Uncategorized

Heavy hitters beat down the door for a piece of GT1’s world class lithium development

Special Report: With big shots like Primero, Lithium Americas Corp and the Canadian government in their corner, Green Technology Metals … Read More

The…

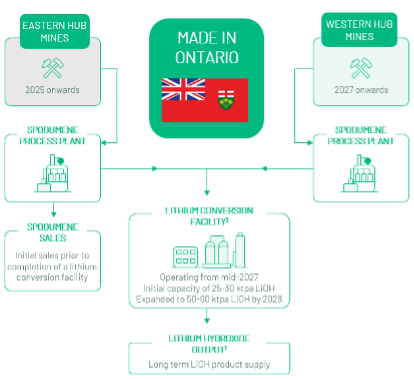

With big shots like Primero, Lithium Americas Corp and the Canadian government in their corner, Green Technology Metals is on the fast track to first spodumene production in 2025.

Green Technology Metals (ASX:GT1) listed November last year after inking a deal to develop gold explorer Ardiden’s (ASX:ADV) non-core lithium assets in Ontario.

An initial payment by GT1 marked the establishment of a joint venture (51% GT1, 49% ADV) to progress ‘Seymour Lake’, ‘Root Lake’, and ‘Wisa Lake’.

GT1 now owns 100% of the projects after recently acquiring the remaining 20% from ADV for a very reasonable ~$18.5.

The company has been drilling hard all year. This will culminate in a resource upgrade at Seymour and a maiden resource at Root, scheduled for release in Q1 2023.

A scoping study – the first proper look at the economics of building an integrated lithium operation, from mine through to lithium hydroxide chemical production — is due for release around the same time.

With heavy hitters like Primero, Lithium Americas Corp and the Canadian government in their corner, GT1 is aiming for first spodumene production in 2025.1

Beyond that, the company is planning to set up a lithium hydroxide production facility to supply the fast-growing local battery and car manufacturing sector.

1Potential lithium concentrates, and chemical conversion facility capacities presented are to be evaluated by the Company as part of its downstream and integrated feasibility study work, which is targeted for completion in H1 CY24. The numbers are not projections of future production and investors are cautioned not to rely on the potential plant capacities as being indicative of forecast production volumes.

Like the project, GT1’s team is tier 1

The GT1 board includes some real heavy hitters, says CEO Luke Cox.

“Our chair John Young founded Pilbara Minerals (ASX:PLS), and then right behind John there’s Cam Henry, who founded Primero,” he told Stockhead. “Primero is one of the world’s largest builders of lithium processing facilities.”

“Primero is driving the processing side of the ongoing scoping study, which will look at converting the spodumene concentrate into high value lithium hydroxide in a newly built facility in Thunder Bay.

“When you look at our share registry it is all held by the big funds, which comes off the back of having John Young and Cam Henry on the board – [the funds] are prepared to back those guys.”

Cox himself started life as a production geologist, working his way up to technical services and then into mine management.

“I used to manage the Wodgina lithium operation,” he says. “The GT1 team has explored, mined, and processed so this is nothing new to us.

“We know what it takes to take something all the way into production.”

Game-changing backing

In March, when GT1 moved to 80% ownership of the projects, it completed a $55m cap raise.

As part of the raise, $5bn market cap NYSE/TSX listed lithium project developer Lithium Americas Corp (LAC) acquired a large stake.

LAC is currently building the Cauchari-Olaroz lithium brine project in Argentina where construction nearly complete.

It’s Thacker Pass clay deposit in Nevada — the largest known lithium resource in the US – is also nearing a development decision.

Cox says LAC was looking to partner with someone to break into the hard rock spodumene market, and GT1 were at the top of their list.

“They chipped in about $US10m as an equity partner,” he says. “We now work directly with Lithium Americas Corp and we are looking at additional hard rock projects [to partner on] in North America.

“They also have a test centre in Reno for all their products, which means that we have a ready-made metallurgical test centre for anything that we produce.”

GT1 is also getting pushed hard to build the mine and downstream processing facility by the Ontario Government.

“Their remit is to get a lithium supply chain up and running as soon as possible,” Cox says.

“When I was over there recently, I got a call to meet the Minister of Mines ‘because we need to know how soon we can get Seymour up and running’.

“They have done a lot of deals downstream to get the OEMs, the car manufacturers, the battery manufacturers in-country to build their facilities — but where is the feed going to come from?

“The battery manufacturers have realised there is no lithium offtake in Ontario, and none in the adjoining states either for sale.”

Someone must feed that near term demand. That’s what GT1 is about, Cox says.

“The meeting that went on last Friday with Invest Canada, who work with overseas companies to develop projects in Canada.

“there must’ve been 20 people from a range of government bodies on that call.

“They said we were one of the first companies to come through the door which has the capability to build a vertically integrated lithium business in Ontario, Canada.

“A lot of the other companies in Canada are explorers – they have projects, but not the capability to fast-track to production.

“With our partners Primero and LAC, GT1 can build projects.”

GT1 is now in advanced discussions with three of the major Canadian government bodies that have several billion dollars to invest in downstream lithium processing facilities.

The company is also speaking to the car makers about a long-term partnership.

“We have spoken to all the OEMS and battery manufactures. They all want offtake, but we said we don’t want just a non-binding offtake agreement” Cox says.

“This is a big project. We need partners to jump on, grab a bit of equity in the business and come with us on this journey to build a vertically integrated lithium business.

“Then we can talk offtake.”

This article was developed in collaboration with Green Technology Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

The post Heavy hitters beat down the door for a piece of GT1’s world class lithium development appeared first on Stockhead.