Uncategorized

Horse Well yields more IOCG potential for Cohiba

Special Report: Cohiba Minerals has boosted confidence in its Horse Well Project after drilling intersected the same host granite found … Read More

The…

Cohiba Minerals has boosted confidence in its Horse Well Project after drilling intersected the same host granite found at the nearby BHP Oak Dam and OZ Minerals Carrapateena iron oxide-copper-gold (IOCG) deposits.

The latest news from Cohiba (ASX:CHK) comes only days after Fitch forecast copper prices reaching $US11,500/t by 2031 “as a long-term structural deficit emerges” due to the “very strong” long-term demand outlook. That price is up from about $US7749/t today and is why some of the world’s biggest miners have been jostling for more red metal assets essential for decarbonisation efforts.

The latest news from Horse Well is also just a month after Cohiba intersected more visible copper mineralisation at the prospect.

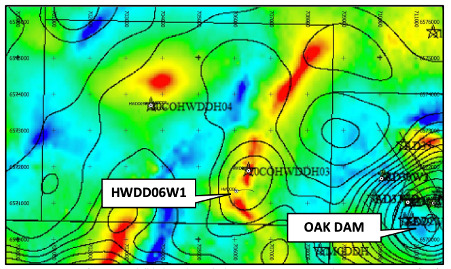

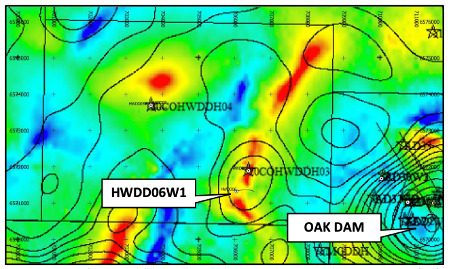

Just 5km from BHP’s (ASX:BHP) up-and-coming Oak Dam deposit the drill hole (HWDD06W1) was completed to a target depth of 1,504.1m and intersected Donington Granite. This is the host rock to both the globally significant Oak Dam and OZ Minerals’ (ASX:OZL) $1bn Carrapateena copper-gold mine within South Australia’s mineral rich Gawler Craton, the world’s top spot for IOCG deposits.

Cohiba says initial interpretation suggests a possible major fault, with the prospective area lying to the north of the fault.

This gain in geological and structural understanding will help Cohiba refine its overall exploration model for Horse Well as it searches for further evidence of IOCG-style mineralisation.

The company is now looking forward to receiving the drill core sample assays to add to its knowledge of the prospect.

Hot target

CEO Andrew Graham said: “The Horse Well Prospect represents a key IOCG target zone within the Gawler Craton and we are committed to investigating it to the fullest extent possible.

“HWDD06 is considered to have great potential and was earmarked for investigation following encouraging results from HWDD03, HWDD04, HWDD05 and HWDD05W. Given the considerable target depth, we have ensured that all technical information at our disposal has been assessed in detail to maximise our potential for exploration success.”

Big players’ M&A

The world’s largest producers are all bullish about the red metal, forecasting dramatically increased demand as the world transitions to cleaner energy.

Last week BHP CEO Mike Henry told a Financial Times mining conference there was a risk of “a mismatch between the timing of increase in demand and when supply meets that demand (of copper, nickel and lithium)”.

In August BHP’s $8.4b offer for OZ Minerals was roundly rejected by shareholders, fuelling speculation the mining giant might come back with a more attractive bid.

This was followed in September by Rio Tinto (ASX:RIO) reaching a final agreement to acquire all Turquoise Hill Resources, which owns a large copper mine in Mongolia as part of efforts to add to its stores of the industrial metal.

This article was developed in collaboration with Cohiba Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

The post Horse Well yields more IOCG potential for Cohiba appeared first on Stockhead.