisor which builds custom portfolios using ETFs, said ETF tickers can become synonymous with the name of the fund.

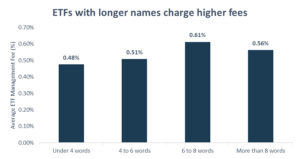

Stockspot senior manager of investments and business initiatives and ticker guru Marc Jocum has crunched the numbers and told Stockhead Aussie ETFs with longer names tend to have higher fees.

In fact every extra word seems to add eight basis points or 0.08% per annum in fees.

“What this suggests is that a longer ETF name relates to active management, use of derivatives, leveraging, or hedging – all of which all add layers of complexity, and thus, higher fees,” Jocum said.

ETFs with shorter names lose less

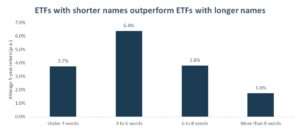

ETF name length can also give a clue into performance too. Jocum said over the past year, ETFs with shorter names lost much less than ETFs with longer names.

“ETFs with under four words lost on average 4.8% in 2022 whereas ETFs with more than eight words lost 10%.

“Over a five year period, ETFs with under six words gained on average up to 6.4% per year while ETFs with more than eight words only returned 1.8% per year.”

Catchy name can add to popularity

Jocum said if the ETF ticker conveys the idea, investors can be compelled to invest in it given its stickiness and memorability.

Over the years Australian ETF issuers have come up with some pretty good ETF names. Here’s just a few:

- BetaShares Future Of Food ETF – IEAT (ASX:IEAT)

- Global X Battery Tech and Lithium ETF – ACDC (ASX:ACDC)

- BetaShares Global Cybersecurity ETF – HACK (ASX:HACK)

-

BetaShares Global Agriculture Companies ETF – Currency Hedged (ASX:FOOD)

- Global X Physical Gold ETF (ASX:GOLD) – worth noting GOLD is actually backed by physical gold bullion.

- Global X Uranium ETF – ATOM (ASX:ATOM)

What about company ticker codes

Some of the company ticker today’s that have caught our eye at Stockhead include:

- A2 Milk Company (ASX:A2M)

- Marley Spoon (ASX:MMM)

- Bounty Oil and Gas (ASX:BUY)

- Lithium Energy (ASX:LEL) – Looks like LOL with a Google search showing LEL as laugh even louder

- Brisbane Broncos (ASX:BBL) – Are they playing footy or cricket? BBL is short for Big Bash League

What’s involved in choosing a ticker code?

ASX senior manager, listed company services Giri Tenneti said ticker companies usually look for the closest thing to the acronym of their name, for example Commonwealth Bank of Australia (ASX:CBA) or a contraction of their name Qantas (ASX:QAN).

Tenneti said in some cases, their business name is an acronym, such as Broken Hill Propriety Company BHP (ASX:BHP).

Some companies, like A2B Australia (ASX:A2B) and Life 360 (ASX:360), prefer numbers in their ticker code.

“We introduced the capacity for alphanumeric around 2014,” she said.

“Choice is solely with the company, but you have to check it isn’t already taken.”

To avoid confusion, the ASX also have a policy of barring a code from use for at least 12 months since the last company that used it delisted.

“You can then reserve it while you’re going through the preparation for listing,” Tenneti said

She said there are no costs in choosing ticker codes which might seem premium like GOLD or BUY, so it’s not like a personalised number plate.

Lucky number 8

Tenneti said a good ticker reinforces the company brand and becomes well known in its own right, such as WES for Wesfarmers or WBC for Westpac Banking Corporation.

“It’s worth putting some thought into the ticker and reserving it early,” she said.

“We have lots of Chinese or China-facing companies with 8 in their code as it is considered a lucky number.”

Among companies with an 8 in their number and Chinese links are manganese and lithium play Accelerate Resources (ASX:AX8), Australasian Gold (ASX:A8G) and Helios Energy (ASX:HE8).

All three companies have managing directors with a Chinese background.

Patience for ticker of choice

Tenneti said if the ticker you want isn’t available, you can grab it when it becomes available.

She said ZIP wasn’t available when the BNPL company ZIP (ASX:ZIP) listed.

“But the company that had the code eventually delisted, so ZIP (which had formerly had the ticker Z1P) changed to ZIP when it became available, ” she said.

She said similarly, AGL was unavailable for a long time, but eventually the utility company AGL Energy (ASX:AGL) was able to secure that code.

“Luckily for ASX, there was a long lead time to listing, so we reserved ASX early in the piece,” she said.

She said the ASX is also careful to ensure a ticker code doesn’t misrepresent the company.

“While it isn’t common, ASX would be sensitive in some situations to granting a code that may facilitate ‘passing off’ or some other form of misinformation,” she said.

“It’s a judgement call, but not often needed to be exercised.”

Choosing a ticker code takes work

Betashares chief commercial officer Ilan Israelstam said coming up with their ticker codes is a very comprehensive process and involves a broad range of team members.

“In a nutshell, we try to use tickers that sum up the essence of a fund in four letters, which means a considerable amount of analysis, research, and engagement with our clients to ensure they are truly memorable,” he said.

“Given the amount of time and effort it takes to come up with these tickers, we are proud of all of them.”

He said some standouts for him include HACK, FOOD and ERTH.

“Apart from the creative side of things, the ASX has a number of rules that determines the construction of a ticker code and its admission to the ASX,” he said.

“As a result, we work constructively with the ASX to bring our creativity to life in a way that aligns with the high standards contained in the governing AQUA rules.”

The post If your ETF performed badly last year, it’s name and ticker code may be… too long? appeared first on Stockhead.