Uncategorized

Guy on Rocks: Time to go gold shopping. This 1Moz in Victoria looks promising…

The view by many of the gold bulls that the USD may well have run or be close to running … Read More

The post Guy on Rocks: Time to go gold shopping….

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market Ructions: I’ve got yellow fever

Gold closed up US$2 to finish the week at US$1,925/ounce climbing to US$1,928 after the FOMC decided to leave rates on hold.

The US dollar rose to its highest levels since March of this year with the DXY finishing the week at 105.58 for a 28-basis point gain.

US 10-year treasuries were trading at 4.33% late last week with the 2–10-year inversion stretching to a record 242 days.

The VIX index (volatility) rose sharply during the week climbing just under 18% to 17.8.

Not many surprises on US economic news last week with the CPI YoY up 3.7% (compared to around 9% over the same period last year) with high energy costs contributing to PPI up another 8-10%. Retail sales remained flat with consumer sentiment off slightly.

The OECD anticipates the US economy to grow by around 2.2% this year, a slight improvement on the 1.6% from their June 2023 call. AUS growth next year is projected to slow to around 1.3%. China on the other hand is anticipated to grow by 5.1% this year and 4.6% in 2024.

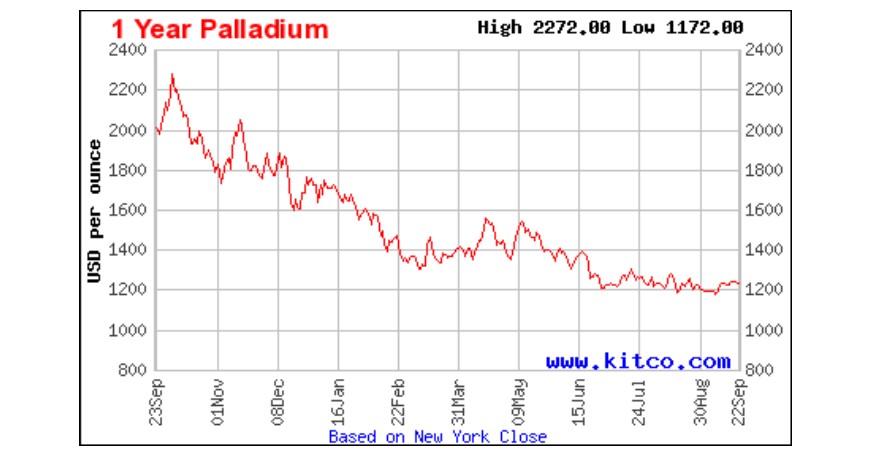

Platinum (figure 1) had a strong week up a further US$5 to finish at US$933/ounce and palladium (figure 2), after being heavily sold off all year, closed up US$3.50 to US$1,257/ounce.

The World Platinum Investment Council (WPIC) believes that automotive demand for platinum this year will reach its highest level since 2017 and is now forecasting a deficit of over one million ounces for 2023. Automotive demand according to the WPIC is anticipated to pick up by 13% year-on-year to 3,283koz this year which represents a six-year high.

Higher palladium prices had previously seen platinum as the favoured substitute however the WPIC points to better-than-expected growth in vehicle production during the second quarter of 2023. The surprising figure last quarter was China where demand surged by 60%.

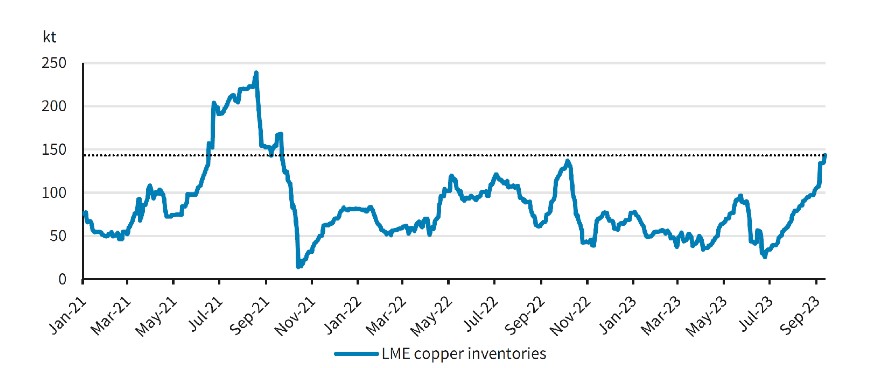

Copper fell back to US$3.71/lb after last week’s 8 cent rally to US$3.81/lb with the three-months futures contract remaining in backwardation. While news of Chinese stimuli spurred on a rally, a rising US dollar and expectation of a further rate rise this year put the brakes on the red metal.

Just to reinforce how volatile the supply-demand metric is for copper, have a look at figure 3 which shows a rapid build-up of LME inventories in September to a two-year high compared to June of this year where inventories were near a two-year low.

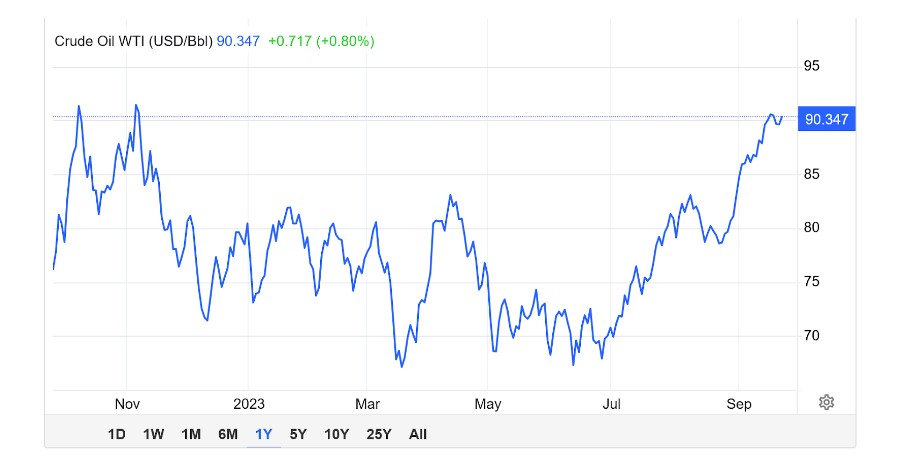

Two big movers that I highlighted last week were oil and uranium.

WTI oil (figure 4) finished the week more or less flat at around US$90 BBL. Drilling rigs in the US were up by nine, reversing three months of declines while oil production remains at post-pandemic highs of 12.9m BBLS (300,000 less than when Trump was in office as Mercenary Geologist Mickey Fulp likes to point out) with oil inventories remaining at seasonal lows of 4m BBLS.

Oil imports rose sharply to 7.6M BOPD up 800,000 BOPD. Average gasoline prices in the US remain over US$3.80 gallon representing a 52-week high.

The US Energy Information Administration stated last week that US oil output from top shale-producing regions is likely to decline for the third straight month to 9.39m BOPD by October, the lowest since May of this year.

Reuters reported last week that Russia is considering an export duty on all oil products at a rate of US$250 per metric ton from October 1 to June 2024 to counter domestic fuel shortages.

Uranium is up over 10% in two weeks and breaching US$70/lb, representing a 25% lift in spot prices over the preceding two months.

The Sprott Physical Uranium Trust (figure 5) is slightly above its net asset backing by 0.25%.

CAMECO CFO Grant Isaac stated last weekend he thought the days of buying US$40/lb uranium and also US$50 and US$60/lb were over, stressing the need for more supplies.

New Ideas: Life’s Good, but could be better

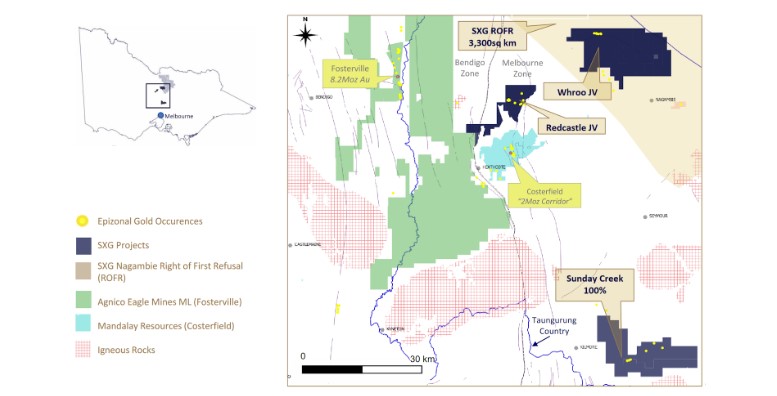

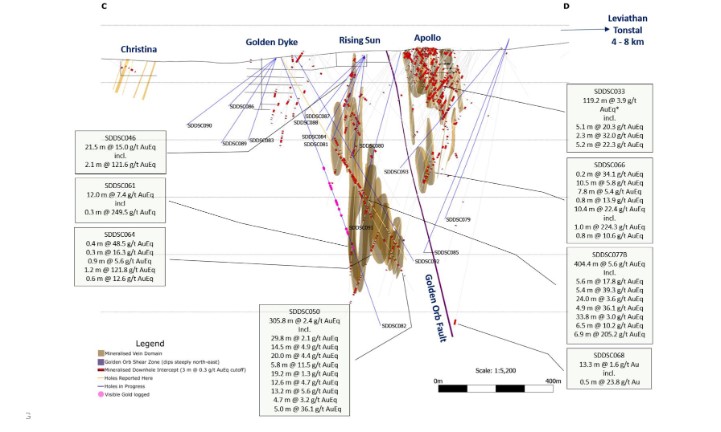

I brought Southern Cross Gold (ASX: SXG) to the attention of the Stockhead faithful late last year as one of the Australian gold plays to watch. The boots on the ground include my former North Flinders colleague and general manager Lisa Gibbons who subsequently changed her name by deed poll to “Life’s Good” on the back of a string of high-grade gold-antimony intercepts at its 100% owned Sunday Creek project in Victoria (figure 7 and 8).

Well, life hasn’t been so good for the junior-mid tier gold sector this year with investors being spooked by rapidly rising production costs and money flowing out of risk assets. The view by many of the gold bulls that the USD may well have run or be close to running its course has many optimistic of a lift in gold prices later this year.

The great hope was that SXG could define another Fosterville (Agnico Eagle Mines, AEM-T) which is producing over 300Koz per annum at an operating cost of under $700/ounce.

I am thinking that the 404.4m @ 5.6g/t AuEq (5.1g/t Au, 0.3% Sb) from 374m downhole intersection (figure 8) announced a couple of weeks ago may bring the punters back in to the stock which recently traded up above 80 cents on the back of this news after falling to the low 40s mid-year as money flowed out of risk assets and back into the USD.

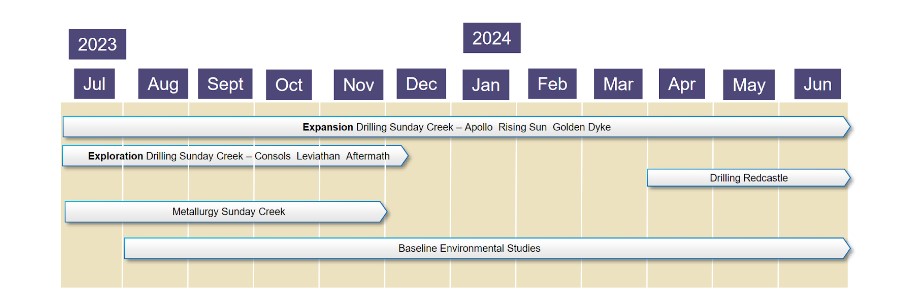

The company has a very aggressive (figure 9) +25,000m diamond drilling program underway having drilled just under 20,000m this calendar year.

An interesting new addition if you look at their latest presentation is the Redcastle project with a strike of around 17km of old workings with numerous narrow high-grade intersections including 0.1m @ +700g/t Au equivalent that the company plans to follow up in the second quarter next year. There is also an untested +1km long induced polarisation lying beneath the old workings.

At $0.80 and an enterprise value of just under $140 million, I stick think this project is good for 1Moz of gold (equivalent). Good to see interest back in Victorian gold plays.

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

The post Guy on Rocks: Time to go gold shopping. This 1Moz in Victoria looks promising… appeared first on Stockhead.