Uncategorized

In 2010, China’s ‘weaponisation’ of rare earths sent prices into low orbit. Could it happen again?

China is reportedly considering banning exports of rare-earth magnet production and process/refining tech. ASX stocks took off in response. … Read More

The…

- China is reportedly considering banning exports of various rare-earth magnet production and process/refining tech

- In 2010 a diplomatic row with Japan saw Beijing throttle REE exports under the guise of protecting the environment; prices went parabolic for a short period

- ASX REE stocks enjoyed a welcome boost on Tuesday

Our High Voltage column wraps all the news driving ASX stocks with exposure to lithium, cobalt, graphite, nickel, rare earths, manganese, magnesium, and vanadium.

China is reportedly considering banning exports of various rare-earth magnet production and process/refining tech in response to the US targeting its chip-making industry.

China is the world’s dominant miner, processor, refiner, importer and exporter of rare earths (REE) products, which are important in the production of many technologies we use today.

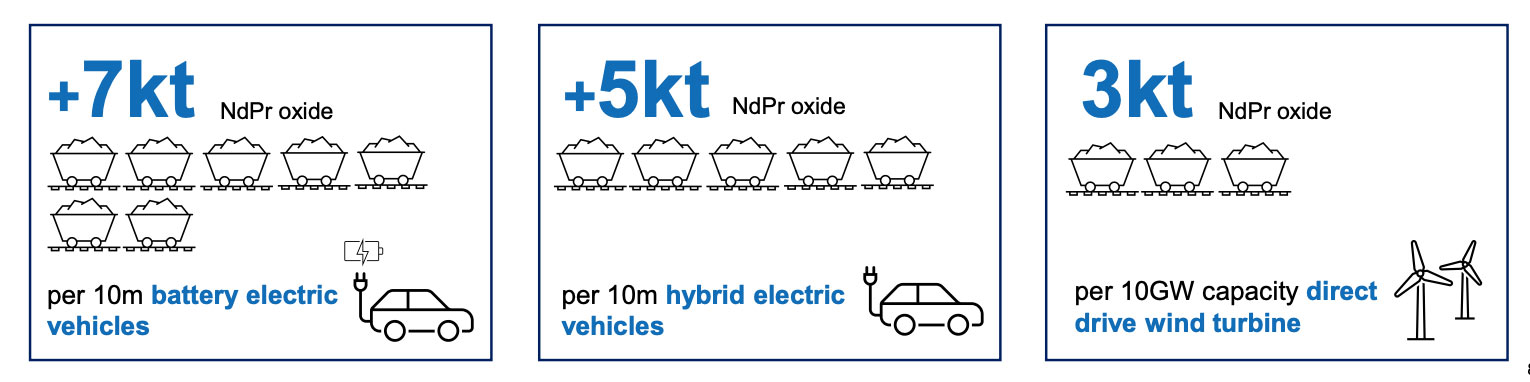

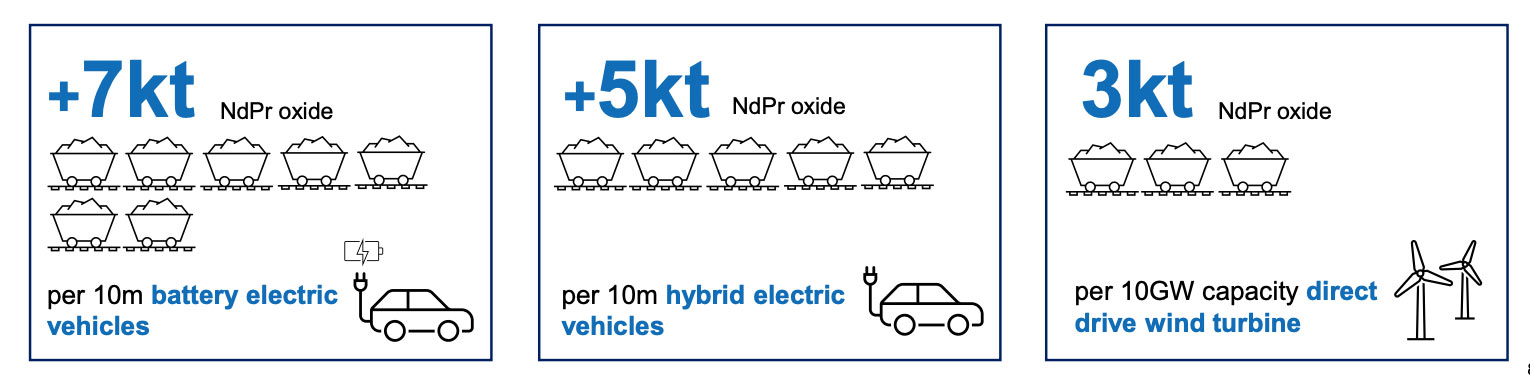

Neodymium and praseodymium (NdPr) are two REEs used in permanent magnets for electric vehicles and wind turbines, markets expected to drive a more than doubling in demand by 2030.

“[Chinese] officials are planning amendments to a technology export restriction list, which was last updated in 2020,” writes Nikkei Asia.

“The revisions would either ban or restrict exports of technology to process and refine rare-earth elements. There are also proposed provisions that would prohibit or limit exports of alloy tech for making high-performance magnets derived from rare earths.

“In all, there are 43 amendments or additions in the draft list first announced in December by the commerce and technology ministries.

“Officials have finished taking public comments from experts, and the changes are expected to go into force this year.”

Rare earths stocks on the ASX went for a run Tuesday in response.

Shades of 2010?

China played a similar card in 2010, when a diplomatic row with Japan saw Beijing throttle REE exports under the guise of protecting the environment.

NdPr prices skyrocketed, and ASX stocks followed suit.

Pre-production Lynas (ASX:LYC), for example, went from 92c to +$26/sh between Feb 2009 and May 2011.

Prices substantially retraced from late 2011, as did share prices, again at China’s behest.

China’s power over REE pricing prompted the US and other jurisdictions to try build out REE supply chains of their own.

Progress has been slow, with China still accounting for around 60% of world supply of rare earths oxides. Importantly it also dominates REE separation, a black art poorly understood by the West.

For example, the only commercial rare earth separation operation in Europe belongs to TSX listed Neo Performance Materials, while Lynas has been selected to build one in the US by the Dept of Defence.

There could be fun and games coming for the REE sector if China becomes more combative, Far East Capital analyst Warwick Grigor says.

A welcome boost for REE prices

Chinese REE imports and exports have been strong, but prices have fallen at a similar rate to lithium in 2023.

The picture is of a market where demand is strong but sentiment is weak.

“The domestic rare earth mining quota has continued to increase steadily in 2023,” Shanghai Metals Market analysts said late March.

“At the same time, the imports of overseas rare earth also increased significantly.

“At the beginning of last week, under the influence of increasing inquiries, the transaction prices of rare earth picked up slightly.

“However, due to the weak downstream demand, most industry players were still pessimistic about the future market.”

Here’s how a basket of ASX stocks with exposure to lithium, cobalt, graphite, nickel, rare earths, magnesium, manganese, and vanadium is performing>>>

Battery metals stocks missing from our list? Shoot a mail to [email protected].

| CODE | COMPANY | 1 WEEK RETURN % | YTD RETURN % | 1 YEAR RETURN % | PRICE | MARKET CAP |

|---|---|---|---|---|---|---|

| WMG | Western Mines | 220% | 150% | 43% | 0.4 | $16,413,000 |

| PRS | Prospech | 179% | 165% | 6% | 0.053 | $8,600,000 |

| G88 | Golden Mile Res Ltd | 115% | 38% | -56% | 0.028 | $5,268,645 |

| AR3 | Austrare | 82% | 11% | -33% | 0.445 | $23,800,388 |

| CLZ | Classic Min Ltd | 50% | -84% | -99% | 0.0015 | $2,913,095 |

| RXL | Rox Resources | 50% | 131% | 7% | 0.405 | $84,132,848 |

| DTM | Dart Mining NL | 45% | 35% | -11% | 0.074 | $10,582,198 |

| AZS | Azure Minerals | 35% | 98% | 31% | 0.445 | $165,850,331 |

| KZR | Kalamazoo Resources | 32% | -21% | -51% | 0.165 | $24,552,216 |

| M24 | Mamba Exploration | 30% | -10% | 4% | 0.13 | $6,708,167 |

| RR1 | Reach Resources Ltd | 25% | 0% | -38% | 0.005 | $9,510,203 |

| WA1 | Wa1Resourcesltd | 24% | 20% | 700% | 1.68 | $54,094,271 |

| QPM | Queensland Pacific | 24% | 18% | -32% | 0.13 | $235,756,969 |

| BRB | Breaker Res NL | 22% | 55% | 90% | 0.495 | $153,624,000 |

| TON | Triton Min Ltd | 21% | -6% | 13% | 0.034 | $51,163,015 |

| WC1 | Westcobarmetals | 21% | -35% | -21% | 0.11 | $8,638,374 |

| WKT | Walkabout Resources | 20% | -18% | -45% | 0.115 | $66,265,473 |

| NWM | Norwest Minerals | 19% | -20% | -28% | 0.043 | $10,636,962 |

| SRN | Surefire Rescs NL | 19% | 108% | 47% | 0.025 | $34,789,996 |

| FG1 | Flynngold | 19% | -4% | -43% | 0.096 | $9,875,860 |

| RAS | Ragusa Minerals Ltd | 18% | -13% | 14% | 0.1 | $13,974,681 |

| JRV | Jervois Global Ltd | 17% | -67% | -89% | 0.091 | $145,548,267 |

| MRD | Mount Ridley Mines | 17% | -30% | -65% | 0.0035 | $23,354,649 |

| KAI | Kairos Minerals Ltd | 17% | -9% | -32% | 0.021 | $39,281,870 |

| VMC | Venus Metals Cor Ltd | 14% | 48% | 8% | 0.2 | $33,834,950 |

| STK | Strickland Metals | 14% | 0% | -25% | 0.04 | $60,642,222 |

| ADV | Ardiden Ltd | 14% | 14% | -43% | 0.008 | $21,506,683 |

| TAR | Taruga Minerals | 14% | -33% | -36% | 0.016 | $11,296,429 |

| CAI | Calidus Resources | 14% | -9% | -74% | 0.245 | $101,096,693 |

| CY5 | Cygnus Metals Ltd | 14% | -36% | 58% | 0.245 | $45,968,553 |

| E25 | Element 25 Ltd | 14% | -15% | -26% | 0.75 | $130,465,352 |

| OD6 | Od6Metalsltd | 14% | 0% | 0% | 0.335 | $16,504,649 |

| IPX | Iperionx Limited | 13% | 23% | -38% | 0.85 | $138,130,492 |

| KGD | Kula Gold Limited | 13% | -32% | -66% | 0.017 | $5,971,391 |

| ODE | Odessa Minerals Ltd | 13% | -40% | -47% | 0.009 | $5,655,641 |

| AOA | Ausmon Resorces | 13% | -36% | -59% | 0.0045 | $4,361,802 |

| EGR | Ecograf Limited | 12% | -14% | -66% | 0.19 | $78,808,355 |

| YAR | Yari Minerals Ltd | 12% | 12% | -50% | 0.019 | $8,682,441 |

| MMC | Mitremining | 12% | 4% | 35% | 0.29 | $11,088,179 |

| MEK | Meeka Metals Limited | 11% | -26% | 0% | 0.05 | $51,245,229 |

| ETM | Energy Transition | 11% | -32% | -42% | 0.042 | $59,652,737 |

| PEK | Peak Rare Earths Ltd | 10% | 19% | -30% | 0.535 | $97,906,842 |

| LSR | Lodestar Minerals | 10% | 10% | -63% | 0.0055 | $8,692,187 |

| TVN | Tivan Limited | 10% | 22% | -4% | 0.088 | $116,627,131 |

| VRC | Volt Resources Ltd | 10% | -27% | -45% | 0.011 | $43,333,663 |

| PGM | Platina Resources | 10% | 16% | -60% | 0.022 | $13,709,967 |

| IMI | Infinitymining | 10% | -40% | -13% | 0.165 | $13,001,314 |

| GSR | Greenstone Resources | 10% | -28% | -36% | 0.023 | $26,568,937 |

| PMT | Patriotbatterymetals | 9% | 99% | 0% | 1.49 | $402,227,095 |

| AAJ | Aruma Resources Ltd | 9% | 36% | -54% | 0.072 | $11,144,267 |

| QXR | Qx Resources Limited | 9% | -14% | -58% | 0.036 | $32,287,044 |

| HXG | Hexagon Energy | 9% | -29% | -73% | 0.012 | $6,154,991 |

| ESR | Estrella Res Ltd | 9% | -14% | -56% | 0.012 | $17,802,862 |

| NMT | Neometals Ltd | 9% | -22% | -63% | 0.625 | $342,699,529 |

| HRE | Heavy Rare Earths | 9% | -13% | 0% | 0.1 | $5,948,793 |

| TKL | Traka Resources | 8% | -19% | -41% | 0.0065 | $4,908,078 |

| LPM | Lithium Plus | 8% | -28% | 0% | 0.265 | $13,230,932 |

| SLZ | Sultan Resources Ltd | 8% | -52% | -75% | 0.041 | $4,028,091 |

| WCN | White Cliff Min Ltd | 8% | -50% | -79% | 0.007 | $5,488,381 |

| GCM | Green Critical Min | 8% | -18% | -2% | 0.014 | $14,797,179 |

| BOA | Boadicea Resources | 8% | -19% | -58% | 0.085 | $7,038,075 |

| PVW | PVW Res Ltd | 7% | -27% | -86% | 0.072 | $7,384,770 |

| CHN | Chalice Mining Ltd | 7% | 24% | 12% | 7.79 | $2,842,176,315 |

| AKN | Auking Mining Ltd | 7% | -32% | -59% | 0.065 | $12,579,500 |

| INR | Ioneer Ltd | 7% | -18% | -58% | 0.31 | $608,518,097 |

| GL1 | Globallith | 7% | -21% | -41% | 1.46 | $295,244,960 |

| CNB | Carnaby Resource Ltd | 6% | 41% | -4% | 1.315 | $189,099,162 |

| BCA | Black Canyon Limited | 6% | 4% | -31% | 0.25 | $10,762,194 |

| RGL | Riversgold | 6% | -43% | -81% | 0.017 | $14,182,016 |

| RAG | Ragnar Metals Ltd | 6% | 42% | -47% | 0.017 | $6,446,143 |

| BSX | Blackstone Ltd | 6% | 26% | -59% | 0.17 | $82,895,559 |

| ARR | American Rare Earths | 6% | 14% | -53% | 0.2175 | $95,971,872 |

| ILU | Iluka Resources | 6% | 20% | -6% | 11.41 | $4,720,221,890 |

| PUR | Pursuit Minerals | 6% | 13% | -44% | 0.018 | $41,329,347 |

| BC8 | Black Cat Syndicate | 6% | 32% | -31% | 0.47 | $119,954,004 |

| CNJ | Conico Ltd | 6% | 12% | -31% | 0.0095 | $13,544,717 |

| MRC | Mineral Commodities | 5% | -14% | -51% | 0.059 | $41,487,356 |

| CXO | Core Lithium | 5% | -13% | -31% | 0.89 | $1,613,864,611 |

| MLS | Metals Australia | 5% | -10% | -72% | 0.04 | $24,281,448 |

| VR8 | Vanadium Resources | 5% | 53% | -20% | 0.088 | $41,175,052 |

| GAL | Galileo Mining Ltd | 5% | -13% | 250% | 0.77 | $148,218,695 |

| 1AE | Auroraenergymetals | 5% | -27% | 0% | 0.11 | $13,502,960 |

| VTM | Victory Metals Ltd | 5% | 0% | 33% | 0.22 | $12,109,207 |

| TLG | Talga Group Ltd | 5% | 22% | 7% | 1.705 | $614,881,263 |

| EUR | European Lithium Ltd | 4% | -3% | -40% | 0.072 | $105,735,981 |

| PTR | Petratherm Ltd | 4% | 26% | 46% | 0.073 | $15,058,326 |

| IXR | Ionic Rare Earths | 4% | -24% | -70% | 0.025 | $90,760,413 |

| RDT | Red Dirt Metals Ltd | 4% | -18% | -31% | 0.39 | $157,942,159 |

| RBX | Resource B | 4% | 59% | -34% | 0.135 | $7,704,427 |

| WC8 | Wildcat Resources | 3% | 25% | -14% | 0.03 | $19,860,682 |

| OMH | OM Holdings Limited | 3% | 8% | -17% | 0.75 | $557,660,619 |

| FRB | Firebird Metals | 3% | 0% | -58% | 0.155 | $10,961,250 |

| CWX | Carawine Resources | 3% | -5% | -55% | 0.095 | $18,304,025 |

| PRL | Province Resources | 3% | -32% | -56% | 0.041 | $48,441,219 |

| MAN | Mandrake Res Ltd | 2% | 5% | -29% | 0.042 | $25,746,677 |

| M2R | Miramar | 2% | -45% | -76% | 0.044 | $3,437,357 |

| EMN | Euromanganese | 2% | -38% | -51% | 0.22 | $56,388,644 |

| ESS | Essential Metals Ltd | 2% | 53% | -2% | 0.4975 | $132,445,514 |

| EV1 | Evolutionenergy | 2% | 13% | -38% | 0.255 | $36,150,000 |

| VHM | Vhmlimited | 2% | 0% | 0% | 0.8 | $118,354,465 |

| LIN | Lindian Resources | 2% | 74% | 671% | 0.27 | $268,300,343 |

| DEV | Devex Resources Ltd | 2% | -4% | -53% | 0.27 | $101,964,108 |

| PAT | Patriot Lithium | 2% | 4% | 0% | 0.275 | $16,439,626 |

| BKT | Black Rock Mining | 2% | 6% | -46% | 0.1425 | $147,898,304 |

| VUL | Vulcan Energy | 2% | -9% | -39% | 5.78 | $821,884,275 |

| OCN | Oceanalithiumlimited | 2% | -4% | 0% | 0.33 | $12,776,010 |

| SCN | Scorpion Minerals | 1% | -3% | 1% | 0.068 | $21,779,490 |

| PGD | Peregrine Gold | 1% | 0% | -24% | 0.385 | $18,754,035 |

| RVT | Richmond Vanadium | 1% | 72% | 0% | 0.405 | $34,483,122 |

| DVP | Develop Global Ltd | 1% | 2% | 9% | 3.26 | $537,020,867 |

| LTR | Liontown Resources | 1% | 99% | 52% | 2.63 | $5,693,997,499 |

| GBR | Greatbould Resources | 1% | 4% | -24% | 0.094 | $40,406,847 |

| NIC | Nickel Industries | 0% | -6% | -28% | 0.9075 | $2,555,497,396 |

| OZL | OZ Minerals | 0% | 1% | 9% | 28.15 | $9,441,419,283 |

| EG1 | Evergreenlithium | 0% | 0% | 0% | 0.295 | $14,057,500 |

| IPT | Impact Minerals | 0% | 57% | -13% | 0.011 | $24,813,706 |

| SRZ | Stellar Resources | 0% | -15% | -61% | 0.011 | $10,046,309 |

| REE | Rarex Limited | 0% | 9% | -44% | 0.059 | $31,866,262 |

| S2R | S2 Resources | 0% | -18% | -18% | 0.14 | $55,362,355 |

| PSC | Prospect Res Ltd | 0% | 29% | 248% | 0.155 | $69,338,919 |

| PAM | Pan Asia Metals | 0% | -20% | -39% | 0.33 | $49,633,789 |

| POS | Poseidon Nick Ltd | 0% | -5% | -57% | 0.038 | $125,949,143 |

| SGQ | St George Min Ltd | 0% | -21% | 13% | 0.054 | $44,547,059 |

| VIA | Viagold Rare Earth | 0% | 0% | 0% | 2 | $166,624,808 |

| COB | Cobalt Blue Ltd | 0% | -38% | -61% | 0.365 | $135,070,998 |

| AVZ | AVZ Minerals Ltd | 0% | 0% | -30% | 0.78 | $2,752,409,203 |

| FFX | Firefinch Ltd | 0% | 0% | -46% | 0.2 | $236,569,315 |

| ATM | Aneka Tambang | 0% | 22% | -4% | 1.1 | $1,434,014 |

| AQD | Ausquest Limited | 0% | 0% | -36% | 0.017 | $14,027,537 |

| 1MC | Morella Corporation | 0% | -25% | -74% | 0.009 | $54,887,224 |

| EMS | Eastern Metals | 0% | -17% | -66% | 0.062 | $2,421,994 |

| CTN | Catalina Resources | 0% | -50% | -69% | 0.005 | $6,192,434 |

| ENT | Enterprise Metals | 0% | -10% | -61% | 0.009 | $6,345,726 |

| ENV | Enova Mining Limited | 0% | -27% | -50% | 0.011 | $4,300,223 |

| AVW | Avira Resources Ltd | 0% | 0% | -57% | 0.003 | $6,401,370 |

| ABX | ABX Group Limited | 0% | -9% | -45% | 0.105 | $23,477,035 |

| CDT | Castle Minerals | 0% | -10% | -68% | 0.019 | $21,365,367 |

| LLI | Loyal Lithium Ltd | 0% | 8% | 23% | 0.32 | $19,036,800 |

| PBL | Parabellumresources | 0% | 1% | 86% | 0.345 | $18,879,263 |

| SBR | Sabre Resources | 0% | -37% | -70% | 0.024 | $7,141,412 |

| TKM | Trek Metals Ltd | 0% | -12% | -17% | 0.067 | $25,112,211 |

| SRI | Sipa Resources Ltd | 0% | -22% | -53% | 0.025 | $5,932,112 |

| AVL | Aust Vanadium Ltd | 0% | 48% | -53% | 0.037 | $170,181,383 |

| MRR | Minrex Resources Ltd | 0% | -47% | -78% | 0.017 | $19,527,615 |

| CLA | Celsius Resource Ltd | 0% | -6% | -44% | 0.015 | $29,927,246 |

| AML | Aeon Metals Ltd. | 0% | -15% | -66% | 0.023 | $27,410,016 |

| BYH | Bryah Resources Ltd | 0% | -12% | -59% | 0.023 | $7,031,337 |

| LPD | Lepidico Ltd | 0% | -31% | -72% | 0.011 | $91,653,261 |

| THR | Thor Energy PLC | 0% | -33% | -76% | 0.004 | $6,651,508 |

| XTC | Xantippe Res Ltd | 0% | -20% | -71% | 0.004 | $47,610,449 |

| RLC | Reedy Lagoon Corp. | 0% | -30% | -79% | 0.007 | $4,533,757 |

| ALY | Alchemy Resource Ltd | 0% | -39% | -13% | 0.014 | $18,849,220 |

| MCR | Mincor Resources NL | 0% | -7% | -42% | 1.4 | $750,522,352 |

| ARU | Arafura Rare Earths | -1% | 5% | 29% | 0.49 | $1,014,271,596 |

| IGO | IGO Limited | -1% | -7% | -8% | 12.53 | $9,268,958,031 |

| GRE | Greentechmetals | -1% | -36% | -68% | 0.09 | $2,809,230 |

| PNN | Power Minerals Ltd | -1% | -18% | -37% | 0.435 | $30,704,483 |

| AGY | Argosy Minerals Ltd | -1% | -27% | -17% | 0.415 | $561,762,999 |

| EMC | Everest Metals Corp | -1% | -11% | -50% | 0.07 | $7,663,184 |

| ASN | Anson Resources Ltd | -1% | -7% | 11% | 0.1725 | $201,527,321 |

| LMG | Latrobe Magnesium | -1% | -10% | -25% | 0.069 | $115,253,261 |

| LPI | Lithium Pwr Int Ltd | -2% | -26% | -61% | 0.325 | $195,020,244 |

| S32 | South32 Limited | -2% | 7% | -15% | 4.265 | $19,112,059,743 |

| ITM | Itech Minerals Ltd | -2% | -8% | -46% | 0.245 | $28,064,055 |

| BMM | Balkanminingandmin | -2% | -29% | -36% | 0.235 | $10,297,563 |

| KNI | Kunikolimited | -2% | -8% | -60% | 0.47 | $23,380,929 |

| JMS | Jupiter Mines. | -2% | 5% | -12% | 0.23 | $440,772,982 |

| BNR | Bulletin Res Ltd | -2% | -3% | -61% | 0.09 | $25,248,835 |

| RNU | Renascor Res Ltd | -2% | 5% | -29% | 0.225 | $596,760,762 |

| BHP | BHP Group Limited | -2% | 1% | -1% | 45.89 | $228,215,216,048 |

| GLN | Galan Lithium Ltd | -2% | -1% | -51% | 1.055 | $311,519,136 |

| NTU | Northern Min Ltd | -2% | -5% | -32% | 0.04 | $198,028,190 |

| MIN | Mineral Resources. | -2% | 2% | 28% | 78.73 | $14,692,179,443 |

| FBM | Future Battery | -3% | 45% | -45% | 0.077 | $32,088,385 |

| CAE | Cannindah Resources | -3% | -23% | -53% | 0.185 | $101,156,392 |

| ARN | Aldoro Resources | -3% | 13% | -33% | 0.18 | $20,324,217 |

| QEM | QEM Limited | -3% | 0% | -28% | 0.18 | $25,677,278 |

| DRE | Dreadnought Resources Ltd | -3% | -35% | 48% | 0.068 | $225,265,519 |

| PLS | Pilbara Min Ltd | -3% | -2% | 15% | 3.69 | $10,822,828,804 |

| AXN | Alliance Nickel Ltd | -3% | 5% | -31% | 0.096 | $63,608,122 |

| LIT | Lithium Australia | -3% | -29% | -71% | 0.032 | $40,299,325 |

| ZNC | Zenith Minerals Ltd | -3% | -43% | -63% | 0.15 | $52,755,907 |

| KTA | Krakatoa Resources | -3% | -34% | -51% | 0.029 | $9,479,523 |

| A11 | Atlantic Lithium | -4% | -13% | 0% | 0.54 | $316,805,663 |

| KOB | Kobaresourceslimited | -4% | -4% | 0% | 0.135 | $10,496,250 |

| HAS | Hastings Tech Met | -4% | -31% | -55% | 2.435 | $298,402,367 |

| AX8 | Accelerate Resources | -4% | 9% | -60% | 0.025 | $9,817,646 |

| BM8 | Battery Age Minerals | -4% | -26% | -26% | 0.37 | $27,460,720 |

| ASO | Aston Minerals Ltd | -4% | 50% | -29% | 0.12 | $122,620,403 |

| MNS | Magnis Energy Tech | -4% | -35% | -49% | 0.24 | $232,376,241 |

| SUM | Summitminerals | -4% | -17% | 0% | 0.12 | $2,967,306 |

| LKE | Lake Resources | -4% | -43% | -75% | 0.46 | $647,212,342 |

| NWC | New World Resources | -4% | 35% | -25% | 0.046 | $101,063,618 |

| CMX | Chemxmaterials | -4% | -41% | -57% | 0.11 | $5,572,724 |

| KFM | Kingfisher Mining | -4% | -54% | -27% | 0.22 | $11,817,300 |

| TMB | Tambourahmetals | -4% | -19% | -69% | 0.085 | $3,501,371 |

| TMB | Tambourahmetals | -4% | -19% | -69% | 0.085 | $3,501,371 |

| LYC | Lynas Rare Earths | -5% | -20% | -36% | 6.31 | $5,658,921,791 |

| FGR | First Graphene Ltd | -5% | -28% | -52% | 0.081 | $46,683,089 |

| SYA | Sayona Mining Ltd | -5% | 3% | -38% | 0.195 | $1,733,949,571 |

| PAN | Panoramic Resources | -5% | -19% | -61% | 0.1425 | $287,127,961 |

| MQR | Marquee Resource Ltd | -5% | -49% | -83% | 0.019 | $6,216,943 |

| TEM | Tempest Minerals | -5% | -17% | -83% | 0.019 | $9,629,611 |

| NKL | Nickelxltd | -5% | -29% | -62% | 0.057 | $5,344,367 |

| KOR | Korab Resources | -5% | -40% | -57% | 0.018 | $6,606,900 |

| A8G | Australasian Metals | -6% | -11% | -66% | 0.17 | $6,998,984 |

| FRS | Forrestaniaresources | -6% | -39% | -75% | 0.085 | $5,358,435 |

| ADD | Adavale Resource Ltd | -6% | -11% | -67% | 0.017 | $9,870,996 |

| AKE | Allkem Limited | -6% | -1% | -15% | 11.11 | $6,905,837,071 |

| BUR | Burleyminerals | -6% | 14% | 92% | 0.25 | $14,125,301 |

| LLL | Leolithiumlimited | -6% | 0% | 0% | 0.485 | $463,728,749 |

| CZN | Corazon Ltd | -6% | -24% | -54% | 0.016 | $9,154,958 |

| VML | Vital Metals Limited | -6% | -16% | -75% | 0.016 | $84,898,396 |

| AZL | Arizona Lithium Ltd | -6% | -23% | -74% | 0.048 | $131,857,320 |

| STM | Sunstone Metals Ltd | -6% | -16% | -56% | 0.031 | $83,854,285 |

| JRL | Jindalee Resources | -6% | 22% | -44% | 2.3 | $132,545,411 |

| L1M | Lightning Minerals | -6% | -9% | 0% | 0.15 | $5,777,044 |

| GED | Golden Deeps | -6% | -17% | -66% | 0.0075 | $9,241,814 |

| EVR | Ev Resources Ltd | -6% | 7% | -75% | 0.015 | $14,975,745 |

| ASM | Ausstratmaterials | -7% | -12% | -84% | 1.26 | $202,546,851 |

| MOH | Moho Resources | -7% | -33% | -76% | 0.014 | $3,322,595 |

| MTM | Mtmongerresources | -7% | 30% | -54% | 0.1025 | $7,429,826 |

| SYR | Syrah Resources | -7% | -21% | 2% | 1.62 | $1,052,390,354 |

| CMO | Cosmometalslimited | -7% | 0% | -25% | 0.135 | $3,443,850 |

| AUZ | Australian Mines Ltd | -7% | -49% | -88% | 0.027 | $15,502,991 |

| EVG | Evion Group NL | -7% | -24% | -58% | 0.054 | $17,322,566 |

| CTM | Centaurus Metals Ltd | -7% | -22% | -42% | 0.875 | $384,395,646 |

| GT1 | Greentechnology | -7% | -19% | -33% | 0.67 | $126,841,031 |

| CRR | Critical Resources | -7% | -7% | -52% | 0.04 | $63,790,195 |

| AS2 | Askarimetalslimited | -7% | -8% | -48% | 0.4 | $24,912,670 |

| GW1 | Greenwing Resources | -7% | -29% | -54% | 0.195 | $28,260,981 |

| GRL | Godolphin Resources | -7% | -22% | -54% | 0.065 | $7,694,014 |

| EMH | European Metals Hldg | -7% | -9% | -58% | 0.58 | $73,012,697 |

| HNR | Hannans Ltd | -8% | -37% | -65% | 0.012 | $32,695,258 |

| VMS | Venture Minerals | -8% | -24% | -73% | 0.0175 | $30,034,029 |

| WIN | Widgienickellimited | -8% | -12% | -42% | 0.29 | $77,922,477 |

| OM1 | Omnia Metals Group | -8% | 44% | 31% | 0.23 | $6,818,421 |

| IDA | Indiana Resources | -8% | -16% | -23% | 0.046 | $24,129,831 |

| AZI | Altamin Limited | -8% | -15% | -25% | 0.068 | $27,616,031 |

| MLX | Metals X Limited | -8% | -29% | -59% | 0.275 | $244,961,838 |

| LEL | Lithenergy | -8% | -21% | -44% | 0.605 | $36,992,250 |

| GSM | Golden State Mining | -8% | -23% | -65% | 0.033 | $3,978,483 |

| EFE | Eastern Resources | -8% | -62% | -79% | 0.011 | $14,282,384 |

| PVT | Pivotal Metals Ltd | -8% | -25% | -21% | 0.033 | $16,606,699 |

| WR1 | Winsome Resources | -9% | 20% | 182% | 1.48 | $226,845,524 |

| LRS | Latin Resources Ltd | -9% | 7% | -45% | 0.105 | $231,173,766 |

| SRL | Sunrise | -9% | -15% | -45% | 1.625 | $153,098,394 |

| LOT | Lotus Resources Ltd | -9% | -2% | -55% | 0.2 | $268,716,052 |

| WML | Woomera Mining Ltd | -9% | -47% | -61% | 0.01 | $9,561,612 |

| TMT | Technology Metals | -9% | -16% | -40% | 0.295 | $67,143,858 |

| LRV | Larvottoresources | -9% | -9% | -47% | 0.145 | $10,424,482 |

| LEG | Legend Mining | -9% | 20% | -41% | 0.048 | $140,511,922 |

| LNR | Lanthanein Resources | -10% | -14% | -50% | 0.018 | $19,627,572 |

| AXE | Archer Materials | -10% | -35% | -56% | 0.4 | $101,938,805 |

| IG6 | Internationalgraphit | -10% | -19% | -39% | 0.22 | $19,357,384 |

| ARL | Ardea Resources Ltd | -10% | -39% | -74% | 0.435 | $75,461,220 |

| INF | Infinity Lithium | -10% | 8% | -21% | 0.13 | $62,449,933 |

| EMT | Emetals Limited | -11% | -20% | -47% | 0.008 | $6,800,000 |

| NC1 | Nicoresourceslimited | -12% | -21% | -54% | 0.485 | $43,962,501 |

| AM7 | Arcadia Minerals | -12% | -10% | -29% | 0.185 | $8,639,110 |

| PNT | Panthermetalsltd | -13% | -44% | -54% | 0.105 | $3,228,750 |

| RMX | Red Mount Min Ltd | -13% | -30% | -65% | 0.0035 | $9,087,404 |

| CHR | Charger Metals | -13% | -34% | -64% | 0.295 | $13,332,882 |

| PLL | Piedmont Lithium Inc | -13% | 19% | -18% | 0.77 | $333,239,830 |

| BUX | Buxton Resources Ltd | -15% | 52% | 67% | 0.175 | $31,118,714 |

| NVX | Novonix Limited | -15% | -24% | -83% | 1.11 | $542,874,467 |

| DM1 | Desert Metals | -15% | -44% | -71% | 0.11 | $7,979,519 |

| FTL | Firetail Resources | -17% | -38% | 0% | 0.1 | $7,700,000 |

| LML | Lincoln Minerals | -25% | 119% | 119% | 0.015 | $9,199,739 |

| NVA | Nova Minerals Ltd | -31% | -51% | -65% | 0.33 | $98,063,746 |

The post High Voltage: In 2010, China’s ‘weaponisation’ of rare earths sent prices into low orbit. Could it happen again? appeared first on Stockhead.

tsx

asx

gold

lithium

cobalt

vanadium

manganese

rare earths

ree

praseodymium

neodymium

nickel