Uncategorized

Guy on Rocks: Mother of dogs! Is this the West African gold hope you’ve been looking for?

Burkina Faso is well endowed with gold mineralisation hosting over 20Moz of gold resources with nine operating mines. A good … Read More

The post Guy…

- Gold is marching toward all-time highs, Bitcoin also seeing a resurgence

- Mercenary Geologist Mickey Fulp believes that US$100/bbl oil is on its way

- Stock Pick of the Week: Sarama Resources (ASX:SRR)

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market Ructions: Gold tests all-time A$ highs

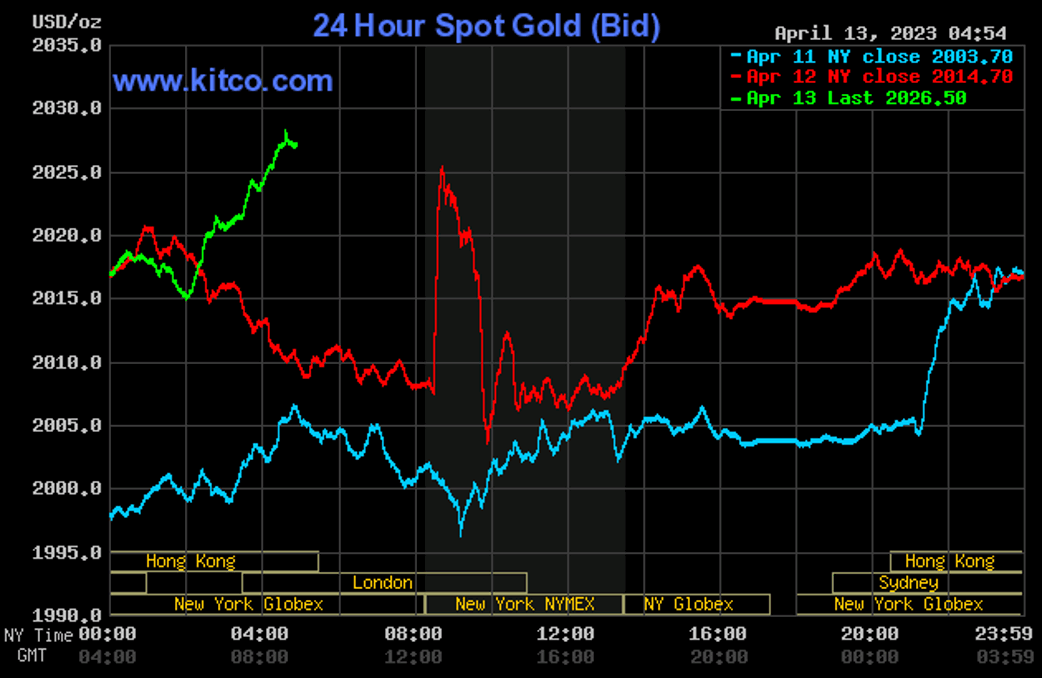

Gold closed the week up 1.8% on the week US$21/oz to finish at US$2,006/oz and then has crept up to US$2027/oz mid-week (figure 1).

Interestingly, Bitcoin has risen above US$30,000 for the first time since June 2022, after many believed it was in a longer-term decline.

The World Gold Council is salivating as what they consider to be the biggest banking crisis since the Great Financial Crisis of 2008 is prompting investors to accumulate gold after 10 consecutive months of Exchange Traded Fund outflows. The WGC recently pointed out that 32 tonnes of gold (US$1.9 billion) flowed back into global gold-backed ETF products over March of this year.

The WGC pointed out that “lower yields, a weaker dollar and safe haven buying lifted the gold price in March by 9%, fuelled by the recent banking industry crisis”, but “despite the recent inflows, first quarter net outflows remain at 28.7 tonnes worth $1.5 billion”.

The US dollar (figure 2) has been down six weeks in a row closing at 101.89 with 10-year treasuries down four of the last five weeks but rallying later this week 3.42%. The 2-to-10-year treasury inversion remains at +/- 50 basis points. The market, according to Bell Potter (12/4/2023) is now pricing in a 72% probability of a May 2023 rate hike.

Silver finished the week at US$24.90 for a near 2023 year high, up 3.7% on the week, while platinum closed up US$16 to finish at US$1,007/oz. Palladium had a late rally closing last week at US$1,391/oz before rallying this week to US$1,454.

Copper finished at US$4.03 after a down week but closed slightly up after reports of low inventories. Copper’s undulating forward curve would suggest that economic headwinds are balancing out projected copper deficits.

Not surprisingly the IMF earlier in the week downgraded global growth by a tenth of one per cent to 2.8% for 2023 and 3.0% for 2024 with further downside risks. They noted the “perilous combination of vulnerabilities”.

Negative PMI Manufacturing at 46 last week all pointed towards a shrinking US economy with the employment market looking shaky as FedEx, Netflix and a number of big retailers announced some big layoffs. Available jobs in the US dropped below 10 million for the first time in two years. US inflation mid-week came in at 5% (down from 6% in February) however not enough, it appears, to head off another rate hike in May according to many commentators.

Uranium had a slight uptick up 50 cents to US$51.13/lb, the highest weekly since mid-February 2023 with the news that Cameco is set to reopen one of the world’s largest uranium mines, namely Macarthur River. Despite the outperformance of the yellow metal, uranium equities both on the ASX and TSX-V remain weak.

The oil price got a further boost on production cuts of 1.6MBBLS of oil from OPEC last week with the Mercenary Geologist Mickey Fulp (7 April 2023) believing that US$100/bbl is on its way with oil closing the week at US$80.55/bbl for a 6.5% gain and now trading around US$83bbl. The Biden administration is now trying to make up shortfalls in oil inventories from Venezuela, traditionally a producer of the less desirable high-sulphur oil by reducing sanctions.

All sounds good news for the doomsday preppers and gold bugs out there!

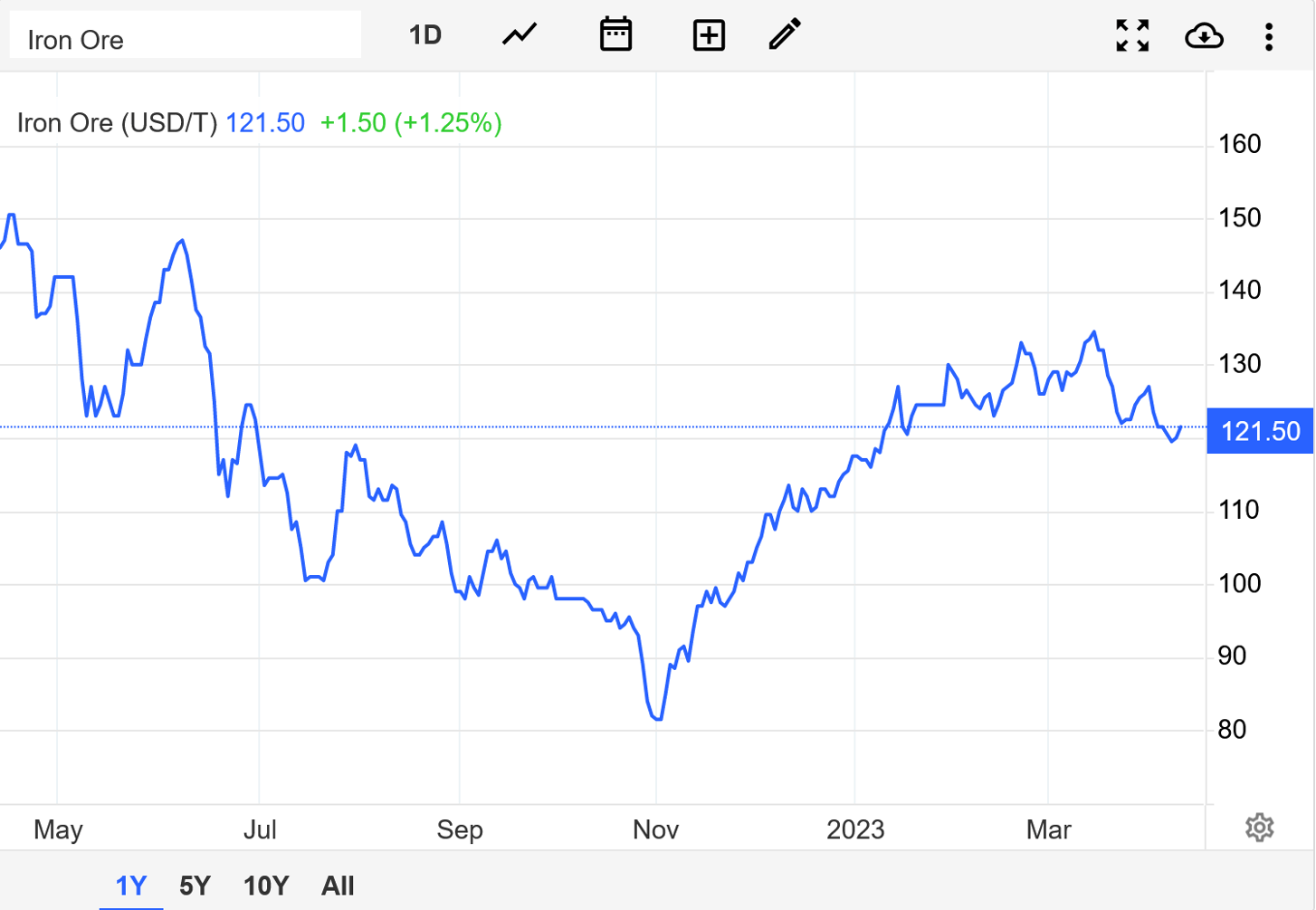

I think iron ore (figure 3) is also going to stay stronger for longer given the better credit growth figures from March. China inflation data, unlike the majority of developed countries, remains on the weak side, being one of the few central banks according to Bell Potter with inflation running well below their target.

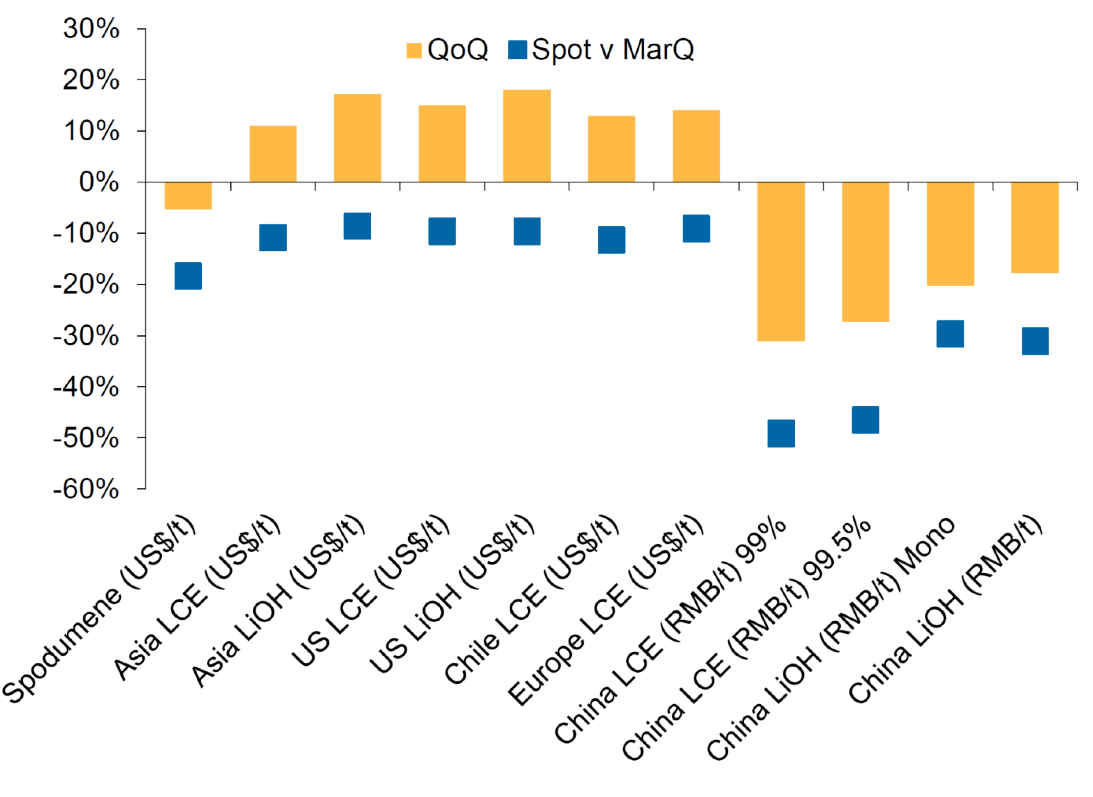

Lithium prices (figure 4) have been mixed according to Macquarie Research (11/4/2023) in the past three months with lower China LCE and LiOH prices and reduced spot spodumene prices.

Regional lithium prices were higher quarter on quarter, reflecting pricing lags and better market fundamentals. Macquarie considers RMB200,000/t LCE an incentive price to attract strategic customers.

On the rare earth front, neodymium/praseodymium prices have continued to trend down and 1QCY23 pricing came in at US$98/kg compared to US$95/kg in 4QCY22.

Rare earth production is predominantly from China and to a lesser extent USA, Australia, and Myanmar (figure 5) with plenty of interest in sourcing supply ex China. There remains a big opportunity for emerging Australian REE clay explorers/developers to have a significant impact on world production if they can solve the metallurgical challenges that are currently keeping a number of well-known laboratories busy.

New Ideas: The female dog of the gods

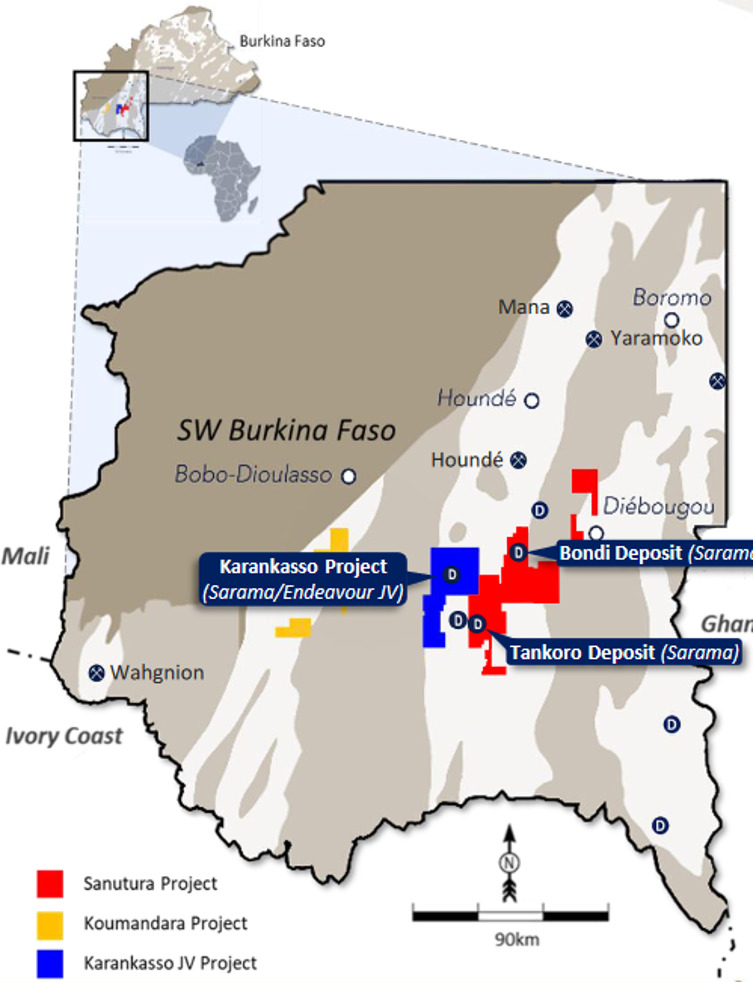

Sarama Resources (ASX: SRR) is another undervalued Western African gold developer with projects located in southwestern Burkina Faso, fortunately in a relatively stable part of the country away from trouble spots further north.

The company is headed by former Moto Gold Mines (+21Moz gold and taken over by Rand Gold in 2009 for around $600m) mining engineer Andrew Dinning with over 30 years’ experience in Africa, Russia, and Australia.

Burkina Faso is well endowed with gold mineralisation hosting over 20Moz of gold resources with nine operating mines producing in excess of 2 million ounces of gold per annum.

SRR has already outlined over 3Moz of gold which includes around a third high grade oxides at over 2g/t gold. This should be relatively cheap to treat through a conventional CIP/CIL circuit.

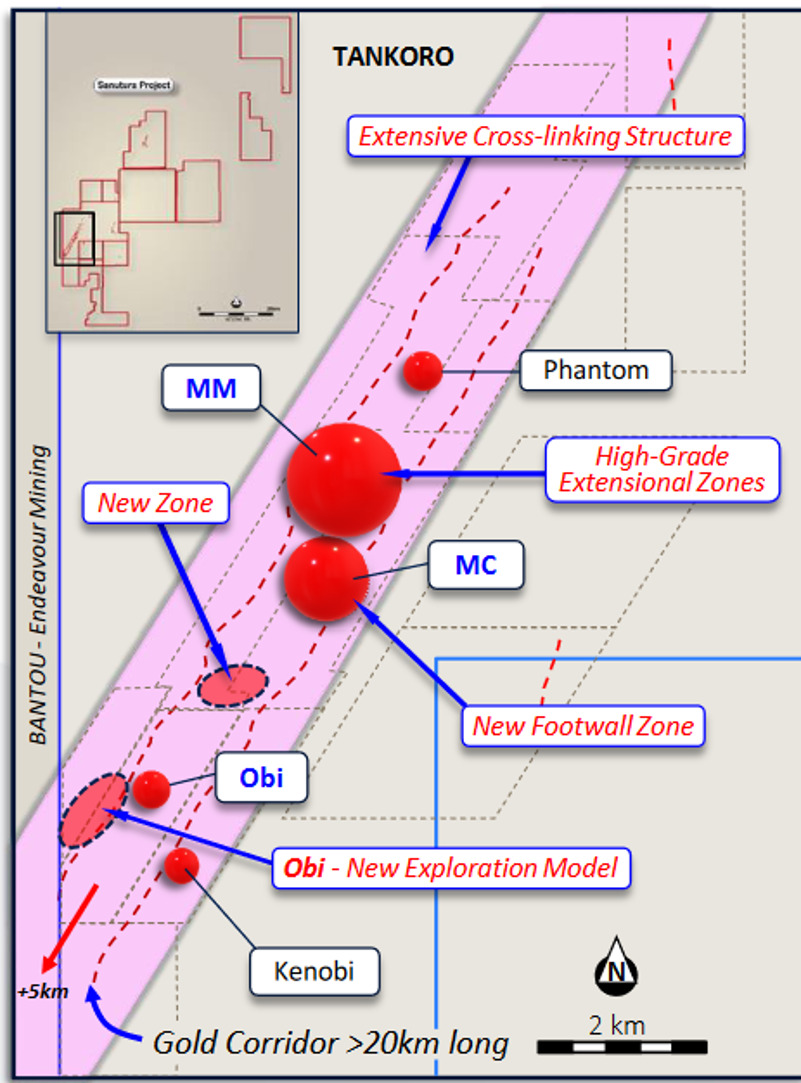

Despite the large resource base, there remains plenty of exploration side with prospective lithologies at Tankoro stretching for over 16km x 1km (figure 8).

A Preliminary Economic Assessment is due out later in CY 2023 and I am reasonably confident of a fairly compelling set of metrics based on a modest start-up spend of hopefully under US$100 million.

The Bondi Deposit also presents plenty of exploration upside with plenty of high grade historical intercepts including 52m @ 5.3g/t gold.

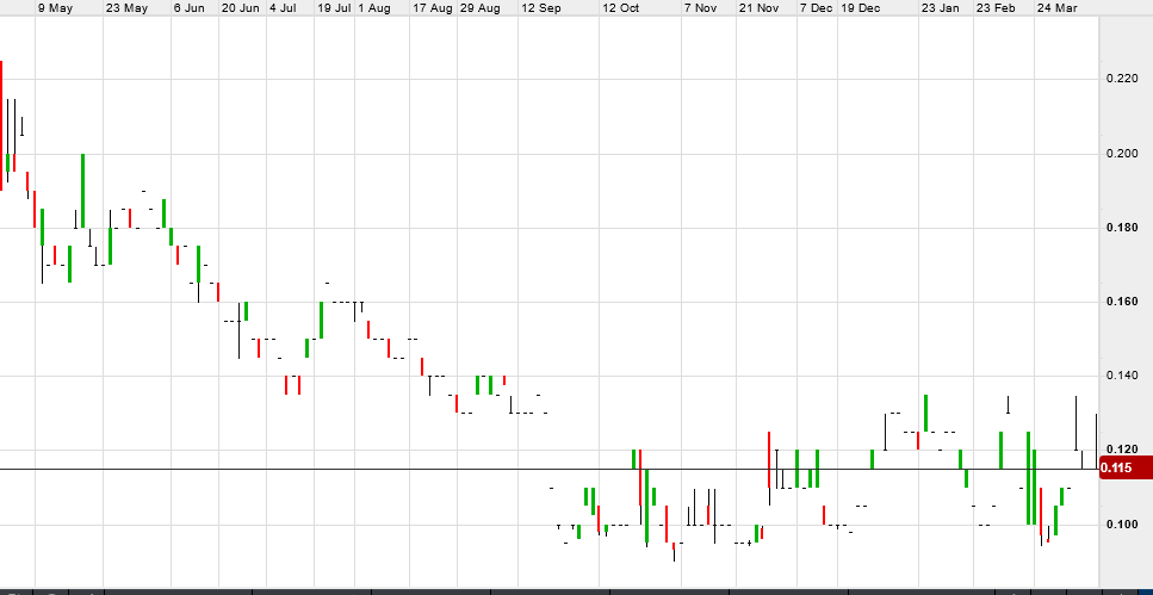

At a market capitalisation of $17.5 million, around $3.5 million in cash and an enterprise value of $14 million, SRR is trading at valuation of under A$4/JORC Resource ounce (not including any value for exploration) which makes it a screaming buy in my humble opinion.

Apparently in Hindu mythology Sarama is the female dog of gods or the mother of all dogs. Let’s hope this doesn’t translate to share price performance…

I hope the Stockhead faithful have taken note that I haven’t had a crack at any company directors this week for their past (or current) sins or obvious weaknesses. It is unlikely to last however, as the Cigar Social Climate Change Sceptic Committee, who are also known to opine on such things as land rights and gender equality on junior resources boards, believe I have already offended half of West Perth and a quarter of North-Caulfield, so I may as well finish the job.

I would be wise to accept their counsel.

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

The post Guy on Rocks: Mother of dogs! Is this the West African gold hope you’ve been looking for? appeared first on Stockhead.

tsx

asx

tsxv

gold

lithium

uranium

rare earths

ree

praseodymium

neodymium

copper

iron