Energy & Critical Metals

Here’s how to play the TSX and invest in some of the world’s biggest and best mining companies

The Toronto Stock Exchange (TSX) is the world’s 10th biggest exchange, and home to some resources stocks to tempt any … Read More

The post Here’s how…

- The TSX houses some of the world’s best companies

- Canada is also home to significant ‘green metals’ deposits

- Here’s how Aussies can invest on the TSX and things to watch for

The Toronto Stock Exchange (TSX) is the 10th biggest exchange in the world, and the second biggest in North America (behind NYSE and Nasdaq).

The TSX has a total market cap of around CAD$3.5 trillion, compared to the ASX’s $2 trillion (CAD$1.85 trillion).

The sectoral makeup of the TSX is similar to the ASX – with Financials, Mining and Energy being the three largest sectors.

And just like Australia, Canada issues very few banking licences so lending and depositing are concentrated in its five largest banks.

The TSX is home to well known global brands like Spotify and the Royal Bank of Canada, as well as first tier mining companies like Barrick Gold and Franco-Nevada.

Increasingly, the TSX is also hosting a handful of new up-and-coming explorers in the green metals space.

These explorers are attracted to Canada’s abundant deposits of lithium, cobalt, nickel, copper, and rare earths – found in regions such as Quebec, Ontario, and British Columbia.

A handful of ASX-listed lithium explorers have set up camps there, including Lithium Australia (ASX:LIT) and Galaxy Resources (ASX:GXY).

Locally, there are a few exciting Canadian green metals explorers too like Nemaska, Global Energy Metals, and E3 Metals.

How Aussies can invest on the TSX

If you want to buy Canadian shares from Australia, you’ll need to sign up with a broker that has access to the Canadian market – simple as that.

Many licensed brokers in Australia have direct trading access to the TSX, and the process of opening an account is pretty quick and easy.

At the moment, brokers providing that service include CommSec, Westpac Trading, IG, Saxo Markets, and CMC Markets.

These brokers allow you to open CAD brokerage accounts, and you can practically trade on day one after funding your account.

Commissions vary between brokers so you need to shop around. For example Saxo offers a sliding fee where stocks trading below CAD$1 have a commission rate of CAD$20 per trade, and less for stocks trading above CAD$1.

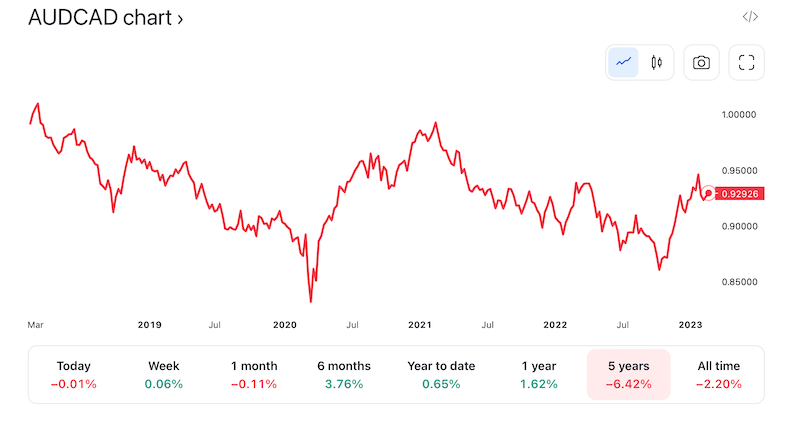

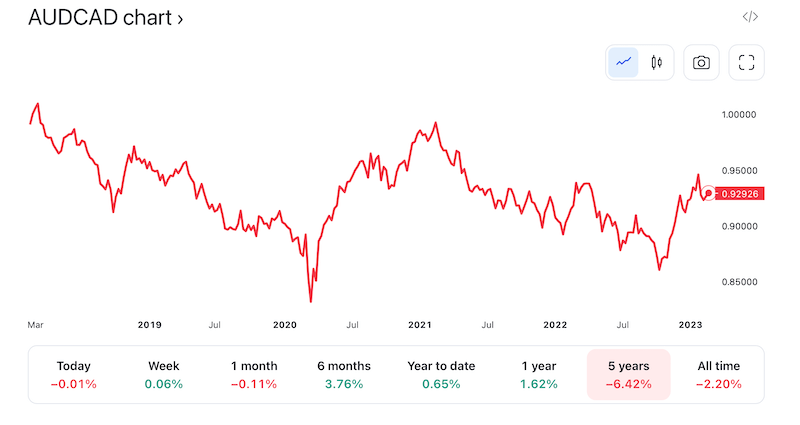

Bear in mind also that investing in Canadian stocks means that you’re exposed to the AUD/CAD exchange rate.

At the time of writing, 1 AUD equals CAD 93c, and this rate has pretty much been hovering around this level (take or give a few per cent) over the last few years.

Tax implications for Aussies

Canadian shares trading on the TSX are mostly liquid, so you should not have a problem when trying to sell.

But trading in overseas stocks, including the TSX, has tax implications for Australian residents because we are subject to tax on worldwide income.

For foreign stock investments, Aussies are taxed on both dividends and capital gains.

In order to prevent double taxation, Australia has entered into “tax treaties” with more than 40 jurisdictions, including Canada.

This tax treaty ensures that you avoid double taxation and are able to get a reduced rate of tax – provided you fit the definition of an Australian resident for tax purposes.

To get these benefits, you need to claim a credit for any taxes already by the companies you invested in Canada.

This can be done by completing the Foreign Income Tax Offset (FITO) section on your Australian tax return.

Currently, Canada has a withholding tax rate of 25% for non-residents, but this can be reduced to 15% for Aussie residents under this treaty.

You should read more about double taxation on the ATO website.

The post Here’s how to play the TSX and invest in some of the world’s biggest and best mining companies appeared first on Stockhead.

tsx

toronto stock exchange

nyse

nasdaq

asx

ax

lithium

rare earths

Uranium Exploration Company Announces Additional Staking in the Athabasca Basin

Source: Streetwise Reports 12/22/2023

Skyharbour Resources Ltd. announced an update from its Canada-based Falcon Project along with additional…

Tesla Launches New Mega Factory Project In Shanghai, Designed To Manufacture 10,000 Megapacks Per Year

Tesla Launches New Mega Factory Project In Shanghai, Designed To Manufacture 10,000 Megapacks Per Year

Tesla has launched a new mega factory…

Giving thanks and taking stock after “a remarkable year”

An end-of-year thank you to our readers, industry colleagues and advertisers before Electric Autonomy breaks from publishing until Jan. 2

The post Giving…