Uncategorized

High Voltage: Lithium miners dominate reporting season, large stockpile of DRC cobalt spells danger for metal prices

US$1.5bn of copper and cobalt is being stockpiled in the DRC due to a dispute, and if it hits the … Read More

The post High Voltage: Lithium miners dominate…

- Reporting season wrap: PLS announces maiden divvy on $1.24bn NPAT, AKE and MIN also enjoy skyrocketing lithium profits

- +US$1.5bn of copper and cobalt is being stockpiled in the DRC due to a dispute

- If it hits the market cobalt prices will suffer, Bloomberg says

Our High Voltage column wraps all the news driving ASX stocks with exposure to lithium, cobalt, graphite, nickel, rare earths, manganese, magnesium, and vanadium.

Lithium miners dominate reporting season

Pilbara Minerals (ASX:PLS) announced its maiden dividend — a payout of 11c a share or $329.8m — after posting a more than 900% rise in net profit after tax to $1.24 billion.

The profit print was more than double the combined profits of Australia’s three ASX 100 listed gold miners, Newcrest (ASX:NCM), Northern Star (ASX:NST) and Evolution (ASX:EVN).

Allkem (ASX:AKE) and MinRes (ASX:MIN) posted some handy battery metals profits as well, with MinRes’ lithium contribution to EBITDA rising from $61 million in H1 FY22 to $756m of its $939m total.

Allkem’s group revenue for the half year increased almost 3x to US$558m ($830m) on the previous corresponding period.

“Excellent operating performance and highly supportive market conditions” generated consolidated net profit after tax of US$219m ($330m).

AKE has existing net cash balance of US$552m ($820m) to fully fund committed projects, it says.

A couple of new producers will be joining them soon, with Core Lithium (ASX:CXO) and Sayona Mining (ASX:SYA) ramping up at their respective hard rock lithium projects.

PLS, AKE, MIN share price charts

+US$1.5bn of copper and cobalt is being stockpiled in the DRC

A brawl between Chinese mining giant CMOC and its Congolese state-owned partner over royalty payments means its exports from the country have been blocked since mid-July.

Meanwhile, its tier 1 Tenke Fungurume mine has kept running at close to full clip, “simply stockpiling the extra metal until it can resume shipments”, people familiar with the matter told Bloomberg.

The 250,000tpa copper, 20,000tpa cobalt mine is the #2 biggest copper producer in the DRC.

Bloomberg estimates an ever-growing stash of ~120,000 tons of copper and ~12,500 tons of cobalt is stuck waiting to leave the country.

That’s about 7% of total global monthly copper production, “and is unlikely to affect international prices when it does hit the market”.

But for cobalt, 12,500t represents ~7% of total global annual production. If the stockpile is dumped on the market it could further weaken already soft prices for the battery metal.

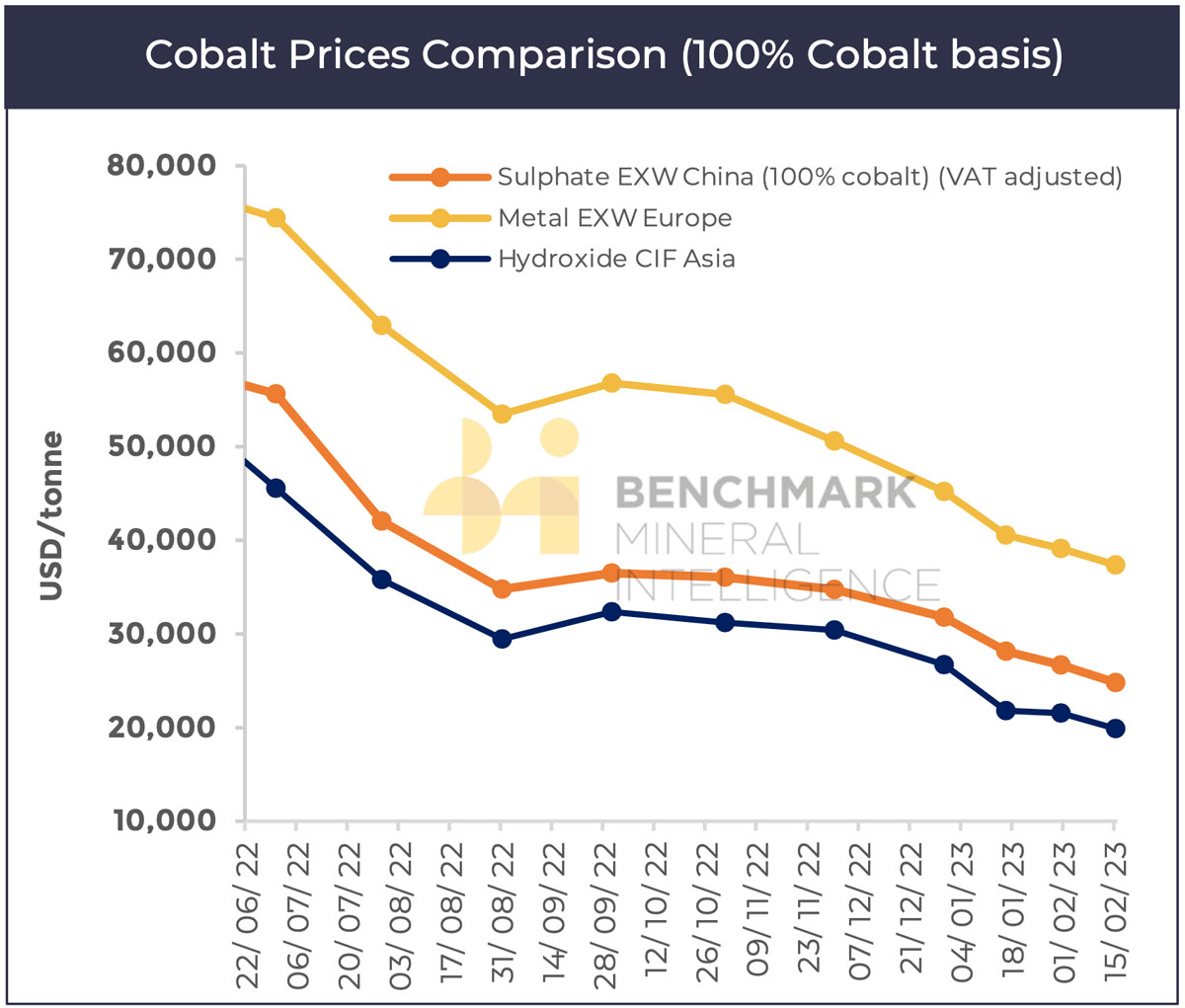

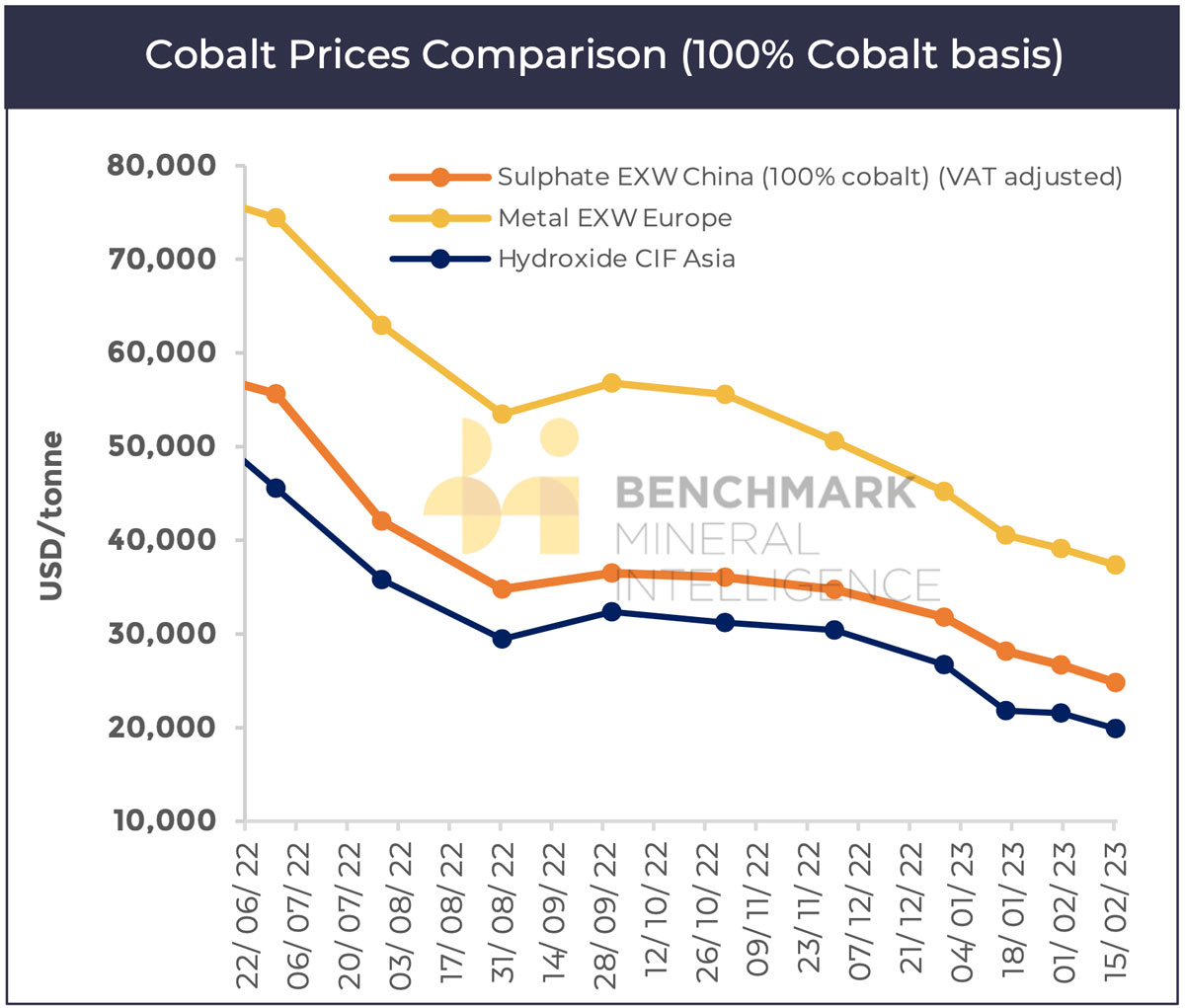

The cobalt metal price has continued its bearish run in 2023, driven by soft demand and negative sentiment as major raw material producers, such as CMOC, announce sizeable ramp ups at their assets.

Here’s how a basket of ASX stocks with exposure to lithium, cobalt, graphite, nickel, rare earths, magnesium, manganese, and vanadium is performing>>>

Battery metals stocks missing from our list? Shoot a mail to [email protected].

| CODE | COMPANY | 1 WEEK RETURN % | 1 MONTH RETURN % | 6 MONTH RETURN % | 1 YEAR RETURN % | PRICE | MARKET CAP |

|---|---|---|---|---|---|---|---|

| MTM | Mtmongerresources | 103% | 74% | 3% | -9% | 0.15 | $5,987,543 |

| ASO | Aston Minerals | 36% | 22% | 28% | -14% | 0.12 | $110,239,562 |

| BUX | Buxton Resources | 29% | 76% | 83% | 110% | 0.22 | $35,008,553 |

| STK | Strickland Metals | 28% | 8% | -18% | -33% | 0.041 | $62,197,150 |

| LSR | Lodestar Minerals | 25% | 0% | -29% | -50% | 0.005 | $8,692,187 |

| GBR | Greatbould Resources | 20% | 10% | -9% | -31% | 0.096 | $40,941,671 |

| VRC | Volt Resources | 20% | -14% | -43% | -14% | 0.012 | $46,553,087 |

| SYA | Sayona Mining | 13% | -17% | -17% | 107% | 0.2325 | $1,956,423,216 |

| TAR | Taruga Minerals | 13% | -18% | -31% | -50% | 0.018 | $12,708,482 |

| CZL | Cons Zinc | 11% | 5% | -13% | -20% | 0.02 | $9,647,156 |

| WC1 | Westcobarmetals | 11% | -11% | 19% | -3% | 0.155 | $13,389,480 |

| PVT | Pivotal Metals | 11% | 5% | 35% | -24% | 0.042 | $18,611,171 |

| NMT | Neometals | 10% | -1% | -40% | -31% | 0.87 | $444,956,647 |

| PTR | Petratherm | 10% | -8% | -4% | 116% | 0.069 | $16,182,082 |

| AM7 | Arcadia Minerals | 9% | 0% | -14% | 17% | 0.24 | $11,207,494 |

| AXN | Alliance Nickel | 9% | -2% | -15% | 61% | 0.098 | $62,965,616 |

| BC8 | Black Cat Syndicate | 8% | -3% | 11% | -33% | 0.39 | $103,799,262 |

| QEM | QEM Limited | 8% | 13% | -9% | 39% | 0.215 | $27,028,714 |

| BSX | Blackstone | 7% | -12% | -29% | -69% | 0.15 | $68,640,845 |

| KOB | Kobaresourceslimited | 7% | -6% | 7% | 0% | 0.15 | $11,020,000 |

| AZI | Altamin Limited | 7% | 1% | -16% | 11% | 0.075 | $30,162,190 |

| AVL | Aust Vanadium | 7% | 3% | -30% | 0% | 0.032 | $139,636,007 |

| BM8 | Battery Age Minerals | 7% | -2% | -2% | 14% | 0.49 | $35,624,718 |

| MLS | Metals Australia | 6% | -12% | -12% | 22% | 0.05 | $30,351,810 |

| AQD | Ausquest Limited | 6% | -6% | -11% | -11% | 0.017 | $14,027,537 |

| FRB | Firebird Metals | 6% | -11% | -19% | -47% | 0.17 | $12,067,927 |

| NKL | Nickelx | 6% | -4% | -47% | -51% | 0.071 | $5,902,733 |

| GCM | Green Critical Min | 6% | -10% | 26% | 46% | 0.018 | $17,756,615 |

| PGM | Platina Resources | 6% | -17% | -39% | -63% | 0.019 | $12,152,016 |

| RVT | Richmond Vanadium | 5% | 39% | 0% | 0% | 0.39 | $32,327,927 |

| IMI | Infinitymining | 5% | -22% | 3% | 14% | 0.2 | $14,913,272 |

| ARN | Aldoro Resources | 5% | 0% | -14% | -45% | 0.21 | $18,065,971 |

| PMT | Patriotbatterymetals | 5% | 9% | 0% | 0% | 1.5 | $233,100,546 |

| BNR | Bulletin Res | 5% | 12% | -24% | -12% | 0.11 | $32,295,021 |

| LTR | Liontown Resources | 5% | -17% | -22% | -6% | 1.35 | $2,890,967,842 |

| OCN | Oceanalithiumlimited | 5% | -15% | -51% | 0% | 0.34 | $12,562,830 |

| NWC | New World Resources | 5% | -6% | 21% | -18% | 0.046 | $98,958,126 |

| QPM | Queensland Pacific | 4% | -12% | -35% | -25% | 0.097 | $167,649,401 |

| NVX | Novonix Limited | 4% | -14% | -35% | -70% | 1.545 | $730,161,933 |

| AML | Aeon Metals . | 4% | -7% | -13% | -46% | 0.026 | $28,506,416 |

| GLN | Galan Lithium | 4% | -6% | -7% | -15% | 1.16 | $343,745,254 |

| CMX | Chemxmaterials | 4% | -6% | -26% | -26% | 0.145 | $7,345,863 |

| FTL | Firetail Resources | 4% | -3% | -48% | 0% | 0.145 | $9,750,000 |

| WR1 | Winsome Resources | 3% | -8% | 642% | 478% | 1.965 | $320,353,219 |

| KNI | Kunikolimited | 3% | -18% | -42% | -38% | 0.465 | $23,502,380 |

| PLL | Piedmont Lithium Inc | 3% | 2% | 5% | 40% | 0.955 | $385,173,310 |

| LRV | Larvottoresources | 3% | -16% | -33% | -18% | 0.16 | $11,097,029 |

| CHN | Chalice Mining | 3% | 1% | 36% | -15% | 6.26 | $2,269,976,580 |

| WIN | Widgienickellimited | 3% | -7% | 18% | 9% | 0.355 | $86,599,426 |

| EMN | Euromanganese | 3% | -12% | -22% | -33% | 0.2825 | $69,587,259 |

| PSC | Prospect Res | 3% | 65% | 90% | 326% | 0.19 | $87,829,298 |

| NC1 | Nicoresourceslimited | 3% | -10% | -35% | -10% | 0.57 | $48,358,751 |

| VUL | Vulcan Energy | 3% | -14% | -21% | -27% | 6.305 | $889,298,866 |

| PGD | Peregrine Gold | 2% | -20% | -43% | -15% | 0.43 | $16,668,042 |

| A11 | Atlantic Lithium | 2% | -7% | 0% | 0% | 0.65 | $384,645,954 |

| AGY | Argosy Minerals | 2% | 4% | 81% | 124% | 0.695 | $983,085,249 |

| FGR | First Graphene | 2% | 1% | -23% | -43% | 0.1 | $61,038,221 |

| ARR | American Rare Earths | 2% | 11% | 2% | -32% | 0.25 | $111,595,200 |

| PRL | Province Resources | 2% | -10% | -55% | -51% | 0.054 | $63,800,630 |

| AS2 | Askarimetalslimited | 2% | -12% | 55% | 64% | 0.575 | $28,213,592 |

| MMC | Mitremining | 2% | 5% | 131% | 50% | 0.3 | $10,975,456 |

| PEK | Peak Rare Earths | 2% | 39% | 17% | -9% | 0.61 | $123,945,896 |

| EVG | Evion Group NL | 2% | -3% | -37% | -38% | 0.062 | $16,484,377 |

| EUR | European Lithium | 1% | -18% | -21% | -17% | 0.069 | $98,548,264 |

| LLI | Loyal Lithium | 1% | -27% | -9% | 36% | 0.36 | $19,631,700 |

| SYR | Syrah Resources | 1% | -22% | 9% | 36% | 1.865 | $1,186,881,134 |

| CXO | Core Lithium | 0% | -18% | -34% | 22% | 0.9225 | $1,725,165,618 |

| MIN | Mineral Resources. | 0% | -11% | 26% | 83% | 81.985 | $15,263,371,394 |

| OZL | OZ Minerals | 0% | 0% | 8% | 12% | 28.01 | $9,387,736,729 |

| VIA | Viagold Rare Earth | 0% | 0% | 0% | 0% | 2 | $166,624,808 |

| INF | Infinity Lithium | 0% | -16% | -34% | -22% | 0.105 | $50,885,130 |

| PAM | Pan Asia Metals | 0% | -1% | -23% | -24% | 0.37 | $54,336,568 |

| QXR | Qx Resources Limited | 0% | -17% | 29% | 29% | 0.04 | $34,080,768 |

| GSR | Greenstone Resources | 0% | -17% | -68% | -26% | 0.025 | $26,568,937 |

| LPD | Lepidico | 0% | 0% | -46% | -50% | 0.015 | $106,928,804 |

| LKE | Lake Resources | 0% | -25% | -48% | -32% | 0.615 | $830,667,651 |

| AVZ | AVZ Minerals | 0% | 0% | 0% | 5% | 0.78 | $2,752,409,203 |

| RLC | Reedy Lagoon Corp. | 0% | -20% | -47% | -68% | 0.008 | $4,533,757 |

| CLA | Celsius Resource | 0% | -11% | 31% | -29% | 0.017 | $31,572,469 |

| ADV | Ardiden | 0% | -13% | 0% | -46% | 0.007 | $18,818,347 |

| NTU | Northern Min | 0% | 2% | 2% | -16% | 0.043 | $213,261,128 |

| CWX | Carawine Resources | 0% | -17% | -5% | -53% | 0.1 | $19,681,747 |

| TKL | Traka Resources | 0% | -13% | 0% | -36% | 0.007 | $5,059,422 |

| IPT | Impact Minerals | 0% | -10% | 13% | -16% | 0.009 | $24,813,706 |

| VML | Vital Metals Limited | 0% | -11% | -44% | -47% | 0.024 | $127,347,594 |

| FFX | Firefinch | 0% | 0% | 0% | -11% | 0.2 | $236,569,315 |

| ATM | Aneka Tambang | 0% | 5% | -4% | -4% | 1.1 | $1,434,014 |

| ALY | Alchemy Resource | 0% | -9% | -26% | 19% | 0.0155 | $18,849,220 |

| BMM | Balkanminingandmin | 0% | 6% | 95% | 31% | 0.38 | $17,013,365 |

| G88 | Golden Mile Res | 0% | -13% | -40% | -60% | 0.021 | $4,296,385 |

| EMS | Eastern Metals | 0% | -16% | -49% | -65% | 0.071 | $2,773,573 |

| RAG | Ragnar Metals | 0% | 7% | -64% | -50% | 0.016 | $6,066,958 |

| ENT | Enterprise Metals | 0% | -11% | -27% | -47% | 0.008 | $5,640,646 |

| ENV | Enova Mining Limited | 0% | -20% | -33% | -45% | 0.012 | $4,691,152 |

| AVW | Avira Resources | 0% | 20% | -25% | -40% | 0.003 | $6,401,370 |

| ODE | Odessa Minerals | 0% | -17% | -29% | -8% | 0.012 | $8,483,461 |

| XTC | Xantippe Res | 0% | 9% | -40% | -25% | 0.006 | $63,480,598 |

| LIN | Lindian Resources | 0% | -10% | -16% | 594% | 0.215 | $215,107,600 |

| ETM | Energy Transition | 0% | -6% | -30% | -16% | 0.047 | $63,719,969 |

| VTM | Victory Metals | 0% | -7% | -20% | 18% | 0.2 | $10,733,739 |

| JRL | Jindalee Resources | 0% | 25% | -3% | -3% | 2.52 | $140,578,467 |

| ESS | Essential Metals | -1% | -3% | 13% | 55% | 0.495 | $132,445,514 |

| JMS | Jupiter Mines. | -1% | -1% | 22% | 6% | 0.2375 | $470,157,848 |

| RNU | Renascor Res | -1% | -21% | 6% | -15% | 0.2125 | $533,275,575 |

| TVN | Tivan Limited | -1% | -1% | -25% | 37% | 0.082 | $116,627,131 |

| INR | Ioneer | -1% | -16% | -43% | -31% | 0.375 | $776,385,159 |

| ASN | Anson Resources | -1% | -34% | -28% | 70% | 0.1875 | $224,074,587 |

| LMG | Latrobe Magnesium | -1% | -4% | -18% | -18% | 0.072 | $118,499,832 |

| GT1 | Greentechnology | -1% | -31% | -8% | -11% | 0.67 | $123,026,263 |

| KZR | Kalamazoo Resources | -1% | -27% | -27% | -45% | 0.165 | $25,299,294 |

| EMH | European Metals Hldg | -2% | -7% | -16% | -46% | 0.62 | $74,968,460 |

| OMH | OM Holdings Limited | -2% | 2% | 15% | -16% | 0.7725 | $579,819,320 |

| MRC | Mineral Commodities | -2% | -12% | -31% | -47% | 0.061 | $42,870,268 |

| PLS | Pilbara Min | -2% | -16% | 16% | 51% | 4.13 | $12,591,634,587 |

| MRR | Minrex Resources | -2% | -24% | -47% | -47% | 0.0295 | $32,546,025 |

| AKE | Allkem Limited | -2% | -19% | -19% | 24% | 11.295 | $7,116,264,240 |

| IGO | IGO Limited | -2% | -18% | 0% | 19% | 13.015 | $9,776,327,466 |

| BRB | Breaker Res NL | -2% | -16% | 19% | 19% | 0.28 | $89,830,473 |

| MAN | Mandrake Res | -2% | 11% | 18% | 16% | 0.052 | $29,834,996 |

| SLZ | Sultan Resources | -2% | -32% | -57% | -65% | 0.052 | $4,330,788 |

| CAI | Calidus Resources | -2% | -19% | -63% | -68% | 0.235 | $101,096,693 |

| BCA | Black Canyon Limited | -2% | -13% | -15% | -2% | 0.235 | $10,537,981 |

| ZNC | Zenith Minerals | -2% | -10% | -28% | -31% | 0.22 | $79,133,860 |

| EGR | Ecograf Limited | -2% | 0% | -45% | -61% | 0.21 | $94,570,026 |

| ARU | Arafura Rare Earths | -2% | 4% | 93% | 219% | 0.59 | $1,267,027,094 |

| KTA | Krakatoa Resources | -3% | -10% | -40% | -10% | 0.038 | $13,443,687 |

| WMG | Western Mines | -3% | 6% | 16% | 9% | 0.185 | $7,385,850 |

| LYC | Lynas Rare Earths | -3% | -11% | -10% | -15% | 8.11 | $7,213,430,296 |

| POS | Poseidon Nick | -3% | -12% | -36% | -59% | 0.036 | $122,545,112 |

| M2R | Miramar | -3% | -11% | -47% | -58% | 0.071 | $5,018,404 |

| LPI | Lithium Pwr Int | -3% | -26% | -43% | -38% | 0.35 | $204,456,707 |

| IXR | Ionic Rare Earths | -3% | -8% | -31% | -32% | 0.034 | $137,991,172 |

| TON | Triton Min | -3% | -6% | 26% | 10% | 0.034 | $45,631,878 |

| CRR | Critical Resources | -3% | -5% | 5% | -35% | 0.0485 | $77,926,298 |

| S32 | South32 Limited | -3% | -8% | 3% | -6% | 4.345 | $19,614,234,573 |

| DM1 | Desert Metals | -3% | -20% | -40% | -59% | 0.16 | $11,590,572 |

| TMT | Technology Metals | -3% | -10% | -3% | -3% | 0.305 | $63,996,490 |

| PNN | Power Minerals | -3% | -17% | -15% | 11% | 0.44 | $29,259,566 |

| BKT | Black Rock Mining | -3% | -12% | 0% | -37% | 0.145 | $142,483,385 |

| WC8 | Wildcat Resources | -3% | -6% | 7% | -3% | 0.029 | $18,536,636 |

| HRE | Heavy Rare Earths | -4% | 4% | -44% | 0% | 0.135 | $8,328,310 |

| ILU | Iluka Resources | -4% | -7% | -4% | 4% | 10.31 | $4,338,557,262 |

| NIC | Nickel Industries | -4% | -10% | -6% | -36% | 0.9825 | $2,870,762,052 |

| ABX | ABX Group Limited | -4% | -4% | -4% | -4% | 0.125 | $27,948,852 |

| AZL | Arizona Lithium | -4% | -15% | -31% | -47% | 0.0605 | $146,550,278 |

| LEG | Legend Mining | -4% | 12% | 20% | -27% | 0.048 | $132,246,515 |

| OM1 | Omnia Metals Group | -4% | 41% | 60% | 0% | 0.24 | $7,263,101 |

| TEM | Tempest Minerals | -4% | -15% | -41% | 0% | 0.023 | $11,649,566 |

| SCN | Scorpion Minerals | -4% | -22% | -22% | 1% | 0.069 | $23,853,727 |

| BYH | Bryah Resources | -4% | -8% | -19% | -53% | 0.022 | $5,906,323 |

| CDT | Castle Minerals | -4% | -4% | -35% | -53% | 0.022 | $21,988,846 |

| WKT | Walkabout Resources | -5% | 0% | -39% | -47% | 0.105 | $58,113,236 |

| LLL | Leolithiumlimited | -5% | -18% | -6% | 0% | 0.515 | $498,261,741 |

| KFM | Kingfisher Mining | -5% | -48% | 5% | 33% | 0.305 | $16,383,075 |

| AZS | Azure Minerals | -5% | -8% | 32% | -21% | 0.29 | $95,296,784 |

| CAE | Cannindah Resources | -5% | -17% | -22% | -37% | 0.19 | $103,966,291 |

| CZN | Corazon | -5% | -17% | -10% | -34% | 0.019 | $11,596,281 |

| LNR | Lanthanein Resources | -5% | -10% | -60% | -27% | 0.019 | $21,309,936 |

| LNR | Lanthanein Resources | -5% | -10% | -60% | -27% | 0.019 | $21,309,936 |

| CNB | Carnaby Resource | -5% | 9% | 21% | -26% | 1.11 | $162,188,897 |

| IPX | Iperionx Limited | -5% | -3% | -13% | -1% | 0.875 | $151,591,541 |

| LIT | Lithium Australia | -6% | -14% | -51% | -63% | 0.0405 | $48,847,667 |

| EFE | Eastern Resources | -6% | -11% | -48% | -69% | 0.016 | $19,871,143 |

| BOA | Boadicea Resources | -6% | -10% | -33% | -52% | 0.094 | $7,341,693 |

| WA1 | Wa1Resources | -6% | -28% | 578% | 455% | 1.22 | $43,951,595 |

| GAL | Galileo Mining | -6% | -16% | -23% | 300% | 0.76 | $149,206,820 |

| VHM | Vhmlimited | -6% | -12% | 0% | 0% | 0.91 | $127,708,178 |

| MQR | Marquee Resource | -6% | -23% | -62% | -70% | 0.03 | $9,816,225 |

| EVR | Ev Resources | -6% | -6% | -52% | -68% | 0.015 | $14,039,761 |

| RXL | Rox Resources | -6% | -24% | -42% | -66% | 0.145 | $32,531,368 |

| REE | Rarex Limited | -6% | -31% | -20% | -50% | 0.0505 | $28,969,329 |

| AOU | Auroch Minerals | -7% | -5% | -16% | -43% | 0.057 | $24,387,173 |

| FRS | Forrestaniaresources | -7% | -18% | -24% | -56% | 0.14 | $8,524,782 |

| DTM | Dart Mining NL | -7% | -24% | -52% | -58% | 0.042 | $7,158,546 |

| EMC | Everest Metals Corp | -7% | -16% | -20% | -40% | 0.084 | $8,940,381 |

| GRE | Greentechmetals | -7% | 17% | -58% | -48% | 0.14 | $4,359,150 |

| RBX | Resource B | -7% | 56% | 22% | -22% | 0.14 | $7,704,427 |

| LOT | Lotus Resources | -7% | -11% | -18% | -20% | 0.205 | $272,254,356 |

| S2R | S2 Resources | -7% | -21% | -7% | -27% | 0.135 | $48,178,105 |

| CTM | Centaurus Metals | -7% | -13% | -13% | -20% | 0.98 | $418,564,148 |

| BHP | BHP Group Limited | -7% | -9% | 5% | 13% | 45 | $225,682,305,770 |

| ESR | Estrella Res | -7% | -13% | -19% | -50% | 0.013 | $19,286,434 |

| SRI | Sipa Resources | -7% | -24% | -40% | -50% | 0.026 | $6,160,270 |

| WML | Woomera Mining | -7% | -35% | -12% | -18% | 0.013 | $12,430,096 |

| AAJ | Aruma Resources | -7% | -27% | -13% | -22% | 0.063 | $9,888,575 |

| PUR | Pursuit Minerals | -7% | 14% | 67% | 19% | 0.025 | $30,848,846 |

| EV1 | Evolutionenergy | -7% | -19% | -17% | -46% | 0.25 | $39,915,625 |

| HNR | Hannans | -8% | -33% | -43% | -61% | 0.012 | $32,695,258 |

| DEV | Devex Resources | -8% | -19% | -38% | -33% | 0.24 | $92,694,644 |

| GL1 | Globallith | -8% | -36% | -11% | 19% | 1.54 | $324,023,349 |

| A8G | Australasian Metals | -8% | -13% | -44% | -63% | 0.165 | $6,998,984 |

| PAN | Panoramic Resources | -8% | -29% | -40% | -45% | 0.1375 | $287,127,961 |

| GW1 | Greenwing Resources | -8% | -31% | -17% | -21% | 0.22 | $32,616,950 |

| 1MC | Morella Corporation | -8% | -21% | -56% | -45% | 0.011 | $67,084,385 |

| THR | Thor Energy PLC | -8% | -21% | -45% | -58% | 0.0055 | $7,378,064 |

| VMS | Venture Minerals | -8% | -21% | -27% | -42% | 0.022 | $40,634,275 |

| WCN | White Cliff Min | -8% | -15% | -42% | -54% | 0.011 | $8,624,599 |

| STM | Sunstone Metals | -9% | -16% | -27% | -58% | 0.032 | $91,715,625 |

| IDA | Indiana Resources | -9% | -10% | -16% | -16% | 0.053 | $27,566,265 |

| ARL | Ardea Resources | -9% | -25% | -39% | -17% | 0.58 | $94,326,525 |

| KOR | Korab Resources | -9% | -13% | -22% | -51% | 0.021 | $8,442,150 |

| RGL | Riversgold | -9% | -30% | -46% | -7% | 0.021 | $20,800,290 |

| L1M | Lightning Minerals | -9% | -18% | 0% | 0% | 0.155 | $5,590,687 |

| MLX | Metals X Limited | -9% | -28% | 9% | -48% | 0.3 | $285,788,811 |

| TMB | Tambourahmetals | -9% | -17% | -38% | -50% | 0.1 | $4,325,223 |

| EMT | Emetals Limited | -9% | -17% | -17% | -33% | 0.01 | $8,500,000 |

| SRZ | Stellar Resources | -9% | -33% | -33% | -60% | 0.01 | $10,046,309 |

| MCR | Mincor Resources NL | -9% | -25% | -44% | -36% | 1.245 | $661,144,770 |

| KAI | Kairos Minerals | -10% | -21% | -34% | -17% | 0.019 | $37,317,776 |

| CY5 | Cygnus Metals | -10% | -35% | 4% | 71% | 0.3075 | $57,001,006 |

| IG6 | Internationalgraphit | -10% | -4% | -33% | 0% | 0.235 | $21,557,087 |

| MNS | Magnis Energy Tech | -10% | -19% | -22% | -11% | 0.365 | $339,616,019 |

| MRD | Mount Ridley Mines | -10% | -10% | -18% | -50% | 0.0045 | $38,924,414 |

| GED | Golden Deeps | -10% | -10% | -44% | -10% | 0.009 | $10,397,040 |

| JRV | Jervois Global | -10% | -42% | -65% | -74% | 0.18 | $384,663,278 |

| ADD | Adavale Resource | -10% | -18% | -44% | -47% | 0.018 | $9,351,470 |

| SUM | Summitminerals | -10% | -7% | -19% | 0% | 0.135 | $3,461,857 |

| DRE | Dreadnought Resources | -10% | -26% | -26% | 113% | 0.081 | $253,617,073 |

| OD6 | Od6Metals | -10% | 0% | 44% | 0% | 0.26 | $14,304,029 |

| MEK | Meeka Metals Limited | -10% | -32% | -48% | -16% | 0.043 | $46,974,793 |

| DVP | Develop Global | -11% | -22% | 27% | -8% | 3.11 | $520,103,384 |

| AX8 | Accelerate Resources | -11% | -14% | -36% | -36% | 0.025 | $9,440,044 |

| COB | Cobalt Blue | -11% | -32% | -49% | -12% | 0.41 | $155,424,163 |

| BUR | Burleyminerals | -11% | 4% | 180% | 133% | 0.28 | $16,581,876 |

| RDT | Red Dirt Metals | -11% | -26% | -38% | -31% | 0.3775 | $180,187,533 |

| SGQ | St George Min | -11% | -7% | 173% | 61% | 0.071 | $58,616,988 |

| PBL | Parabellumresources | -11% | -29% | 30% | 94% | 0.35 | $20,247,325 |

| E25 | Element 25 | -12% | -29% | -1% | -37% | 0.69 | $134,274,559 |

| LRS | Latin Resources | -12% | -4% | 0% | 219% | 0.115 | $242,182,041 |

| TKM | Trek Metals | -12% | -16% | -30% | -28% | 0.061 | $22,200,650 |

| LEL | Lithenergy | -12% | -15% | -29% | -18% | 0.71 | $43,308,000 |

| VR8 | Vanadium Resources | -12% | -16% | -6% | -13% | 0.066 | $32,940,041 |

| KGD | Kula Gold Limited | -12% | -27% | 0% | -45% | 0.022 | $7,946,662 |

| PAT | Patriot Lithium | -12% | 2% | 0% | 0% | 0.32 | $20,010,376 |

| RAS | Ragusa Minerals | -13% | 5% | -65% | 62% | 0.105 | $14,259,879 |

| ITM | Itech Minerals | -13% | -17% | -23% | -37% | 0.275 | $31,572,062 |

| VMC | Venus Metals Cor | -13% | -13% | -18% | -25% | 0.135 | $24,040,622 |

| AXE | Archer Materials | -13% | -15% | -30% | -47% | 0.525 | $130,707,784 |

| LPM | Lithium Plus | -13% | -18% | -56% | 0% | 0.295 | $14,434,737 |

| AR3 | Austrare | -13% | -38% | -51% | -75% | 0.195 | $19,992,326 |

| NVA | Nova Minerals | -13% | -27% | -41% | -43% | 0.52 | $112,378,960 |

| CHR | Charger Metals | -14% | -7% | -38% | -50% | 0.31 | $12,895,739 |

| GSM | Golden State Mining | -14% | -14% | -41% | -53% | 0.037 | $4,329,526 |

| ASM | Ausstratmaterials | -15% | -17% | -55% | -80% | 1.59 | $266,728,363 |

| TLG | Talga Group | -16% | -11% | 11% | 15% | 1.575 | $551,640,738 |

| MOH | Moho Resources | -16% | -27% | -38% | -68% | 0.016 | $3,322,595 |

| PNT | Panthermetals | -16% | -18% | -33% | -33% | 0.16 | $4,920,000 |

| PVW | PVW Res | -16% | -32% | -67% | -85% | 0.088 | $8,664,797 |

| CNJ | Conico | -17% | -29% | -86% | -16% | 0.01 | $16,004,649 |

| RR1 | Reach Resources | -17% | 25% | 11% | -38% | 0.005 | $11,887,753 |

| AOA | Ausmon Resorces | -17% | -23% | -38% | -29% | 0.005 | $5,309,091 |

| AUZ | Australian Mines | -17% | -28% | -51% | -74% | 0.042 | $23,614,733 |

| AKN | Auking Mining | -17% | -32% | -36% | -64% | 0.067 | $12,310,608 |

| HXG | Hexagon Energy | -18% | -13% | -13% | -70% | 0.014 | $7,180,823 |

| SBR | Sabre Resources | -18% | -42% | -60% | -38% | 0.028 | $9,619,044 |

| RMX | Red Mount Min | -18% | 0% | -36% | -44% | 0.0045 | $11,359,255 |

| FG1 | Flynngold | -18% | -29% | -29% | -55% | 0.071 | $6,481,033 |

| GRL | Godolphin Resources | -18% | -29% | -21% | -41% | 0.071 | $8,404,231 |

| HAS | Hastings Tech Met | -22% | -36% | -53% | -57% | 2.34 | $291,943,442 |

| CMO | Cosmometalslimited | -24% | -19% | -19% | -31% | 0.125 | $3,188,750 |

| CTN | Catalina Resources | -25% | -33% | -33% | -63% | 0.006 | $7,430,921 |

| CLZ | Classic Min | -25% | -67% | -84% | -98% | 0.003 | $3,695,493 |

| 1AE | Auroraenergymetals | -25% | -32% | -58% | 0% | 0.105 | $13,502,960 |

| LML | Lincoln Minerals | -26% | -66% | 236% | 236% | 0.023 | $13,799,608 |

| M24 | Mamba Exploration | -31% | -46% | 39% | -31% | 0.125 | $7,622,917 |

| NWM | Norwest Minerals | -48% | -49% | -44% | -37% | 0.034 | $7,329,544 |

The post High Voltage: Lithium miners dominate reporting season, large stockpile of DRC cobalt spells danger for metal prices appeared first on Stockhead.

asx

ax

gold

lithium

cobalt

vanadium

manganese

rare earths

ree

nickel

copper

zinc