Uncategorized

Guy on Rocks: While you wait for these 3 things to send metal prices up, here’s a likely graphite stock

UBS: we must see three key metrics turning around to arrest the commodity slide — shift in China’s COVID policy, … Read More

The post Guy on Rocks:…

- UBS: we must see three key metrics turning around to arrest the commodity slide — shift in China’s COVID policy, recovery in China property market, or peak pricing of US (& other central banks) rate hikes and reversal of USD strength

- Tight supplies in copper, iron ore and zinc should underpin prices for now

- Sarytogan (ASX:SGA) could see a reasonably sharp rebound later in CY 2022 on further drilling, met testwork results

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market Ructions: Extreme volatility persists

Last week continued the trend of extreme volatility across both currency and metals markets with the USD Index making a new high of 115 before settling at 113.25 — up a whopping 110 basis points for the week.

US 10-year treasuries also hit 4.06% during the week on higher-than-expected US inflation figures (running at 8.2% YoY).

CME’s FedWatch consider there is a 96.7% probability of a 75-basis point rate hike in November, and a 66.7% chance of a further 75-basis point hike in December.

Some commentators are predicting interest rates will run to 6% next year.

Major indices were also extremely volatile with the DOW trading within a 1,600-point range on Friday closing at 26,935, up over 3% on the week.

The NASDAQ closed at 10,321 for a 2.5% loss while the bellwether for junior miners in Canada, the TSX-V, almost made a new closing low below average – less than 20 million shares per day turnover. It closed at 581 for a 2% loss on the week.

Precious metals were down across the board in the face of a surging US dollar. Gold closed at US$1,643/ounce for the week, down 3.4%, with silver down 9.5% to US$18.20/ounce. Platinum US$888 was down 1.9% and palladium was off almost 9% to US$1,923/ounce.

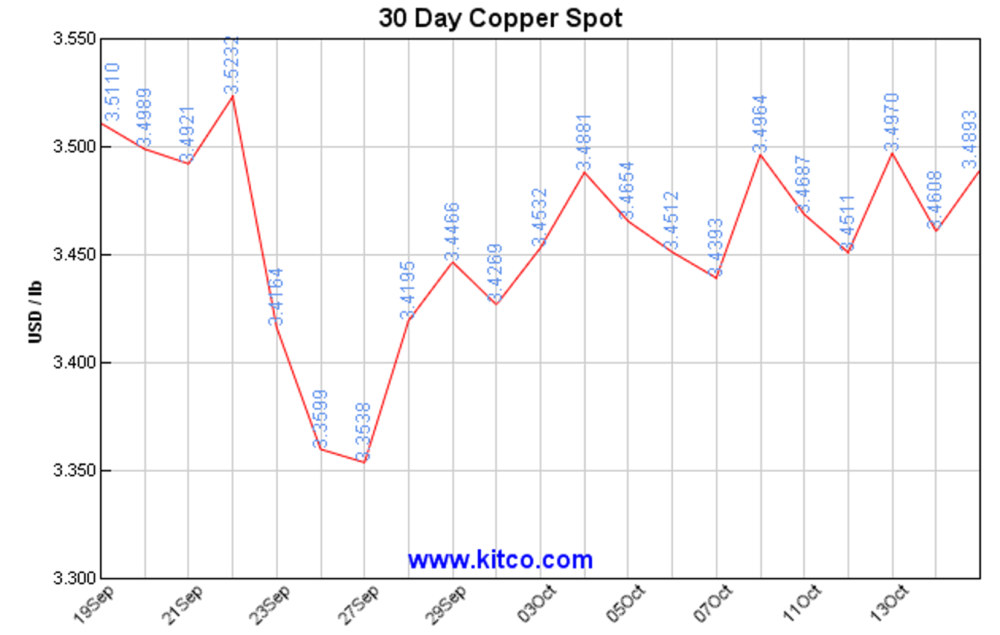

Copper (figure 1) was up 4 cents on the week to close around US$3.46/lb and is now sitting around US$3.48/lb.

The slight rise was most likely on hopes of a Chinese stimulus, but the red metal remains in backwardation in the order of 4 cents going out three months.

It appears Chinese domestic copper supplies remain tight with the Yangshan premium, a key indicator of demand at one of China’s ports, rising to a yearly high of $137.50/tonne (Bloomberg, 13 October 2022).

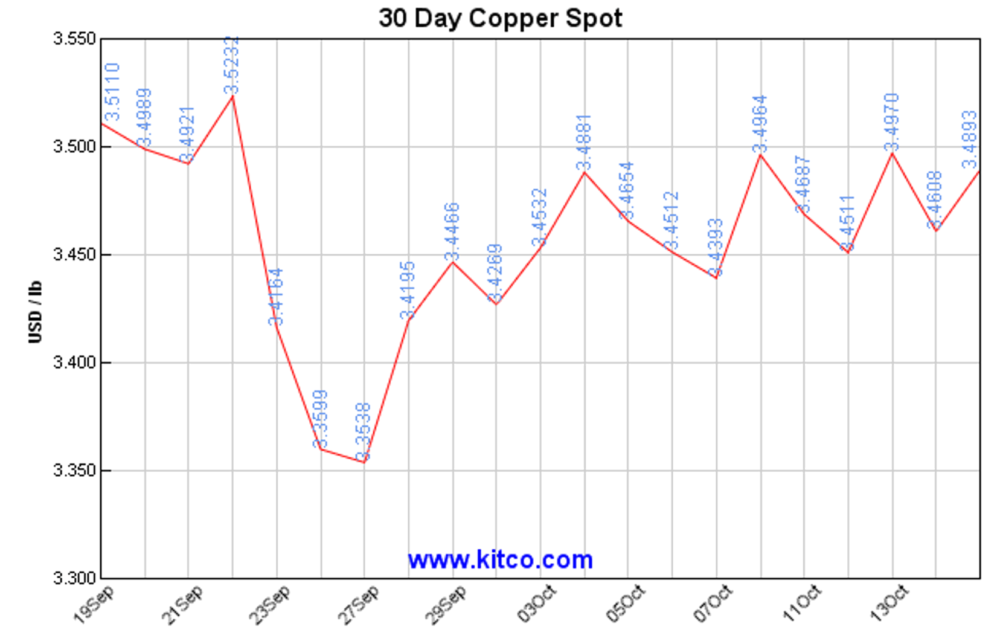

The LME has some difficult decisions to make with unwanted Russian sourced copper arriving in London Metal Exchange approved warehouses (figure 2) in Germany, the Netherlands and Taiwan. Some consumers are starting to reject Russian sourced copper.

Europe’s largest copper smelter Aurubis however is lifting 2023 copper premiums by 85% to US$228 (US$123/tonne in 2022) on expectations of rising copper demand, low inventories, and rising energy and transport costs (Reuters, 13/10/2022).

One of the few bright lights was uranium finishing the week up slightly to US$50/lb. This was likely in response to the Japan announcing the restart of 17 nuclear reactors. Only seven reactors are currently producing electricity in Japan.

What needs to happen to reverse the commodity slide?

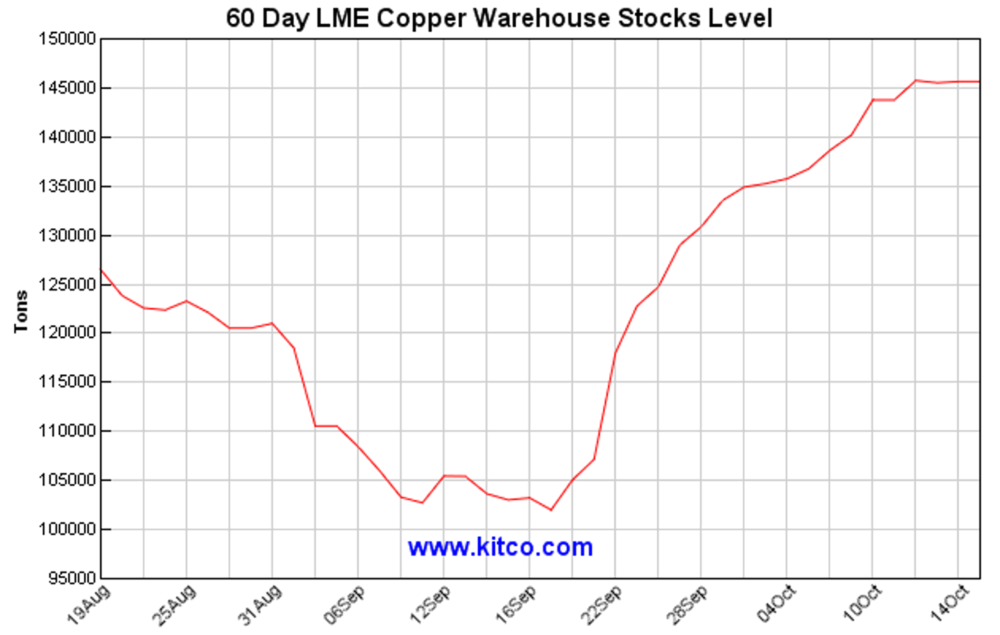

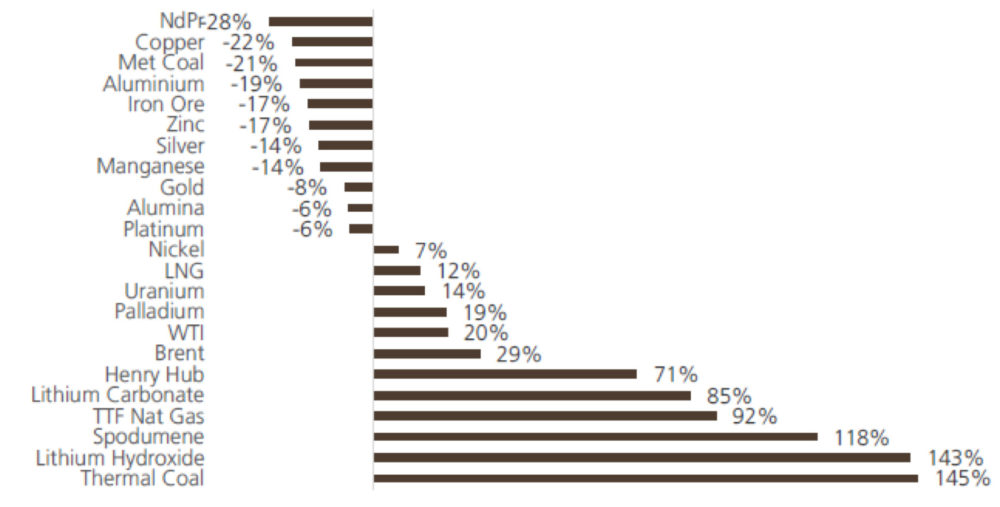

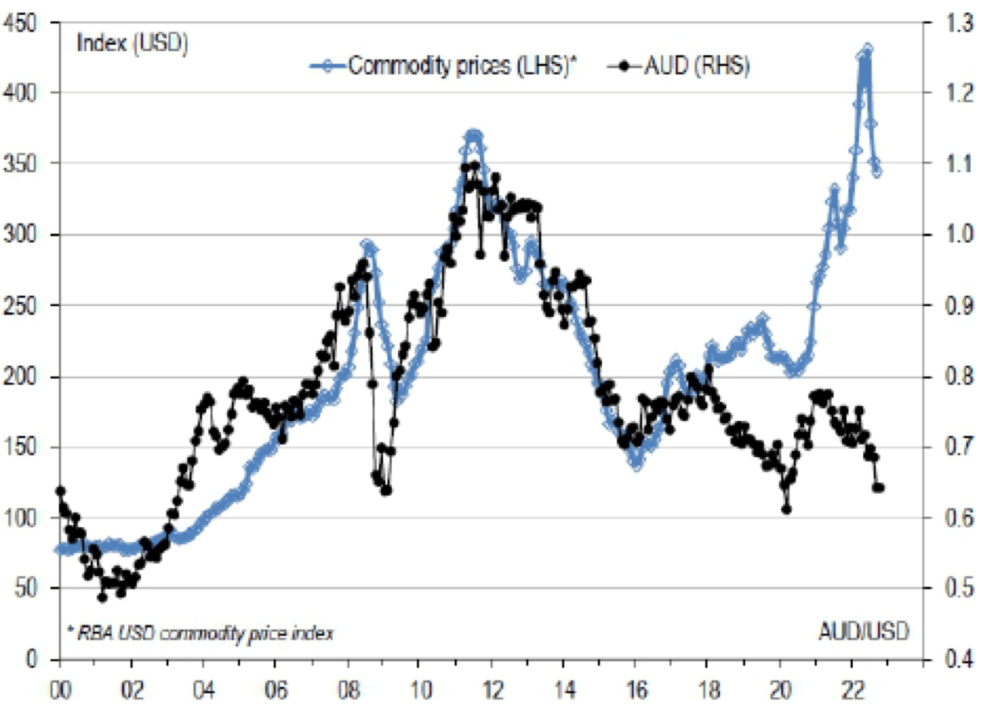

UBS (11/10/2022) believes they need to see three key metrics turning around to arrest the commodity slide (figure 3, 4) and send metal prices up again; namely (1) a shift in China’s COVID policy, (2) a recovery in the China property market, or (3) peak pricing of US (& other central banks) rate hikes and reversal of USD strength.

(1) appears to be the big driver which will no doubt underpin a pick-up in construction activity; however, in the opinion of UBS, this is unlikely prior to Jun-Q 23.

Tight supplies in copper, iron ore and zinc miners in my view should underpin prices for now with UBS preferring energy-related commodities such as thermal coal, aluminium, and zinc with strong medium term demand growth from lithium, nickel, and cobalt.

New ideas: High grade graphite play

This section is dedicated to the memory of multi-talented metallurgist and former Independence Group (ASX: IGO) managing director Peter Bradford who sadly passed away last Saturday at the age of 64.

Peter was a giant of the Australian mining community and was instrumental in a slew of company-making deals during his eight-year tenure at IGO. As former Euroz director and corporate advisor Doug Young once said to me, it is better to go out with a “bang than a whimper” and Peter was certainly at the very pinnacle of his career when he left the building last week.

I first mentioned Sarytogan Graphite (ASX:SGA) back in early August 2022 soon after the IPO on ASX that was joint lead managed by Perth based Inyati Capital and RM Corporate Finance (yes I am declaring an interest in the shares and fees received from the IPO).

The stock had a solid debut before running up to 57 cents on the back of some strong graphite sector tailwinds before retreating to the low 20s following the release of the initial metallurgical results that showed recoveries of around 92%.

I think the market missed the point that this was a bulk sample and therefore was not targeted towards those parts of the orebody that have superior grade and/or metallurgical characteristics.

Perth based Metallurgy Pty Ltd undertook flotation, low-temperature caustic roast, leaching with a weak sulphuric acid and a final calcine step that was considered a “sighter test” (figure 6).

Given Russian testwork back in the 1980s did achieve recoveries around the 98% mark (Prospectus dated 23rd February 2022), I am quietly confident that metallurgical recoveries will improve from this very preliminary testwork.

The company has also engaged some world leading laboratories in Germany including ANZAPLAN and Prographite who will no doubt be looking to match or improve the work of previous operators.

I’m not much of a chartist but believe we could see a reasonably sharp rebound later in CY 2022 on receipt of further drilling and metallurgical testwork results.

A JORC Resource upgrade is also due out in 1-2Q 2022 and I am anticipating a substantial upgrade to the 209Mt @ 28.5% JORC Resource.

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

The post Guy on Rocks: While you wait for these 3 things to send metal prices up, here’s a likely graphite stock appeared first on Stockhead.