Uncategorized

Guy on Rocks: Instos, high net worths are buying into this $18m capped high gold explorer

For those gold bulls among you (100% of the Stockhead faithful), Pacgold (ASX:PGO) is worth taking a close look at. … Read More

The post Guy on Rocks:…

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market Ructions: Central banks boost gold holdings

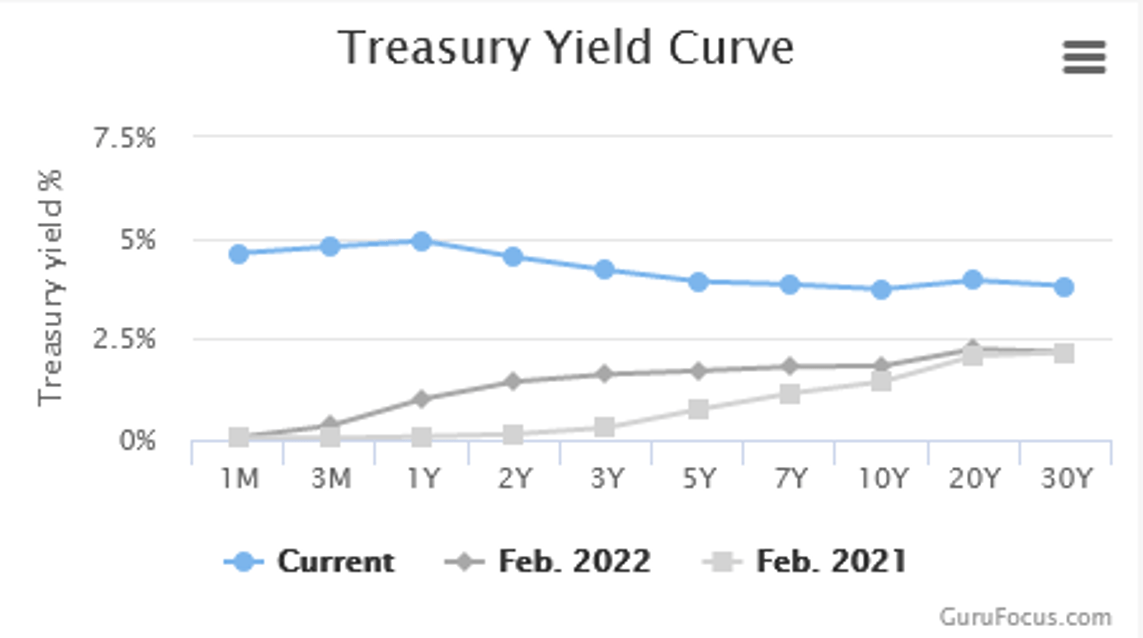

Despite a huge yield curve inversion (figure 1) not seen since the early 1980s, gold remained largely flat at US$1,864/ounce late last week before dropping back to US$1,831/ounce after Wednesday’s CPI figures.

No doubt central bank buying over recent months, which included 15 tonnes from China in January, has put a floor under the gold price. The last big purchases by China was between 2002 and 2019 when it accumulated 1,148 tonnes. A notable exception last month was Russia which sold 3.6 tonnes of gold to help fund its US$25 billion deficit.

In contrast, the World Gold Council reported that for the ninth straight month, 26 tonnes of gold flowed out of global hold-backed exchange traded funds. North American funds however saw nine tonnes of inflows over the same period. It appears that lower oil and gas revenues from Western sanctions are also starting to bite.

The US CPI report came in slightly higher than expected at 6.4% (consensus for January was 6.2%) with gold off US$18/oz in response.

The market is concerned with the Federal Reserve Chair Jerome Powell’s comments that if the US economy continues to surprise on the upside, the central bank would be forced to raise rates higher than anticipated.

As a result, the gap further widened between 2- and 10-year treasuries which were yielding 4.6% and 3.77% respectively at the end of the week.

Platinum lost 3% for the week to close at US$946/ounce while palladium dipped below US$1,500/ounce for the first time in three years to close at US$1,463/ounce for a 6% loss for the week bringing its year-to-date losses to 15%.

Copper was also flat closing at US$4.04/lb with the forward market falling into backwardation.

The big mover last week was oil (figure 2) which closed at up 9% following the announcement by the Russian Government of a 500,000 BOPD production cut due to European price caps and sanctions. In the US domestic production was up 100,000 BOE to 12.3m BOPD with Inventories up 2.4MMBLS.

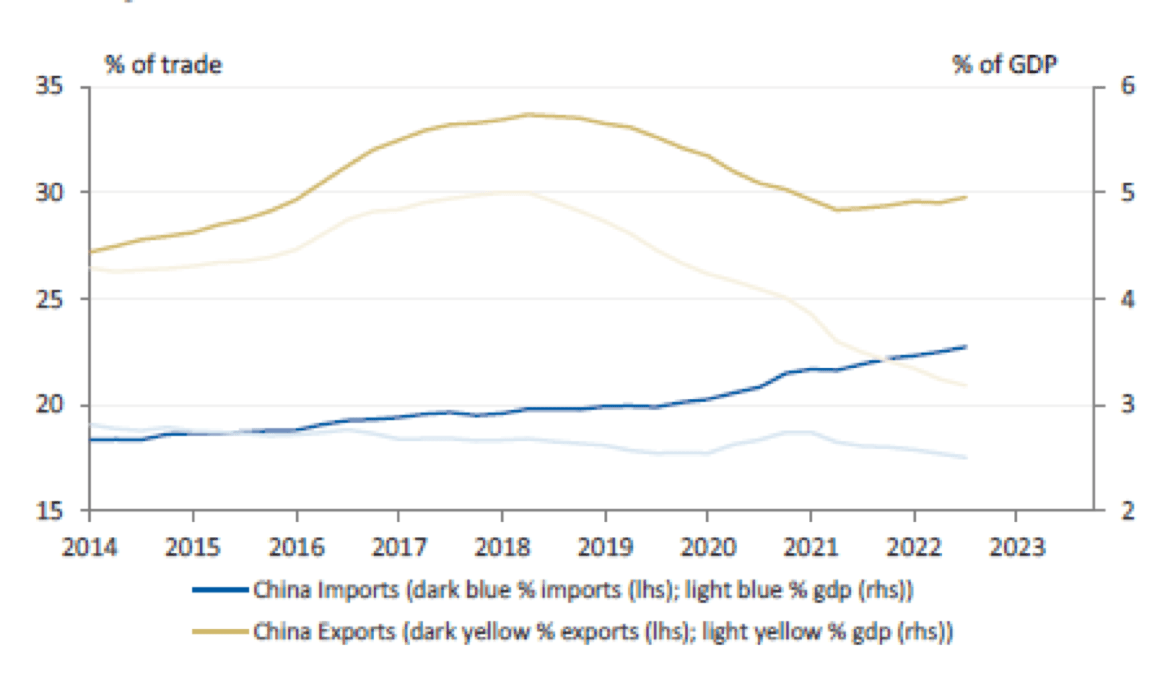

Morgan Stanley have remained bullish on Australia’s prospects on the back of a rapid shift away from Covid-zero and raising their 2023 GDP forecast above consensus for China from 5.4% to 5.7% for CY 2023 (consensus 5.1%).

Given China accounts for 30% of Australia’s total exports and 23% of total imports, Australia remains well positioned. The caveat is clearly the waning domestic demand however this should be offset in part by a return to Chinese students and tourist migration.

Stock of the Week: A sub $20m capped high-grade gold explorer

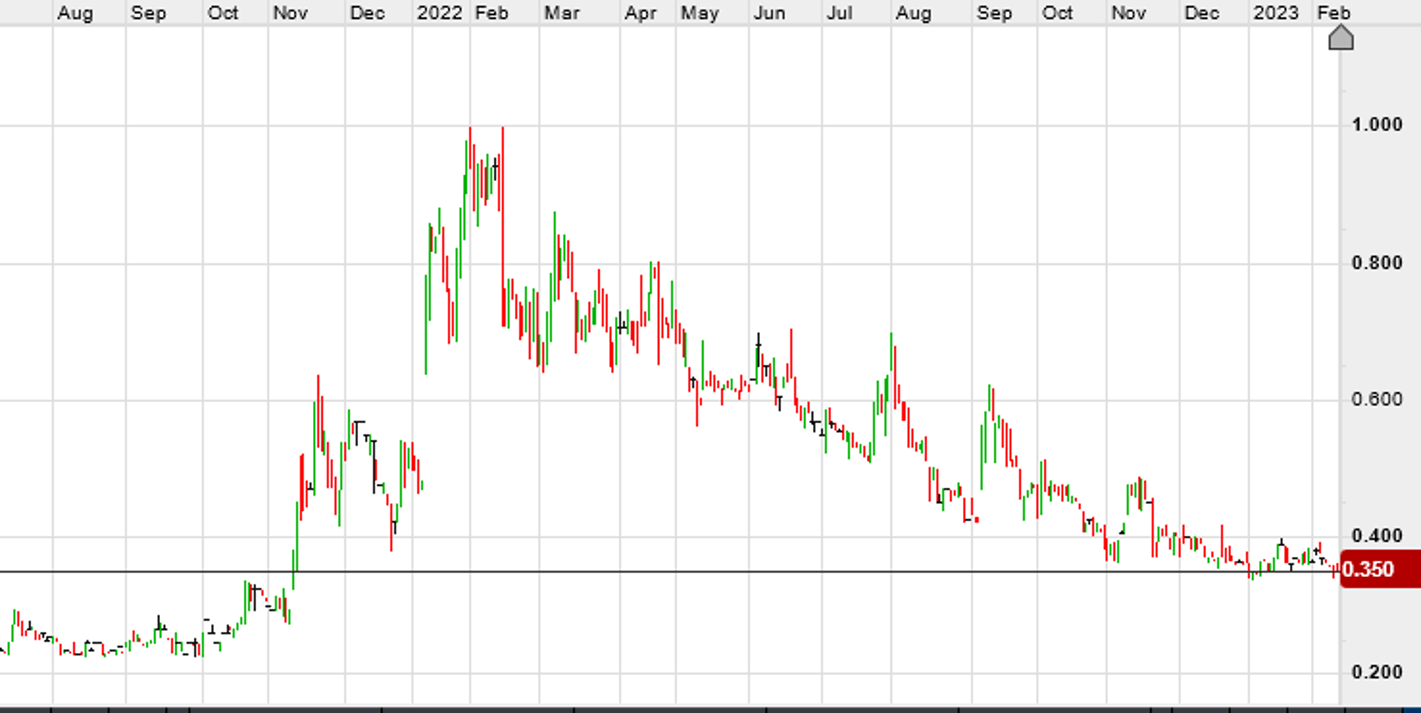

For those gold bulls among you (which I can only assume would be 100% of the Stockhead faithful), Pacgold Limited (ASX:PGO) (figure 5) is worth taking a close look at.

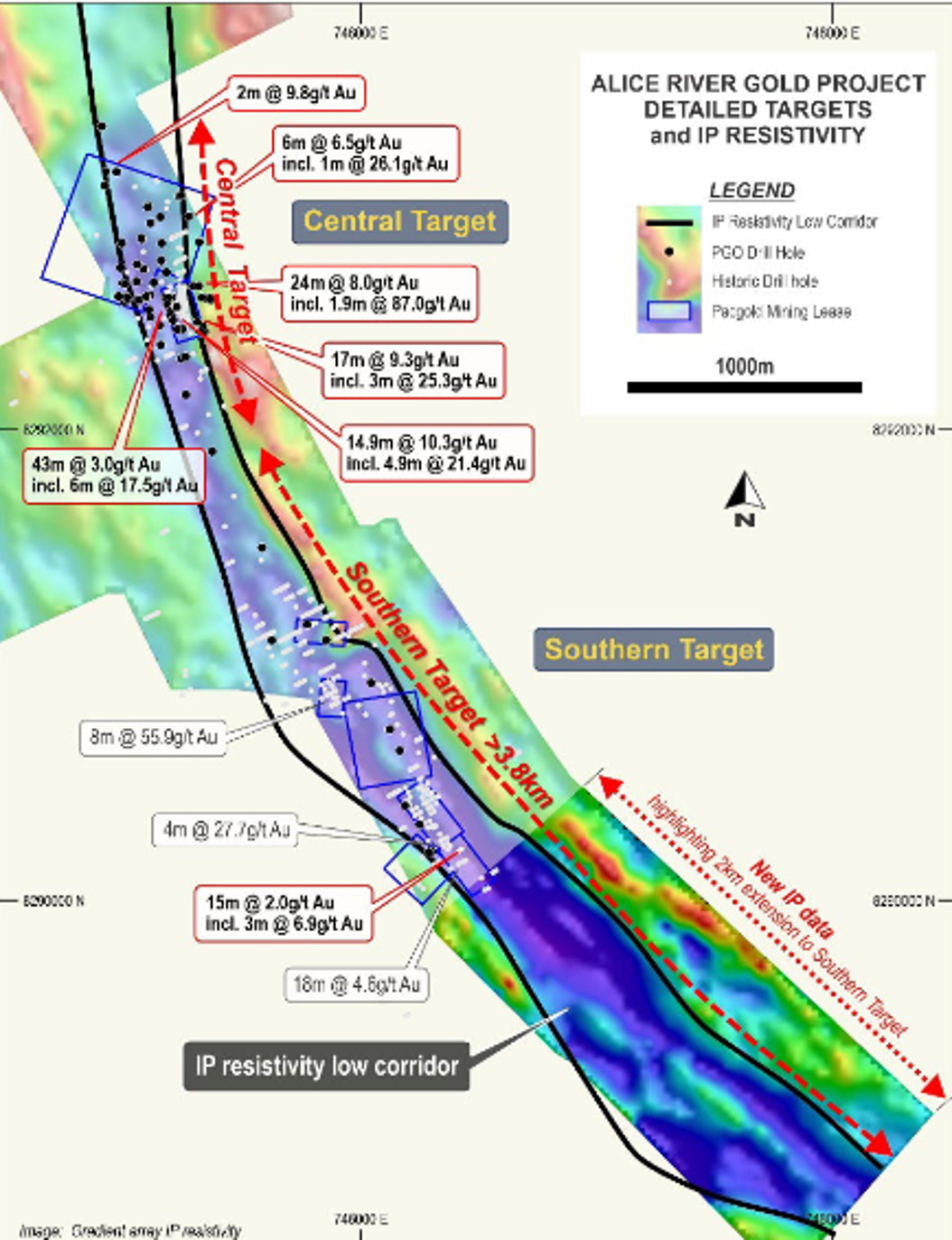

The Alice River Project (figure 6) has been delivering some impressive intersections including 17m @ 9.3g/t gold with mineralisation extending to depth.

The company is headed by geologist Tony Schreck, a former colleague at the magnificent North Flinders Mines Ltd (taken over by Normandy Mining Ltd in the mid 1990s). I recall Tony was close to developing cirrhosis of the liver in a dry (no alcohol) camp. Almost as remarkable as the Immaculate Conception.

A recently completed IP survey has extended the prospective horizons to just under four kilometres. Great news given that the area has been lightly drill tested and there are some impressive intersections to the southeast.

This looks like it has potential for +750K ounces of gold at good grade which is likely to support and open pit and underground mine. At an enterprise value of $18 million certainly one to accumulate. The stock is also tightly held with some notable institutions and high-net worth individuals creeping up the register.

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

The post Guy on Rocks: Instos, high net worths are buying into this $18m capped high gold explorer appeared first on Stockhead.